BraunS

Investment Thesis – FQ3’22 Deliveries May Be Lower Than Expected, But Not Terrible

On 02 October 2022, Tesla, Inc. (NASDAQ:TSLA) reported 343.83K vehicle deliveries and 365.92K output for FQ3’22, compared to consensus estimates of 357.93K and 359.85K, respectively. The delivery miss has naturally caused the stock to plunge, highlighting the outrageous sell-off from Mr. Market’s overly bearish sentiments. However, these numbers are actually to be expected, due to the rising costs, China’s ongoing Zero Covid Policy, and the global supply chain issues. Furthermore, the company had produced 1.68% higher than expected for the quarter, despite the “money furnaces” in Texas and Germany.

In addition, the delay reported by TSLA is comparatively mild, compared to those by other automakers. General Motors (GM) is still screaming immense global chip tightness in FQ2’22, with 95K vehicles worth approximately $5.7B (based on the Average Transaction Prices (ATP) of $60K for trucks and SUVs) produced in North America, being undelivered due to missing components. Ford (F) similarly reported up to 45K vehicles impacted by parts supply in its early FQ3’22 report, potentially worth up to $2.25B (based on ATP of $50K).

In other words, anyone who expected TSLA to be above all supply chain concerns is probably living under a rock. With the notable upgrades in its production capacity in China and eventually Berlin, we expect the company to easily deliver another record high of up to 400K vehicles in FQ4’22, if not more at 450K, with sustainably robust auto margins. Multiple chip players, such as Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) and ON Semiconductor (NASDAQ:ON) are already signaling a potential easing of production capacity for auto chips from Q3’22 onwards, due to the destruction of demand in personal devices market.

Therefore, it is genuinely not ambitious to say that we may potentially witness an impressive 2.05M delivery by FY2023, indicating an upward of 53% growth YoY from a bullish estimate of 1.35M in FY2022. Demand remains insatiable, due to the new $7.5K tax credits from 2023 onwards partly negating the effects of the economic downturn.

TSLA Remains The Only EV Company With Robust Profit Margins

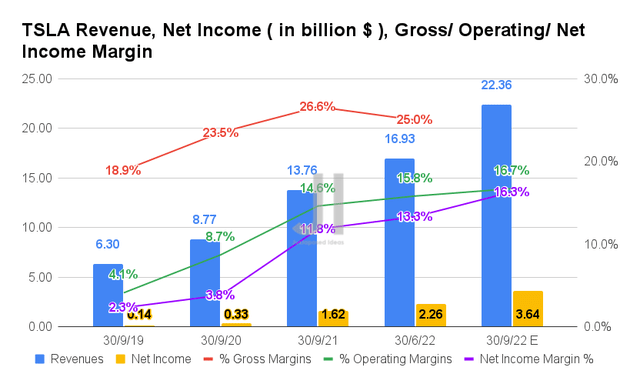

For the upcoming FQ3’22 earnings call, TSLA is expected to report revenues of $22.36B and operating margins of 16.7%, indicating a massive YoY growth of 62.5% and 2.1 percentage points, respectively. Naturally, these also contributed to the growth in its profitability, to net incomes of $3.64B and net income margins of 16.3% for the next quarter. It will represent a tremendous increase of 224.69% and 4.5 percentage points YoY, respectively, despite the rising costs and short-term factory upgrades in Shanghai/ Berlin.

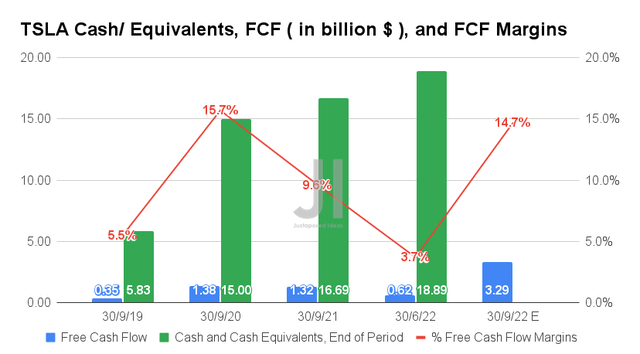

This will also contribute to its stellar Free Cash Flow (“FCF”) generation of $3.29B and FCF margins of 14.7% in FQ3’22, indicating massive growth of 249.24% and 5.1 percentage points YoY, respectively. Thereby, further strengthening its liquidity over the next few quarters of economic uncertainty, despite the $1.32B inventory impact on its balance sheet from the 22.09K vehicles yet delivered for the quarter, based on a $60k average ATP.

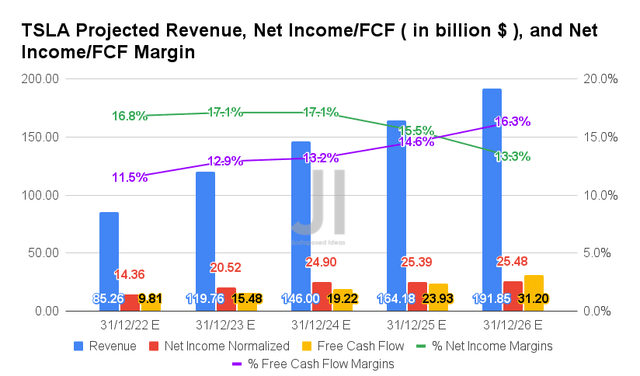

Over the next five years, TSLA is expected to report revenue and net income growth at a CAGR of 28.94% and 35.83%, respectively. These were impressive, given the consensus estimate upgrade by 9.01% since our bearish analysis in May 2022. In the meantime, the improvement in its profitability is also astounding, from net income/FCF margins of -3.5%/4% in FY2019, 10.3%/9.3% in FY2021, and finally settling at a stellar 13.3%/16.3% by FY2026.

For FY2022, analysts expect TSLA to record revenues of $85.26B, net incomes of $14.36B, and FCF of $9.81B, representing generous increases of 58.41%, 260.61%, and 96.98% YoY, respectively. It is no wonder that the stock remains richly valued at a premium over the others, despite the S&P 500 Index’s catastrophic plunge below June lows indicating peak market pessimism and fear levels. Nonetheless, TSLA’s reduced Q3 deliveries have also temporarily put pressure downwards on its stock performance, causing a -8.61% decline on 03 October.

In the meantime, we encourage you to read our previous article on TSLA, which would help you better understand its position and market opportunities.

So, Is TSLA Stock A Buy, Sell, Or Hold?

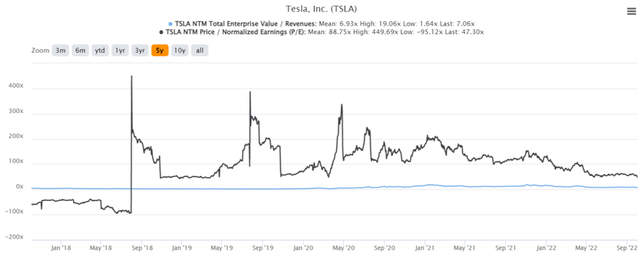

TSLA 5Y EV/Revenue and P/E Valuations

TSLA is currently trading at an EV/NTM Revenue of 7.06x and NTM P/E of 47.30x, higher than its 5Y EV/Revenue mean of 6.93x though massively moderated from its 5Y P/E mean of 88.75x. The stock is also trading at $249.44, down -39.82% from its 52 weeks high of $414.50, though at a premium of 20.58% from its 52 weeks low of $206.86. Nonetheless, consensus estimates remain bullish about TSLA’s prospects, given their price target of $325.57 and a 30.52% upside from current prices.

TSLA 5Y Stock Price

There is much anticipation among analysts waiting to see if TSLA and Apple (AAPL), the two last giants standing, will succumb to the bearish market sentiment. The former had unfortunately free-falled by -37.63% YTD, with the latter declining by -19.73%and the S&P 500 Index plunging by -20.97% at the same time. All eyes will be on the September CPI released over the next few days, potentially triggering a volatile market reaction then. If inflation moderates from August’s 8.3% level, the market may see a meaningful short-term recovery, with persistently high rates further putting downward pressure on an already downbeat Mr. Market.

In the meantime, we may also speculate that most of the pessimism is already baked in. This is attributed to the Fed’s projected terminal rate of 4.6% by 2023, indicating a 75 basis point hike in November, with January 2023 moderating to 50. Whichever way it plays out, one thing is for sure. Massive volatility will remain for the next few weeks or so, though we are of the opinion that the market is already near bottom levels.

Bottom fishing investors may potentially wait for below $200s, which may just occur due to the mixed feelings about the Twitter (TWTR) deal, combined with the worsening macroeconomics and TSLA’s Q3 delivery miss. The stock had previously plunged by -37.05% between 25 April and 24 May 2022, when Elon Musk previously announced his intentions to acquire Twitter. The CEO had also liquidated an immense amount of TSLA stock worth approximately $32B, backtracking on its previous stock pledge again and again.

Given the implications of the upcoming acquisition and legal proceedings in the Delaware trial, it is undoubted that Elon Musk had tied the fates and valuations of TSLA and Twitter together moving forward. Mr. Market’s misgivings about the CEO’s over-crowded plate are valid as well, due to the split time between SpaceX, The Boring Company, Neuralink, OpenAI, TSLA Automotives, (underperforming) TSLA Energy, and now, Twitter.

Assuming a similar pessimism, TSLA stock may be tragically corrected to $157 indeed, pointing to November 2020 levels. If that happens, investors should definitely load up on the stock, given the immense rally the stock will experience upon the recovery of macroeconomics by H2’23. Combined with its next decade promise of 20M annual deliveries, TSLA remains the solid pick for long-term portfolio growth and investing. Naturally, the market will always be full of pitfalls for those who try to pitch the perfect timing, since one might also miss the departing boat.

In the meantime, we rate TSLA stock as a cautious Buy, since the stock has also meaningfully retraced near to its previous support level of mid to low $200s. With the stock trading below its 50, 100, and 200-day moving average, investors with higher risk tolerance and long-term trajectory may consider nibbling at current levels.

Be the first to comment