Kira-Yan

Introduction

In this article, I analyze the recent reports from investment banks on the release of the infamous Meta Platforms (NASDAQ:META) earnings figures, which caused the stock to fall 24.56% in one trading session. More specifically, it was not quite the report that became the hero of the Bears’ triumph – Mark Zuckerberg’s comment, following the report’s findings, about continuing to invest heavily in the Metaverse (Reality Labs) influenced most:

We expect Reality Labs expenses will increase meaningfully again in 2023, with the biggest drivers of that being the launch of the next generation of our consumer Quest headset and hiring that has been done in 2022, but for which we are going to be paying the first full year of salaries next year.

More broadly, beyond 2023, we expect to pace Reality Labs investments to ensure that we can achieve our goal of growing overall company operating income. Our capital allocation philosophy over the long-term is to allocate a portion of the profits generated from the Family of Apps towards these future-focused areas while enabling a greater return of capital to shareholders.

Source: SA Earnings Call Transcript (Q3 2022)

You have probably read other articles – 12 pieces were posted on Seeking Alpha yesterday alone (and 6 more the day before the earnings release). For my part, I’d like to take a closer look at Wall Street’s analyses – what conclusions analysts draw based on their assumptions and models. Let’s get started.

Barclays – Tough Lesson In Ad-Land, But There’s Still Value Inside The Walls In Menlo (October 26)

Analysts: Ross Sandler, Mario Lu, Trevor Young, CFA, John Hall

Analysts of the English bank lowered their price target from $250 to $165 per share (-34%) but kept their rating on the stock at “Overweight” with a positive industry outlook. That is, taking into account yesterday’s decline, the upside potential is 68.47%. Here are their key takeaways:

META reported revenue and EPS broadly in-line with consensus and guided below. Management’s message remains largely consistent but is falling on deaf ears: META is making heavy investments in AI, ad product improvement, and FRL, with little near-term payoff but lots of confidence long term. Given the stock’s reaction to largely the same story as before, it’s clear the buy-side has lost patience and is voting with their feet (since they can’t actually vote with shares). In contrast to GOOG which is also investing heavily, investors don’t have the same confidence in the return profile of what META is dumping billions of dollars into, which we think is a bit unfair. While painful, this kind of wake-up call should help steer the ship back on track eventually, in classic value trap fashion. The ad businesses are high margin and META can still surprise as these investments taper off in 2024 and the digital ad market recovers. Until then, shares likely remain volatile.

Source: Barclays, October 26 (emphasis added by the author)

I fully agree with their conclusions that the buy side is finally disillusioned with the optimality of the capital allocation principles of META – the U.S. economy is still quite strong, but the macroeconomic environment should theoretically force corporations to shift into a frugal mode and not spend money left and right. Mark Zuckerberg stunned everyone when he did not adjust his CAPEX policy for 2023 and decided to go full in, giving META time to swallow as much as possible of a new and promising market in the coming years.

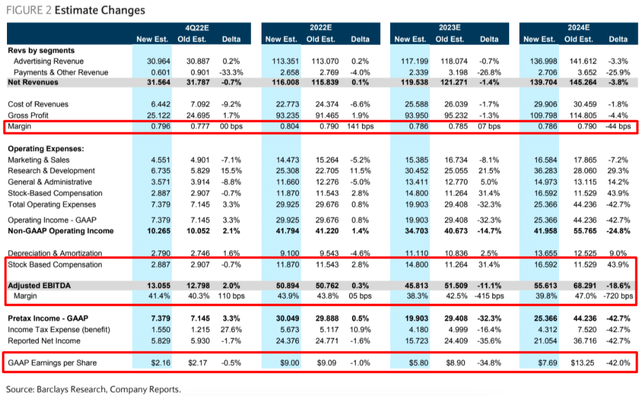

As a result, Barclays was forced to adjust its forecasts for GAAP EPS by -34.8% and -42% for 2023 and 2024, respectively (and that seems like a lot, actually):

Barclays, October 26, author’s notes

The main part of the business – advertising – as we can see from the gross profit, will not suffer much in 2023. In fact, according to their forecasts, it should be 0.07 bp better next year than previously thought. The bulk of the EPS reduction is in operating costs, which are expected to rise 33.36% from FY2022 to FY224 – revenue and gross margin will only increase by 20.43% and 17.76%, respectively, over the same period.

Note: I had to calculate the total operating expenses myself because the analysts mistyped the numbers in their spreadsheet.

But even despite the stagnation described, META is undervalued according to Barclays’ valuation model – I tried to adjust it to yesterday’s severe dip:

Barclays, October 26 (adjusted by the author, based on YCharts data)![Barclays, October 26 [adjusted by the author, based on YCharts data]](https://static.seekingalpha.com/uploads/2022/10/28/49513514-16669424924805405.png)

It is obvious that yesterday’s drop in META’s share price is nothing more than an overreaction of the market – with an FCF yield of 9.81%, an EV/EBITDA (TTM) of 5.324x and a P/E (TTM) of 9.34x, the company seems vastly undervalued, both by its historical standards and relative to its sector. In addition, we should understand that analysts’ forecasts already take into account the slowdown in sales growth and EBITDA for the next 2 years – META has already fallen so much in the past year that all this is priced in.

Let us not jump to conclusions, though – the TTM multiples do not tell us anything yet. Perhaps other banks can tell us something more.

JPMorgan – Less Exciting Revenue Drivers In ’23, with Macro Uncertainty & Less Cost Control Than Expected (October 27)

Analysts: Doug Anmuth, Katy Ansel

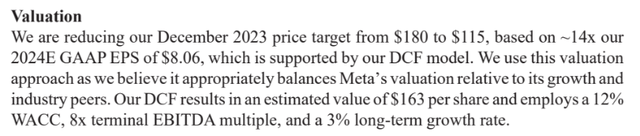

Analysts at JPM remain skeptical about the foreseeable future of META and give the stock a price target of $115 per share (down from the previous target of $180, -36.11%), which implies only a 17.41% upside potential.

This is well below Barclays’ forecasts above, which were based on rather pessimistic assumptions. So what is the difference in the valuation approaches of the two banks?

The difference [compared to Google] is that Meta was supposed to be ahead in shrinking the company in 2023, and transparency around expenses and CAPEX for next year should have been a benefit. Meta will hold headcount flat from 3Q levels in 2023, but total expenses are still anticipated to be $96B-$101B, above Street expectations that were for a low-end around $90B. Reality Labs will lose significantly more in 2023 – going in the wrong direction – largely due to the launch of the next-gen Quest headset. And CAPEX – which has more than doubled over the past 2 years-will increase to $34B-$39B. To be fair, flat headcount & significant slowing of total expenses and CAPEX reflect progress in cost rationalization, but Meta remains committed to investing for the long-term, particularly in: 1) the AI discovery engine; 2) ads & messaging; & 3) the metaverse. However, the timing on return of those investments remains unclear, and we believe the set of revenue drivers into 2023 is less impactful than in previous years, and faces macro headwinds. Key topline drivers in 2023 include Reels (currently at a $3B annualized run-rate), click-to-messaging ($9B run-rate), click-to-WhatsApp ($1.5B run-rate), easier comps, & less Y/Y ATT headwind, all coming against uncertain macro. Net/net, our 2023 revenue estimate remains mostly unchanged at +3% reported growth, but against an elevated expense base. This takes our 2023 GAAP EPS from an already below consensus $9.24 to $7.28 currently.

Source: JPM, October 27 (emphasis added by the author)

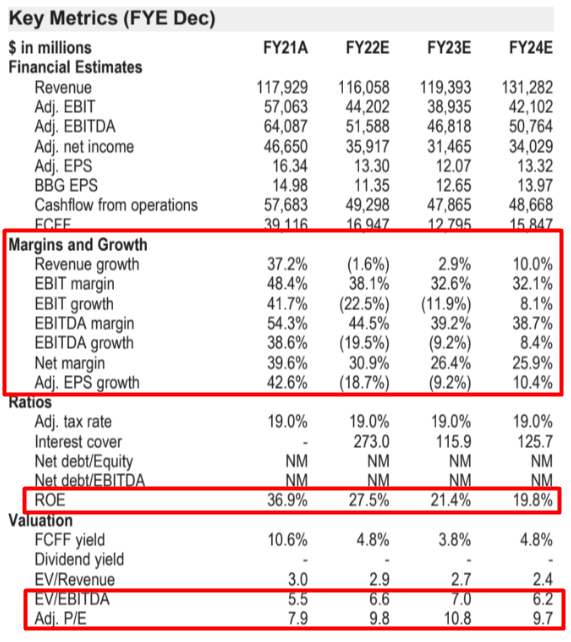

What analysts at the two banks agree on is the issue of the CAPEX payback period and the justification for the increase in overall operational spending. However, JPM is much more conservative in its valuation of the company – the implied valuation multiples allow in principle for a P/E level in 2023 that is similar to what we see today, mainly due to a decline in revenue/EBITDA/EPS growth and a decline in margins (and profitability metrics).

JPM, October 27, author’s notes

Originally, JPM expected META’s Reality Labs revenue of $446 million in Q3 2022, but it turned out that this segment only brought in $285 million (-36.2% miss). That’s why, despite stronger growth in unit economic metrics and generally more robust margins last quarter (than expected initially by the bank), JPM was frustrated with the prospect of META’s new ventures going forward.

The question of the appropriateness of such large capital outflows in “an unknown niche” most likely led JPM’s analysts to use a WACC of 12% over the next 2 years to calculate the fair value of the stock based on DCF modeling:

In general, I agree rather than disagree with JPM, but I assume that their valuation is very sensitive to the WACC assumption – the bank is clearly too conservative when we compare the analysts’ inputs to those reported by third-party investment sources:

Source: Author’s compilation

My assumption is confirmed if we try to find a new price target using the school algebraic proportion formula, assuming a 12% change in WACC to the average from the sample above:

($115 * 0.12) / 0.0852 = $162

As you can see, this is pretty much the same target that we saw in Barclays’ report. Let’s remember this thing before drawing final conclusions.

We have 1 more report left that might shed light on how Wall Street feels about META after Mark Zuckerberg’s fabulous performance.

Goldman Sachs – The Dueling Narratives of (Possibly) Inflecting Revenue Into An Investment Cycle (October 27)

Analysts: Eric Sheridan, Alexandra Steiger, Alex Vegliante, CFA

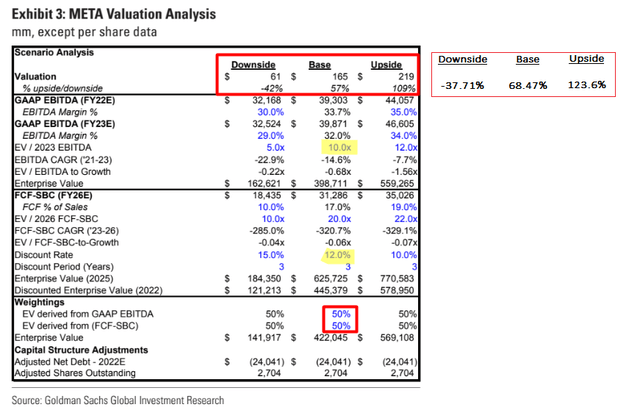

GS’s analysts reiterated their buy rating with a 12-month target price of $165 per share (-17.5% lower than before, in line with Barclays and JPM’s adjusted-for-WACC target). Here’s their reasoning:

In its Q3’22 earnings report, Meta management produced a two-sided story. On one hand, FX-neutral ad revenue was better than feared with management striking an upbeat tone around user growth, engagement (incl. around Reels/short-form video) & the lapping impact of the prior 12+ months of headwinds from Apple’s privacy changes. Taken alone, the narrative around advertising trends would have left investors with an upside surprise relative to both expectations and recent earnings reports with management’s commentary pointing to a potential ~DD% revenue growth in 2022 in a more stable macro environment in 2022. On the other hand, OPEX/CAPEX in 2022 remains elevated with management providing initial 2023 OPEX/CAPEX guidance well above expectations. Despite these investments going toward a range of initiatives in support of AI, knowledge graph/recommendation engine, ad platform automation measurement/attribution and overall data center infrastructure, this level of investment puts a material downward node on profitability and FCF generation in 2023. While management framed the potential for out-year margin stability and CAPEX intensity to lessen, the mixture of low visibility into such trends against investor fears of the current macro environment, competition, and overall sensitivity to GAAP profitability-driven valuation approaches now likely makes META a “show me story” for investors on a 12-18 month view. META’s 2023 revenue trajectory and out-year margin improvements both provide an eventual means to test returns on this investment surge in 2022/2023. While debates will likely persist around product transitions and industry platform headwinds in the quarters & years ahead, were main focused on Meta’s large scaled audience across their Family of Apps (an advantage that continued to scale this past quarter), against which the company can continue to align evolving consumption habits within short-form video, messaging, commerce, augmented reality & social connections. Of note, management disclosed that click-to-message ads are now at a $9bn annualized run-rate (well above our expectations), which have long been discussed as a potential catalyst among investors. Taking a step back from the recent stock performance (both YTD and in the after-market), we see platform/infrastructure investments by Meta (which started in mid-2020) as both a) continuing to build independence from a volatile range of outcomes from future mobile OS platform changes; and b) aligned with a strategic shift toward short-form video and from the social graph to the interest graph.

Source: GS, October 27 (emphasis added by the author)

I like the analysts’ “Show me the story” statement – despite the company’s excellent performance in certain segments – e.g., click-to-message ads – OPEX and CAPEX are a real wild card in the medium term.

And what about valuation?

GS, October 27, author’s notes and calculations

The bank’s analysts have a rather strange approach – they use a rather high WACC of 12% (like JPM) for the first half of the model, but at the same time a rather high EV/EBITDA (10x) for the second half. Apart from that, the conclusion is in line with other banks – META seems to be undervalued, regardless of whether Zuckerberg will really spend that much money on new projects in 2023 or not.

Summary Thesis and Bottom Line

Now that we know what The Street thinks about the new META report, we can draw some conclusions.

The fact that the company’s management did not pay attention to macroeconomics when adopting its strategic development plan, of course, fell on them – the market punished META with a capitalization loss of almost $80B in one day. The likelihood of META maintaining its long-term growth rates of key financials and continuing to buy back shares and provide good returns to shareholders over the next 1-3 years has plummeted after Zuckerberg’s words – if he and his team were to revise the company’s strategy from a focus on Reality Labs to the core business and Reels, we would most likely see a gap up at the market opening.

Judging by trading volumes, institutional investors hastily sold their shares into the hands of retail investors who did not have the strength to keep the price higher.

But did it make sense for retail investors to buy META’s dip?

If this was an “average down”, then the answer is no rather than yes. You will need to be patient and have another cache package ready to average down once again when/if other big techs drag the rest of the market along.

If you first bought META yesterday, the conclusion is the same, but now you have an average purchase price that is well below the fundamentally sound intrinsic share price.

In my opinion, the fair valuation of the company is $150-160 per share, which implies an upside potential of 53-63%, which is a great deal. However, you have to understand that META has to prove in practice that its metaverse initiatives are indeed justified. One of the clearest examples I see is the relatively recent story of Netflix (NFLX) stock. Let me remind you that on April 20, NFLX plunged 35% in one day as its user base declined and management took initiatives to change its business model. After that dip, the quotes fell another 27% until the company finally proved on October 19 (2 quarters later) that the management’s ideas really work. Since that massive first drop (35%), buy-the-dippers have earned between 20% and 40% depending on when they entered the market, which is great in both cases.

Another way META can rise 50-60% from current prices was given by Altimeter Capital’s analyst – Brad Gerstner:

- Reduce headcount expense;

- Reduce annual CapEx (by at least $5 B from $30B to $25B); and

- Limit investment in metaverse/Reality Labs to no more than $5B per year.

These guys held META as the 3rd largest holding in their portfolio, according to Business Insider (Published: Oct 25, 2022), so I think Brad knows what he talks about. Once the company hints at moving forward with these initiatives, some of the departed institutional investors may come back and breathe new life into META.

In any case, my final conclusion, which is also my thesis, is that META is fundamentally overvalued because of the resilience of its core business and the growth and monetization prospects of Reels, WhatsApp, and Messenger. But management has been playing in the metaverse too long, in my opinion, so the market tried to bring them down to earth yesterday. I think they will draw the necessary conclusions and prove the market wrong. I recommend buying META at today’s price. However, be prepared to have to buy more in case of any deeper setbacks.

Thanks for reading! Please share your opinion in the comment below!

Be the first to comment