Luis Alvarez/DigitalVision via Getty Images

By Alexandra Urman, Analyst

As proposed in our previous research, investment analysts using antiquated throughput rates to determine future ones could be undervaluing clinical assets at each stage of development. Next generation sequencing (NGS), artificial intelligence (AI), CRISPR, and other gene therapies should boost clinical trial efficiency, shorten development timelines, and reduce failure rates. As a result, return on investment could improve dramatically.

Recent advances in neural network protein modeling could reduce the costs of clinical pipelines and increase returns on drug R&D beyond what we initially modeled. Based on our ongoing research in this space, we now believe pre-clinical development could become even less expensive and yield results more quickly: a marketable therapy cost only $50 million in pre-clinical investment – halving the number we estimated previously.

What Changed?

Alphabet subsidiary DeepMind announced AlphaFold, a neural-network-based algorithm that can predict protein folding, as well as an open-sourced database of protein structures powered by AlphaFold2. Based on their amino acid sequences, the database predicts the 3D structure of roughly all known human proteins, approximately 350,000.

Critical to life on earth, proteins comprise thousands of linked amino acids that determine their shape and interaction with other molecules, including drugs. To understand those relationships, drug developers typically use X-ray crystallography – a common experimental method that is tedious, slow, and expensive. In recent decades, scientists resorted to computational biology to overcome those obstacles, but none of the algorithms proved accurate enough.

According to our research, innovative neural-network-based algorithms can predict protein structures accurately in lab experiments and could turbocharge human therapies and agricultural breakthroughs. DeepMind’s AlphaFold2 has predictive accuracy that meets and sometimes exceeds high-fidelity experimental approaches[1] and could be applicable to all proteins and protein-to-protein interactions.

Neural Network Based Algorithms Could Lower Pre-Clinical Trial Costs and Invigorate Drug Candidate Pipelines

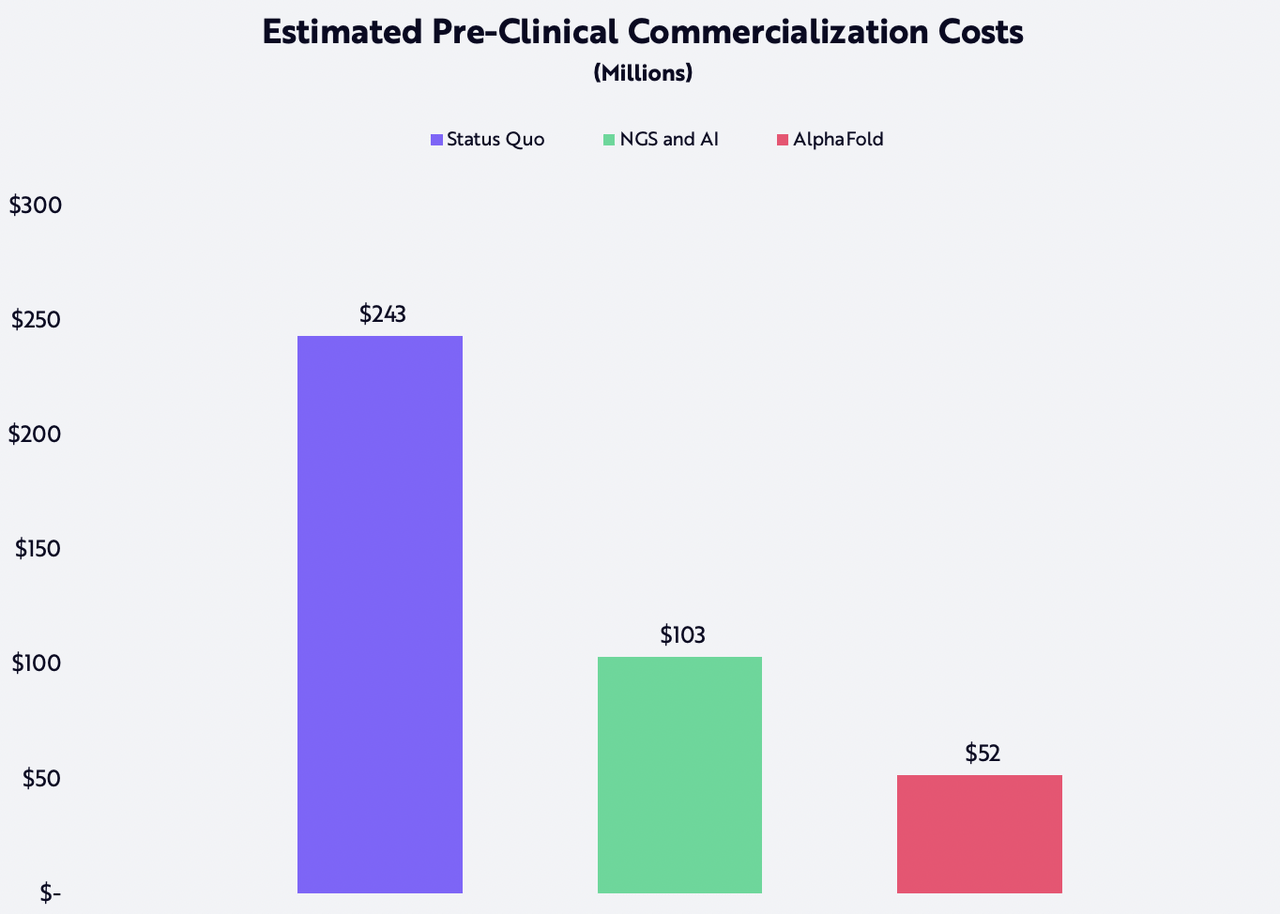

Knowing the shape of a protein structure at the start of research could reduce by 50% the cost and time from discovery to Investigational New Drug (IND) approval. An AlphaFold-like algorithm that quickly determines protein shape could improve the economics more than our previous model suggested. For example, using past clinical trial throughput rates (“Status Quo” in the chart below), we estimated pre-clinical costs per commercialized drug at $243 million. If technologies such as NGS and AI were to improve throughput rates, however, pre-clinical costs per commercialized drug could be cut by more than half to $103 million (“NGS and AI” in the chart below), and new predictive neural-network-based algorithms like AlphaFold could halve those costs to $52 million.

Assumptions: 15% discount rate at all phases except for registration, which has a 3% discount rate, $1B estimated peak sales for non-curative therapies, 70% net margin, 20% tax. Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2022

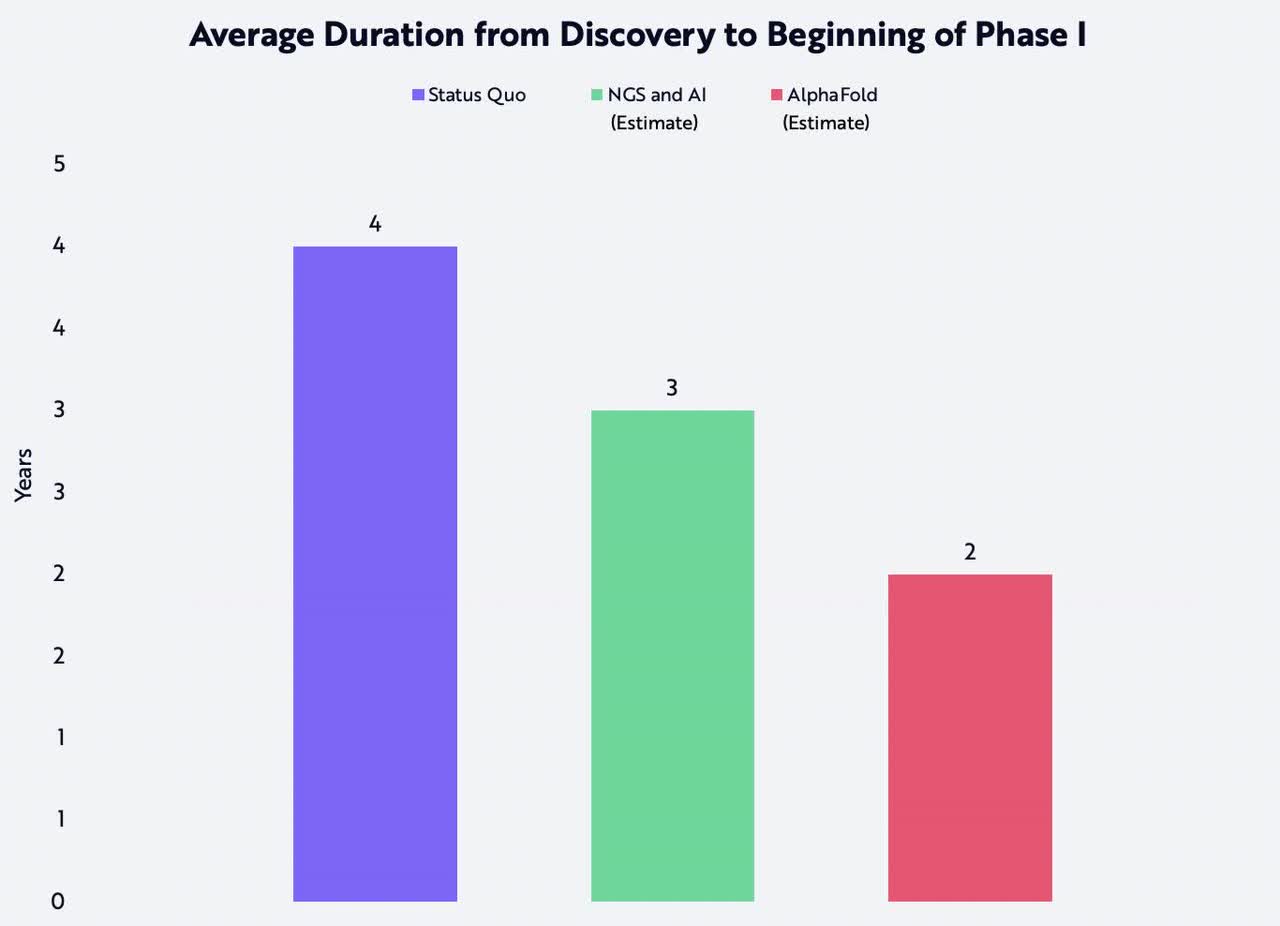

Our research suggests that neural-network-based algorithms could reduce R&D costs, increase the value of clinical trial assets, and increase the probability of clinical trial phase transition. For example, enabling technologies could shorten the average time spent in pre-clinical experimentation. Historically, the duration of pre-clinical testing from discovery to phase 1 has averaged four years. Based on our model assumptions, that number drops to three years and, with neural-network-based algorithms, two years, as shown below. For the entire pipeline – from discovery to the registration of a therapeutic drug – technology could improve efficiency, reduce costs, and eliminate 3.5 years of research and development time.

Assumptions: 15% discount rate at all phases except for registration, which has a 3% discount rate; $1B estimated peak sales for non-curative therapies; 70% net margin; 20% tax. Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2022

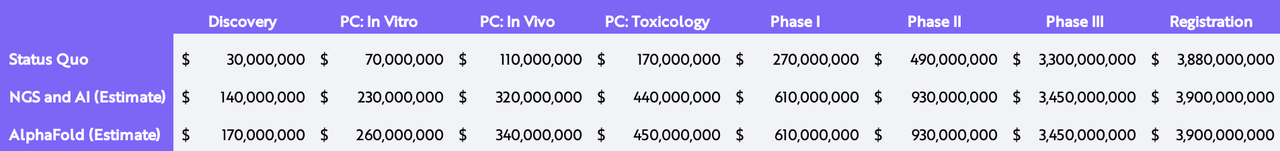

In our view, AlphaFold or similar technologies could increase the net present value (NPV) of a discovery asset from $30 million to approximately $170 million, as shown below. Past drug developers might have spent $120,000 and a year of experimentation to determine a new protein structure. Today that information is accessible in databases, and broadly so, which should increase the pace and success rate of early-stage experimentation, implying both that the net present value of an early-stage asset should be higher and that more of those assets will enter the pipeline. Put differently, cost savings are unlikely to lower overall R&D spend on early-stage experimentation but should instead increase the number of drug candidates entering the pipeline.

Assumptions: 15% discount rate at all phases except for registration, which has a 3% discount rate; $1B estimated peak sales for non-curative therapies; 70% net margin, 20% tax. Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2022

Mass adoption and scaling of NGS, AI, neural-network-based algorithms, and curative therapies could narrow the gap between the net present values of pre-clinical and clinical assets. In other words, we believe current early-stage pipelines, which growth equity investors often neglect, will be far more valuable than many realize.

Footnote:

- 1 https://alphafold.ebi.ac.uk/entry/P02088?utm_campaign=Sunday%20Newsletter&utm_medium=email&_hsmi=145809075&_hsenc=p2ANqtz-_tEuJqOJK3tW6xxkC-F2eOQDg3OzSPywVI1AfEeCacnTxM__gADzGG1tqjI5XGGXKxRa29buLtloed6YaKWUf0fssN-w&utm_content=145809075&utm_source=hs_email

The 3D structure of hemoglobin (a well-known protein in red blood cells that transports oxygen through the body) is characterized in the AlphaFold2 database, as shown in the link above.

Disclaimer:

©2021-2026, ARK Investment Management LLC (“ARK” ® ”ARK Invest”). All content is original and has been researched and produced by ARK unless otherwise stated. No part of ARK’s original content may be reproduced in any form, or referred to in any other publication, without the express written permission of ARK. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence.Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to ARK are strictly beliefs and points of view held by ARK or the third party making such statement and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that ARK’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. For full disclosures, please go to our Terms & Conditions page.The Adviser did not pay a fee to be considered for or granted the awards. The Adviser did not pay any fee to the grantor of the awards for the right to promote the Adviser’s receipt of the awards nor was the Adviser required to be a member of an organization to be eligible for the awards. For full Award Disclosure please go to our Terms & Conditions page. Past performance is not indicative of future performance.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment