RoschetzkyIstockPhoto/iStock via Getty Images

Real Estate Earnings Halftime Report

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 27th.

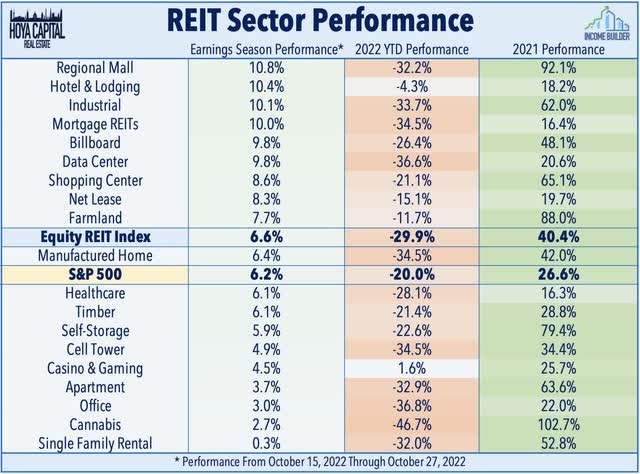

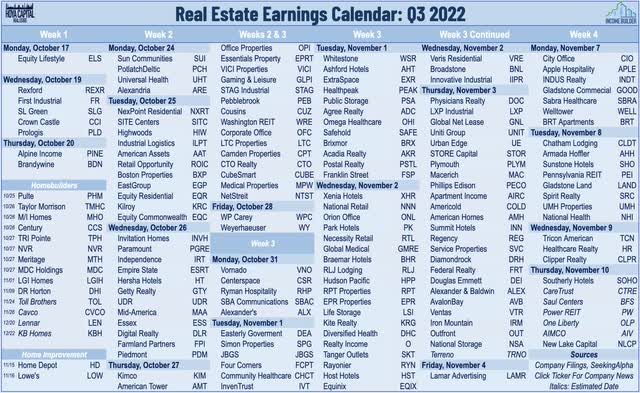

We’re approaching the halfway point of another newsworthy real estate earnings season with 50 equity REITs and 20 mortgage REITs representing 50% of the total market capitalization reporting results. Among the 41 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 28 REITs (67%) raised their outlook while just 4 REITs (10%) have lowered their outlook. Solid results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies have boosted their outlook.

Upside standouts thus far have been Industrial, Shopping Center, and Apartment REITs. Sunbelt-focused office REITs have also surprised to the upside while the initial batch of results from Hotel and Healthcare REITs have been solid. While so far avoiding the downdraft from the broader “tech wreck” this earnings season, currency headwinds dragged on technology REITs. Meanwhile, Single-Family Rental REITs and Homebuilder results expounded the sharp rate-driven housing cooldown. The fundamental earnings outperformance reflects the fact that most REIT sectors are still earlier in their post-pandemic recovery relative to the broader market, having just recovered to 2019 FFO levels in early 2022 while total dividend payments are still about 10% below pre-pandemic levels. The Equity REIT Index has rallied 6.6% since the start of earnings season while Mortgage REITs have jumped 10% – each outpacing the 6.2% gain from the S&P 500 over this period.

Residential Real Estate Halftime Report

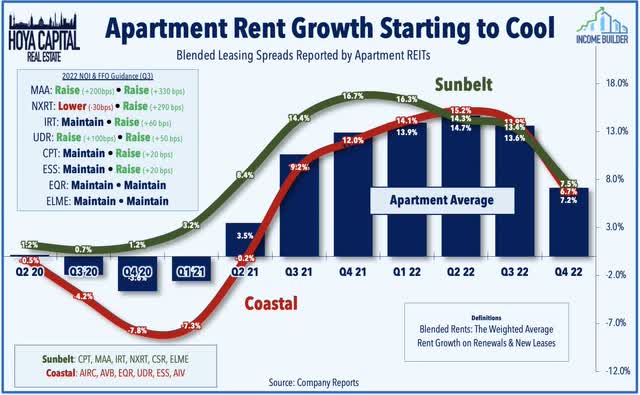

Apartment: (Halftime Grade: B+) We’ve heard results from 8 of the 10 largest apartment REITs and despite the apparent cooldown in the pace of rent growth, results have been quite impressive with six of the eight raising their full-year FFO growth outlook. Sunbelt markets continue to show relative strength compared to Coastal markets. The three Sunbelt-heavy REITs – Mid-America (MAA), Camden (CPT), and NexPoint Residential (NXRT) CPT, NXRT) have all raised their full-year earnings outlook this quarter – and now expects FFO growth of nearly 25% this year – while performance among the Coastal-heavy REITs Equity Residential (EQR), Essex (ESS) and UDR, Inc. (UDR) have been less impressive with average FFO growth of about 16%. Perhaps the most notable trend is the rather sharp sequential slowdown in rent growth – especially in new lease rates. New Lease rates peaked in Q2 at 17.5% and slowed to 12.7% in Q3 and just 5.1% in October.

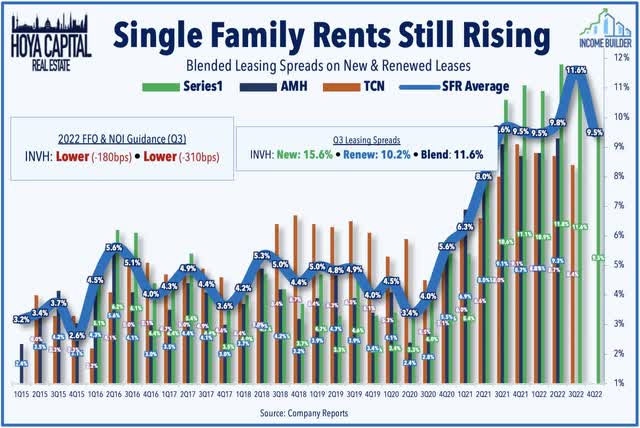

Single-Family Rental: (Halftime Grade: C+) Invitation Homes (INVH) – the nation’s largest single-family housing owner – reported perhaps the most notable of the residential REIT reports thus far. INVH lowered its full-year outlook, citing a hit from higher-than-expected property taxes and higher bad debt expense from renters who have fallen behind on their rent. While INVH reported impressive leasing spreads of nearly 12% in Q3 and roughly 9.5% in October, its rent collection rate dipped to 97% in Q3 – down 200 basis points from last quarter and its pre-COVID average of 99% – consistent with signs of stress across the broader economy amid historically high levels of inflation. INVH also scaled back its acquisition activity and noted “little bit of softening in cap rates” and emphasized that it’s looking to grow its investment management businesses which it noted is an opportunity for “extremely accretive growth when REIT’s cost of capital isn’t as good as we’d hope.”

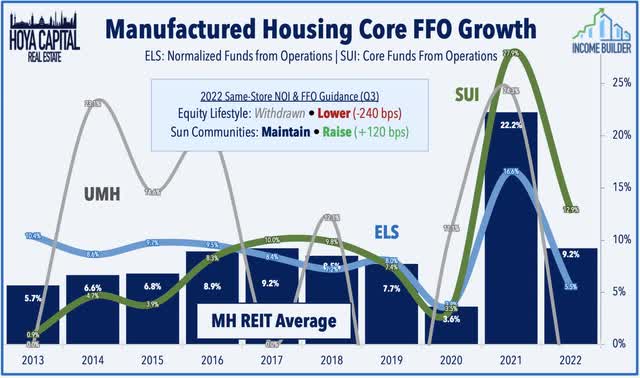

Manufactured Housing: (Halftime Grade: B) Sun Communities (SUI) – one of our three “Best Ideas in Real Estate” – has been an upside standout this earnings season after reporting better-than-expected results and raising its full-year outlook driven by strength in its RV and marina division and expectations of accelerating rent growth in its core manufactured housing communities for the 2023 renewal season. SUI now expects its full-year FFO to rise 12.9% this year – up 120 basis points from last quarter – which is particularly impressive in light of the earnings miss from its MH peer, Equity LifeStyle (ELS) – which revised its FFO growth lower by 240 basis points. ELS and SUI each reported a relatively muted impact from Hurricane Ian representing less than 1% of its annual revenues. Both MH REITs expect to send out record-high rent increases for the 2023 renewal season in the range of 6-8%, consistent with our expectation that MH REITs will leverage the record-setting cost-of-living adjustment (COLA), which should result in a roughly 9% rise in benefits to a significant percentage of MH REIT residents.

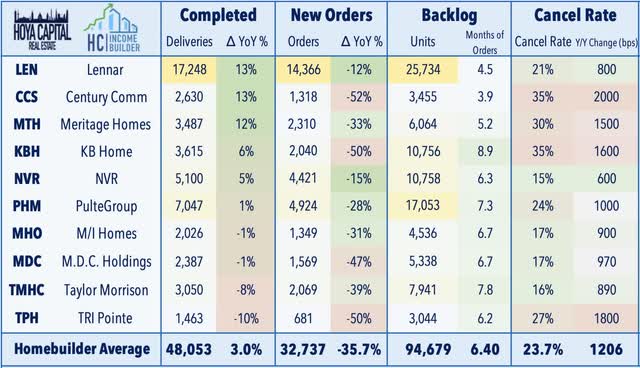

Homebuilders: (Halftime Grade: C+) Rates, rates, rates. Results from the ten homebuilders that have reported results over the past month have shown that while the existing pipeline of previous orders has kept homebuilding revenues and EPS near record-high levels, the surge in mortgage rates has led to a sharp drop-off in new orders – lower by over 35% year-over-year in Q3 – and a surge in cancellation rates, which jumped to nearly 25% during the quarter. Positively, builders still have more than six months’ worth of backlog to work through at the current sales pace – which should help to buffer the immediate downside pressure on revenues and earnings metrics. Upside standouts in earnings season have included M.D.C. Holdings (MDC) – which maintained its sector-leading dividend of over 6% and KB Home (KBH) which reported a solid improvement in margins and has the accumulated largest backlog relative to its current sales with nearly three-quarters of existing orders.

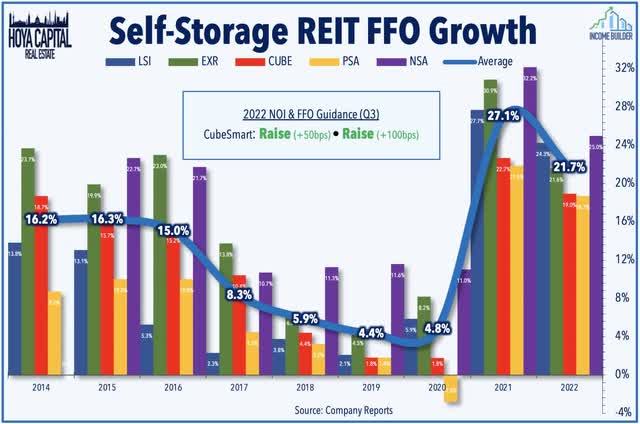

Storage: (Halftime Grade: A) Can storage REITs defy expectations yet again -the sector that has delivered more comprehensive upside surprises than any REIT sector over the past two years. Earnings season started strong with a “beat and raise” report from CubeSmart (CUBE), which boosted its full-year FFO growth target to 19.0% – up 100 basis points from last quarter – and its NOI growth target to 16.0% – up 50 basis points. CUBE reported that it “continues to see solid demand across the portfolio as we returned to more normalized seasonal trends during the quarter.” While the rate-driven slowdown in housing market activity is expected to temper incremental storage demand, recent data and interim REIT updates have indicated strong demand trends continued deep into the third-quarter.

Technology & Logistics REIT Halftime Report

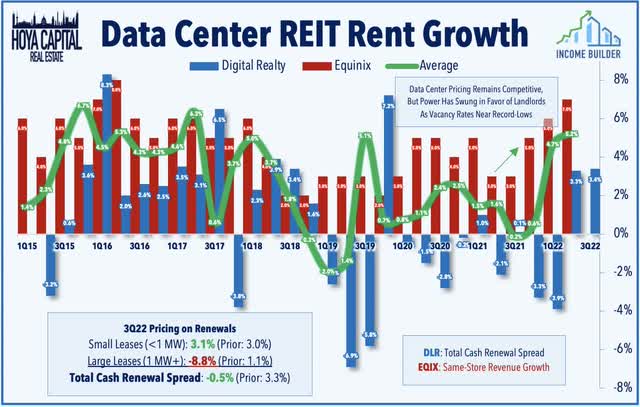

Data Center: (Halftime Grade: B-) Technology REITs have so far been able to avoid the tech downdraft this earnings season amid sharp selloffs from major tenants Amazon (AMZN), Google (GOOG), and Microsoft (MSFT). Digital Realty (DLR) reported mixed results – highlighted on the upside by a record-level of leasing volume – but offset by softer pricing trends. During the quarter, DLR signed total bookings expected to generate $176M of annualized GAAP rental revenue – its strongest quarter of bookings on record. Rental rates on renewal leases signed during the quarter rolled down 0.5% on a cash basis – down from the 3.3% average in the first half of 2022. Foreign currency headwinds prompted a downward revision to its full-year FFO growth target, which is now expected to rise 3.0% this year – down from the 4.1% outlook last quarter. We’ll hear results from Equinix (EQIX) next Wednesday.

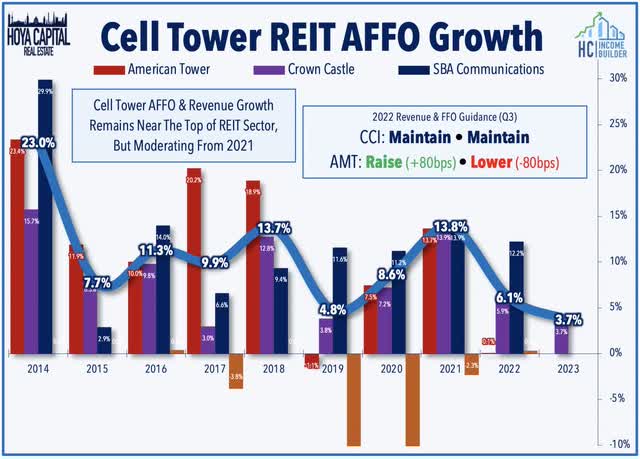

Cell Tower: (Halftime Grade: B-) Results from the two largest Cell Tower REITs have been similarly lukewarm. Results from Crown Castle (CCI) were the stronger of the two, highlighted by strong organic “same-tower” growth metrics and another 6.5% dividend hike. CCI maintained its full-year outlook calling for FFO growth in 2022 of roughly 6% while also providing 2023 guidance which calls for growth of 3.7%. American Tower (AMT) revised down its full-year FFO target, citing negative FX effects and a drag from deferred rent payments from Vodafone India – which is undergoing a government-backed restructuring. AMT did raise its full-year revenue growth target by 80 basis points, however, driven by strong “organic” rent growth in the U.S. and in its Latin America and Africa markets. Of note, AMT expects 2023 to be a “challenging year” given the headwind from rising interest rates which will “certainly will take us off of our target AFFO growth” but noted that property-level fundamentals should continue to “accelerate” into 2024.

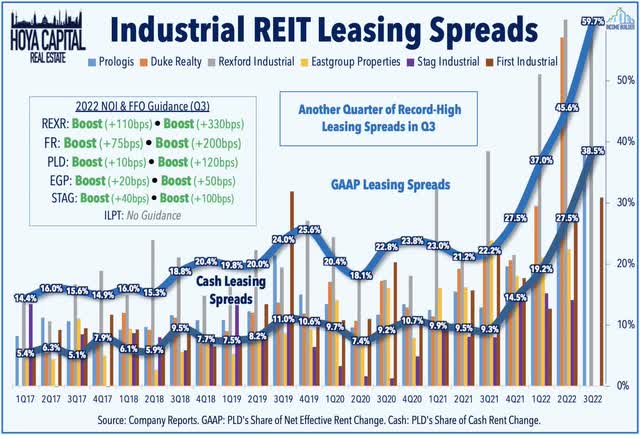

Industrial: (Halftime Grade: A-) No signs of slowdown here. Powered by another quarter of head-spinning cash rental rate spreads of over 30%, all five of the industrial REITs that provide guidance raised their full-year FFO growth target. Sector stalwart Prologis (PLD) reported a record-high effective leasing spread of 59.7% and record-high cash same-store NOI growth at 9.3%. First Industrial (FR) also reported record-high cash leasing spreads of 30.9%, driving a boost to its NOI outlook by 75 basis points to 9.5% and its FFO growth outlook by 200 basis points to 13.2 while Rexford (REXR) reported incredible cash rental rate spreads of 62.9% in Q3. STAG Industrial (STAG) also delivered impressive results with rent growth on new leases of nearly 20%. Small-cap Industrial Logistics (ILPT), however, has continued to lag following their ill-timed acquisition of Monmouth and commented that its dividend resumption is “not going to happen until late-2023 at the earliest.”

Retail REIT Halftime Report

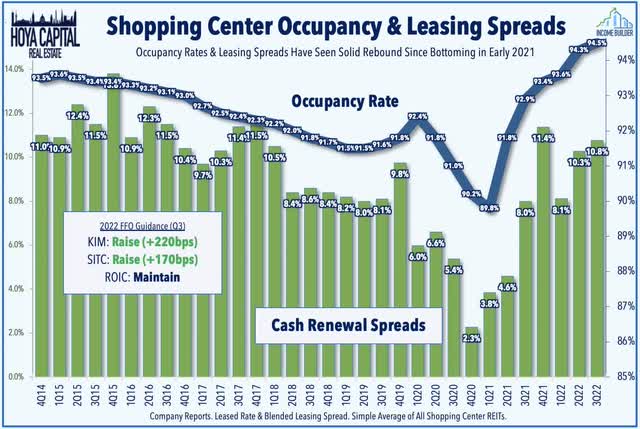

Shopping Center: (Halftime Grade: A-) Earnings season is still young for the retail sector, but results thus far have been quite solid. We’ve heard results from three of the 16 shopping center REITs – two of which have raised their full-year FFO growth outlook. Kimco Realty (KIM) has been an early standout, boosting its full-year FFO growth target to 14.5% – up 220 basis points from last quarter – driven by an acceleration in blended leasing spreads to 7.5% and a 20 basis point sequential rise in occupancy to 95.3% KIM also hiked its quarterly dividend by another 4.5%. SITE Centers (SITC) also boosted its full-year FFO growth target higher by 170 basis points driven by solid leasing spreads of 7.2%. Retail Opportunity (ROIC) reported in-line results – highlighted by a continued acceleration in blended leasing spreads to 13.6% – while maintaining its full-year FFO and NOI guidance.

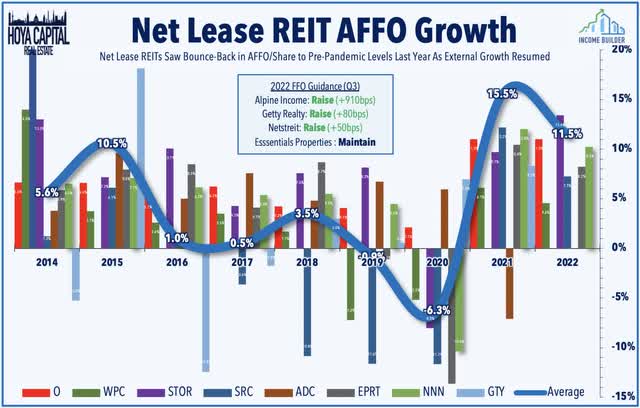

Net Lease: (Halftime Grade: B+) The typically rate-sensitive net lease sector is off to a strong start this earnings season with three “beat and raise” reports. Getty Realty (GTY) has been an early upside standout after boosting its FFO growth target along with its quarterly dividend by 4.9% to $0.43/share – becoming the 120th REIT to raise its dividend this year. GTY – which owns gas stations and adjacent convenience facilities – now sees FFO growth of 7.9% this year – up 80 basis points from its prior outlook. Small-cap Alpine Income (PINE) also reported impressive results, raising its full-year FFO growth target by 910 basis points to 10.1%. NETSTREIT (NTST), meanwhile, boosted its full-year FFO growth target by 50 basis points to a sector-high 23.4%. Essentials Property (EPRT) maintained its 2022 FFO guidance while issuing 2023 guidance calling for FFO growth of roughly 4%.

Office, Hotel, & Healthcare Halftime Report

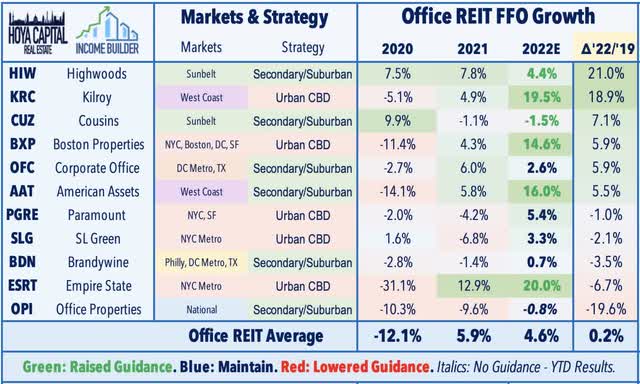

Office: (Halftime Grade: B) We’ve seen results from 11 of the 24 hotel REITs, of which six have raised their full-year FFO growth outlooks while the other five have maintained their outlook. Sunbelt-focused Highwoods (HIW) has been an upside standout, raising its full-year FFO growth target to 4.4% – up 180 basis points from its prior outlook while noting that it leased 518k SF of space in Q3 – its highest volume of new leases since 2014 with rents that were 20% above its prior five-quarter average. Cousins (CUZ) and Brandywine (BDN) also reported notable strength in their Sunbelt markets. Results from coastal-focused REITs have been shakier – with the exception of the lab space segment which has seen continued robust leasing demand. NYC-focused SL Green (SLG) reported that rental rates were about 10% lower on renewed leases this year. Boston Properties (BXP) slightly raised its full-year FFO outlook, but noted that it expects its FFO to be about 4% lower in 2023 at the midpoint of its range. Lab space demand powered a solid quarter from Kilroy (KRC) which boosted its full-year FFO growth target to nearly 20%.

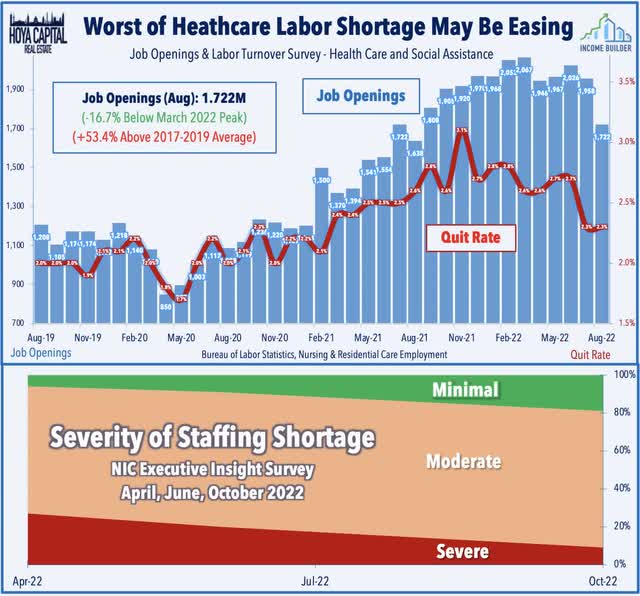

Healthcare: (Halftime Grade: B) Speaking of lab-space, Alexandria Real Estate (ARE) reported another very strong quarter highlighted by impressive cash NOI growth of over 20% driven by renewal rent spreads of 27.1% GAAP / 22.6% cash. Elsewhere in the healthcare sector, hospital owner Medical Properties Trust (MPW) rallied after reporting better-than-expected results and raising its full-year FFO growth target. Citing improvement in operating performance at its hospital facilities and forecasted escalations in its CPI-linked leases, MPW raised its full-year FFO growth target to 3.4% – up 50 basis points from last quarter. Universal Health (UHT) has also been an upside standout after its external manager Universal Health Services (UHS) reported better-than-expected results, commenting that “staffing vacancies and corresponding premium pay expenditures continue to sequentially decline” consistent with our recent report – Healthcare REITs: Staffing Shortage Stumble – which noted that recent data suggest that the labor pressures may be easing.

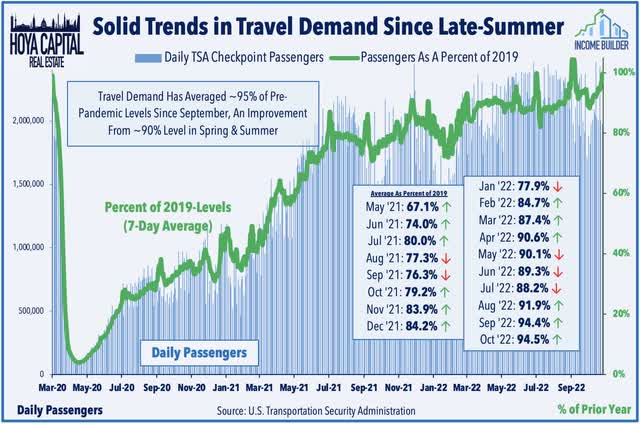

Hotel & Casinos: (Halftime Grade: A) While we’ve only seen complete third-quarter results from a pair of hotel REITs, preliminary updates over the past two weeks have indicated that hotel demand has been quite solid in recent weeks and months despite signs of slowing across other segments of the economy as an uptick in business travel has offset a moderation in leisure demand. Pebblebrook Hotel (PEB) reported that its RevPAR in the third quarter was 1% above comparable pre-pandemic levels with the strongest month coming in September, which was about 5% above 2019-levels. Hersha Hospitality (HT) reported that its comparable RevPAR growth exceeded 2019-levels for the first time since the pandemic in September while commenting that its “seeing this trend accelerate into October, which is on pace to record RevPAR growth of approximately 8% as compared to 2019.” DiamondRock (DRH) reported that its Revenue Per Available Room (“RevPAR”) in Q3 was 8.7% above comparable 2019-levels while September was 9.8% above pre-pandemic levels. Also of note, Apple Hospitality (APLE) hiked its monthly dividend by 14% to $0.08/share while casino REITs VICI Properties (VICI) and Gaming and Leisure Properties (GLPI) each raised their full-year outlook.

Mortgage REITs Halftime Report

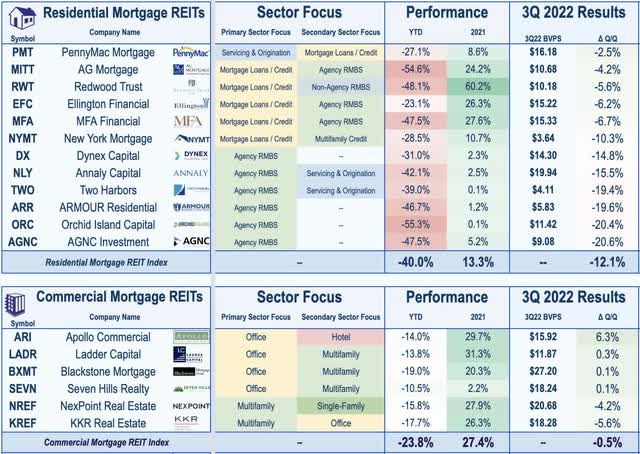

Residential mREITs: (Halftime Grade: B+) We’ve seen results and/or preliminary third-quarter book value updates from 12 of the 24 residential mREITs in our coverage. Consensus expectations called for Book Value Per Share (“BVPS”) declines of up to 20% in Q3 during a historically brutal quarter for fixed income securities – particularly MBS securities – but mREITs have rebounded in recent weeks as results have not been as catastrophic as many feared with average book value declines of roughly 12%. Book Value declines have been more muted for credit-focused mREITs compared to pure-play agency-focused mREITs with particularly solid results from PennyMac (PMT) – a strong read-through for Rithm Capital (RITM). Among the agency-focused mREITs, BVPS declines ranged from 15%-20%, but earnings metrics have generally been less ugly. Annaly Capital (NLY) – the largest mortgage REIT reported better-than-expected EPS results while confirming that its BVPS declined 15% in the quarter – consistent with its update in early October

Commercial mREITs: (Halftime Grade: A) On the commercial mREIT side, we’ve seen results from 6 of the 17 commercial mREITs, where the movement in BVPS has been far more muted – and even positive from the REITs that focus primarily on floating rate lending. Apollo Commercial (ARI) soared after reporting better-than-expected results including a 6% rise in its BVPS to $16.12. Blackstone Mortgage (BXMT) – which owns a similar book of floating-rate loans – reported a 1% rise in its BVPS while noting that its average loan rates increased 100 basis points in Q3 alone. Seven Hills (SEVN) and Ladder Capital (LADR) also reported positive BVPS gains in Q3 while KKR Real Estate (KREF) and NexPoint Real Estate (NREF) reported BVPS declines of around 5% each. The earnings calendar heats up in the week ahead with results from two dozen mREITs.

Previewing The Second-Half of Earnings

At the halfway point of another newsworthy real estate earnings season, 67% of REITs have raised their outlook while 10% have lowered their outlook. Solid results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies have boosted their outlook. Upside standouts thus far have been Industrial, Shopping Center, and Apartment REITs. Sunbelt-focused office REITs have also surprised to the upside while the initial batch of results from Hotel and Healthcare REITs have been solid. While so far avoiding the downdraft from the broader “tech wreck” this earnings season, currency headwinds dragged on technology REITs. Meanwhile, Single-Family Rental REITs and Homebuilder results expounded the sharp rate-driven housing cooldown. We’ll continue to provide real-time coverage and follow-up analysis articles for Hoya Capital Income Builder throughout earnings season.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment