Butsaya/iStock via Getty Images

Investment Thesis

The Hurricane Ian and oil/gas output cuts from OPEC+ have obviously put a speculative floor to the falling prices by late September and also temporarily boosted Mosaic Company’s (NYSE:MOS) stock prices, despite the recessionary and demand destruction fears. However, times are uncertain, since the Feds are determined to tamp down on rising inflation through 2023, with the August CPI being relatively elevated at 8.3% compared to pre-pandemic levels and the Feds’ mandate of 2%.

The stock market volatility over the next few weeks will be largely driven by the September CPI released on 13 October, as it will be the Fed’s key indicator for the next rate hike by 02 November’s meeting. As of 05 October, 658.2% of market analysts expect an inline hike of 75 basis points, with the optimistic ones speculating a moderation of 50 basis points hike by the Fed’s January 2023 meeting. Assuming so, we may possibly surmise the stock market’s near bottom levels, due to the current interest rate between 3% to 3.25% and the Fed’s terminal rate of 4.6% by 2023.

MOS Is Set To Report A Smashing Year Indeed

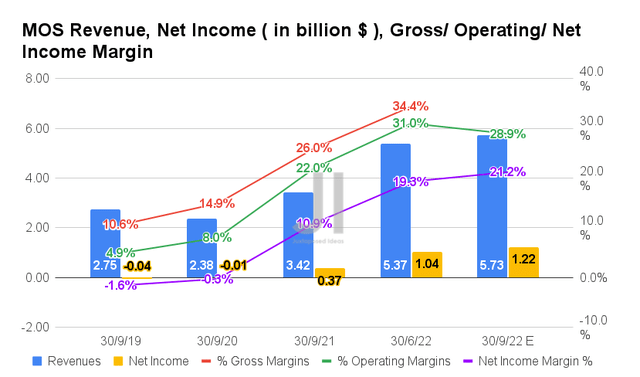

In its upcoming FQ3’22 earnings call, MOS is expected to report revenues of $5.73B and operating margins of 28.9%, representing a notable increase of 6.7% though a moderation of -2.1 percentage points QoQ, respectively. Otherwise, a tremendous YoY growth of 67.54% and 6.9 percentage points, respectively. This is impressive, given the impact of up to 250K Mt reductions in phosphate production from Hurricane Ian. Though assuming an average between the $758 DAP selling price in FQ1’22 and $920 in FQ2’22, this translates to a nominal $213.12M sum. We shall see.

Meanwhile, the revenue growth will also contribute to MOS’ improved profitability, with projected net incomes of $1.22B and net income margins of 21.2% for the next quarter, indicating an excellent increase of 17.3% and 20.16 percentage points QoQ, respectively. Otherwise, a tremendous YoY growth of 329.72% and 10.3 percentage points, respectively.

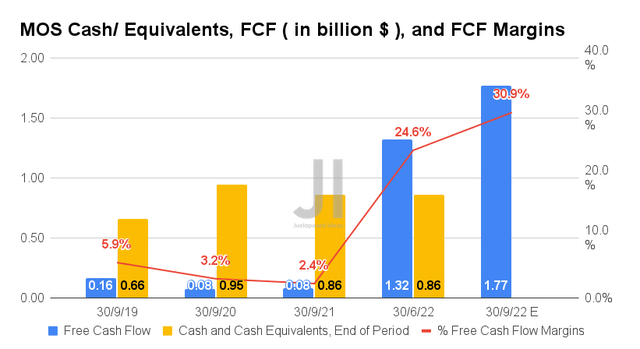

MOS is also expected to report an immense growth in Free Cash Flow (FCF) generation to $1.77B and an FCF margin of up to 30.9% in FQ3’22, indicating representing a remarkable increase of 34.09% and 6.3 percentage points QoQ, respectively, despite the tougher comparison. Otherwise, an eye-watering growth of 2212.5% and 28.5 percentage points YoY, respectively. Thereby, further strengthening its balance sheet and ensuring its dividend safety for the economic downturn ahead.

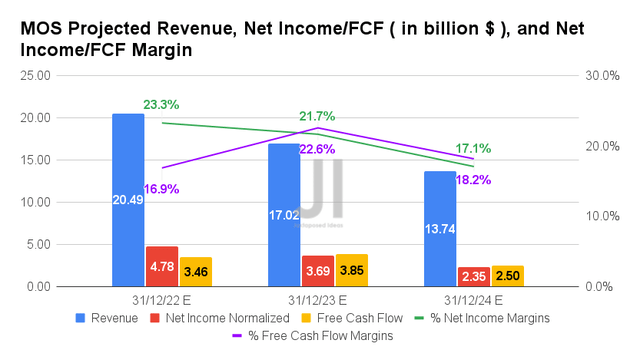

Over the next three years, MOS is expected to report relatively inline revenue and net income growth, as reported in our previous analysis in July 2022. Notably, our predictions for an upwards rerating on its top and bottom line growth have yet to happen, pointing to Mr. Market’s ever-growing pessimism about the impending recession. Despite the massive uplift effect of the Inflation Reduction Act and the massive supply constraints surrounding the fertilizer and Phosphate market, it is evident that the Feds’ hawkish commentary post-September meeting has worked in tamping down hopes of any market recovery in the short term.

In the meantime, MOS’ FY2022 revenue and net incomes have also been downgraded by -5.09% and -4.79%, respectively, from our previous analysis, likely attributed to the impact of Hurricane Ian. However, investors should be encouraged by the impressive projection of $3.46B in FCF generation and 16.9% in FCF margins for the year, since it represented stellar YoY growth of 385.12% and 9.6 percentage points, respectively. Otherwise, a gargantuan increase of 839.80% and 12.2 percentage points from FY2020 levels, respectively.

We may also see an upwards rerating of MOS’ FCF generation, given the $1.53B (cash from operations – Capex) reported by H1’22 and the mega-sized projection of $1.77B in FQ3’22. Those numbers already totaled $3.33B for the first three quarters, potentially boosting the whole year’s projection to over $4B, maybe even $5B if not for Hurricane Ian. These would go a long way towards the management plan in deleveraging by $1B, annual capital expenditure of $1.3B, and excellent shareholder returns for FY2022.

MOS 5Y Shareholder Returns

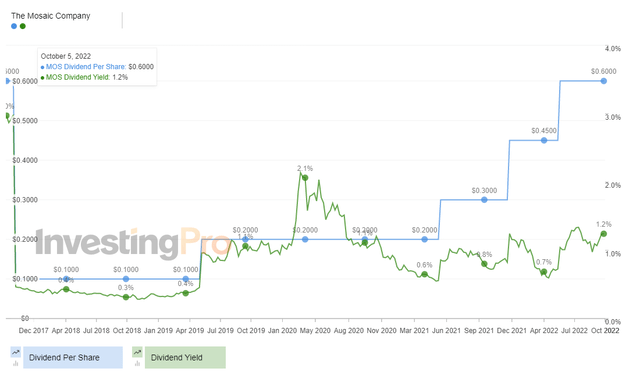

MOS had also pledged a new $2B share repurchase program, on top of raising its dividends thrice over the past two years. Though current yields of 1.15% may seem relatively low compared to other dividend aristocrats, we are not overly concerned, given the cyclical nature of the fertilizer industry and the impending economic downturn. It is indeed wiser to be prudent for now, since the S&P 500 Index has also continued to plunge by -20.97% YTD, previously breaking June lows on 30 September 2022. Thereby, pointing to the extreme market pessimism and fear levels.

In the meantime, we encourage you to read our previous article on MOS, which would help you better understand its position and market opportunities.

- Mosaic: Tapping Tesla’s And Ford’s EV Success – Green Pastures Ahead

So, Is MOS Stock A Buy, Sell, Or Hold?

MOS 5Y EV/Revenue and P/E Valuations

MOS is currently trading at an EV/NTM Revenue of 1.07x and NTM P/E of 4.09x, lower than its 5Y mean of 1.41x and 17.04x, respectively. The stock is also trading at $52.09, down -34.29% from its 52 weeks high of $79.28, though at a premium of 55.07% from its 52 weeks low of $33.59. Nonetheless, consensus estimates remain bullish about MOS’s prospects, given their price target of $65.88 and a 26.47% upside from current prices.

MOS 5Y Stock Price

Given the factors discussed above, everything is naturally up in the air. However, we are cautiously hopeful. Combined with the projected record-high demand for oil/gas during the coming winter, we continue to rate MOS stock as a speculative Buy, especially combined with the insatiable demand for LFP batteries previously discussed in our in-depth analysis. In the meantime, investors should also size their portfolios accordingly, given the potential volatility and markedly record-high FUD levels in the stock market.

Be the first to comment