Solskin

The nail that sticks out farthest gets hammered the hardest. ― Patrick Jones

In today’s deep dive, we take a look at a small digital health marketing company that has fallen on hard times. Valuation metrics are now more compelling than they were and some insider buying has emerged. An analysis follows below.

Company Overview:

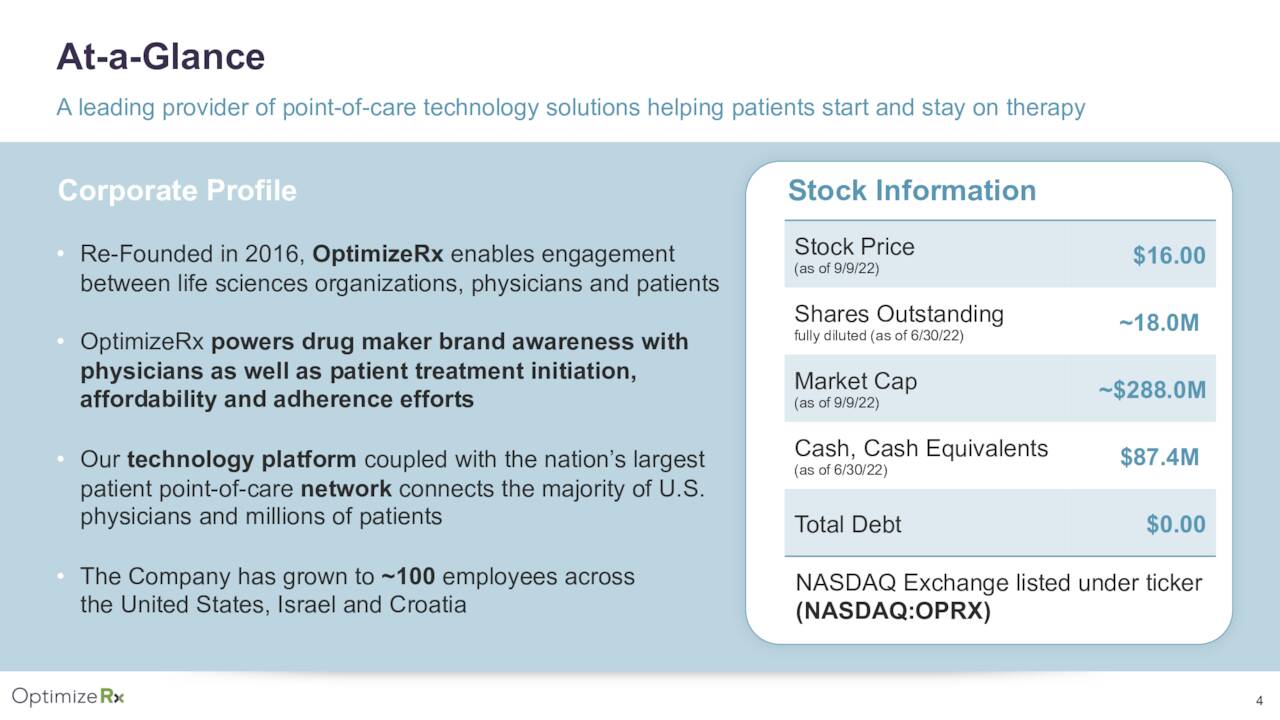

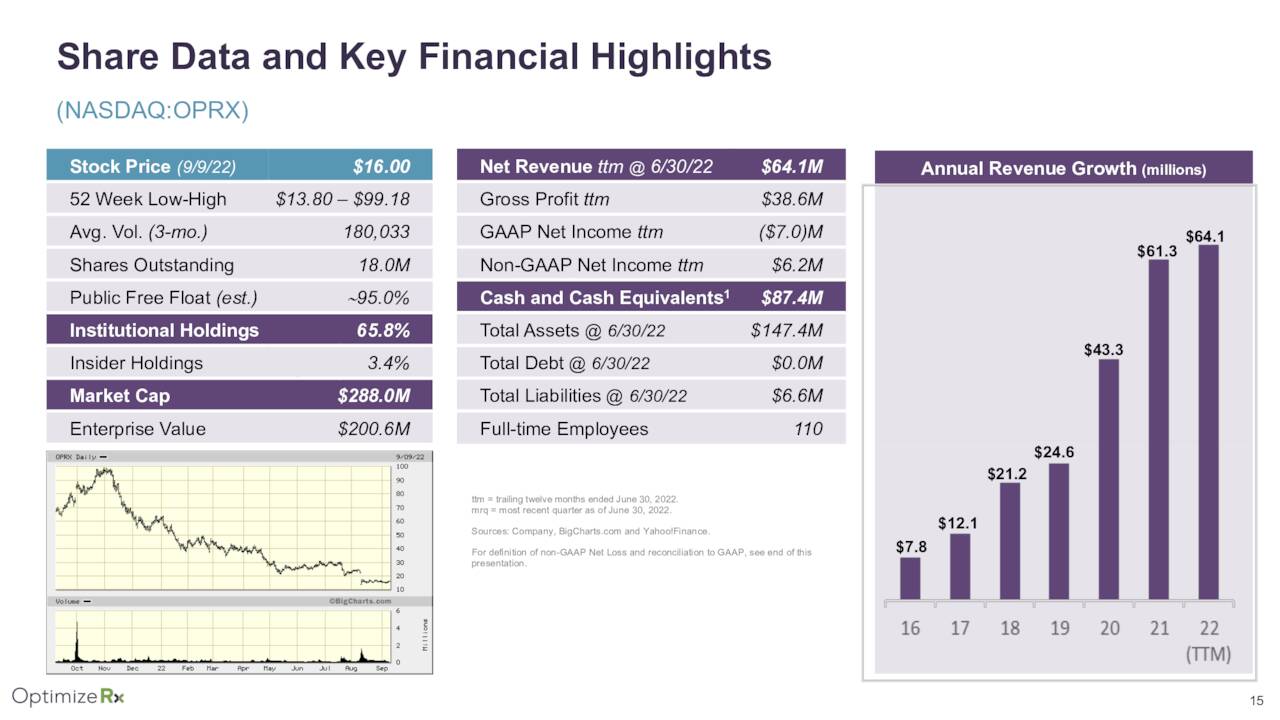

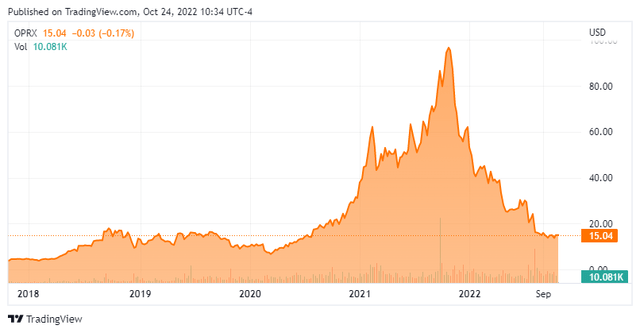

OptimizeRx Corporation (NASDAQ:OPRX) is a Rochester, Michigan digital health company focused on enabling engagement between life sciences concerns, healthcare professionals, and patients with an endgame of helping patients start and stay on their medications. Its point-of-care network boasts over 700,000 healthcare professionals, 19 of the top 20 pharmaceutical concerns, and millions of patients. OptimizeRx was founded in 2006 as an online portal directing customers to cheaper prescriptions and went public in 2008 through a reverse merger, listing on the OTC Bulletin Board with two full-time employees. The company was essentially re-founded in 2016 with its current raison d’etre and uplisted to the NASDAQ with its first traded conducted at $7.50 a share. (It now employs ~110 worldwide.) After a wild rollercoaster ride that saw its shares soar to $99.19 per in October 2021, its stock currently trades at around $15.00 a share and sports an approximate market capitalization of $270 million.

September Company Presentation

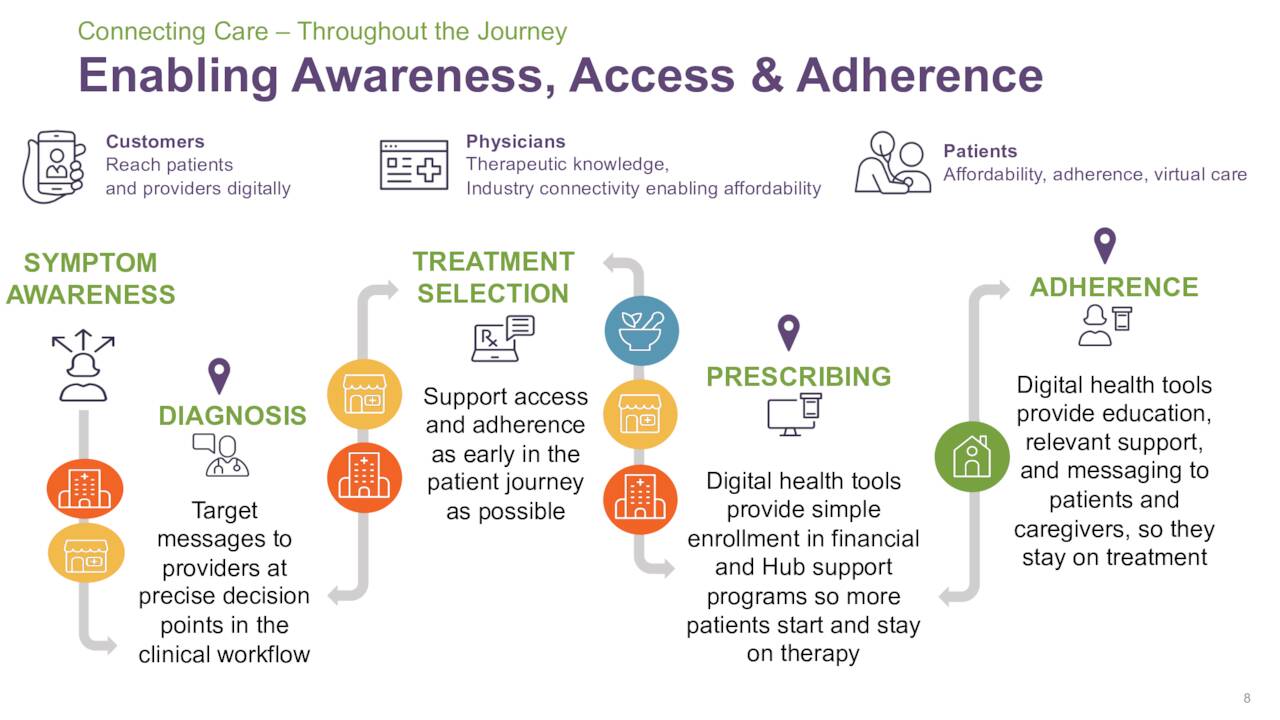

The company’s digital platform provides six solutions, the initial one being financial messaging. It serves as a virtual patient support center that allows healthcare providers to access sample vouchers and co-pay coupons through their electronic medical records and direct their patients to a national network of pharmacies, eliminating the need to manage and store drug samples. OptimizeRx’s platform also tracks samples and co-pay savings, removing an admin headache at the doctor’s office. The ultimate goal of the service is to provide a more effective method to increase affordable access and adherence to prescribed branded medications.

September Company Presentation

Owing to the growing demand from the healthcare industry for end-to-end patient engagement solutions to drive better adherence, OptimizeRx has expanded its platform to include brand awareness messages, reminder ads, therapeutic support messages, as well as unbranded messages that can be targeted by diagnostic code, amongst other criteria. It also has patient and physician engagement offerings, the latter of which uses AI to identify patients who may qualify for specific therapies or are demonstrating early signs of non-compliance. Furthermore, OptimizeRx provides a therapy initiation workflow solution that simplifies the paperwork required prior to pharmacies dispensing prescribed medication.

September Company Presentation

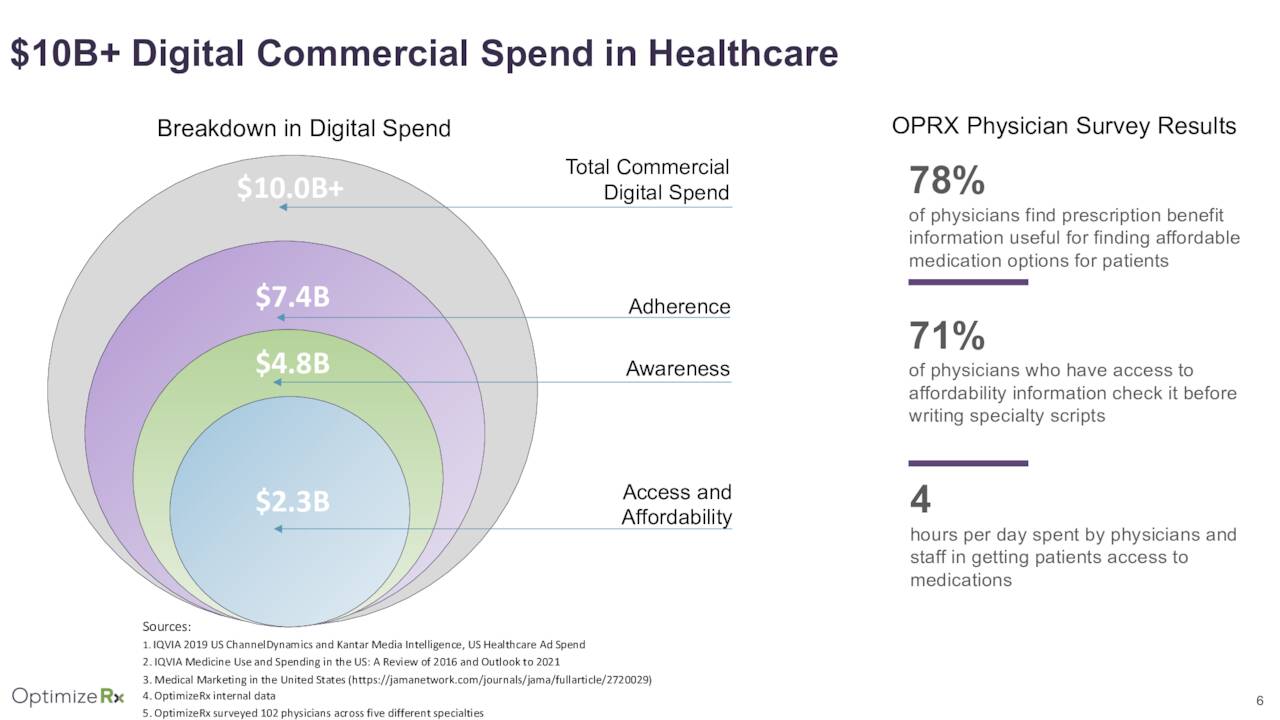

What amounts to a digital platform to drive more prescription drug consumption – essentially a third-party marketing arm for Big Pharma – has been highly effective. Platform users realized up to 60% monthly subscription increases and drug companies experienced a 13-to-1 return on investment for enterprise programs (i.e., utilizing OptimizeRx’s entire suite of solutions) in FY21. Management estimates the total digital commercial spend in healthcare at ~$10 billion of which $7.4 billion is for access and affordability, awareness, and adherence. An example of the inherent potential of the paradigm shift to digital marketing for OptimizeRx lies in the fact that one of the top 20 drug concerns spent $14.3 million on its offerings in FY21, or 23% of its total top line. For this business, the company competes primarily with privately held ConnectiveRx and the in-house efforts of Big Pharma.

Stock Price Performance

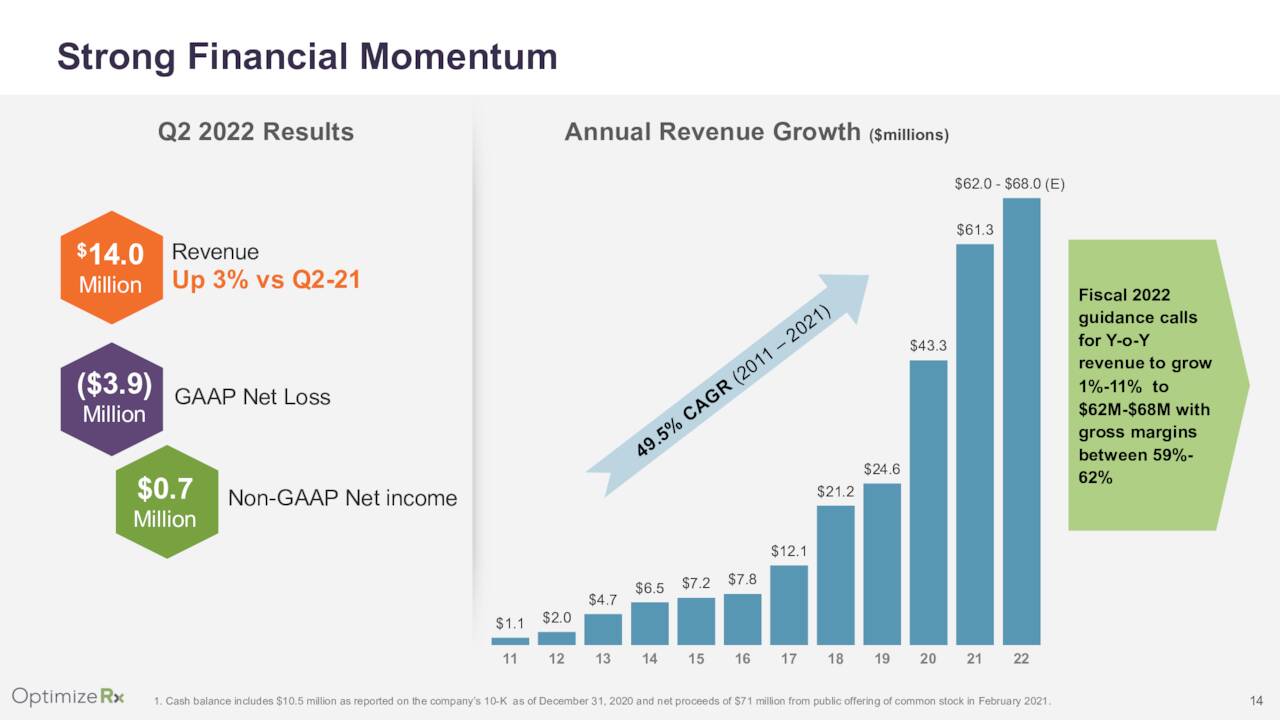

With nearly 60% of the nation’s healthcare providers now part of its network, it is easy to see why the company grew at a 49% CAGR from FY11 through FY21. And with top-line growth of 42% in FY21, gross margin at 58%, and non-GAAP earnings up 125% to $0.45 per share, it is easy to see why investors developed enthusiasm towards OptimizeRx’s stock. Seen as big winner in Big Pharma’s move to digital marketing, that excitement morphed into mania with shares of OPRX melting up 1,426% off a pandemic-selloff low of $6.50 in March 2020 to $99.18 by October 2021. The 19+ month rally had the company trading at a priced-beyond-perfection 28.6 times FY21 sales.

The first crack in fervor occurred after OptimizeRx reported 3Q21 financial data in early November. Although revenue was up 53% in the quarter, traders used it as an opportunity to take profits, especially with the tape becoming unkind to high-growth names with nosebleed valuations – even profitable and marginally cash flow positive ones like OptimizeRx. The market was also noticing that the company had now onboarded 19 of the top 20 Big Pharma concerns, who comprised more than three-quarters of its top line. This accomplishment meant that OptimizeRx’s growth was predominantly contingent upon the expand portion of its ‘land and expand’ strategy, making it dependent on Big Pharma behemoths shifting increasing amounts of their digital marketing budgets its way. This dynamic portended a deceleration of growth.

When the company gave its first FY22 outlook in mid-February, its stock had already been cut in half, trading in the mid-40s. It forecasted 35% top-line growth (based on a range midpoint), suggesting revenue of $82.5 million, meaning it was still trading around 10 times FY22E revenue, and that was assuming it could count on the top 20 Big Pharma accounts to grow its top line by 35%. That projection seemed somewhat incompatible with the fact that its Top 20 accounts’ average spend of $2.48 million in FY21 was only up 27% over FY20. Further enforcing this incredulity was its 22% year-over-year revenue growth in 1Q22. At that time, not one Street analyst picked up on this or chose to write it off as the least important (seasonally slowest) stanza.

2Q22 Earnings & Revised Outlook

By the time OptimizeRx reported 2Q22 financials on August 9, 2022, shares of OPRX were trading at $22.25. The report was a big miss with the company earning $0.04 a share (non-GAAP) on revenue of $14.0 million versus Street expectations of $0.09 a share on revenue of $16.95 million. The miss was blamed on 40% fewer drugs being approved by the FDA in 1H22 versus the same period in 2021. As such, average revenue from the top 20 drug concerns was flat (at $2.4 million) for the trailing twelve months [TTM] ending June 30, 2022 versus TTM ending June 30, 2021.

September Company Presentation

With only 3% revenue growth year-over-year, management was compelled to revise it FY22 revenue forecast at range midpoints from $82.5 million to $65.0 million, or 6% growth. It further added that this screeching halt to its momentum was temporary in nature with a return to 20%-30% growth in FY23. However, based on its forecast for the balance of the year, it would appear that the more challenging environment is going to last until YE22.

Not surprisingly, by the close of the subsequent trading session shares of OPRX had cleaved another 30% of market cap, finishing at $15.57.

Balance Sheet & Analyst Commentary:

On a positive note, OptimizeRx’s balance sheet is in excellent shape, reflecting cash and equivalents of $87.4 million and no debt. This was the result of 1Q21 secondary offering in which it raised net proceeds of $70.7 million at $49.50 a share. Now, with its stock price significantly discounted, the board okayed a $20 million share repurchase program in 2Q22, under which it bought 12,868 shares at an average price of $24.95 through June 30, 2022, leaving $19.7 million remaining on its authorization.

September Company Presentation

The only Street soothsayer who did not end up with egg on his face was actually late to the party. Piper Sandler analyst Jeff Garro initiated coverage on OptimizeRx on July 1, 2022 with a hold rating. He has already lowered his price target from $29 to $16. SVB Leerink was also late, initiating coverage on July 15, 2022 with an outperform rating and a $38 price objective (since lowered to $30). As for the other five analysts who have ridden the rollercoaster down 85% over the past eleven months, they are all constructive with three buy and two outperform ratings. They have yet to sharpen their pencils after the company reassessed its outlook, still sporting price targets between $50 and $66. On average, they expect OptimizeRx to earn $0.31 a share on revenue of $63.9 million in FY22, followed by $0.63 a share on revenue of $80.5 million in FY23, reflecting 26% growth at the top line.

In a show of solidarity, the CEO, CFO, CCO, two board members, and chief legal counsel all purchased stock in mid-to-late August, totaling 29,800 shares.

Verdict:

The company’s latest presentation materials suggest that Big Pharma is going to increase their digital marketing spend by >50% over the next three years. If this forecast holds true, and OptimizeRx realizes a proportionate share of that spend (~15% per annum), it signifies that Street expectations for revenue of $80.5 million will need to be lowered by ~10% – assuming, of course, their consensus revenue outlook for FY22 is correct. That said, with its platform generating high ROIs for Big Pharma, the company can anticipate a higher than pro rata capture of the digital marketing spend.

And with the company’s balance sheet is in excellent shape, management is utilizing it to defend its stock price. However, as precipitous as the decline has been, it is still trading at over a 23 P/E on FY23E EPS and a price-to-FY23E sales of 2.2 – a sales figure that looks shaky. The options have decent liquidity for a somewhat thinly traded stock and reflect attractive implied volatility, but the downside risk remains too great. There may be a paradigm shift afoot in the digital healthcare marketing space, but I plan to sit this one out until signs of reacceleration emerge.

Fearlessness in those without power is maddening to those who have it. ― Tobias Wolff

Be the first to comment