subman/iStock Unreleased via Getty Images

Investment thesis

While a rising interest rate cycle is usually a positive for a banking stock like JPMorgan Chase & Co. (NYSE:JPM), high wage inflation, geopolitical tensions, and increased investments in growth initiatives are some of the major headwinds for the company’s bottom line. JPM is significantly increasing its investments in new projects and technology from between $10 bn and $12 bn annual range to ~$15 bn in the current year. These headwinds are expected to more than offset any positive impact from increasing interest rates and, according to consensus estimates, the company’s EPS is expected to decline from $15.36 in FY2021 to $11.17 in FY2022. While the company’s EPS should start recovering in FY2023, the pace of recovery is uncertain with management not providing enough clarity on the payback of these investments. Hence, I have a neutral or hold rating on the stock despite the improving interest rate environment.

Last Quarter Earnings Analysis

JP Morgan Chase & Co. reported its Q4 21 earnings on January 22nd. Its managed net revenue of $30.3 billion increased 1% on a year on year basis beating the consensus estimate of $29.9 billion. Net interest income was higher by 3% driven by balance sheet growth partially offset by lower net interest income in CIB markets. Noninterest revenue was down 1% because of lower revenue in CIB Markets and lower production revenue in home lending offset mostly by higher investment banking fees. Noninterest expenses were up 11% year over year because of an increase in both higher compensation and non-compensation expenses. Net income of $10.39 billion in the quarter was down by 14% year over year driven by higher noninterest expense partly offset by higher revenue and net benefit in provision for credit losses. Q4 EPS of $3.33 down 12% year on year but higher than the consensus estimate of $3.01

JPM Stock Key Metrics

Like any banking company, net interest income (NII), non-interest revenues (NIR), corporate and investment banking (CIB) revenues, provisions and other charges, and non interest expenses are the key metrics for JPMorgan Chase and Co.

For the full fiscal year FY’21, net interest income and non-interest revenue were $44.5 billion and $53.4 billion. Both of these figures exclude CIB markets revenue of $27.4 billion. For FY 2022, management’s guidance for NII excluding CIB markets is $50 billion. However, this was given in January based on the expectation of three rate hikes in 2022. The interest rate forecasts have changed considerably and analysts are now expecting multiple rate hikes this year. In a recent analyst conference, Jeremy Barnum, JPMorgan Chase & Co. CFO, said that NII can grow to $53 billion with six rate hikes. For CIB markets, management has not given any guidance, but given the volatility in the equity markets, they see some deals getting pushed out to outer quarters, waiting for more stable conditions.

On the expense side, there are several headwinds. The first is a projected increase in adjusted noninterest expense from $70.9 billion to $77 billion in FY’22, an increase of about $6 billion year over year.

The annualization of post-reopening trends accounts for nearly $2.5 billion of this increase. Another $3.5 billion is due to growth investments in technology, distribution and marketing. This investment is consistent with the company’s prior focus on areas like cloud capability building, more data centres, improvement in digital customer experience, branch expansion and card related marketing expenses, etc. Normally, the company spends around $10 billion to $12 billion on growth investments in a year. However, on the Q4 earnings call, management revealed their plans to spend close to $15 billion in FY’22.

Though management believes they can increase their market share through these investments, there is a good deal of uncertainty regarding the payback period of these increased investments and management provided little clarity on it. Investors didn’t like it and the company’s stock price is under pressure as a result.

What Is The Target Price For JPM?

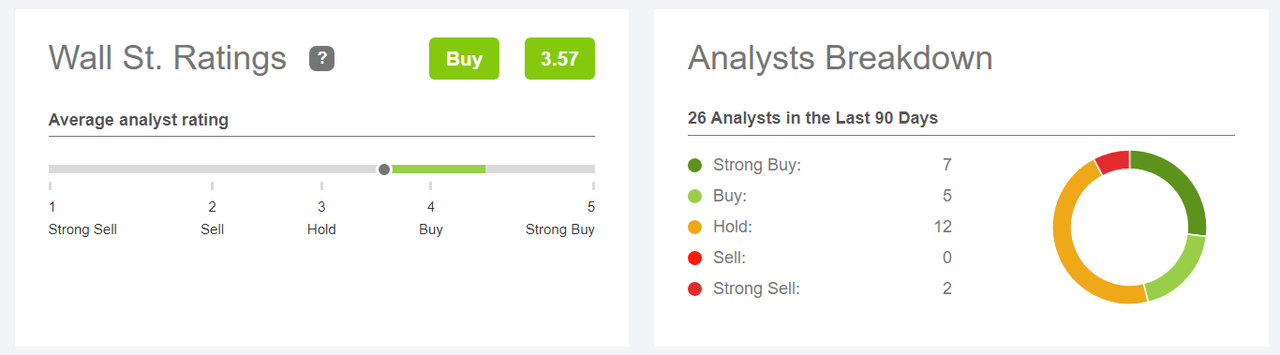

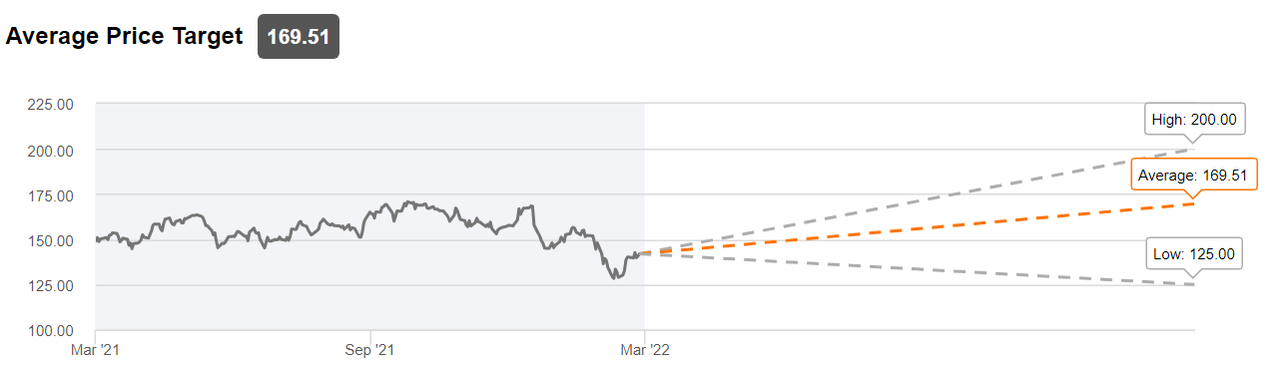

Wall Street is slightly bullish on the company with seven analysts having strong buy ratings, five having buy ratings, 12 analysts having hold ratings and two analysts having strong sell ratings. Their average target price is $169.51. However, there is a wide range of opinions with the lowest target price being $125 and the highest target price being $200.

JPM Wall Street Ratings (Seeking Alpha)

JPM Wall-Street Target Price (Seeking Alpha)

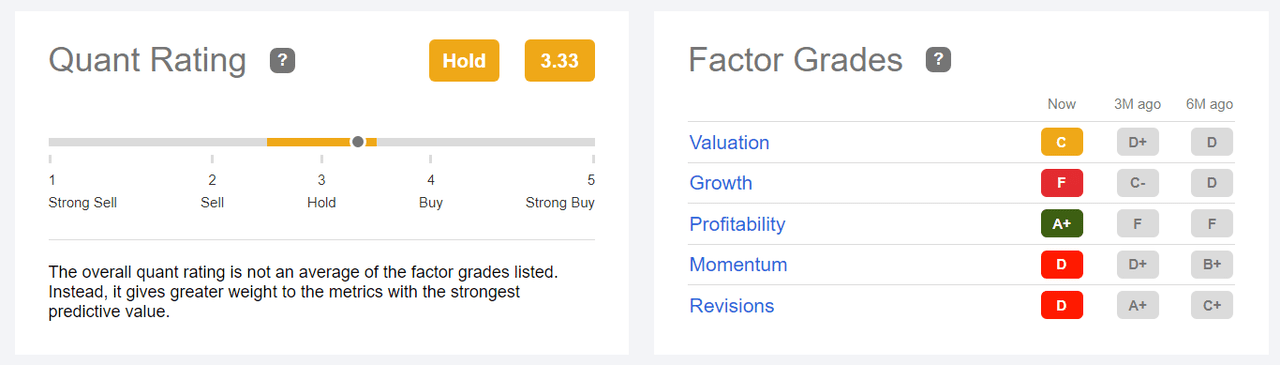

The quant rating on the company is neutral with it scoring poorly on growth, momentum and earnings revision metrics.

JPM Quant Rating (Seeking Alpha)

What Is The Short-Term Future Of JPMorgan?

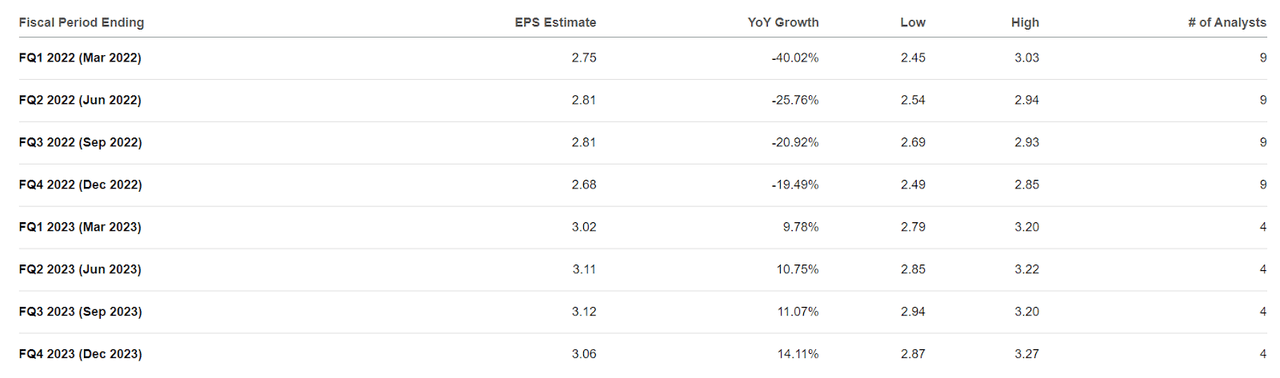

If we look at the near term earnings prospects, the company’s EPS is expected to decline sharply this year. The consensus numbers are expecting EPS to decline ~40.02% in Q1, 25.76% in Q2, 20.92% in Q3 and -19.49% in Q4.

JPMorgan Consensus EPS Estimates (Seeking Alpha)

The company is expected to return to earnings growth in FY2023 helped by easy comparison and NII continuing to benefit from rising interest rates. However, it might take some time before JPM’s earnings recover to FY2021 levels when the company posted an EPS of $15.36. So, in the short term, investors would likely focus on the extent of earnings decline this year and the pace of recovery next year. If we look at the current year consensus estimates of $11.07 and next year’s estimates of $12.27, the company’s near term prospects don’t look encouraging.

Where Will JPM Stock Be By 2025?

There is a lot of uncertainty around the payback period of the company’s increased investment in growth initiatives. Also, I don’t think the federal reserve will move too much beyond a 2% rate hike as inflationary conditions will get better in the long term with supply chain constraints easing. So, beyond FY 2023 I am expecting a limited tailwind from the rising interest rate cycle. Also, while the bank is currently well-capitalized, the implementation of Basel IV will further raise the capital requirements for systemically important banks like JP Morgan. So, not great news on the regulatory side either. If the company can gain market share based on increased growth investment the earnings might recover to FY21 levels and the stock might reclaim the all-time high of $173 it made last year. However, there is a great deal of uncertainty attached to it and limited clarity provided by management. I believe the $173 stock price by FY2025 will be the bull case for the company while the base case will be somewhere around the current $140 to $150 levels with a healthy dividend yield of ~2.84% providing the downside support.

JPM Stock A Buy, Sell, or Hold?

JP Morgan Chase & Co. is currently trading at ~$142, with a forward non-GAAP P/E of 12.82x. While there is a possibility that the stock does well in the long term if the company’s growth investment works and it is able to gain market share, there is too much uncertainty attached to it. In the near term, JPM’s EPS is likely to see a significant reduction this year and the near term outlook is not encouraging. I believe the company’s healthy dividend yield of ~2.84% will provide some downside support, but the stock is unlikely to see an upward trajectory unless investors get more clarity on where exactly JPM is planning to put incremental spending and what kind of outcome or longer-term targets can investors expect. Hence, I have a hold or neutral rating on the stock.

Be the first to comment