JohnFScott

Starbucks (NASDAQ:SBUX) delivered surprisingly resilient fourth quarter results, despite inflationary headwinds and ongoing Covid restrictions in China. Daily store traffic in the US reached approximately 95% of pre-pandemic levels in September, and the average ticket once again broke a record, primarily driven by pricing and food attachment. In other good news for the company, apparently even Italians are embracing Starbucks.

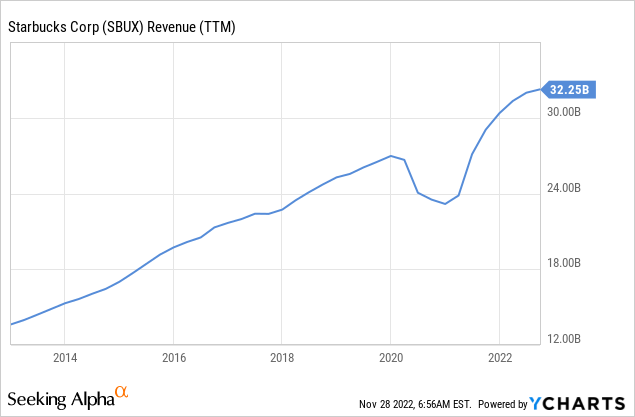

In Q4 Starbucks grew global revenues 11% y/y to a quarterly record of $8.4 billion, driven by 7% comparable growth globally and 11% comparable growth in North America. For the fiscal year the company grew global revenues 13% y/y to a record $32.3 billion, driven by 8% comparable growth globally and 12% comparable growth in North America. The global store base grew 6% in FY2022, ending the year with roughly 36,000 stores in 83 countries. The company also impressed with a 16% y/y increase in the US Starbucks Rewards membership to nearly 29 million members. Cold coffee beverages are becoming a really important part of the business, now accounting for 76% of total beverage sales in US company-operated stores. This has the added benefit that it opens the door to beverage customization, which adds high-margin revenue.

Q4 2022 Results

Q4 consolidated revenue reached $8.4 billion, up 11% from the prior year or 14% when excluding a 3% foreign currency impact. Revenue growth was primarily driven by 7% comparable store sales growth and 6% net new store growth. Q4 consolidated operating margin contracted 380 basis points from the prior year to 15.1%, mainly due to wage increases. The operating margin was also impacted by inflationary headwinds and deleverage related to Covid restrictions in China. Earnings per share in Q4 came in at $0.81, declining 9% y/y.

For full year fiscal 2022 consolidated revenue reached $32.3 billion, up 13% y/y or 15% when excluding a 2% foreign currency impact. Growth was driven by 8% comparable store growth and 6% net new store growth. Full-year earnings per share were $2.96.

Growth

Looking at the revenue graph, it is clear that Starbucks has mostly recovered from the negative effects of Covid, even if there are regions like China where it remains a significant headwind.

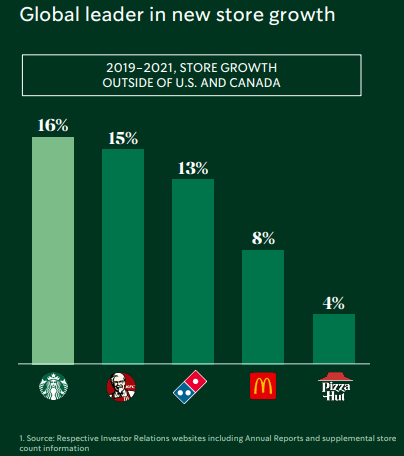

International growth has been particularly strong, and the company continues to open new stores at an impressive pace. During its investor day Starbucks compared its international store growth to that of other popular brands such as KFC (YUM), Domino’s (DPZ), and McDonald’s (MCD). Between 2019 and 2021 Starbucks opened roughly twice as many stores outside the US and Canada as did McDonald’s.

Starbucks Investor Presentation

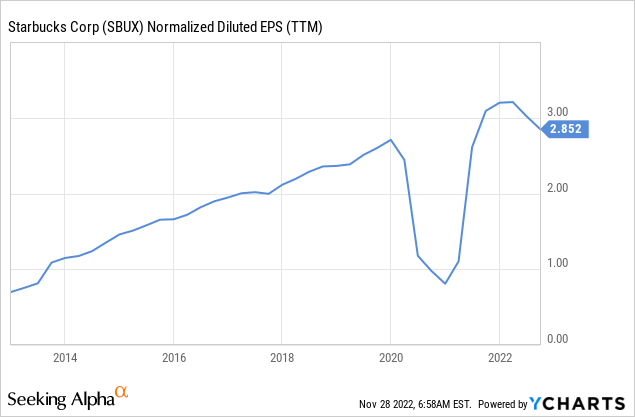

Revenue growth has resulted in corresponding earnings per share growth. The recovery in earnings has been even more impressive than the recovery in revenue. Earnings have roughly tripled from the lows reached during the worst of the Covid crisis.

Guidance

Guidance shared by the company was very strong, in particular comparable sales growth in the US. The company expects fiscal 2023 US comparable sales growth in the range of 7% to 9%. Similarly the fiscal 2023 global comparables growth is expected to be near the high end of its long-term target range of 7% to 9%.

Despite approximately three percentage points of unfavorable impact expected from foreign currency translation, the company is guiding consolidated revenue growth in the range of 10% to 12% for fiscal year 2023. Fiscal 2023 GAAP EPS growth is guided to be at the high end of the 15% to 20% range.

Valuation

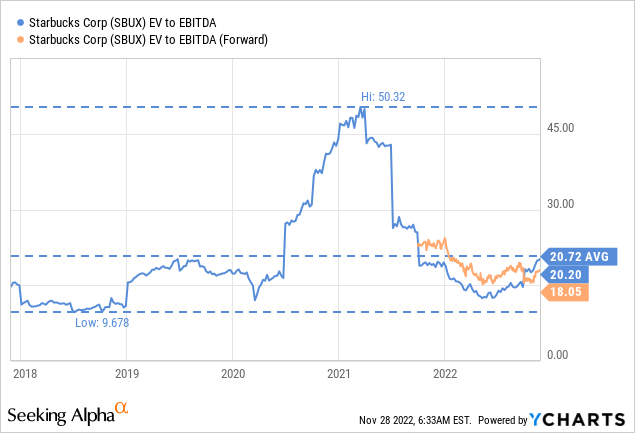

While the company is delivering excellent results, we believe this is already reflected in the share price, which we believe is currently close to fair value. At least the company continues to reward shareholders, recently announcing a dividend increase and saying that it remains committed to targeting an approximately 50% dividend payout ratio. The company will also resume its buyback program in fiscal 2023. As to valuation ratios, shares are trading close to the EV/EBITDA five-year average of ~20.7x.

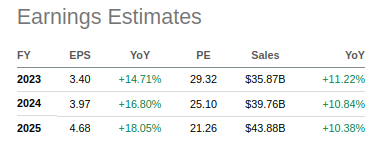

Through comparable sales growth, store count growth, and margin improvement, the company said at its investor day that it can grow earnings between FY23 and FY25 at a 15% to 20% rate. This is in line with what analysts are expecting on average, as can be seen in the table below.

Seeking Alpha

If we assume the company can maintain at least a 15% earnings growth rate until FY33, use a 3% terminal growth rate, and discount everything with a 10% rate, we estimate a net present value of the future earnings stream of ~$109. This is just a little higher than the current share price, leading us to believe shares are close to fair value.

| EPS | Discounted @ 10% | |

| FY 23E | 3.40 | 3.09 |

| FY 24E | 3.97 | 3.28 |

| FY 25E | 4.68 | 3.52 |

| FY 26E | 5.38 | 3.68 |

| FY 27E | 6.19 | 3.84 |

| FY 28E | 7.12 | 4.02 |

| FY 29E | 8.19 | 4.20 |

| FY 30E | 9.41 | 4.39 |

| FY 31E | 10.83 | 4.59 |

| FY 32E | 12.45 | 4.80 |

| FY 33E | 14.32 | 5.02 |

| Terminal Value @ 3% terminal growth | 204.52 | 65.17 |

| NPV | $109.59 |

Risks

Starbucks has demonstrated once again that it has a powerful brand, and very loyal customers. We are not too worried about the business continuing to be profitable or the possibility of it getting into financial trouble. What we think Starbucks investors should worry about the most is potential growth deceleration, as the current share price reflects high growth expectations.

Conclusion

We found Starbucks’ Q4 results to be really impressive, especially when considering the significant headwinds the company is facing. The company is showing that it continues to have a long growth runway, especially in international markets. Shares, however, already appear to reflect strong growth expectations, and we believe they are currently trading at close to fair value and with little in the form of margin of safety.

Be the first to comment