magicmine/iStock via Getty Images

Company Background

Travere Therapeutics (NASDAQ:TVTX) is a US-based biotech company that is developing and commercializing rare kidney, liver, and metabolic diseases treatments. The company’s lead asset is Sparsentan targets rare kidney diseases.

Sparsentan is a novel dual-acting ARB+ERA combination therapy that showed clinically meaningful proteinuria benefits in Phase 3 trials for IgAN and FSGS, which are rare kidney diseases with limited treatments. We highlight that there is no approved treatment option for FSGS and Tarpeyo (from Calliditas Therapeutic (CALT)) is the only treatment approved for IgAN. Currently, TVTX is pursuing NDA filings under the accelerated regulatory pathway with Immunoglobulin A (IGA) Nephropathy (Berger’s Disease).

The company has an interesting history, Retrophin, the pharmaceutical company that was run by Martin Shkreli, was rebranded to Travere Therapeutics in 2020.

In November 2020, Eric Dube, Retrophin’s new Chief Executive, announced the company would be rebranded as Travere Therapeutics Inc. in an effort to further distance the company from Shkreli, and said the company is no longer working on treatments for the disease from which the company takes its name. Source

Catalysts: all eyes on Sparsentan

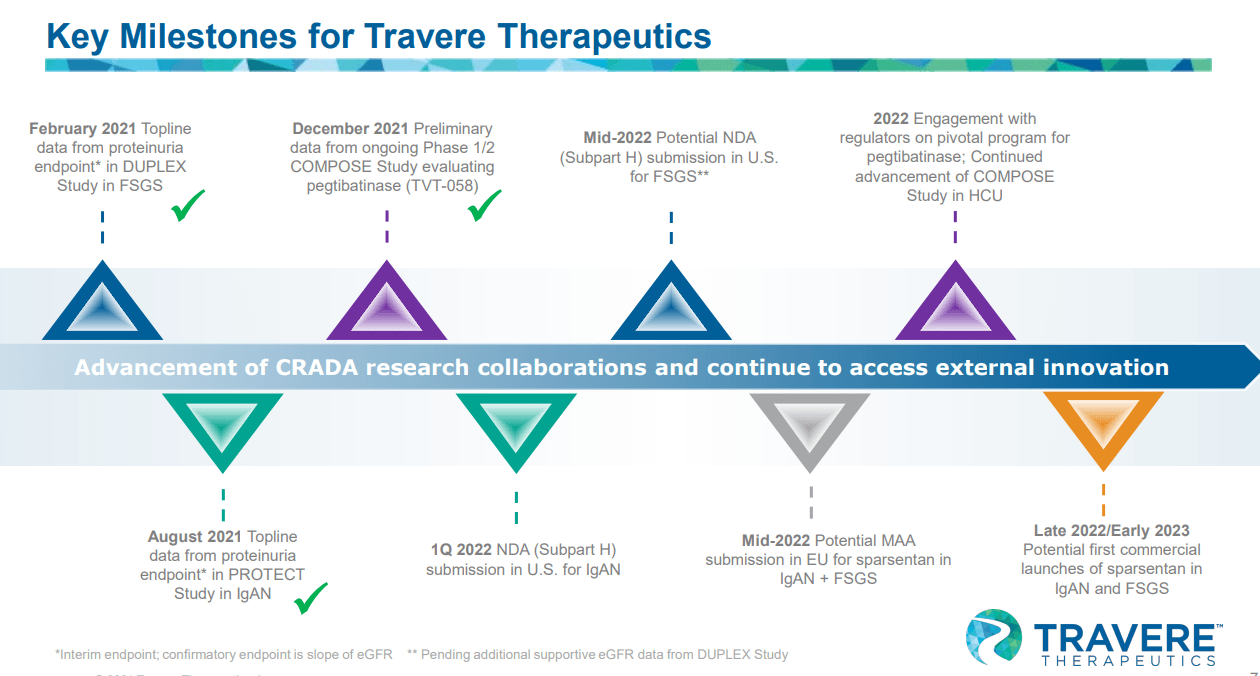

Sparsentan has multiple catalysts this year and in 2022.

TVTX IR deck

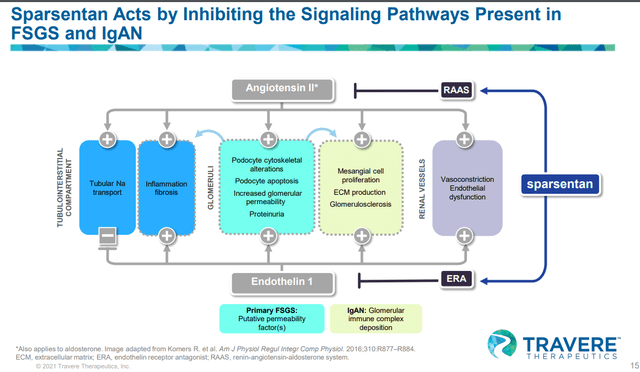

Sparsentan mechanism of action: ARB + ERA

Sparsentan has a combination of ARB and ERA. Angiotensin II receptor blockers (ARBs) are clinically validated treatments for hypertension, CHF, and diabetic nephropathy. ARB is known for renal protection and it is a standard of care for kidney diseases (associated with high proteinuria), based on its proven nephroprotective properties. It works by blocking the angiotensin II hormone from binding its receptor causing vasodilation and increasing excretion of sodium and water, lowering the pressure within the kidney (intraglomerular pressure). Proteinuria (an increase of protein in the urine) is reduced as the pressure within the kidney declines. The other component of the drug, Endothelin receptor antagonist (ERA), is a potent and proinflammatory vasoconstrictor that is used to improve the health of kidneys but comes with undesirable toxicities (peripheral edema) that limits its usage broadly. Sparsentan seems to be highly selective for ETA and research shows that endothelin Type A (ETA) drives the ERA’s effects such as proteinuria reduction, vasodilation, reduction of inflammation, and antifibrosis (reduction of oxidative stress). The toxicity of ERA, peripheral edema, and kidney injury are driven by endothelin type B (ETB), which drives water and sodium retention.

As we will explain later on in the article, we are not confident that mechanistically this combination will drive superior eGFR benefit over Ibresartan monotherapy due to two reasons: 1) doubling down on the RAAS pathway, ACEI+ARB combo didn’t drive superior data than the monotherapy ARB or ACEi (explained in detail below), and 2) ERA component doesn’t have clinical data to show that it drives eGFR benefits.

It is clear that FDA wants to see eGFR benefit, not only proteinuria reduction

We do not believe that FDA will approve Sparsentan purely based on proteinuria data from the Phase III PROTECT study as a surrogate endpoint for kidney survival if Sparsentan does not show a clear eGFR benefit.

eGFR is a more important surrogate endpoint than proteinuria, and drugs must show eGFR benefit for FDA approval

We view eGFR as a gold-standard surrogate endpoint by FDA, even though proteinuria is gaining acceptance as an ESRD surrogate endpoint. Until lately, FDA has only accepted eGFR and creatinine as suitable surrogates based on historical CKD studies.

- NKF-FDA workshop (in 2012) identified a robust relationship between change in eGFR and renal failure & mortality and concluded that 30% or 40% eGFR reduction is a reasonable surrogate endpoint for the progression of ESRD.

- Furthermore, another workshop in 2018 added proteinuria (albumin level) into the analysis and identified that a 30% geometric mean reduction in proteinuria was comparable to an eGFR slope decrease of 0.5-1.0 mL/minute/1.73m^2.

Even though both endpoints drove around 30% risk reduction of ESRD, however, we highlight that eGFR received greater clinical support.

Few examples of recent approval based on proteinuria

Lupkynis (voclosporin) developed by Aurinia Pharmaceutical (AUPH), was the first drug to receive the FDA’s stamp of approval based on proteinuria and eGFR for lupus nephritis. The approval was based on proteinuria reduction as part of a composite endpoint, but eGFR stabilization was the other part of the equation. This highlights the significance of supportive eGFR data for FDA approval.

The primary endpoint was complete renal response at 52 weeks defined as a composite of urine protein creatinine ratio of 0·5 mg/mg or less, stable renal function (defined as estimated glomerular filtration rate [eGFR] ≥60 mL/min/1·73 m² or no confirmed decrease from baseline in eGFR of >20%), no administration of rescue medication, and no more than 10 mg prednisone equivalent per day for 3 or more consecutive days or for 7 or more days during weeks 44 through 52, just before the primary endpoint assessment. – Source

Lupkynis met the primary endpoint of complete renal response with 40.8% vs 22.5% (Lupkynis vs. placebo) at 52 weeks. We highlight that 82% vs 76% (Lupkynis vs. placebo) showed stable eGFR at 52 weeks.

According to the researchers, the mean UPCR at pre-treatment baseline — in AURORA 1 — was 3.94 mg/mg in the voclosporin group and 3.87 mg/mg in the placebo group. The least squares mean change in UPCR from pre-treatment baseline to month 30 was –3.32 mg/mg for the voclosporin arm and –2.55 mg/mg for the placebo group.

The researchers recorded a small, expected and early decrease in mean eGFR among participants who received voclosporin during the first 4 weeks of treatment in AURORA 1. Later, in AURORA 2, eGFR remained stable through month 30 for these patients. The researchers reported no unexpected new adverse events in participants who continued with voclosporin, compared to those who received placebo.

“The AURORA 2 continuation study provides the longest-available outcomes data with Lupkynis for the treatment of lupus nephritis to-date,” Saxena said. “As of this second interim analysis, we found patients in the voclosporin treatment arm maintained meaningful reductions in proteinuria with no change in mean eGFR, no new adverse events and no increases in hyperlipidemia or hyperglycemia at 30 months of treatment.” Source – Healio Rheumatology

Tarpeyo’s PDUFA delay highlights FDA’s view on proteinuria and eGFR

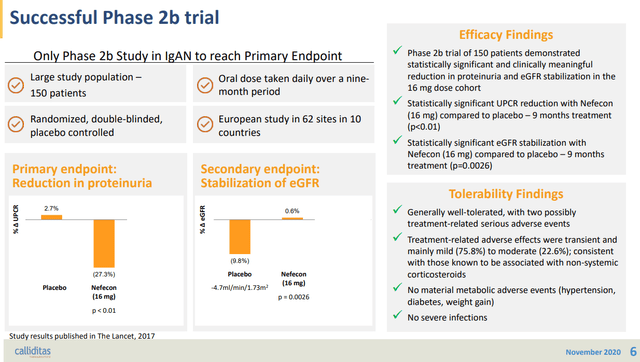

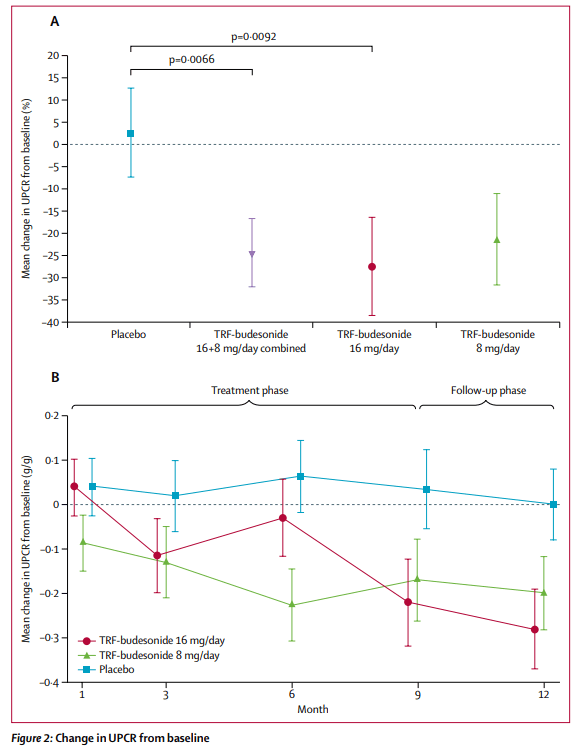

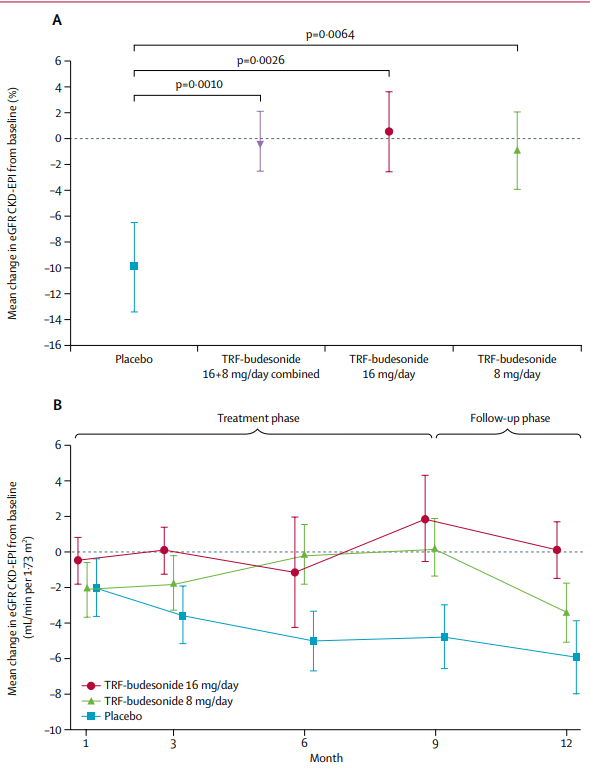

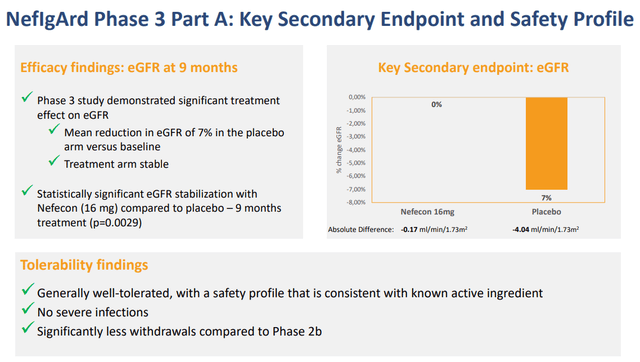

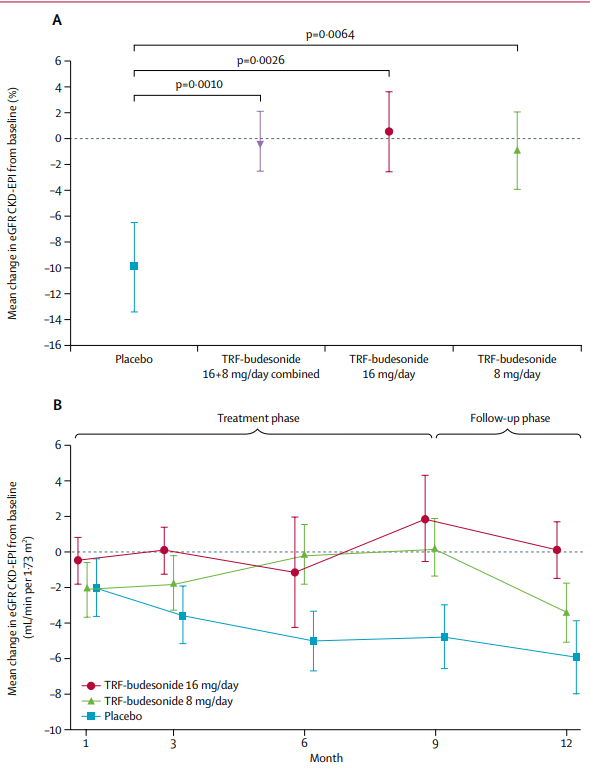

Tarpeyo from Calliditas Pharmaceutical is another drug approved for IgAN based on proteinuria reduction as a primary endpoint and eGFR confirmatory endpoint after 2 years. Tarpeyo showed promising eGFR benefits confirming its primary endpoint of proteinuria reduction: Tarpeyo showed no change in eGFR for Tarpeyo at 9 months vs. -7% decline for placebo (for IgAN, the higher the eGFR, the better).

Calliditas Pharmaceutical IR deck Targeted-release budesonide versus placebo in patients with IgA nephropathy (NEFIGAN): a double-blind, randomised, placebo-controlled phase 2b trial Targeted-release budesonide versus placebo in patients with IgA nephropathy (NEFIGAN): a double-blind, randomised, placebo-controlled phase 2b trial Calliditas Pharmaceutical IR deck

In its review of the NDA, the FDA has requested further analyses of the NeflgArd trial data which the company has provided to the FDA. The Agency has classified these analyses as a major amendment to the NDA. The amendment mainly provides additional eGFR and other related analyses as further support of the proteinuria data provided in the NDA submission. The FDA has therefore extended the PDUFA goal date to December 15, 2021.

Our NDA for Nefecon is the first time that the FDA is considering an approval on the basis of proteinuria as a surrogate endpoint for accelerated approval in IgA nephropathy, requiring an in-depth review process. We will continue to cooperate closely with the FDA as they complete the review of our NDA,” said Renée Aguiar-Lucander, CEO at Calliditas. – Source

We highlight that even with the eGFR data, the FDA initially extended the PDUFA date and requested additional eGFR analysis that supports proteinuria data. As such, we highlight this Calliditas’s approval highlights the importance of showing both proteinuria and eGFR benefits to get the FDA’s nod.

Uncertainty in Sparsentan’s clinical data

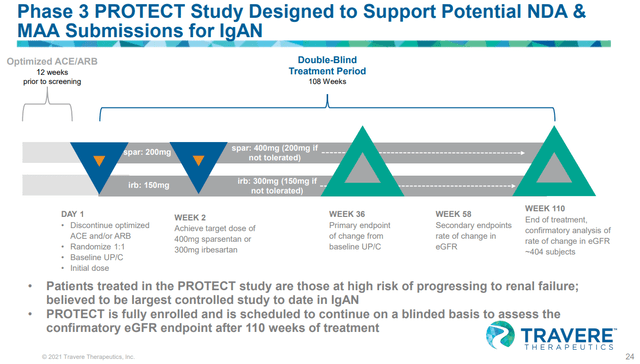

TVTX is conducting a phase III PROTECT study targeting IgAN, and in August 2021, they published interim data of the trial. Based on the results from this interim analysis, TVTX intends to apply for the accelerated approval in the United States during the 1H of 22 and apply for conditional marketing authorization in the EU.

Sparsentan treatment group experienced 49.8 percent mean reduction of proteinuria from baseline after 36 weeks, more than threefold the reduction of active comparator; interim primary efficacy endpoint achieved, p<0.0001

To date in the study, sparsentan has been generally well-tolerated and consistent with the previously observed safety profile

Submission of an NDA under Subpart H accelerated approval pathway in the U.S. expected in first half 2022 – source

What we highlight to readers is not the proteinuria data (which in our view was compelling, but the company’s announcement regarding the eGFR data. Regarding eGFR, the company noted that preliminary eGFR data available at the time of the interim analysis are:

data indicative of potential clinically meaningful treatment effects after two years of treatment.

We find this statement extremely vague; what is the meaningful eGFR data that the observed? If it was great, why didn’t they disclose it?

As noted above, knowing full well that the FDA wants to see a clear trend in eGFR for approval (as we have seen with Tarpeyo and Lupkynis where FDA clearly asked the company to show confirming eGFR benefits), the fact that the company did not disclose eGFR data for both phase III studies (IgAN and FSGS studies) during the interim data readout is a red flag for us. Furthermore, unlike Tarpeyo and Lupkynis, Sparsentan doesn’t have a phase 2 study, they jumped into phase III right away. As such, FDA has lesser data points to build conviction on. Only full eGFR data that the company disclosed was from the phase II FSGS trial that we will dive into in the next section.

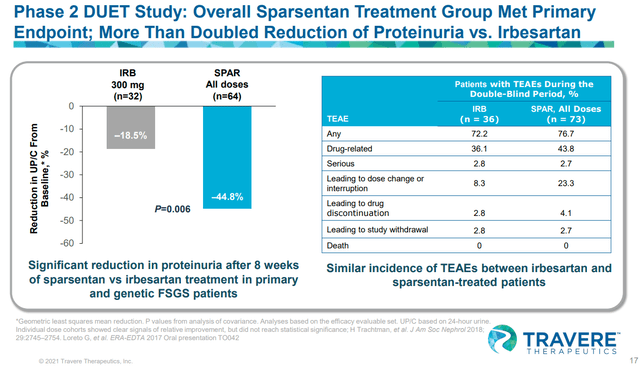

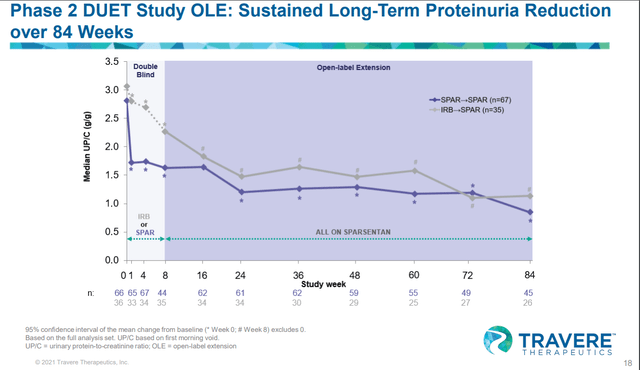

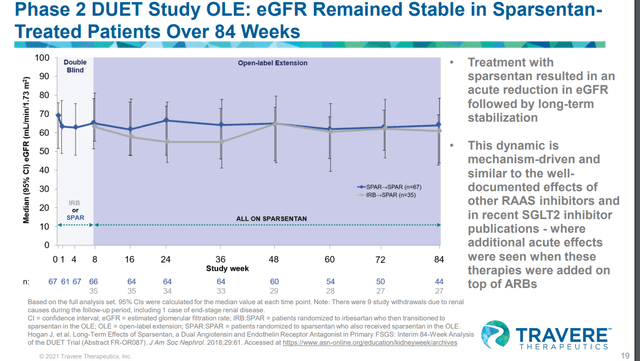

Sparsentan’s phase II FSGS data showed strong proteinuria benefit, but it didn’t translate into material eGFR benefits, adding more uncertainty to Sparsentan’s approval

TVTX IR deck TVTX IR deck TVTX IR deck

During the phase II DUET study’s 84 weeks OLE trial, Sparsentan showed strong proteinuria reduction over 84 weeks, but this benefit did not translate into eGFR benefit.

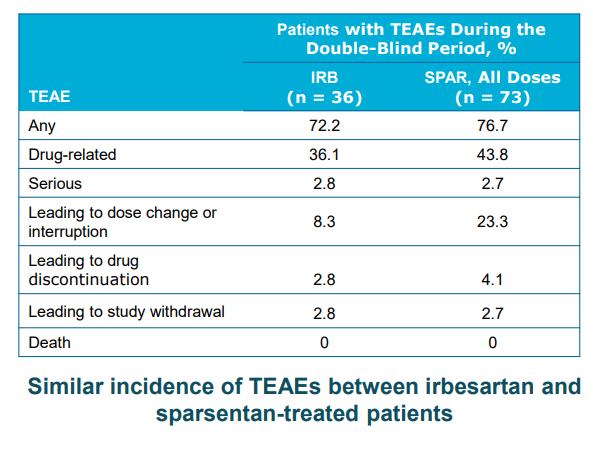

TVTX – Sparsentan adverse event vs Ibresartan

Considering that Sparsentan is a combination of ARB + ERA with a higher degree of adverse events compared to ARB or ERA monotherapy, we see no reason for the FDA to approve such a drug without clear efficacy benefit (defined by both proteinuria and eGFR benefit). One may argue that the trial was not long enough, but we think that the timeframe of 84 weeks (OLE) is long enough for them to show eGFR benefit over Irbesartan. If the drug doesn’t deliver eGFR benefit in 84 weeks, it may be unlikely that a longer trials will show eGFR benefits.

Calliditas’s phase II trial – Targeted-release budesonide versus placebo in patients with IgA nephropathy (NEFIGAN): a double-blind, randomised, placebo-controlled phase 2b trial

Furthermore, we highlight that Calliditas’s Tarpeyo’s showed both robust proteinuria and eGFR benefit within 1-3 months as shown above. Even if Sparsentan gets approved, the slow onset of eGFR improvement will further plague the company’s commercial performance.

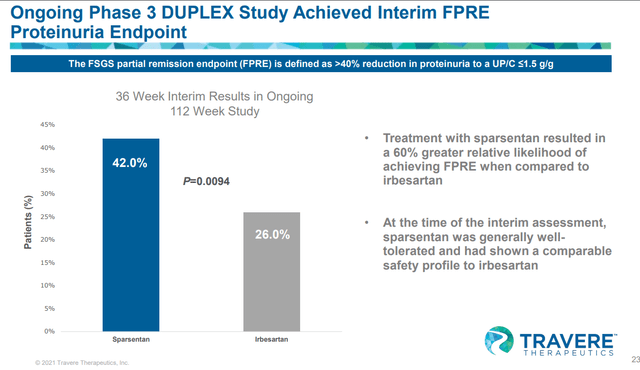

Phase III DUPLEX trial for FSGS trial data also adds to the uncertainty

TVTX IR deck

The interim data for the phase III pivotal trial of sparsentan targeting FSGS were released in Feb 2022. As expected the drug met its primary interim proteinuria endpoint. We note the delta with the irbesartan wasn’t that impressive compared to the phase II DUET study (that showed -18.5 vs 44% – a delta of 25%). Furthermore, only limited details were reported and eGFR data was again not released by the management. During the conference call, there were some questions about eGFR trends as regulators would want to see them for approval, but the company didn’t give a clear answer.

During the conference call on Feb 2, 2022, officials only said they are confident that the proteinuria results could support accelerated approval, though they acknowledged that there were no specific thresholds that regulators had set for the interim and they instead will be looking at the totality of the data to have confidence that the effect is reasonably likely to predict success. Further, they noted that they will be meeting with the FDA in the first half of the year and continuing dialogue with the FDA and EMA to see what types of data analyses they would like.

If the company is waiting to see stronger eGFR data to show by waiting longer and completing the trial (and the eGFR benefit wasn’t shown during the interim cut-off date), we don’t think a favorable outcome will be likely as shown on the phase II DUET study (which showed consistently no eGFR benefit throughout the duration of 84 weeks of the trial).

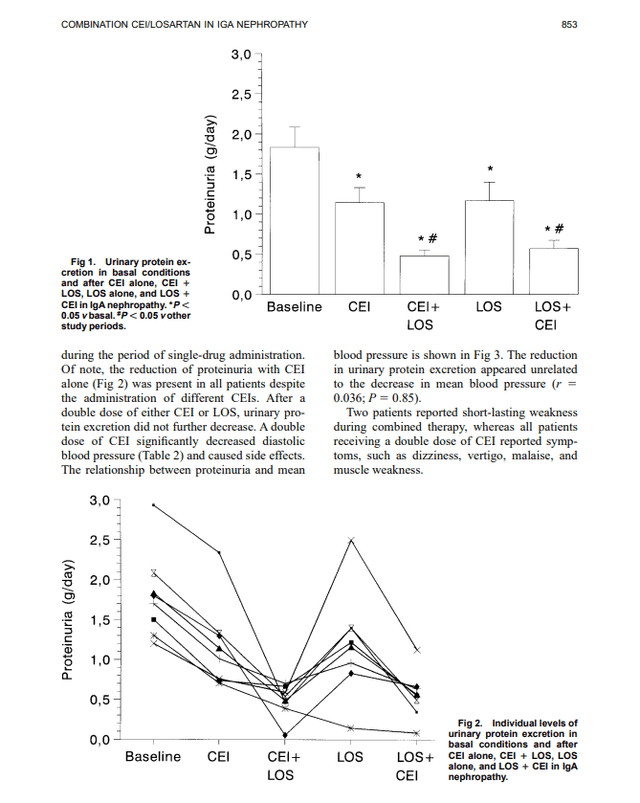

Doubling down on inhibition of the renin-angiotensin-aldosterone system (RAAS) through the ACEI+ARB combo didn’t improve eGFR over ACEi or ARB monotherapy

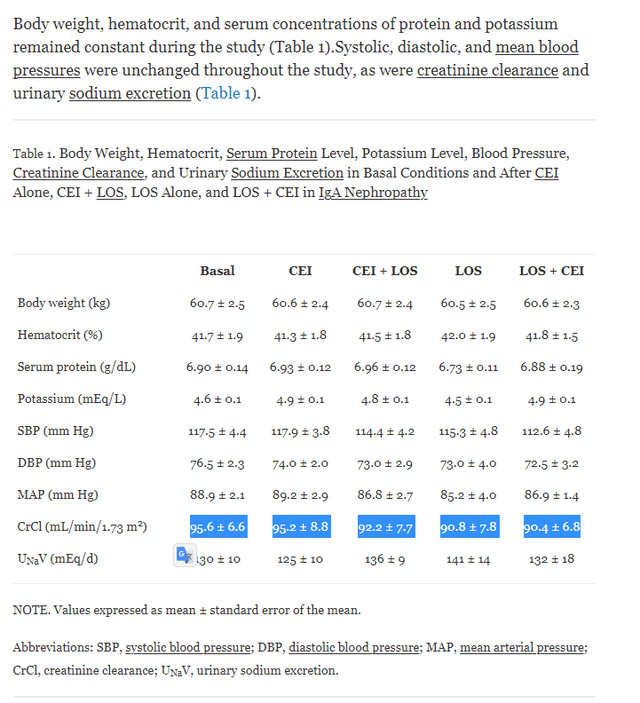

Additive antiproteinuric effect of converting enzyme inhibitor and losartan in normotensive patients with IgA nephropathy

As shown above, LOS+CEI showed proteinuria benefits compared to LOS or CEI monotherapy. However, this did not translate into additional creatine clearance benefits, indicating the eGFR value is likely the same between the combo therapy and the monotherapy.

Additive antiproteinuric effect of converting enzyme inhibitor and losartan in normotensive patients with IgA nephropathy

Note: CEI dosage (ACE inhibitor) (enalapril, 10 mg, three patients; cilazapril, 5 mg, one patient; lisinopril, 5 mg, one patient; and fosinopril, 20 mg, three patients), LOS = Losartan (ARB)

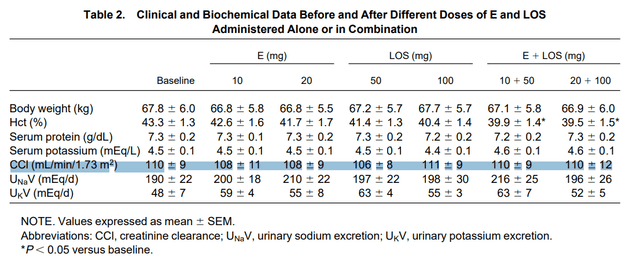

Another small study from the National Kidney Foundation also showed similar results.

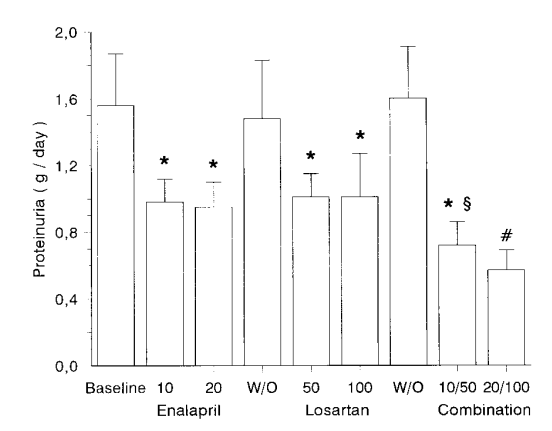

Coadministration of Losartan and Enalapril Exerts Additive Antiproteinuric Effect in IgA Nephropathy

Coadministration of Losartan and Enalapril Exerts Additive Antiproteinuric Effect in IgA Nephropathy

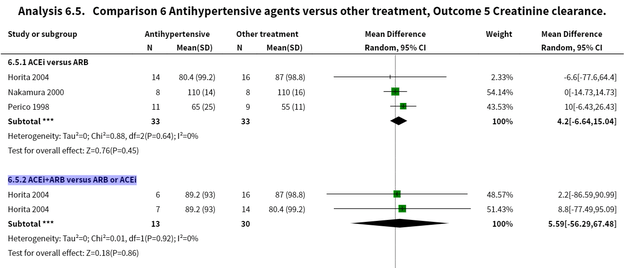

Systemic review from Cochrane library indicates ACEI+ARB may not show eGFR benefits for IgA nephropathy

Non‐immunosuppressive treatment for IgA nephropathy – Cochrane Library

We included 56 studies (2838 participants). Antihypertensive agents were the most beneficial non‐immunosuppressive intervention for IgAN. The antihypertensives examined were predominantly angiotensin‐converting enzyme inhibitors (ACEi), angiotensin receptor blockers (ARB) or combinations of both, versus other antihypertensives and other agents. The benefits of antihypertensive agents, particularly inhibitors of the renin angiotensin system, appear to potentially outweigh the harms in patients with IgAN. The benefits are largely manifest as a reduction in proteinuria, a surrogate outcome. There is no evidence that treatment with any of the antihypertensive agents evaluated affect major renal and/or cardiovascular endpoints or long‐term mortality risk beyond the benefit that arises from controlling hypertension in patients with IgAN. The RCT evidence is insufficiently robust to demonstrate efficacy for any of the other non‐immunosuppressive therapies evaluated here. Source

We don’t have enough clinical data on ERA to build conviction on ERA’s ability to drive eGFR benefits

One may argue that the Endothelin receptor antagonist (ERA) component of Sparsentan may drive eGFR benefits over irbesartan mono even though ACEi and ARBs combination didn’t. ERA’s promising benefit in decreasing proteinuria and slowing tissue damage was shown in multiple trials before, however, a well-designed trial that showed the drug’s ability to drive eGFR benefits was not shown yet. For example, Atrasentan by Chinook therapeutics (KDNY) is being studied for IgAN, but the data has not been published yet. As such, we believe there isn’t enough evidence for us to build conviction on the drug’s mechanism action to expect a clear eGFR benefit by combining ARB and ERA.

Risks to our thesis

1. Shorting TVTX can lead to capital losses due to margin calls, trial success, or volatility.

2. If investors don’t buy the stock or sell the stock, and somehow if TVTX comes up with strong data that FDA would accept and approve the drug, investors may miss out on the upside.

The valuation is expensive and the upside is limited

The stock has appreciated more than 110% since the release of interim data for IGAN nephropathy. The current EV is USD 1.57B (as of April 10th) which is a hefty price for a Biotech with a lot of risks. For example, Calliditas Therapeutics, with an approved agent targeting IgAN nephropathy is valued at an EV of 400M (SA Capital Structure). We project IgAN and FSGS indications to be a USD 2-5Bn peak sales opportunity; however, we only give a 10% probability of success (Pharmaintelligence Biopharma statistic range) based on the stage of development and regulatory uncertainty. As such, using a risk-adjusted peak sales of 3, the appropriate valuation for the stock may be around USD 300-500M EV meaning 85% downside risk.

If the Sparsentan fails, considering that Sparsentan drives the majority of the company’s value, the company’s valuation could fall down to ~ USD 10 per share (The company holds USD 552.88M cash based on the SA Capital Structure database).

Conclusion

We believe TVTX is a ticking time bomb with a high degree of uncertainty due to a lack of evidence around the eGFR benefit. The phase II FSGS trial showed impressive proteinuria benefits, but the OLE study did not show clinically meaningful eGFR benefits over Irbesartan. For the two Phase III studies for IgAN and FSGS, full eGFR data is not released and the management has not given clear guidance around the data. Theoretically, proteinuria benefits should drive eGFR benefits, but not all proteinuria benefits translate into eGFR benefits, as shown above in multiple trials and also the Phase II DUET study of TVTX’s Sparsentan. As shown with Calliditas’s recent approval of Tarpeyo and Voclosporin’s approval, we believe the FDA will not approve Sparsentan only based on proteinuria data without confirmatory eGFR benefit. We are not a fan of TVTX’s decision to use Ibresartan as a comparator arm, if they are competing against a placebo, they would have a higher chance of getting approved. On the valuation front, unlike 1 year ago, after the interim data of the phase III study, the stock has already rallied 110%, and the current risk-reward is not compelling enough for us to establish a position. We are passing on TVTX or planning to short the stock based on the newsflow (if the company releases disappointing eGFR data).

Be the first to comment