Justin Sullivan/Getty Images News

Intro

Gap Inc (NYSE:GPS) is struggling at the moment. Its share price is down 55% YTD, its last quarter’s net sales have slumped by 13%, including a 19% sales decline in its largest revenue source, Old Navy. If you thought the situation could not get worse, Gap’s CEO, Sonia Syngal, has stepped down as of 7/11/22. Shareholders are undoubtedly confused, concerned, and debating whether to hold or sell their shares of one of the largest specialty retailers in America.

While just a few months ago I was reluctant to take a long position, an assessment of company-specific issues revealed that many of the market’s concerns are exaggerated. It seems that Gap’s poor Q1 performance could be attributed to a misread of market trends rather than a deteriorating business model. In my view, one hiccup does not ruin the picnic and Gap’s long-term financial outlook still remains strong. In addition, the industry-specific headwinds, which are costing Gap hundreds of millions in incremental costs, are showing signs of easing. Therefore, Gap could return to profitability by remedying Old Navy’s assortment imbalance and positioning themselves for significant cost reduction in the future.

Old Navy, Down But Not Out

Old Navy’s premature BODEQUALITY initiative has caused a major assortment imbalance in Q1 FY22. While demand for inclusive sizing lagged, demand for their core sizes outpaced supply. This means that there was excess inventory for non-core sizes and inventory shortages for core sizes. Sure enough, this led to massive discounting and significant sales loss. More specifically, Old Navy comp sales were down 22% and total merchandise margin was down 760 bps y/y (280 of 760 due to the Old Navy assortment issue). For the final nail in the coffin, diluted EPS for FY22 has been negatively impacted by $0.90 to $1 per share according to management.

(1)While pleased with some of the early indicators such as the new customer acquisition and increased brand health, we overestimated demand in stores. While we believe that BODEQUALITY is right for today’s consumer and delivers on Old Navy’s mission to democratize styles, we launched too broadly and too quickly. We over plan larger sizes with customer demand under pacing supply, leading to an excessive inventory across stores. – CEO Sonia Syngal, (Q1 ’22 EC)

(2)We are rightsizing our extended size offering in stores to better match demand, starting in Q3 by optimizing the size range to service the customers we acquired with the launch. We’ll continue to offer the full size range online and maintain price parity across sizes in all women’s styles. The team has canceled a significant portion of extended sizes from Q3 is optimizing replenishment and will monitor demand and refine as necessary. And we’re confident that our core sizes will be back in stock for fall. – CEO Sonia Syngal, (Q1 ’22 EC)

While this is not a good look for Gap’s new management, they seem to have correctly identified the main cause of Old Navy’s lackluster sales performance and have taken the appropriate course of action. According to management, Old Navy has cancelled a significant portion of extended sizes and are confident that their core sizes will be back for Q3. As Old Navy’s President and CEO, Nancy Green, stepped down, management seems committed to ensuring that a mistake like this will not reoccur.

I, along with management, believe that Old Navy should rebound in the 2nd half of this fiscal year and no long-term damage has been done to Gap’s largest source of revenue. However, sales recovery at Old Navy alone will not give the market confidence that Gap is back on track.

Margin Expansion Drivers

Air Freight and Port Congestion

Gap’s margins have taken a beating thanks to $403M in total air freight costs last year, and an expected $350M in total air freight this year. Last fall, Gap deviated from most of its retail peers and planned to transport 35% of its inventory through air. In essence, Gap was willing to pay more to avoid inventory shortages at stores. While an argument could be made that this costly alternative was necessary to prevent inventory delays, it has further shrunk Gap’s already small profit margins. Thus, the road to improved margins starts with Gap’s management feeling comfortable transporting inventory through sea again.

Fortunately, shipping rates have recently declined due to slowing demand from retailers. This is in contrast to air freight prices, which have remained relatively stable since the fall. Make no mistake, ocean freight rates are still several times higher than pre-pandemic levels; but demand slowing down is a good sign as new container ships are scheduled to be delivered starting early 2023. While increasing capacity and moderating demand will bring down costs for the large portion of Gap’s inventory that does get transported by sea, future port congestion is still a concern for inventory delays.

Port congestion was exacerbated by pent-up demand as Covid restrictions were lifted simultaneously and labor shortages hit U.S. ports. However, I believe we are starting to see early signs of a slowdown in U.S. demand for goods. As shown above, the National Retail Federation’s recent report forecasts import volumes to decline y/y starting in August. As ports start to see less volume, and trucking capacity increases, Gap could soon regain their confidence in punctual inventory deliveries.

These early signals of an easing supply chain are significant as Gap’s management decides whether or not to continue transporting 35% of their inventory via air. If they do significantly dial back the air freight volume, they could save more than $300M next year which could lead to significant profit margin expansion. It is worth mentioning that this scenario assumes that substantial sales decline does not offset the profit margin expansion that comes with reducing costs.

Cotton Prices

While not a significant driver of Gap’s recent troubles, cotton prices have nosedived in the past month.

1yr Cotton (USd/Lbs) (TradingEconomics)

While I do not believe that small movements in cotton futures will have a significant impact on any apparel company’s margins; cotton prices falling from $1.45/Lbs in mid-June, to under $1/Lbs in less than a month, eases concerns that high raw material prices may be the next headwind for Gap. As recession fears mount, the last thing apparel retailers like Gap Inc need is higher input costs that cannot be passed along to the consumer.

Valuation

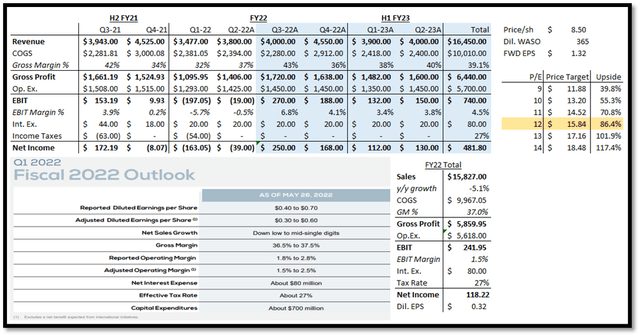

As supply chain issues ease and Old Navy’s inventory stabilizes, margins could expand y/y and sales could grow modestly. Starting from the second half of FY22 and using a FWD P/E valuation model, we can determine Gap’s upside. I engineered my FY22 assumptions to match the guidance provided by management during last quarter’s earnings presentation. Next, I forecasted the first half of 2023. Assuming margin expansion due to significantly less air freight costs, recovered sales compared to H1 FY22’s inventory shortages, and slightly higher operating expenses; I grouped together H2 FY22 and H1 FY23 to arrive at a FWD EPS estimate. The P/E model is shown below:

FWD P/E Model H2 FY22 to H1 FY23 (Author (using Gap Q1 ’22 EP Guidance))

Using Gap’s recent Q2 update and engineering the results of the second half of the year to meet management’s outlook, I forecast a 5% decline in sales and a 1.5% EBIT margin. However, the purpose of this valuation is to look further out. While trying to forecast 2+ years into the future is difficult, forecasting the first half of FY23 using current cost trends is a much more viable approach. Therefore, I used the 12 months starting in Q3 ’22 and ending in Q2 ’23 (blue shaded region) for the P/E valuation.

In my forecast, Q1 ’23 sales recover y/y due to better inventory management at Old Navy. As a result, H1 ’23 margins expand due to less discounting and better supply chain conditions (discussed in ‘Margin Expansion Drivers’). I forecasted gross margins at 39.1% for the 12 month period, which is lower than 2021’s 39.8% but higher than 2019’s 37.4%. When you factor in Sonia’s comments on Old Navy’s recent inventory mismanagement negatively affecting FY22 EPS by $0.90 to $1.00, a higher EPS in H1 ’23 seems feasible. Thus, my diluted EPS estimate for the period comes out to a reasonable $1.32.

As multiples are compressed throughout the sector due to a variety of uncertainties, a high FWD P/E multiple seems too optimistic. Currently, the sector median FWD P/E is ~12 which seems fair as Gap Inc is neither struggling with debt nor vanishing in the apparel space. When using the current 12x FWD P/E multiple and the $1.32 Diluted EPS estimate, we arrive at a price target of $15.84. This implies an ~85% upside from the current share price.

Dividend Yield

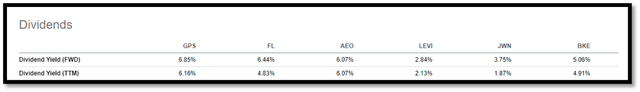

It seems like the only gains many investors see during a bear market are dividends. It just so happens that Gap Inc is leading its peers in both TTM and FWD dividend yield.

Gap Inc Peer Group Dividend Yield (TTM & FWD) (Seeking Alpha)

While future dividends are never guaranteed, a balance sheet analysis will give us a better understanding of Gap’s financial health as well as their ability to continue to pay out dividends.

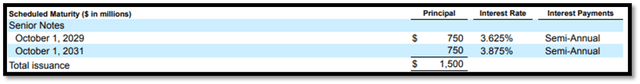

Last September, Gap restructured $1.9B of old debt with proceeds from an issuance of $1.5B in senior notes. The $1.9B was made up of senior secured notes, issued during the first few months of the pandemic, with maturities in 2023, 2025, and 2027. Due to the low interest rate environment, Gap transformed their debt to Senior Notes with lower interest rates (3.625 and 3.875% compared to 8.375, 8.625, and 8.875%) and further out maturities. As a result, S&P raised Gap’s credit rating to ‘BB’ from ‘BB-” and the new senior notes to ‘BB+’ from ‘BB’.

Schedule Maturity and Interest Rate on Gap’s Senior Notes (10-k FY21 from SA)

While Gap’s balance sheet looks healthier, last quarter’s hiccup forced them to draw $350M, from their $1.8675B ABL facility, to preserve cash. While I expect the current conditions, which are negatively affecting Gap’s cash flows, to ease in the second half of the year, future ABL withdrawals will be drastic to the bottom line via higher interest payments.

Despite the recent withdrawal and rising rates, Gap’s debt load seems manageable enough where they will not be forced to cut their dividend anytime soon. Therefore, we can reasonably assume that their dividend is safe for the foreseeable future. However, other risks remain.

Risks

As of 7/11/2021, both Sonia Syngal and Nancy Green, Gap Inc’s and Old Navy’s CEO, have stepped down. A shakeup in management is not exactly something investors can get excited over. While investors can debate whether or not Gap’s current issues were exacerbated by Syngal’s and Green’s leadership, investors cannot be certain that incoming management will correctly steer Gap back in the right direction. Therefore, new management poses company-specific risk of failing to navigate Gap through a troubling macro environment.

With that in mind, there is also the possibility that supply chain issues will not ease. While shipping demand is declining and companies are adapting, COVID-related factory closures, higher oil prices, an unexpected resurgence of shipping demand, etc could either slow or reverse the easing supply chain pressures we’ve seen so far. This scenario implies little to no margin expansion, which could lead to less cash flows, which could lead to larger ABL facility withdrawals, which leads to higher interest expense which… you get the point.

Conclusion

After an in-depth analysis of the causes of Gap’s recent performance, I believe that recent sales decline and higher costs will not persist. An overambitious campaign to strengthen brand health among a new demographic was the culprit of lost sales at Old Navy this past quarter. As Old Navy makes up over 60% of Gap’s revenue, a mistake there is much more costly to Gap Inc as a whole. However, they seem to have identified the problem, adjusted their incoming inventory, and even replaced management.

While I do not expect Gap to replicate 2021’s record revenue anytime soon, I do expect their valuation to benefit from improved margins. With shipping rates and raw materials starting to decline, Gap’s management should see plenty of opportunities to shed the costs that are negatively affecting their profit margins. If they can take advantage and significantly cut costs, the upside using the current sector FWD P/E multiple (12x) is ~85%. In addition, their past and expected future dividend yield is the highest among their peers. This will offer industry-leading income to investors who are patiently waiting for the supply chain knot to untangle. I am one of those patient investors, and so, I am bullish on Gap Inc given a 12 month investment horizon.

Be the first to comment