adaask

Both Plains All American (NASDAQ:PAA) and Enterprise Products Partners (NYSE:EPD) are investment grade midstream master limited partnerships that sport sky-high distribution yields of 7.4% and 7.0%, respectively.

In this article, we will review their Q2 results and then compare them side by side and offer our take on which one is a better buy.

Q2 Results

PAA’s results were very strong, prompting management hike its full year Adjusted EBITDA guidance. On top of that, management announced that they expect to achieve the midpoint of their target leverage ratio range by the end of the year thanks to aggressive debt reduction and improved EBITDA guidance.

Given these developments, it is looking increasingly likely that PAA will continue to focus on distribution growth and could potentially see it accelerate even further next year. Accelerated buybacks are also an option next year, but it appears that – barring a dramatic sell-off in the unit price – PAA will likely favor distribution increases next year. As the CEO said on the earnings call:

I think you’ll see that we will continue to support distribution increases. I won’t give you specifics on that because, again, we have to have some conversation with our Board, but I would expect that the buybacks will continue to be opportunistic.

EPD, meanwhile, reported that distribution coverage continued to improve, reaching a very safe 1.9x distributable cash flow coverage ratio during Q2. The distribution looks even safer when considering that management is accelerating the unit buyback program, announcing plans to repurchase up to $300 million worth of additional common units by year end. On top of that, the leverage ratio continues to fall, now reaching 3.1x. This is not only one of the lowest ratios in the midstream sector, but it is also well below its own leverage target range of 3.25x-3.75x. This means that the distribution is very safe and likely to continue growing at an accelerated rate.

As a result, EPD has plenty of firepower with 97% of its debt at fixed interest rates and a weighted average term to maturity of 21 years. They will be able to respond opportunistically to any dislocations in the market as a result. As management said on the earnings call:

We’ve been preparing for this environment for a dozen years.

Business Model

PAA has a very large and competitively positioned business in the Permian Basin that is complemented by its Western Canadian NGL assets. Roughly 80% of its adjusted EBITDA comes from its Permian business, making the long-term outlook for that region key to its intrinsic value. As long as demand for midstream services is strong there, PAA will generate very significant cash flow, but the geographic concentration does pose some risk.

In contrast, EPD is a very well diversified business across geographies and energy commodities. Insiders are fully aligned with unitholders as they own about one-third of the partnership. Given EPD’s larger size, great insider alignment, and better diversification, we give it the edge in terms of which partnership has the better business model.

That said, both offer quite stable cash flows thanks to the commodity resistance and long-term fixed-fee nature of their pipeline contracts.

Balance Sheet

EPD is once again the clear winner here thanks to its aforementioned significantly lower leverage ratio, extremely long-dated debt at attractive fixed interest rates, and considerable liquidity. Its BBB+ credit rating also gives it the best credit rating in the midstream sector.

That said, PAA is still solidly investment grade as well and its leverage ratio is expected to be in the middle of its long-term target range by the end of the year. Furthermore, thanks to its massive free cash flow generation and substantially reduced CapEx budget, PAA is retaining a lot of cash that it is using to pay down debt aggressively. As a result, we can conclude that – though EPD clearly has the stronger balance sheet – this is an area of strength for both businesses.

Distribution Safety

Once again, this appears to be an area of strength for both businesses. Based on consensus analyst estimates for 2022 and 2023 distributable cash flow per unit and total distributions per unit, EPD’s distribution coverage ratio is expected to be 1.82x this year and 1.77x in 2023. Meanwhile, PAA’s is expected to be 2.54x this year and 2.75x next year. While neither distribution appears even remotely at risk at this point and it is true that EPD’s balance sheet and asset portfolio are considered stronger, given that those are separate categories that we have already evaluated, we will give the edge here to PAA due to its meaningfully superior coverage ratio.

Track Record

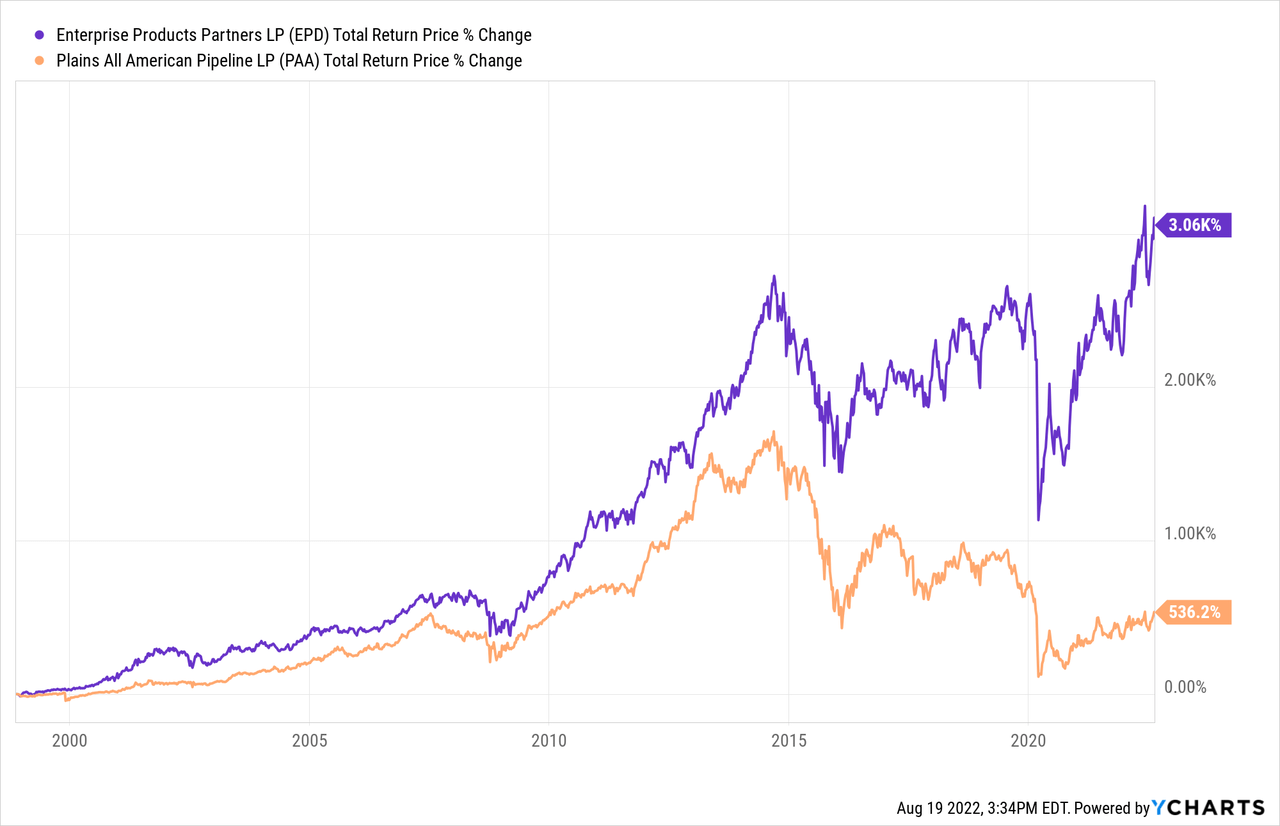

EPD crushes PAA when it comes to track record thanks to its multi-decade streak of growing its distribution per unit each year in contrast to PAA’s track record of repeated distribution cuts. On top of that, EPD’s total returns have massively outperformed PAA’s during the period that both partnerships have traded publicly:

Catalysts And Risks

PAA and EPD both face similar catalysts and risks in many respects given that they operate in the same industry. That said, PAA’s risks are greater given its greater concentration in oil and the Permian Basin. As a result, the single biggest risk and catalyst for PAA is the state of oil midstream supply and demand in the Permian Basin.

Given that it is currently slightly oversupplied, the risk is that in the coming 2-3 years it will remain in that state, forcing PAA to suffer a challenging recontracting environment. This in turn will cause its cash flows to decline and push its leverage ratio up. PAA will therefore have to pause growing unitholder capital returns and/or growth investments and instead have to accelerate its debt reduction efforts. On the other hand, if demand growth outstrips supply growth over the next few years as expected, PAA’s recontracting environment will likely be much more favorable, leading to a stable cash flow profile. In that event, PAA is likely to grow its distribution quite aggressively in the coming years, which in turn will likely lead to a higher unit price as well.

For EPD the risks really are minimal given its immense balance sheet strength and asset diversification. Still, if the energy industry were to enter a prolonged downturn, it would undoubtedly eventually begin to weigh on cash flows as recontracting would be weak and management would be forced to make some concessions to counterparties in order to keep volumes high through its systems.

Valuation

Both businesses also look attractively priced when compared to sector peers as well as their own histories. Here is a side-by-side comparison of them:

| PAA | EPD | |

| EV/EBITDA | 9.20x | 9.65x |

| EV/EBITDA (5-Yr Avg) | 9.85x | 10.9x |

| P/DCF | 5.3x | 7.7x |

| Distribution Yield | 7.4% | 7.0% |

Overall, PAA looks to be the clear winner in terms of cheaper valuation, though it is noteworthy that EPD appears to be trading at a larger discount to its historical average EV/EBITDA than PAA is. On the other hand, PAA’s growth outlook is stronger than EPD’s is over the next few years due to the expected strong recovery in Permian Basin demand.

Investor Takeaway

Both PAA and EPD offer extremely high distribution yields that appear very sustainable for the foreseeable future. On top of that, both are trading at clear discounts to recent valuation averages.

That said, EPD is the clear winner when it comes to being more conservatively positioned, with both its balance sheet and business model coming in as significantly superior to PAA’s. On top of that, EPD is making more aggressive long-term oriented growth investments whereas PAA is having to continue to aggressively pay down its debt in order to secure itself against downside risks in the coming years and is also buying back units. This is largely due to the very high distributable cash flow and free cash flow yields being offered by its units which create a high threshold for growth investments to meet.

Meanwhile, PAA has a meaningfully higher distributable cash flow yield as well as a higher distribution yield than EPD. Given its greater focus on returning capital to unitholders rather than pouring capital into growth investments like EPD is doing, PAA’s distribution growth outlook is superior in the short term. For investors wanting to maximize near-term capital returns and potential appreciation in the near term in exchange for higher long-term risk, PAA is the better bet here. Ultimately, we rate EPD as a low risk Buy and PAA as an Average risk Strong Buy.

Be the first to comment