dszc

Diamondback Energy (NASDAQ:FANG) now has seen a one-two punch of news flow this year. Starting with the roll-up of its captive partnership Rattler Midstream, the venerable Permian producer has now announced another acquisition in the Permian: the purchase of FireBird Energy. I don’t really think this deal is much of a needle mover at the end of the day given my cash flow predictions – the price seems just fair – but at the same time it is hard to ignore Diamondback’s proven history of buying companies at discounts to intrinsic value.

Another Acquisition

On October 11th, Diamondback Energy announced its intent to purchase privately-held FireBird Energy for $1,600mm in cash and stock. Expected to close before the end of the year, Diamondback is picking up 68,000 net acres with an estimated 316 net drilling locations. After positioning the drilling program from a current three rigs to one, this deal will have around twelve years of current drilling inventory, with the potential for additions given the stacked nature of the play. Management has been pressed to add proved reserves over the past several years, and it has built up its inventory into the double digits given Q2 2022 production pace. I’d view this transaction as them furthering their optionality on reserve life, as that part of the E&P story is likely to see more focus from investors going forward than it has over the past several years.

For the FireBird land specifically, expectations are for production to be around 25,000 barrels of energy per day (“boepd”) in 2023, with three quarters of that being oil production. This works out to a transaction price of $64,000 per flowing barrel, a sign of the times that deals are back to being fairly expensive in the Permian Basin. As a good benchmark, Pioneer sold its Permian lands (Delaware Basin) to Continental Resources for $59,000 per flowing barrel at the end of 2021. Despite the lofty price tag, FireBird should be accretive to current metrics. The EBITDA acquisition multiple is 3.0x at current strip, implying EBITDA of around $500mm and $240mm in free cash flow, albeit with the latter benefiting somewhat from tapping the drilled but uncompleted (“DUC”) inventory and tax benefits.

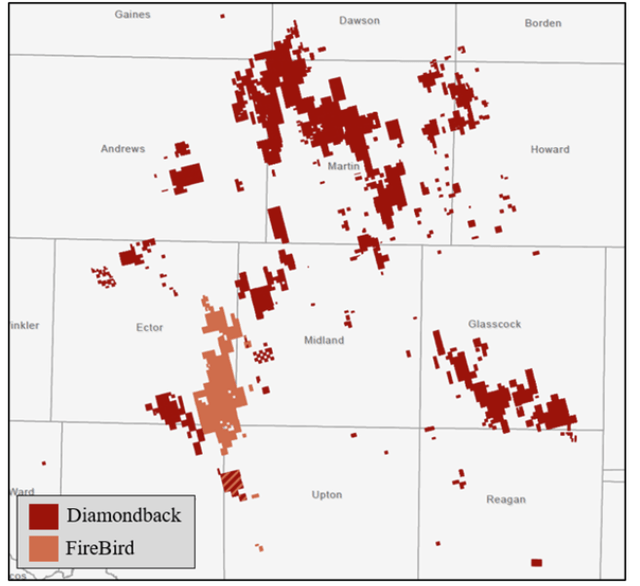

Acreage Map (Diamondback Energy)

FireBird acreage does not sit contiguous with existing Diamondback land, but it is right next door. In my view, outside observers have not given the deal much credit because development is located within Ector County. Despite being adjacent to Midland, activity in Ector has been light; ConocoPhillips (COP) is the only major publicly-traded firm that has had decent success and they have since sold the majority of the interests in their wells here. There is no reputation for being quality rock, and certainly no name recognition. To an extent, I agree and that signals a bit of bearishness, however management made commentary that inventory it is acquiring is “competitive for capital right away” within its current development plan.

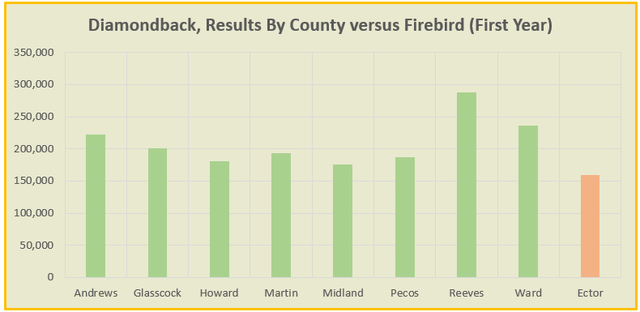

I can see it, but Diamondback might have some work to do. As shown below, Firebird results out of Ector County trail results fairly significantly in the top development areas for Diamondback when it comes to production over the first year – and that’s including throwing out a couple of dud wells that really did not perform well. Martin, Midland, Reeves, and Pecos have been the areas of deepest interest for Diamondback and all four of those counties have seen better results overall. I also don’t see much opportunity for Diamondback to leverage longer laterals, more proppant, or otherwise change drilling approach, at least from publicly-available data. Costs should be relatively the same, so on the net FireBird wells just are not as good. That said, wells in the northeastern part of the play outperformed, and Diamondback made multiple mentions that it reminds them of their Spanish Trail assets in Midland that engineers have really driven improvements out of compared to their early approach.

Drilling Results By County (ShaleProfile Data)

For the skeptics, I think it’s worth remembering Diamondback history. When the firm went public in 2012, its production was barely a trickle. It had to grow by acquisition and since that time, management has been one of the premier acquirers in West Texas, never deviating from its strategy of being a Permian pure play. Big purchases are not foreign to it: Ajax Resources ($1,200mm), Energen ($9,200mm), Guidon ($1,100mm), and QEP Resources ($2,200mm) have all been purchased within the last five years. Despite that reality and being a prodigious issuer of equity, Diamondback Energy has soundly outperformed the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) over the long term. In my view, it has earned some latitude in deal pricing.

Financing, Takeaways

Keeping acquisitions leverage neutral is not a new approach in new age E&P, and that’s the case here. FireBird will be funded with 5.86mm shares of newly-issued common stock and $775mm in cash. The cash will be funded by a combination of cash on balance sheet, its credit facility, and a new bond issuance. It’s likely that part of the capital will come from its new ten year Senior Unsecured Notes that were priced a few days after deal announcement (5.625% coupon).

Interestingly, Diamondback also announced plans to sell $500mm in noncore assets by the end of 2023. While that could include upstream holdings, speculation has been that Diamondback might instead look within its freshly rolled up Rattler Midstream assets were opportunities. Recall that Rattler has diversified significantly into serving third parties, and those assets now make little sense within Diamondback. Captive assets where it can control the rates internally can and should be retained, but pipelines and storage serving other operators in the Permian could be a great source of cash.

Overall, a cash flow model based on current strip prices has this transaction as pretty fairly valued without a material change in well results, synergies, or other drivers. Wall Street as a result has not been particularly enthusiastic about the deal, and I’d caution against being too excited either. But, it’s not value destructive in my view – and could create some value if strip moves up or Diamondback manages to squeeze some better results out of the acreage. Time will tell.

Be the first to comment