Weedezign

A Quick Take On Toast

Toast (NYSE:TOST) went public in September 2021, raising approximately $870 million in gross proceeds from an IPO that priced at $40.00 per share.

The firm provides a cloud-based restaurant software platform for dine-in, takeout and delivery channel management.

TOST has been punished by the market for its high and increasing operating losses in a rising cost of capital environment, so until management makes a meaningful turn toward operating breakeven or the cost of capital starts dropping, I’m on Hold for the stock.

Toast Overview

Boston, Massachusetts-based Toast was founded to develop a SaaS platform to process payments for restaurants via a mobile app, hardware system and third-party providers.

Management is headed by Chief Executive Officer Christopher P. Comparato, who has been with the firm since February 2015 and was previously head of Customer Success at Acquia and Endeca Technologies.

The company’s primary offerings include:

-

Point of sale

-

Restaurant operations

-

Digital ordering & delivery

-

Marketing & loyalty

-

Team management

The firm pursues relationships with medium and large restaurant operators through its direct sales force.

The company has four primary revenue streams:

-

Subscription services

-

Financial technology solutions

-

Hardware

-

Professional services

Toast’s Market & Competition

According to a 2018 market research report by Grand View Research, the global restaurant management software market is forecast to reach nearly $7 billion by 2025.

This represents a forecast CAGR of 14.6% from 2019 to 2025.

The main drivers for this expected growth are a growing awareness by restaurant operators of the benefits of increased efficiencies from software systems.

Also, the COVID-19 pandemic will bring forward significant demand for integrated restaurant management systems in order to streamline processes while providing restaurant services in a more omnichannel approach to customers.

Major competitive or other industry participants include:

-

Square

-

Touchbistro

-

Clover Network

-

Lightspeed POS

-

Oracle/Micros

-

NCR

-

PAR Technology

-

Heartland Payment Systems

-

Shift4 Payments

-

Fiserv

-

FreedomPay

-

Olo

-

Others

Toast’s Recent Financial Performance

-

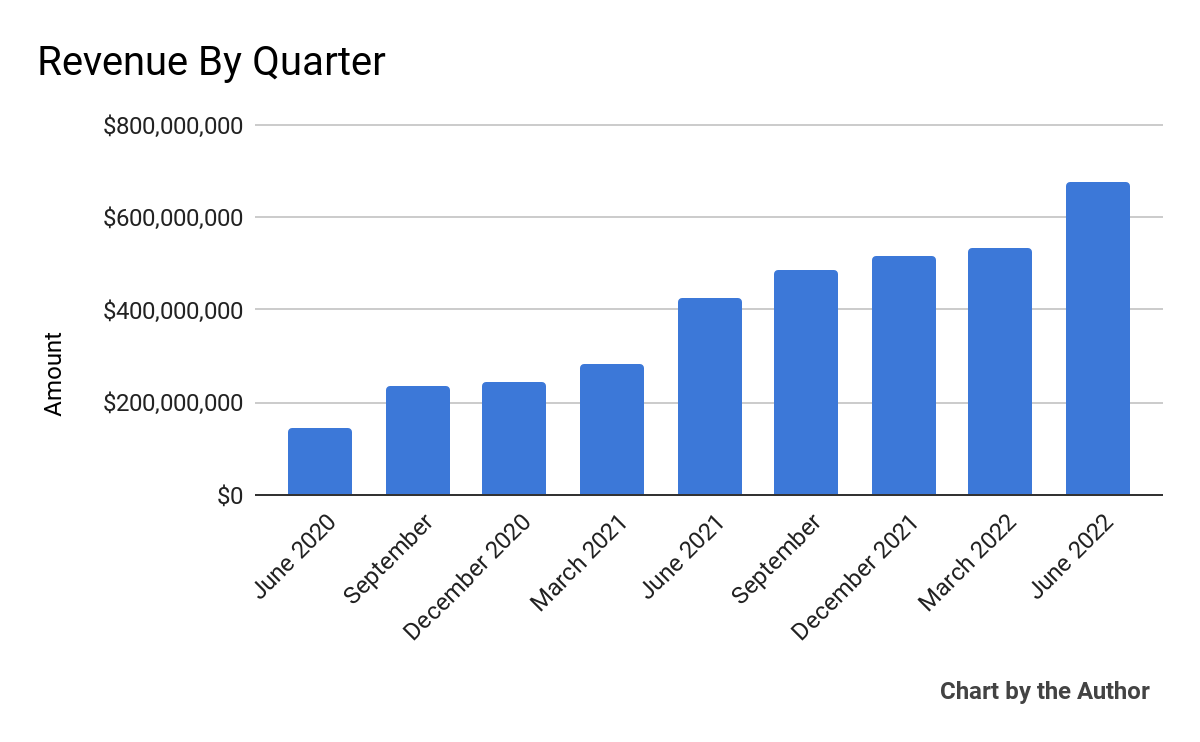

Total revenue by quarter has risen substantially, as the chart shows below:

9 Quarter Total Revenue (Seeking Alpha)

-

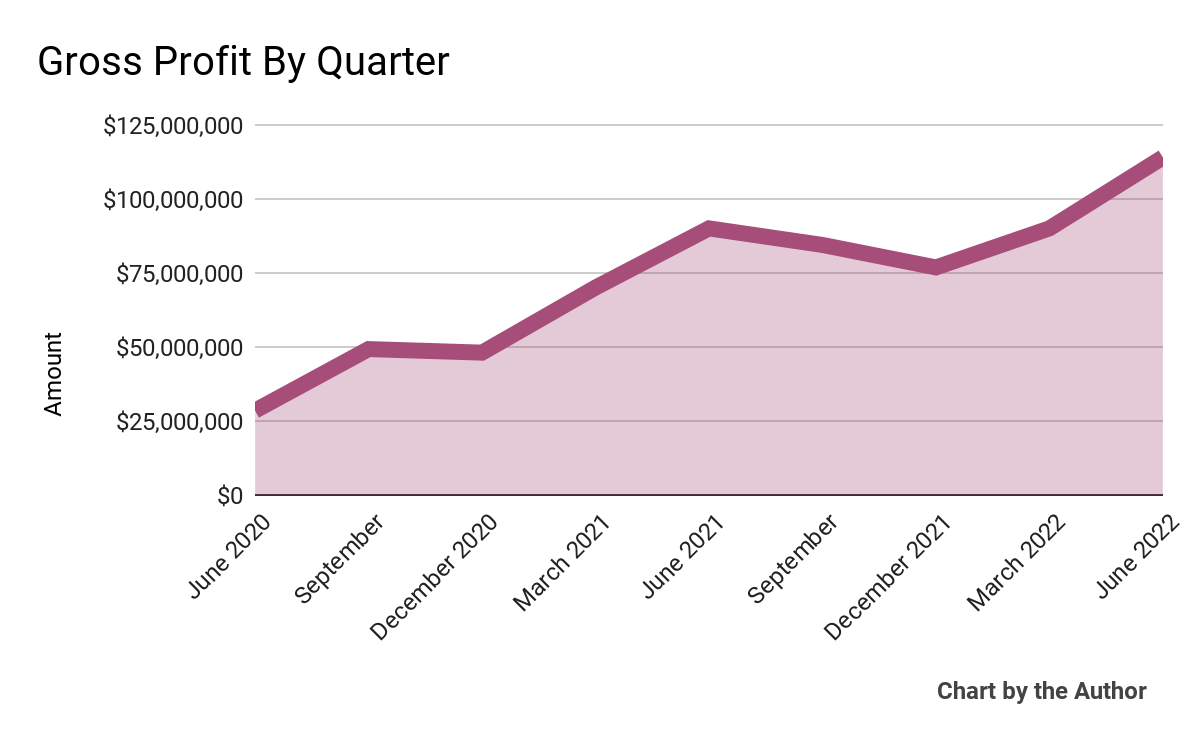

Gross profit by quarter has also grown materially:

9 Quarter Gross Profit (Seeking Alpha)

-

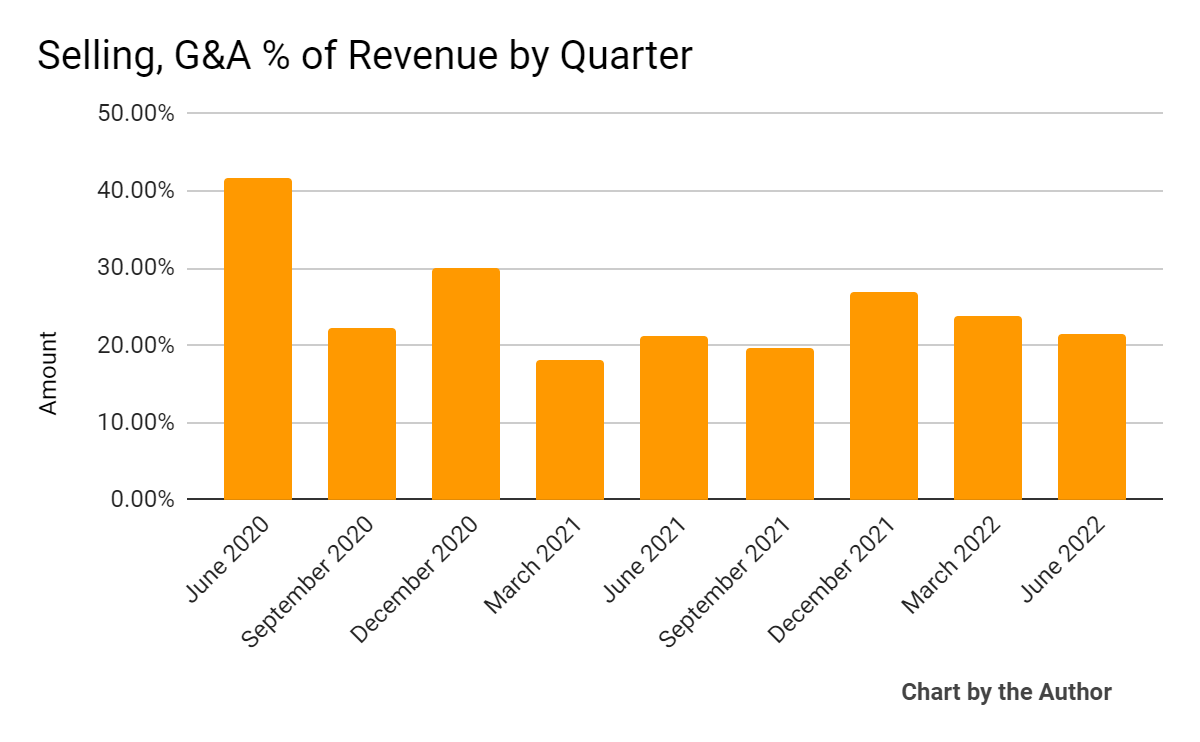

Selling, G&A expenses as a percentage of total revenue by quarter have produced the following results:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

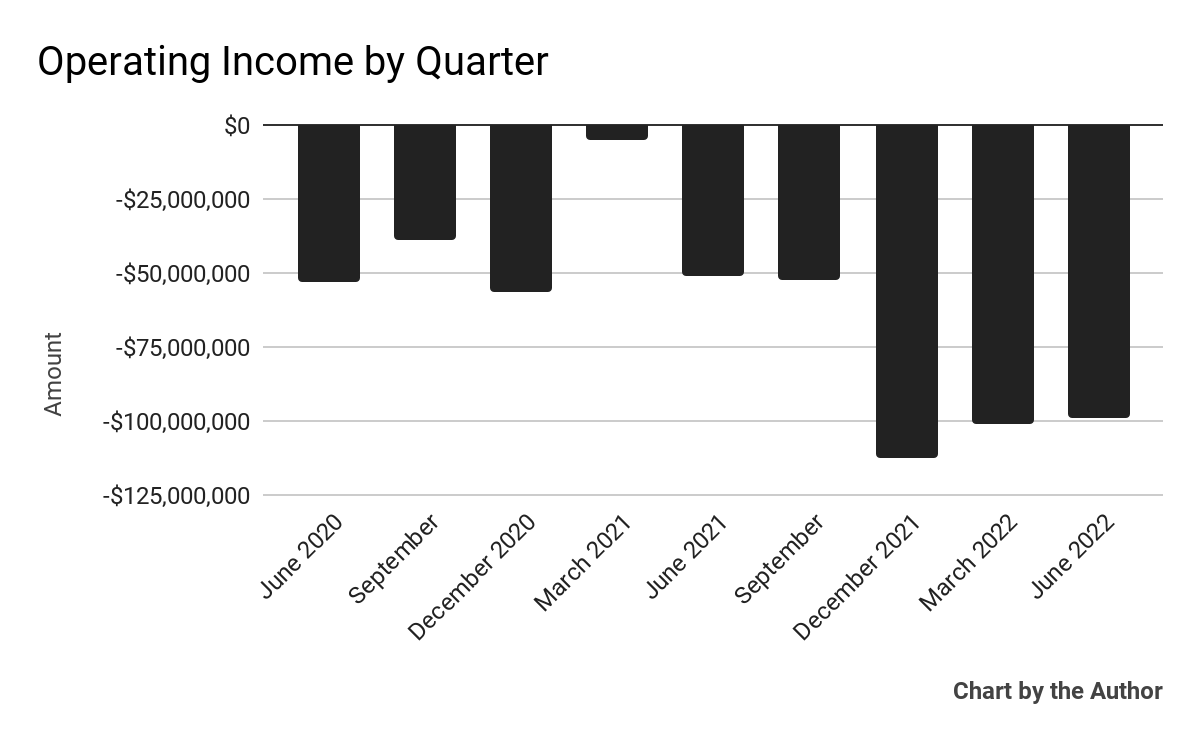

Operating losses by quarter have worsened sharply in the three most recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

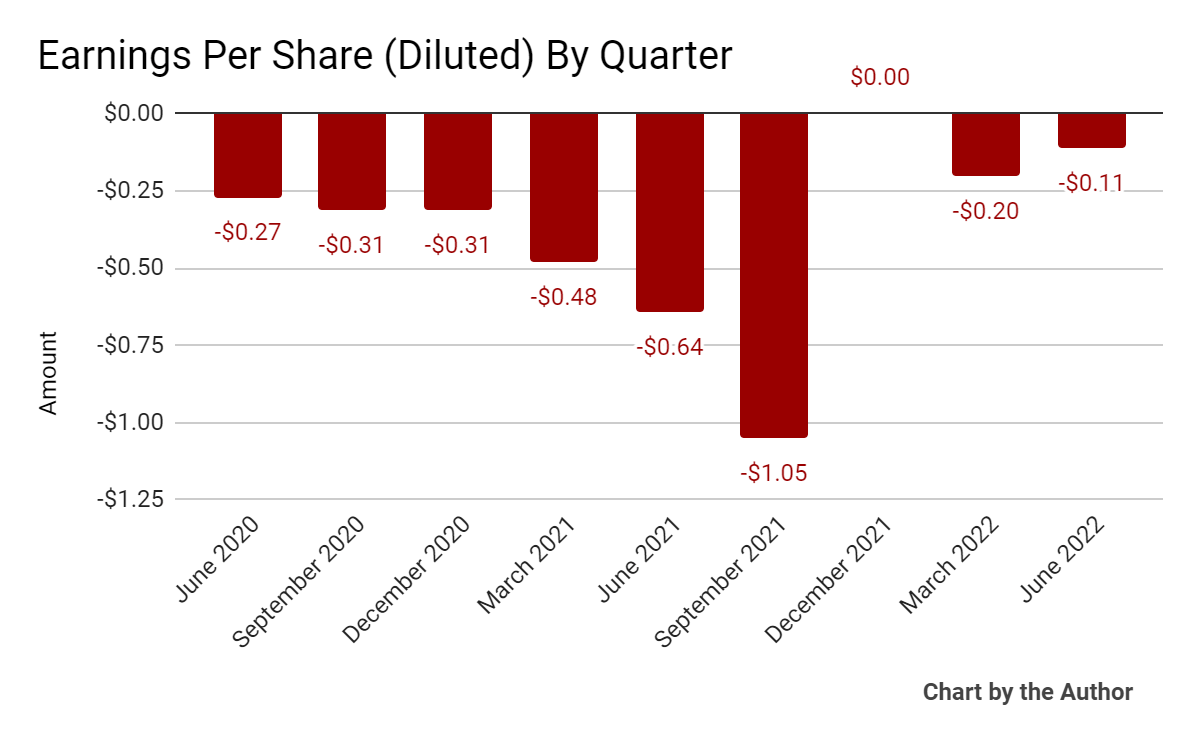

Earnings per share (Diluted) have generally remained negative, as shown below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

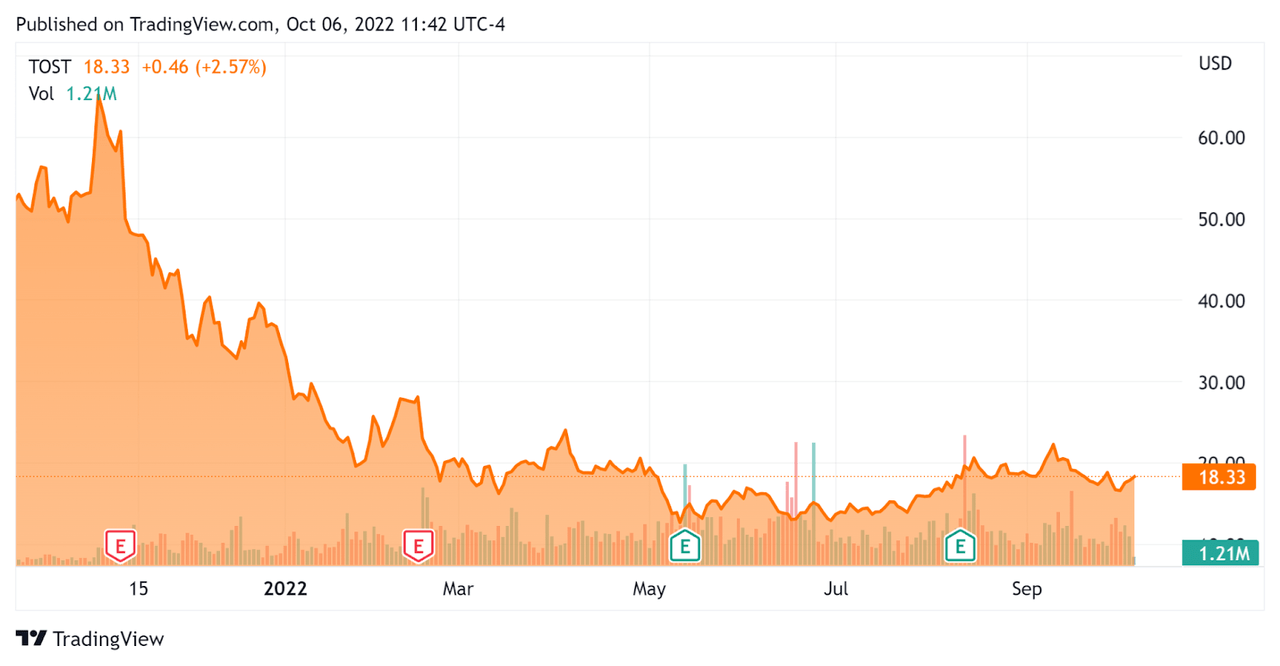

In the past 12 months, TOST’s stock price has fallen 65% vs. the U.S. S&P 500 index’ drop of around 13.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Toast

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.62 |

|

Revenue Growth Rate |

86.2% |

|

Net Income Margin |

-15.0% |

|

GAAP EBITDA % |

-16.0% |

|

Market Capitalization |

$9,080,000,000 |

|

Enterprise Value |

$7,990,000,000 |

|

Operating Cash Flow |

-$117,000,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.36 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Lightspeed POS (LSPD); shown below is a comparison of their primary valuation metrics:

|

Metric |

Lightspeed POS |

Toast |

Variance |

|

Enterprise Value / Sales |

3.56 |

3.62 |

1.7% |

|

Revenue Growth Rate |

101.2% |

86.2% |

-14.8% |

|

Net Income Margin |

-56.1% |

-15.0% |

-73.3% |

|

Operating Cash Flow |

-$106,020,000 |

-$117,000,000 |

10.4% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

TOST’s most recent GAAP Rule of 40 calculation was 70.2% as of Q2 2022, so the firm has performed quite well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

86.2% |

|

GAAP EBITDA % |

-16.0% |

|

Total |

70.2% |

(Source – Seeking Alpha)

Commentary On Toast

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the recent acquisition announcement of Sling, which the firm intends to use to ‘expand our team management suite and help restaurants deepen their relationship with employees.’

However, Toast’s customers are facing higher food and labor costs and macroeconomic growth challenges.

Management said that ‘driving towards profitability is a key priority,’ but recent results haven’t shown any real progress in that regard.

As to its financial results, total revenue rose 58% year-over-year as the company surpassed 6,000 net new restaurant locations, although Q2 is seasonally the firm’s strongest for net location additions.

Management did not disclose the company’s net dollar retention rate, which provides investors with visibility into its product/market fit and sales & marketing efficiency.

The firm’s Rule of 40 results have been impressive as a result of its strong topline revenue growth.

While sales and marketing expenses declined as a percentage of recurring revenue, the firm spent more in R&D and G&A and GAAP operating losses widened as it continued to hand out high stock-based compensation of $57 million during the quarter.

For the balance sheet, the firm finished the quarter with $1.179 billion in cash, equivalents, and short term investments.

Over the trailing twelve months, free cash used was $128 million, the highest amount since 2020.

Looking ahead, management raised its full year revenue guidance by 5%, indicating 55% growth expectations.

Regarding valuation, the market is valuing TOST at an EV/Sales multiple of around 3.6x.

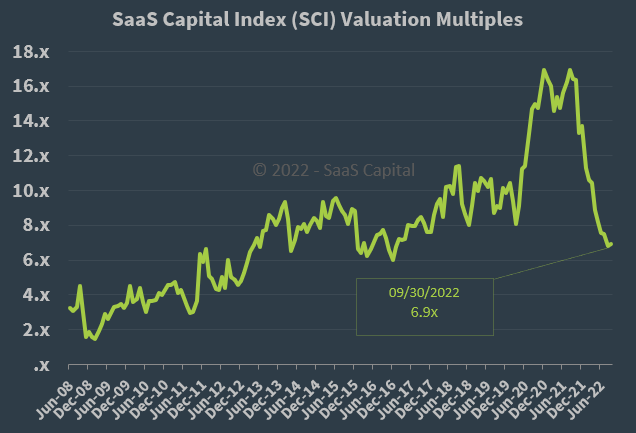

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.9x at September 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, TOST is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of September 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles, restaurant activity and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a ‘short and shallow’ U.S. slowdown and a pause in interest rate hikes by the U.S. Federal Reserve.

TOST has been punished by the market for its high and increasing operating losses in a rising cost of capital environment, so until management makes a meaningful turn toward operating breakeven or the cost of capital starts dropping, I’m on Hold for the stock.

Be the first to comment