JHVEPhoto/iStock Editorial via Getty Images

Underlying Security Symbol: NYSE:PRU

Every market has its opportunities, and a financial company in a rising interest rate environment is where to look. Like a well-run bank, a well-run insurer benefits when interest rates go up. Prudential is a name that has been in my portfolio for a while. I have sold calls against half of my shares and all were called away (assigned). Therefore, to take advantage of the positive fundamentals of this stock, I added today and sold calls on the new shares.

Fundamentals are very important to me. I cannot afford to have a stock go broke. Prudential, with a D/E ratio of just .32, is not going to go broke. And, it has modest revenue growth.

I can afford to watch valuations fluctuate when I am receiving a dividend. Prudential is a good stock for that very reason, it pays a $4.80 annual dividend on earnings of $19.58. Their yield is 4.17%.

When we’re betting on a stock that pays a dividend in a turbulent market, you want a stock with dividend growth. The market may sag so much that you can’t supplement your income with covered calls. You must wait for dividend growth to keep up with inflation. Again, PRU meets this criteria. Over the past 5 years, dividend growth has averaged 12% per year.

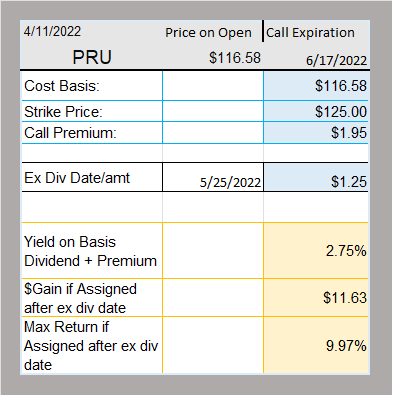

Here is the call I sold today. You’ll notice the call premium of $1.95 is more than the quarterly dividend of $1.25. The cash adds up even if you sell only one call a year.

Consider PRU for you income portfolio.

MM MoneyMadam

Data from Schwab.com and Marketxls

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment