Surendra Sharma

This article is the continuation of a monthly series highlighting the top net payout yield – NPY – stocks that was started back in June 2012 and explained in August 2012. The series highlights the best stocks for the upcoming month, utilized in part to make investment decisions for the NPY model managed on Interactive Advisors. Please review the original articles for more information on the NPY concept.

2H 2021 Returns

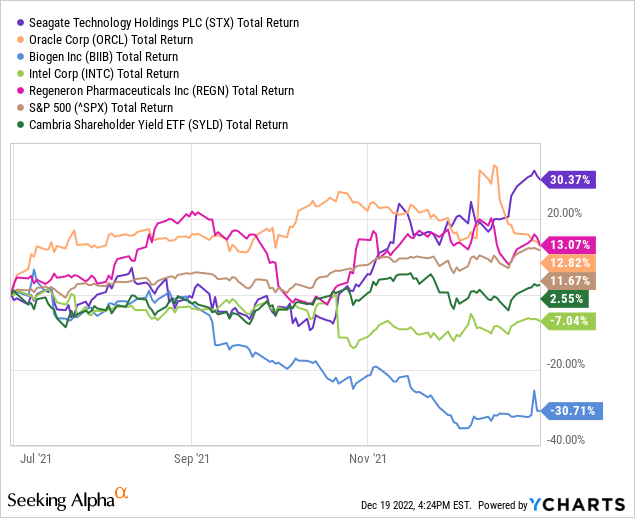

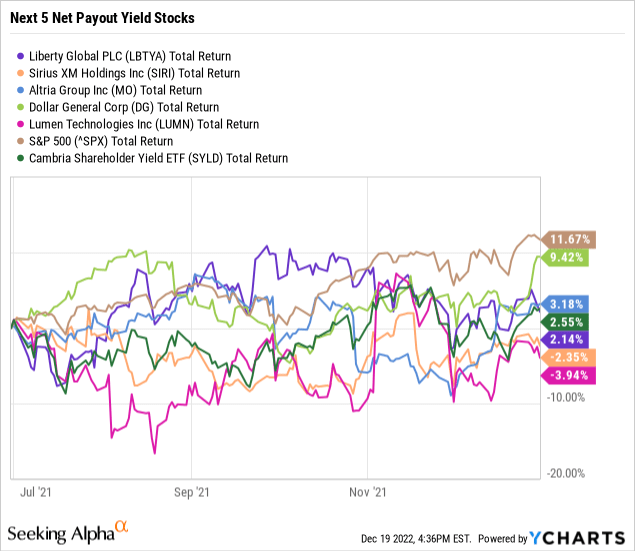

Below are two charts highlighting the returns of the top 10 stocks from July 2021 (see list here) for the second half of 2021. For presentation reasons, the chart is broken into the Top 5 and Next 5 lists and compared to the S&P 500 benchmark index along with the Cambria Shareholder Yield ETF (SYLD), which offers a fund for comparison purposes that is aligned with the NPY concept.

The Top 5 NPY stocks had a particularly weak 2H of 2021 as the market took off, led by tech stocks benefitting from covid boosts. The performance of these NPY stocks far underperformed the benchmark S&P 500 index that was up a solid 11.7% during the 2H of the year.

The tech stocks in the group beat the market led by the over 30% gain of Seagate Technology (STX) and 13% gain of Oracle (ORCL). Intel (INTC) failed to keep up with the other tech stocks and fell 7% during the period, though the semiconductor company cut back from share buybacks and would’ve been pulled from the model before the end of 2021.

Regeneron Pharma (REGN) was the only other stock to beat the S&P 500 index with a 13.1% again. Biogen (BIIB) collapsed 30.7% during the period on the volatile FDA approvals of Alzheimer drugs, though the stock has rebounded in 2022. The Cambria fund generated a small 2.6% gain as the market rushed out of high-yielding stocks. In total, the Top 5 stocks gained only 3.7% for the extended period while the S&P 500 index was up 11.7%.

The next five stocks were extremely disappointing as investors moved out of some of the cyclical stocks. Ironically, the stocks in the group weren’t very volatile, but the stocks failed to keep up with the S&P 500 index.

Dollar General (DG) saw the biggest gain at 9.4%, but the remaining stocks were all around breakeven. Liberty Global (LBTYA) and Altria Group (MO) produced small positive returns, while Sirius XM Holdings (SIRI) and Lumen Technologies (LUMN) had small dips in a period where the benchmark index was up. In total, the five stocks gained 1.7% for the quarter while the S&P 500 index was up 11.7% and the Shareholder Yield ETF gained only 2.6%.

In all, the top 10 stocks had a very weak period in the 2H’22 with four stocks reporting losses for a period where the benchmark index was up double digits. In total, the NPY stocks gained only 0.9% in comparison to the solid 11.7% total return of the benchmark index and the 2.6% gain of the comparable ETF.

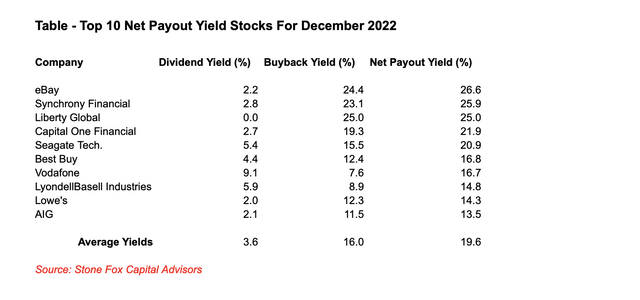

December 2022 List

The top 10 list has been completely refreshed for December. At lot of companies have implemented new capital return programs in 2022 after a period in 2020 and 2021 of not repurchasing shares or slashing dividends. In addition, stocks have turned weak despite large capital returns due to recession fears leading to higher than normal yields.

The list is topped by eBay (EBAY) with a chart-topping NPY of 26.6%. The online retailer has aggressively repurchased shares this year while the stock has collapsed due to a pullback in online shopping. Even though eBay has cut EPS targets during the year, the company still forecasts a relatively solid profit profile in a tough e-commerce environment.

Amazingly, the list still includes the likes of Seagate Tech. and Liberty Global. These two stocks continued to repurchase large amounts of stock throughout the cycle.

New Additions

The big additions to the December list come with a strong history of capital returns and not surprisingly were some of the first companies to return to large capital returns after the Covid rebound. Synchrony Financial (SYF), Capital One Financial (COF) were added to the list with yields topping 20%, though a recession could harm consumer lenders. Best Buy (BBY), Vodafone (VOD), LyondellBasell (LYB), Lowe’s (LOW) and AIG (AIG) were all added to the list with historically high NPYs above 13%.

The stocks falling off the list generally haven’t returned to large capital returns following the Covid crisis.

New Top 10

Due to significant increases in capital returns over the last year along with the weak market, the list saw the average NPY soar back close to 20% for December. The top three yielding stocks have NPYs above 25%.

Source: Stone Fox Capital calculations

The average yield jumped to 19.6% to start December, up from only 8.7% to start July 2021. The buyback yield bumped up to a large 16.0% as most companies reinstated large share buybacks during 2022. The dividend yield is a solid 3.6%, with a few companies on the list having large dividends now.

The one major catch with the NPY concept remains the hiccups from buybacks during a crisis and even capital return restrictions by regulators in the case of the major banks. Investors can invest based on the traditional method of buying the stocks with the highest yields or invest with the companies expected to return to some really high annualized yields in the future.

Lumen Technologies is a prime example of this scenario, with the company suspending the dividend in favor of a large share buyback. The concept technically requires either an ongoing dividend or confirmed stock buybacks in order for the NPY to register. The telecom company has yet to report any official share buybacks, though the $1.5 billion buyback program should’ve already started, especially with the stock trading down to $5.

Even heading into a potential recession and a tough housing market, a home improvement retailer such as Lowe’s has approved plans for a $15 billion share buyback. The stock already offers a solid 2.0% dividend yield and clearly will continue repurchasing shares at a fast clip.

Conclusion

The NPY concept has returned to more normal operations as corporations implement new capital return programs. Investors now actually get solid valuations to buy these stocks, as recession fears have sent the related stocks down to yearly lows.

Either way, the NPY concept will continue to reward investors with strong capital returns.

Be the first to comment