anusorn nakdee

“Time is only relative when you’re man.” – Anthony T. Hincks

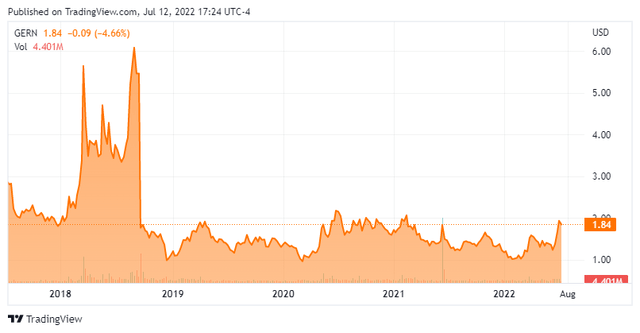

It has been nearly a year and a half since we last took a look at a small biotech concern called Geron (NASDAQ:GERN). I have been following this story for nearly a decade. The company’s quest to achieve FDA approval has been akin to the classical Broadway play ‘Waiting for Godot‘ for some time now. The shares recently hit a 52-week-high. Given that, it seems a good time to circle back on Geron. An analysis follows below.

Company Overview:

Geron is located in San Francisco and is focused on the development and commercialization of therapeutics for hematologic myeloid malignancies. Its primary drug candidate and asset is imetelstat which it has wholly own rights to. Imetelstat is a telomerase inhibitor which inhibits the uncontrolled proliferation of malignant progenitor cells in hematologic myeloid malignancies to reduce dysfunctional blood cell production and enable recovery of normal blood cell production. The stock trades just under two bucks a share and sports an approximate market capitalization of $725 million.

Recent Developments/Coming Potential Catalysts:

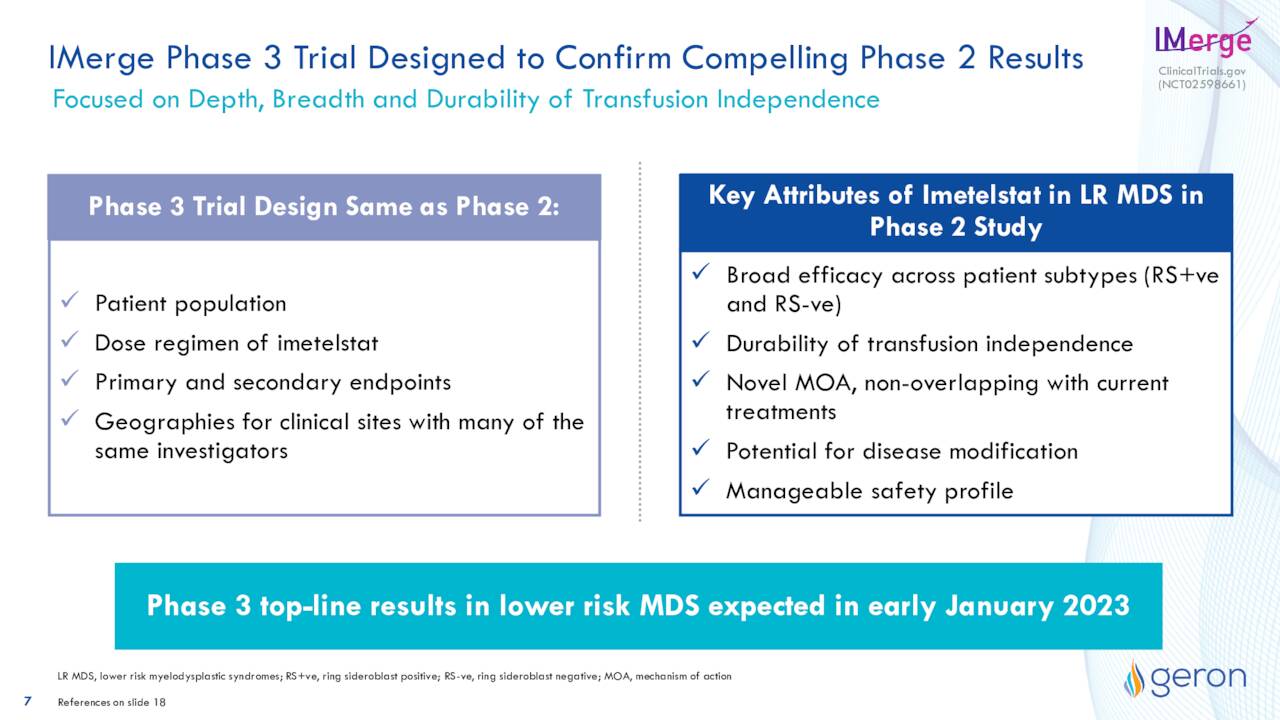

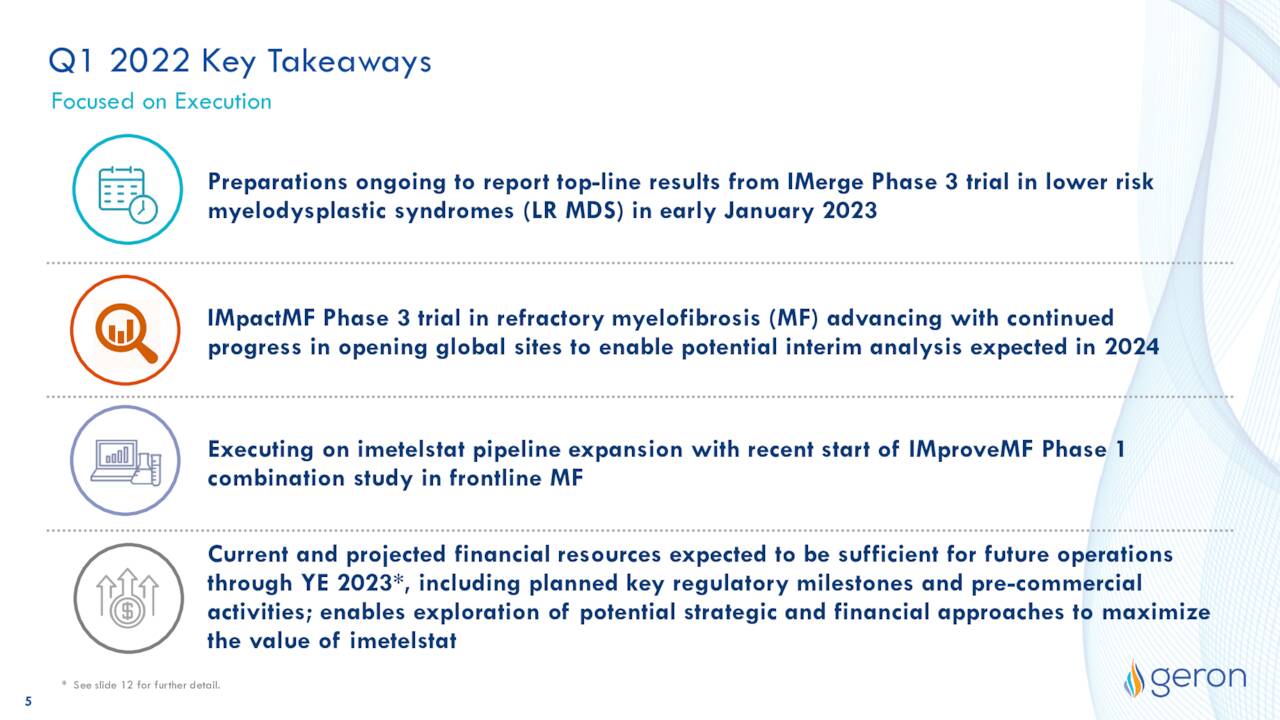

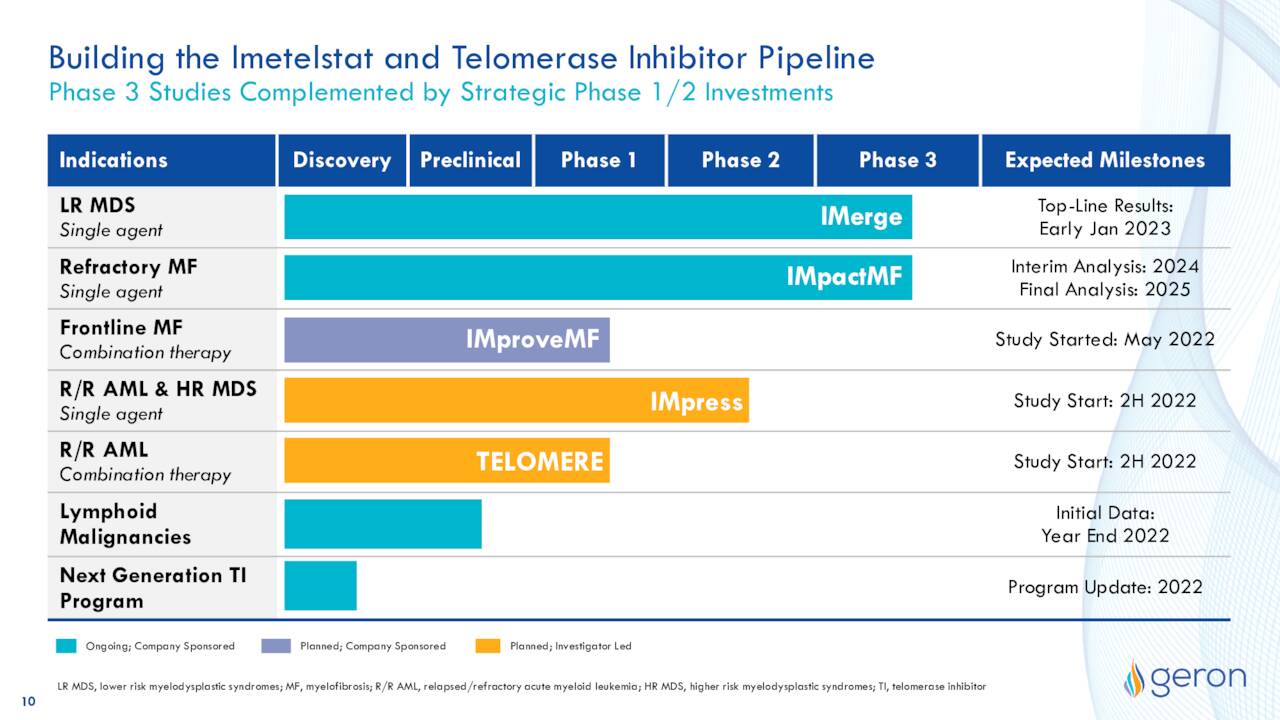

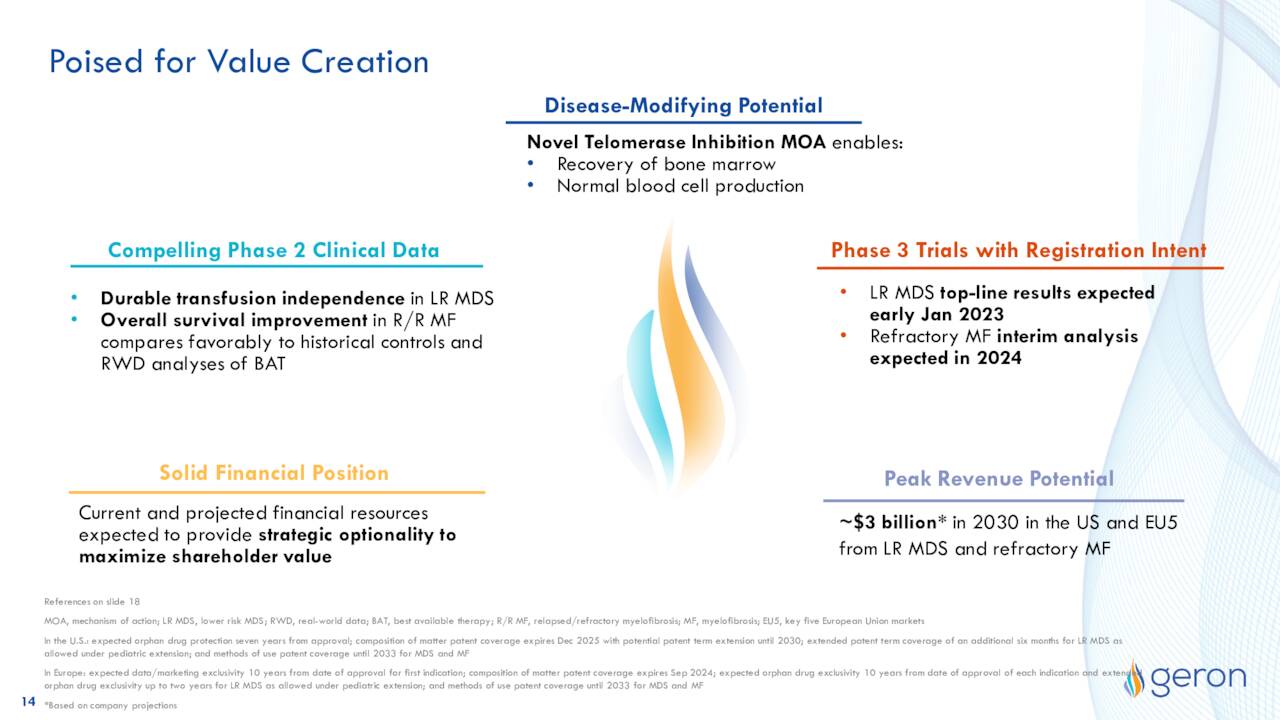

Currently, imetelstat is being evaluated in a confirmatory Phase 3 study named IMerge to treat low-risk myelodysplastic syndrome or LR-MDS. Topline data from this trial should be out late in the first quarter of next year. If the results are successful, marketing applications should soon follow. This follows a successful mid-stage study around this indication.

May Company Presentation

LR-MDS is an affliction that is characterized mainly by anemia in most cases. Supportive care – primarily red blood cell transfusions – remains an important component of their treatment. However, this exposes patients to insufficient correction of anemia, alloimmunization, and organ iron overload. There are just over 30,000 individuals in the U.S. and Europe with this condition, equating to just over a $1 billion annual market in the U.S. and Europe.

May Company Presentation

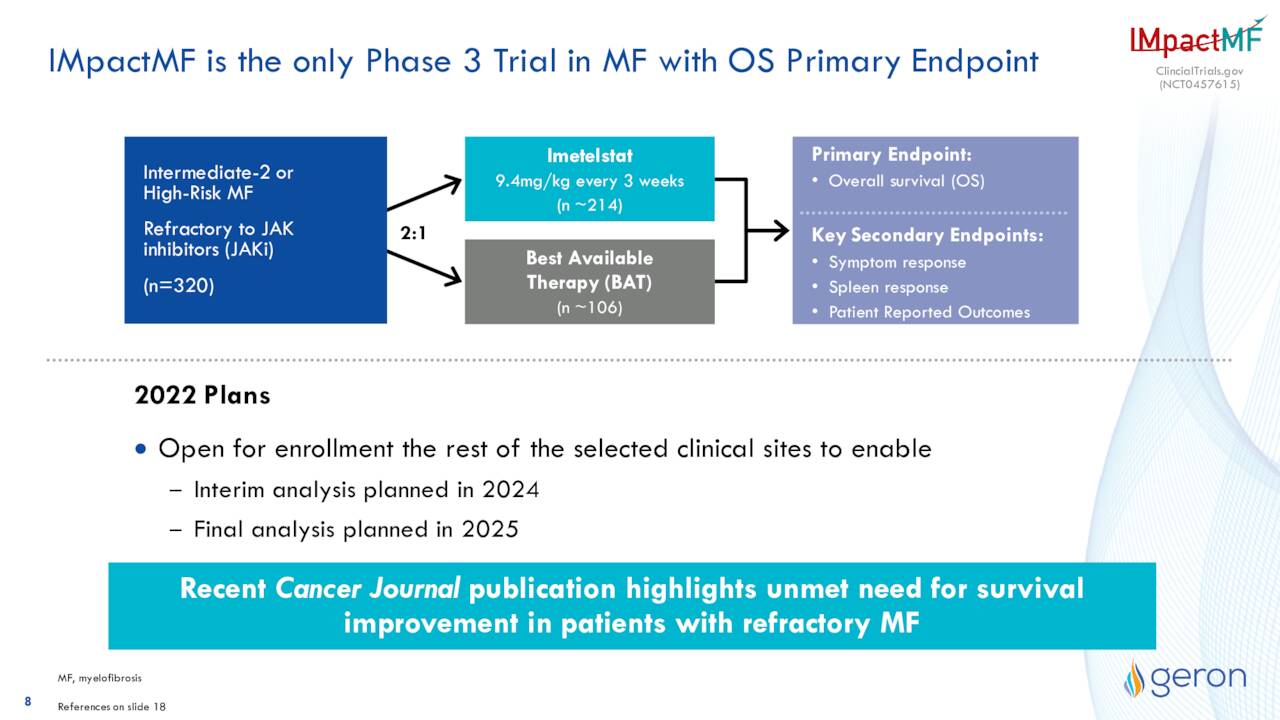

In addition, an interim analysis from a Phase 3 study IMpactMF using imetelstat to treat refractory myelofibrosis should be out sometime in 2024 as the company continues to open sites to enroll patients for this trial. Myelofibrosis is a chronic blood cancer in which abnormal or malignant precursor cells in the bone marrow proliferate rapidly, causing scar tissue, or fibrosis, to form. An earlier stage study with 96 patients with Janus kinase (JAK) inhibitor-relapsed/refractory intermediate-2 or high-risk myelofibrosis demonstrated encouraging results with median overall survival of 29.9 months compared to 12 months with the best available therapy (BAT).

May Company Presentation

The company also has several earlier-stage studies around imetelstat in the works.

May Company Presentation

A month ago, the company announced a new Chief Medical Officer, who has been involved in shepherding imetelstat’s development for some time and has played a strategic role in designing and driving execution of the Phase 3 clinical trials around this compound.

Analyst Commentary & Balance Sheet:

The company gets relatively sparse coverage on Wall Street. On May 11th, Robert W. Baird reissued their Buy rating and $4.00 price target. Both Needham and H.C. Wainwright have reiterated Buy ratings and identical $2.00 a share price targets. Nearly eight percent of the outstanding float in Geron is currently held short. There has been no insider activity in the shares in nearly two years.

The company ended the first quarter with approximately $178 million in cash and marketable securities on its balance sheet. Geron then did a secondary offering in April, which raised approximately $75 million. It was a costly capital raise as each share sold had a warrant attached that could be exercised at $1.45 per share. Management has stated that this funding is ‘sufficient to fund Geron’s projected level of operations, which includes preparatory activities for potential U.S. commercial launch of imetelstat in lower risk MDS, until the end of 2023‘

Verdict:

May Company Presentation

Geron, as it always does, has potential. The company believes if imetelstat is approved for its two lead indications, the drug compound could have $3 billion of peak sales potential by FY2023. This is more than four times its current market cap in comparison.

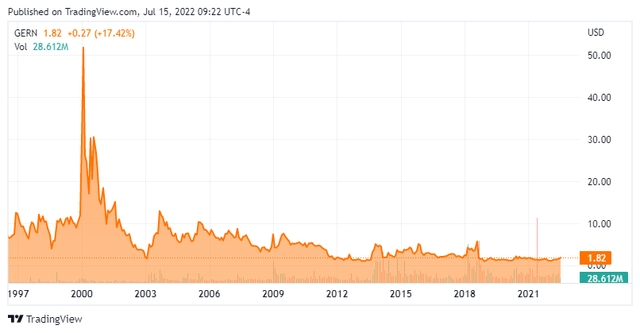

The trouble with Geron is the company has been public for 25 years now and still hasn’t got over the finish line to FDA approval. In the process, it has destroyed massive amounts of shareholder value. With some $150 million in annual operating expenses and no current revenues, it is likely Geron will back for yet another capital raise in the not-so-distant future. My guess is the company will raise money again in 2023 after it files its NDA for imetelstat to treat LR-MDS.

That may be a more certain time to acquire a decent size holding of the stock. Until then, it is probably no more than a small ‘watch item‘ position, given the company’s long history of disappointing shareholders. Options are available against this equity and they are liquid and lucrative making a simple covered call strategy viable. This is how I am personally taking that small watch item holding in GERN in my personal account.

“A patient man is someone who has seen worse.” – Somya Kedia

Be the first to comment