BING-JHEN HONG

One More Year Of Growth Thanks To Forex, Hydrocarbons

Since my review of Mitsui & Co. (OTCPK:MITSY, OTCPK:MITSF) last quarter, the steep drop in iron ore prices (the company’s main commodity) could be considered a risk to my buy recommendation. However, unprecedented strength in the coal market and the weaker yen have more than offset this issue. The stock performance since then seems to indicate the market has gained some confidence in this cyclical company as well. The profit and dividend forecast increase just announced by the company further inspires confidence, leading me to maintain a Buy rating in spite of a potential macro slowdown.

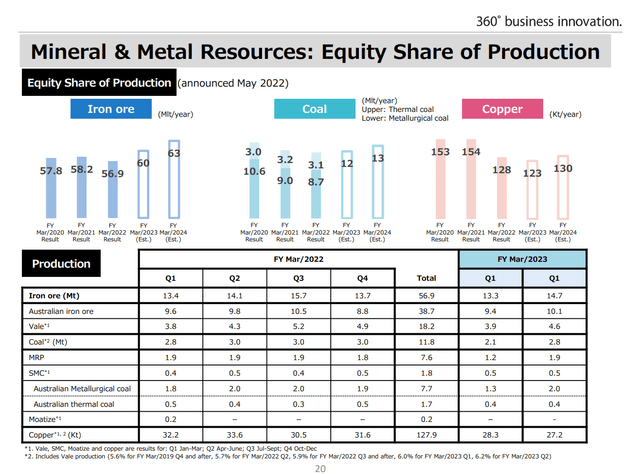

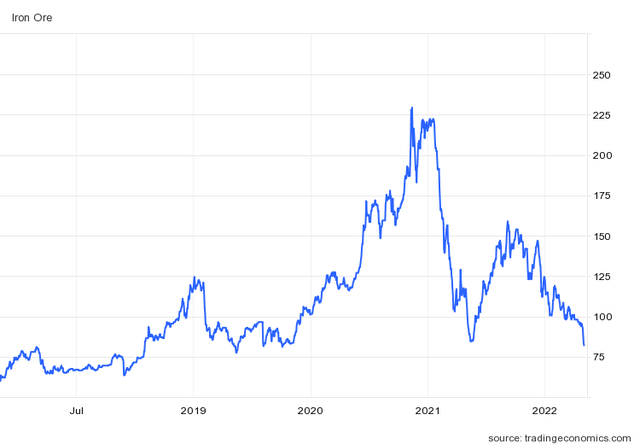

Mitsui & Co. originally planned for lower earnings in Fiscal 2023 due to a decline in iron ore prices. After peaking in FY 2022, Mitsui’s iron ore marker price averaged $121/ton in 1H 2023 and has continued to trend down to the low end of the 5-year range. (Note that the fiscal year starts on April 1, and we are currently in Fiscal 2023.)

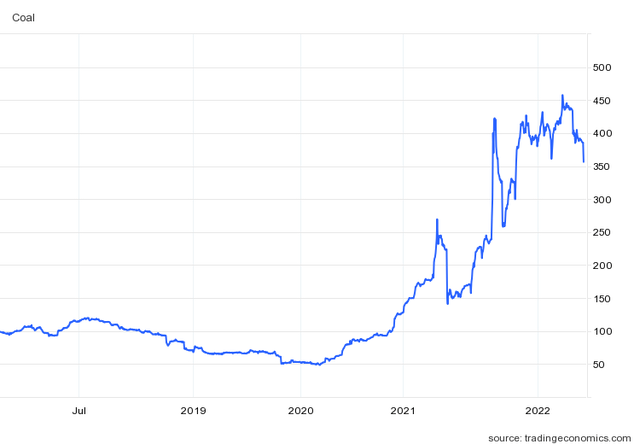

On the other hand, Russia’s invasion of Ukraine has driven up all energy markets, especially LNG and coal, another two of Mitsui’s key commodities. Coal prices for 1H 2023 averaged $406/ton for coking coal and $374/ton for thermal, up strongly from $160 and $110 in 1H 2022.

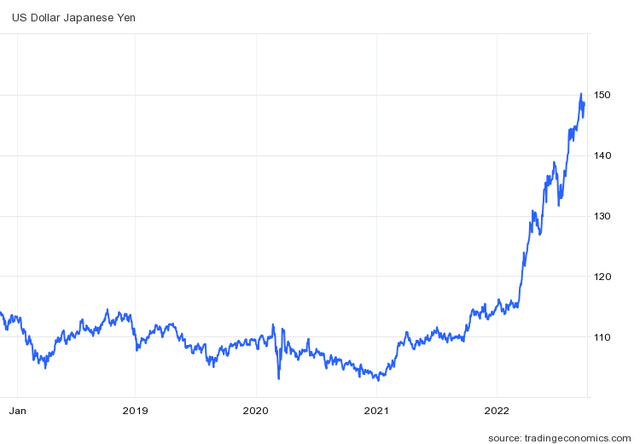

As these commodities are most often price in US Dollars, a weaker yen also provides a boost to earnings in yen terms. The yen has weakened considerably against the dollar since the start of the fiscal year as the Bank of Japan fails to follow other central banks in increasing interest rates to fight inflation.

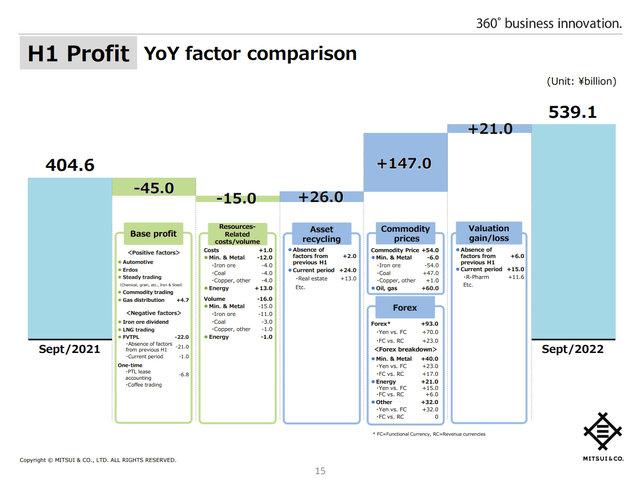

Pricing and foreign exchange effects make up essentially all of the increase in profits from 1H 2022 to 1H 2023. The gain in coal basically offset the decrease in iron ore, but the positive contribution from oil and gas made the overall commodity price impact positive. The positive impact from forex was even larger.

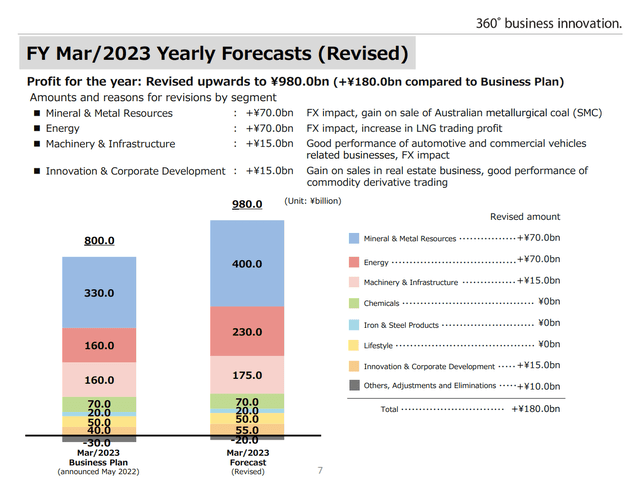

Mitsui 2Q 2023 Earnings Slides

Given the strong first half, Mitsui increased its profit forecast for FY 2023 by 22.5%, to ¥980 billion from the original plan of ¥800 billion. That now represents growth compared to the actual FY 2022 result of ¥914.7 billion. They also announced an increase in the interim and final dividend to ¥65 per share each, up from ¥60. For FY 2023, this is a 23.8% increase compared to 2022.

Looking at the drivers of the profit forecast increase, forex impacts within the commodity businesses are the most significant, as the company expects the exchange rate to stay around ¥140/USD in the second half. There are some other upsides however, including an additional ¥15 billion in Machinery & Infrastructure, largely from US businesses including Mitsui’s share in Penske Automotive Group (PAG) and Penske Truck Leasing. Finally, there was a gain on sale of real estate in the first half and another gain is expected from selling the Australian metallurgical coal business in 3Q.

Mitsui 2Q 2023 Earnings Slides

Valuation And Capital Management

Mitsui’s profit forecast of ¥980 billion is equal to ¥620.65 per ordinary share. The company reduced share count by about 2% since the start of the fiscal year through ¥100 billion of buybacks. An additional ¥140 billion of buybacks through Feb. 2023 was just authorized.

The P/E is now down to 5.6 based on the ¥3479 closing price in Tokyo on the earnings report date. Book value grew thanks to retained earnings and forex impacts, with shareholder’s equity increasing 4.7% in the quarter to ¥6,045 billion or ¥3851.53 per share. There were also no further big write-downs of Russia-based assets like the Sakhalin II Russian LNG project in 1Q. The current P/B ratio is now up to 0.90 from 0.80 last quarter.

Mitsui’s relative valuation to peers has increased on many metrics this year. The market seems to have given the company credit for its strong results despite its exposure to volatile commodity prices. Of the five major Japanese trading companies, Mitsui is now second highest to ITOCHU (OTCPK:ITOCY) (OTCPK:ITOCF) in both P/E and P/B. However, the company also had the second highest trailing 4-quarter Return on Equity as of the end of 1Q.

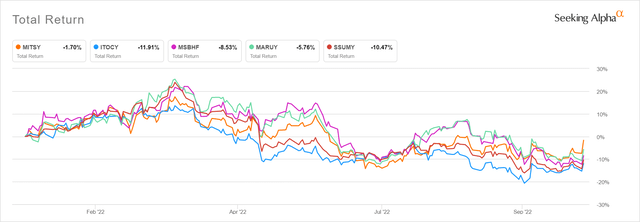

The increasing valuations have resulted in the total return performance being at the top of the pack YTD in calendar 2022. (Based on ADR prices in dollar terms.)

Mitsui increased its dividend plan for FY 2023 from ¥120 to ¥130 per share, split in two semiannual payments of ¥65. This is a dividend yield of 3.7%. This yield is lower than it was last quarter due to the increase in share price. The dividend represents a conservative payout ratio of just 20.9%. With ¥204 billion of planned dividends and ¥240 billion of planned buybacks, capital return for FY 2023 would be 39% of planned core operating cash flow of ¥1,130 billion. This would allow Mitsui’s to hit its medium-term (3-year) plan to return about 33% of the core operating cash flow to shareholders.

We won’t see the next medium-term plan until May 2023 but Mitsui should be able to maintain and grow its dividend in future years. Even if 2023 is a recession year, the company could first reduce buybacks, then temporarily exceed the 33% payout target if needed.

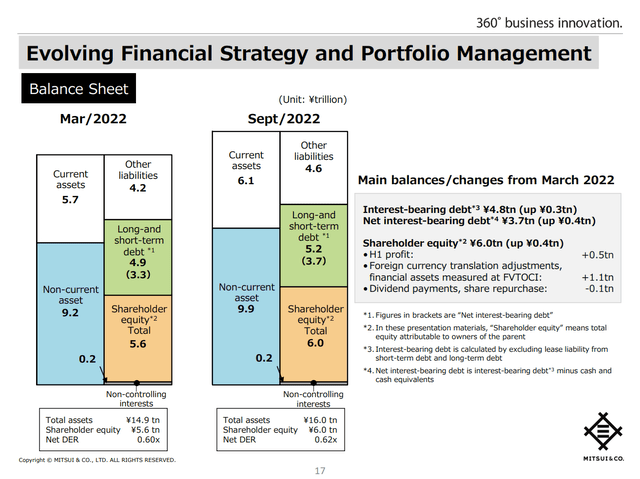

Mitsui’s increased equity by only ¥400 billion since the start of the fiscal year. Debt has increased around ¥300 billion. The debt/equity ratio is now 0.62, up slightly from 0.60 at the start of the fiscal year but in-line with the end of 1Q.

Mitsui 2Q 2023 Earnings Slides

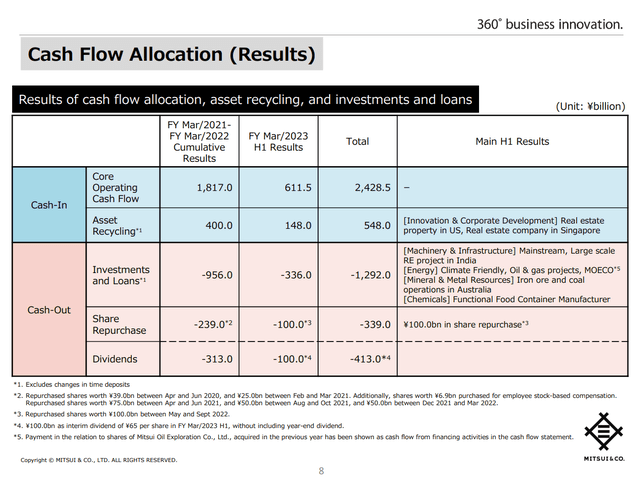

Mitsui had core operating cash flow of ¥611.5 billion in 1H 2023 which is 54% of the updated forecast of ¥1,130 billion. The company also raised cash through real estate sales in the U.S. and Singapore. This cash covered all investments, capex, and buybacks with ¥223.5 billion left over to pay for the next semi-annual dividend and planned buybacks.

Key capex areas included renewable energy projects in India (Mainstream) and Australia (Climate Friendly) which I noted as risks last quarter. However, the company is still investing in the Metals & Mineral Resources and Energy segments as noted on the slide below. They also invested in a plastic food container manufacturer in Malaysia within the Chemicals segment.

Mitsui 2Q 2023 Earnings Slides

Production volumes of both iron ore and coal have improved sequentially in 2Q compared to Q1, so I am a little less worried than last quarter that Mitsui can deliver its forecasted volumes for the full year.

Mitsui 2Q 2023 Earnings Slides

Conclusion

After record results in FY 2022, Mitsui’s growth was expected to slow this year due to falling iron ore prices. With half of FY 2023 in the books, we see that stronger coal and hydrocarbon prices have more than offset the weakness in iron ore. Profits in yen terms have also been helped greatly by currency weakness. The updated profit forecast for FY 2023 would set a new record if achieved.

The company’s P/E of 5.6 is lower than last quarter, but the stock is now the second highest valued of its peer group after outperforming YTD. Mitsui has a strong balance sheet with 0.62 debt/equity. Core operating cash flow is sufficient to cover the recently raised dividend yielding 3.7% as well as recently expanded buyback plans.

While Mitsui stock has been a great performer in yen terms, the ADR is about flat YTD in 2023 in dollars. That is still good performance in a bear market year for the US stock markets. Mitsui will continue to be a heavily cyclical company due to its commodities exposure, but its ability to deliver record earnings and a dividend raise in a tough year is encouraging.

Be the first to comment