pixelfit

“The art of banking is always to balance the risk of a run with the reward of a profit; a good banker safely and profitably treads the middle ground.”- James Grant

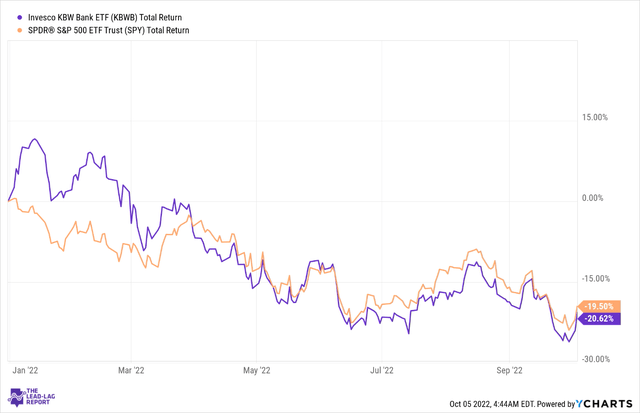

The Invesco KBW Bank ETF (NASDAQ:KBWB), a $2bn sized portfolio of U.S. financial stocks, has largely performed in line with the broader markets this year.

Going forward, could we see a repetition of the same or a divergence of sorts? I wouldn’t want to make a wager on the likely direction, but here are some factors to consider.

Underlying market conditions

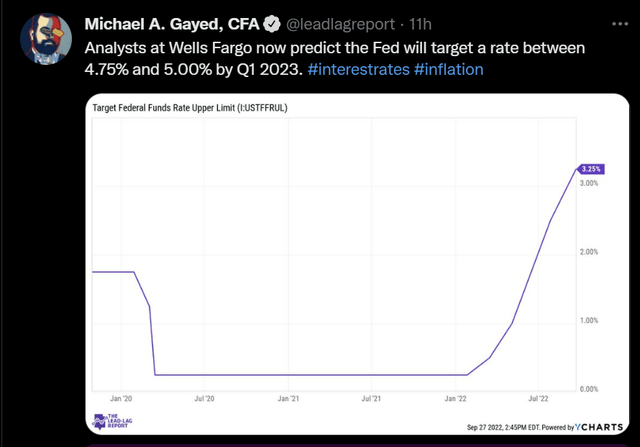

The U.S. Fed’s monetary tightening initiatives have dominated financial news portals for much of the last 12-18 months, and it doesn’t look like that will go away anytime soon. If you thought a 3.25% Fed Funds Rate was high enough, recalibrate your expectations, as analysts now believe it may well hit levels of 5% by Q1-23.

While aggressive hikes of this sort are somewhat inimical for the prospects of most sectors, there are silver linings for the financial sector.

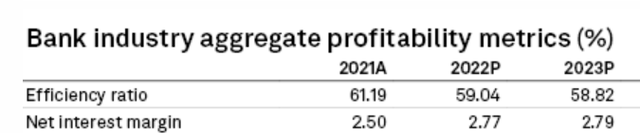

Net interest margins, which have been subdued for years, will likely continue to expand. According to S&P Global, the aggregate net interest margin, which stood at 2.5% at the end of FY21, will likely hit 2.79% by FY23. The higher net interest income flow should abet the Pre-provision operating profits, setting up a useful base for the efficiency ratio to trend lower (this is a function of how effectively banks manage costs relative to the total income generated).

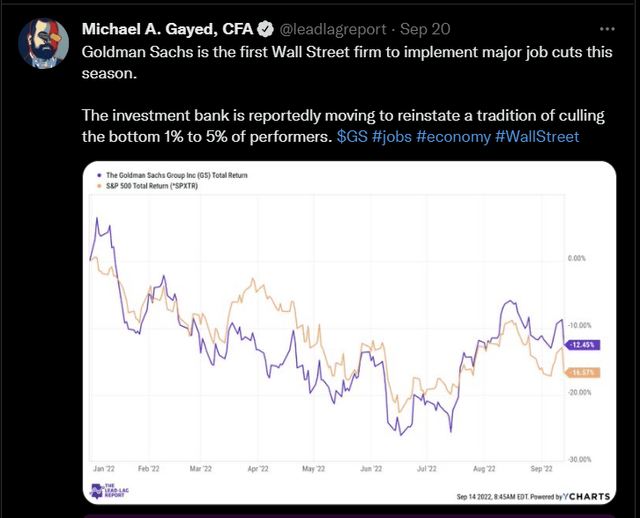

The onset of recessionary conditions also means that these banks will likely turn more defensive with headcount additions which could help bring down costs. As noted in The Lead-Lag Report, some banks, including the likes of Goldman, Wells Fargo, and Bank of America, have been trimming their workforce, thus also aiding the prospects of better efficiency ratios going forward.

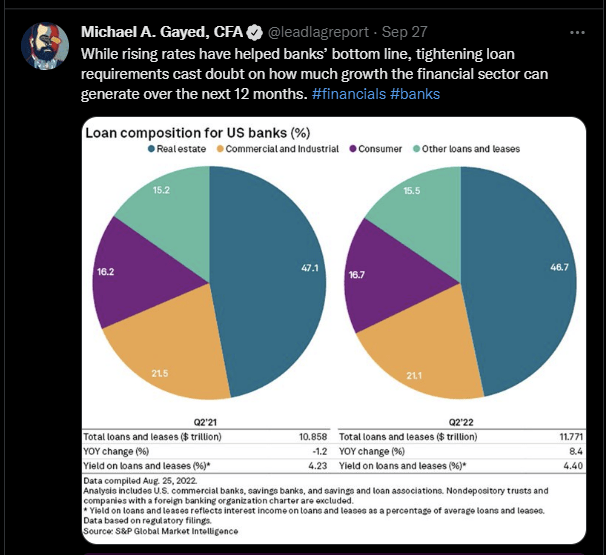

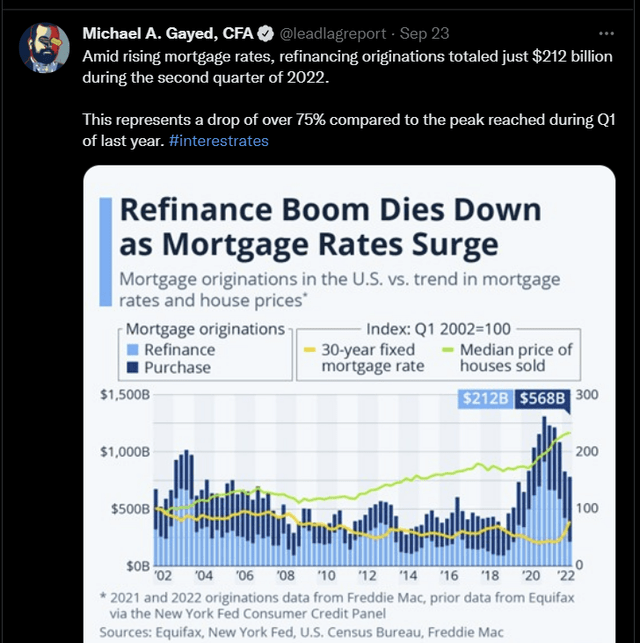

Nonetheless, the flip side of higher rates is that one will inevitably witness declining appetite for loans, and it doesn’t help that the bulk of these financials are exposed to the housing and real estate market where things have taken a turn for the worse. This was an essential fulcrum of banking business since the onset of the pandemic, but things may well reverse course.

Twitter

As you can see from the image below, mortgage refinancing initiatives have collapsed in recent months, and are effectively down by 75% from peak levels seen last year.

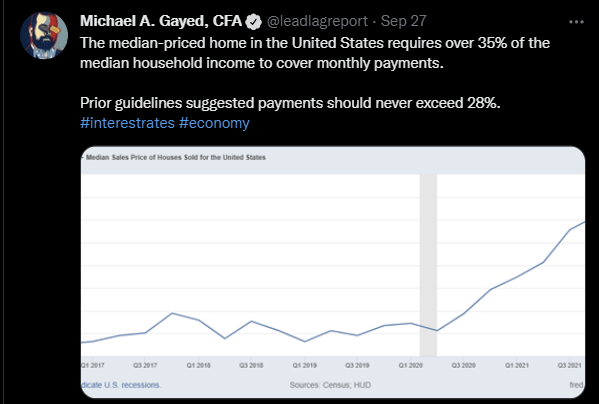

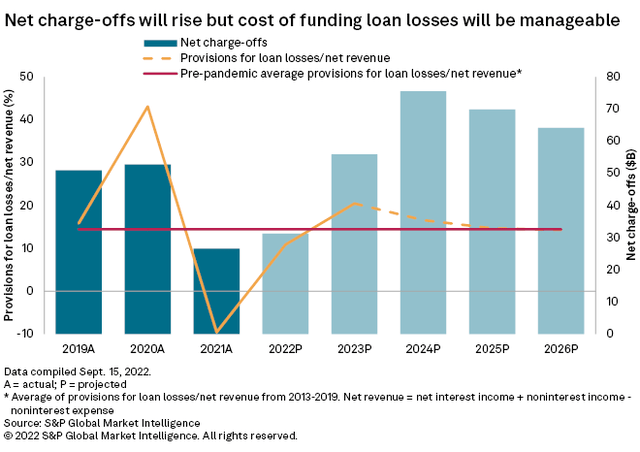

You also must consider what likely recessionary conditions will do for the asset quality of these banks as household finances appear to be stretched. As flagged in The Lead-Lag Report, traditionally, only 28% of the median household income would be devoted towards monthly payments, but lately, it has been well over that mark at 35%. With inflation fast eroding monthly household budgets, it’s only a matter of time before we see increased defaults on loans.

Twitter

Last year banks didn’t have to deal with this problem, and most of them benefitted from ample loan loss reserve releases. Looking ahead, net charge-offs next year will likely surge, hitting levels of over $50bn. This could dampen some of the benefits seen from NIM expansion.

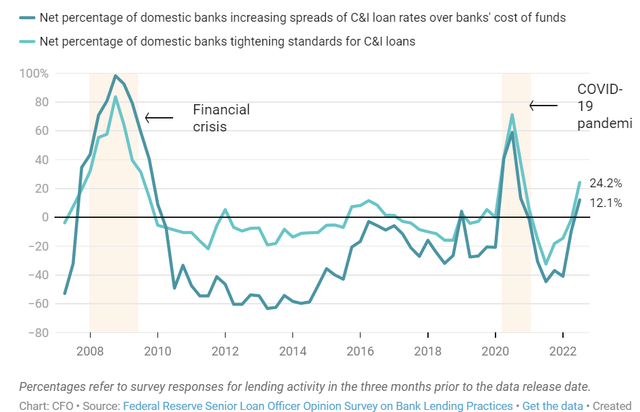

Conversely, these banks could seek to arrest asset quality pressures by tightening lending standards. As captured by the Federal Reserve Senior Loan Officer Opinion Survey, we’ve already seen some evidence of this in the commercial and industrial loan space. After staying subdued over the last few quarters, the net percentage of domestic banks that tightened standards increased to 24%. If changes haven’t been made to standards, lending spreads have gone up. Still, it remains to be seen if corporates will be willing to borrow at those rates, particularly considering the deteriorating economic scenario.

Conclusion

As noted in the Leaders-Laggers section of my paywalled research, the prospects of dividend stocks, a healthy chunk of which are financial stocks, look relatively positive. Most of these stocks have now dropped to a point where yields are looking increasingly tasty, and this cohort could serve as useful fodder for income seekers looking to reduce their exposure to falling bond prices. Interestingly enough, KBWB itself is currently yielding a decent enough figure of 3.13% a good 75bps higher than its 5-year average dividend yield.

At the current price levels, KBWB’s valuations too look enormously tasty; despite largely keeping pace with the broader markets on a YTD basis (roughly -20% drawdowns), the current valuation differentials are quite stark. KBWB can be availed at a P/E of just 7.6x and a P/BV of less than 1x, whereas the constituents of the S&P500 currently trade at corresponding weighted average P/Es and P/BVs that are roughly 2x higher!

Besides, if you’ve been keeping track of the developments on The Lead-Lag Report Twitter page, you’d recollect that I’ve been postulating the prospects of a melt-up rally over the last few days. Whilst markets conditions remain extremely oversold; it’s also worth noting that my inter-market utility signal flipped to risk-on mode, and I’d like to think there’s some merit in that.

Traditionally, recoveries from major lows tend to be driven by large-cap stocks, which bodes well for something like a KBWB where 92% of the total holdings are large-cap names.

Be the first to comment