Jetlinerimages/iStock Unreleased via Getty Images

Southwest Airlines (NYSE:LUV) reported third quarter results on Thursday. In this report, I will be analyzing the third quarter results and the outlook that Southwest Airlines provided. Overall, we are seeing Southwest Airlines delivering and continued demand strength is expected despite macro-economic headwinds.

Southwest Airlines Delivers

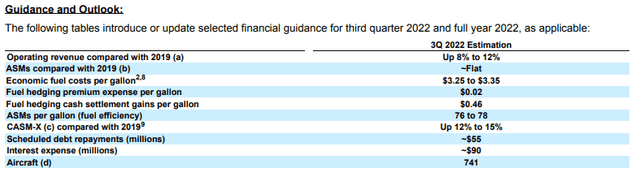

For the third quarter, Southwest Airlines guided revenues to be up between 8 to 12 percent, and they delivered right in the mid-point of that with a 10.3% revenue increase. However, while initially it was expected that Q3 would see more prominent strength and revenue support from business travel, that was not the case. In July and August, leisure demand was stronger than expected while business was weaker but caught up in September. Previously, Southwest Airlines planned on flying shorter trips into business-oriented markets and that plan did drag down revenues for the third quarter somewhat as business demand was not as strong as initially expected, but this is mostly seen as a timing issue offset by higher leisure travel demand. Capacity was expected to be flat, and with a 0.3% decline in capacity, Southwest delivered on that guidance. Economic fuel costs came in at $3.34 per barrel within the range that Southwest guided for. CASM-X was expected to be up 12 to 15 percent and the rise was at the lower end with 12.2%.

So, when it comes to unit costs, top line and capacity Southwest Airlines nailed it. They had a bit of a different revenue build out between leisure and business but still got right in the middle of the targeted revenue range.

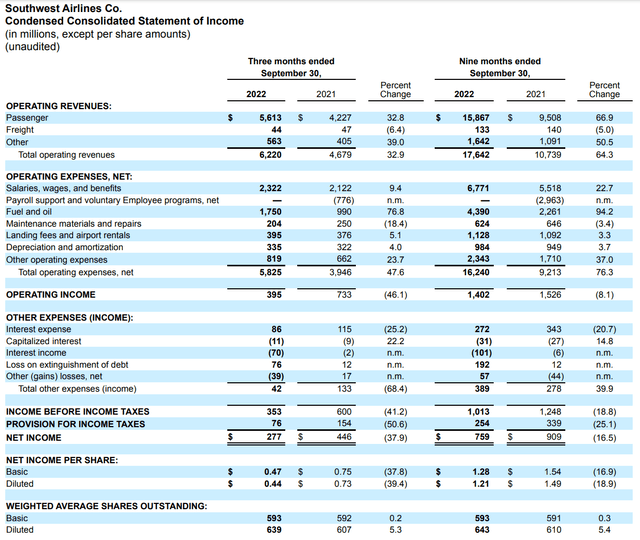

Revenues of $6.22 billion, marking a 33% increase in revenues, were in line with what analysts expected, driven by 17.5% more revenue passengers carried and a 31% increase in revenue per available seat-mile offset by lower stage lengths. Operating income showed that seemingly performance was worse. However, we have a 77% increase in fuel prices and inflationary costs included in many of the other cost components while there no longer is any payroll support. Adjusting for the Payroll Support Program, profits went from a $43 million loss to a $395 million gain, which is a strong improvement given that costs went up significantly and Southwest Airlines in some way is carrying excess costs as it is aligning the staff for next year when it aims to further increase its capacity. On a per share basis, core earnings were $0.50, exceeding analyst estimates by 8 cents per share.

Confident About The Future

One thing I like about Southwest Airlines is that, while some airlines were worried about either share price performance, mismatches with financial performance, or seemingly being focused on hiring pilots in Q1 for Q2, Southwest Airlines has always been clear about their entire training footprint and timeline. The company shared how many instructors it would need in previous quarter calls and it will have 26 simulators giving them full pilot training capacity. Additionally, the company recognized it takes 90 days to go from interview to airline. Specific training and a lot of hiring they do these days is not for this year but really to support the company next year as employees, not just pilots, have become more proficient. Southwest Airlines really has an approach I like towards the capacity restoration challenge and I think that is helping them with current performance. Through 2023, pilot shortage will still be the bottleneck, but after that, having enough jets to cope with demand could become the limiting factor.

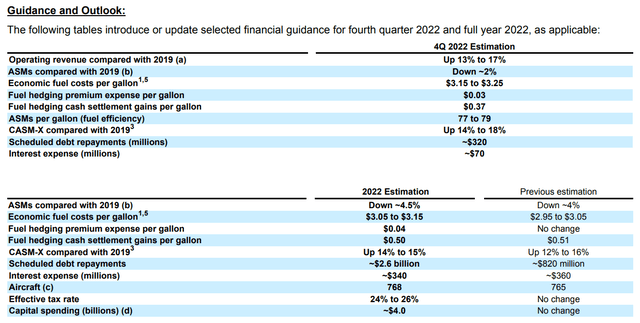

The fourth quarter revenues will continue to exceed 2019 levels on capacity that will be down 2% to size the airline capacity with expected demand. This downward revision does put the CASM-X guide up to 14 to 18 percent. In comparison, for Q3 2022 Southwest Airlines had guided for CASM-X to be up 12 to 15 percent. The differential in CASM-X growth can mostly be attributed to the capacity reduction in the fourth quarter. Economic fuel prices are expected to come down sequentially as well, providing a $185 million hedging gain.

For the full year, capacity is expected to be down 4.5% from a previous estimate of 4% and fuel year economic fuel costs per gallon are expected to be up as well as the overall oil price environment has been brutal. Southwest Airlines also specified its CASM-X guide which narrowed the unit cost growth excluding fuel to the 14-15 percent range from 12-16. The company also expects to repay more debt for the full year as the third quarter included the redemptions of its $1.2 billion principal Note due 2023 and other notes in the mount of $611 million.

The company further detailed changes to its fleet plan with 182 MAX 7 deliveries instead of 192 with 13 fewer aircraft in 2023, three more in 2024 via option conversion and fifteen deliveries from 2030 being pulled into 2026. For the MAX 8, 5 orders have been added to the 2022 plan via option exercise. Seventeen have been added in 2023 via conversion of 13 MAX 7 orders and four option conversions. So, we are also seeing that Southwest Airlines is managing its future fleet and attempts to reduce its exposure to the MAX 7 which is facing regulatory hurdles for certification.

The company expects to be 90% recovered in the summer of 2023 with 100% of its network restored by the end of 2023 and 14% year-over-year growth in capacity, which should put the capacity restoration ahead of the network restoration.

The execution from Southwest Airlines at this point, as well as future planning, allow the airline to extinguish debt early and consider returning value to shareholders. And while there is no firm plan for this, I do believe that Southwest’s methodological approach towards its business will allow it to repurchase shares and consider dividend payments before many other airlines can even start thinking about any such shareholder returns.

Conclusion: LUV Remains A Buy On Strong Execution And Future Shareholder Returns

Southwest Airlines might not have the revenue space for growth that some international focused airlines are enjoying, but there is plenty of space to increase revenues and drive unit costs down. The company is very conscious in its approach towards bringing capacity back, and they have shown that by discussing details such as the number of flight instructors required and the number of simulators they will have. That allows the company to execute well on its plans, meet goals set in the guidance, extinguish debt, and think about shareholder returns. Overall, they are doing all the right things an airline can do to make airline investment as comfortable as possible.

Be the first to comment