tdub303

Author’s note: This article was released to CEF/ETF Income Laboratory members on December 15, 2022. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Data is taken from the close of Friday, December 9th, 2022.

Weekly performance roundup

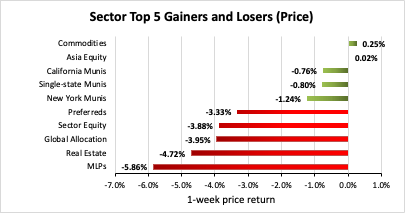

Global equity markets soared on weaker than expected US CPI (inflation) numbers. 2 out of 23 sectors were positive on price (down from 22 last week) and the average price return was -2.41% (down from +1.81% last week). The lead gainer was Commodities (+0.25%) while MLPs lagged (-5.86%).

Income Lab

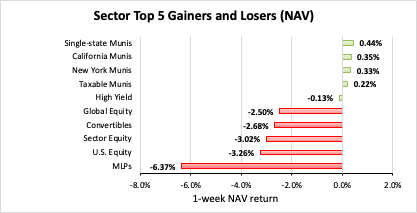

4 out of 23 sectors were positive on NAV (down from 22 last week), while the average NAV return was -1.32% (down from +1.58% last week). The top sector by NAV was Single-state Munis (+0.44%) while the weakest sector by NAV was MLPs (-6.37%).

Income Lab

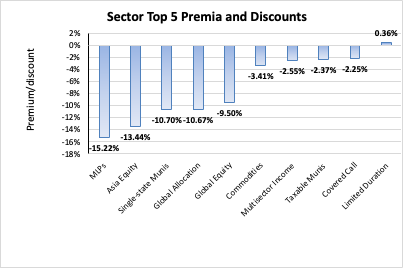

The sector with the highest premium was Limited Duration (+0.36%), while the sector with the widest discount is MLPs (-15.22%). The average sector discount is -6.65% (down from -5.79% last week).

Income Lab

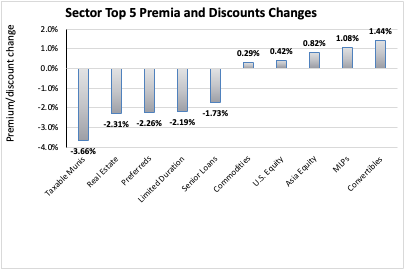

The sector with the highest premium/discount increase was Convertibles (+1.44%), while Taxable Munis (-3.66%) showed the lowest premium/discount decline. The average change in premium/discount was -0.81% (down from +0.23% last week).

Income Lab

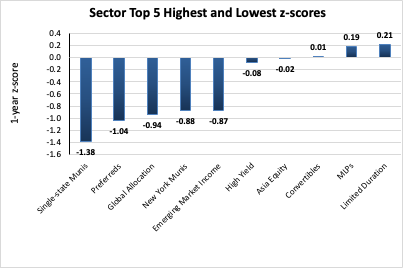

The sector with the highest average 1-year z-score is Limited Duration (+0.21), while the sector with the lowest average 1-year z-score is Single-state Munis (-1.38). The average z-score is -0.49 (down from -0.22 last week).

Income Lab

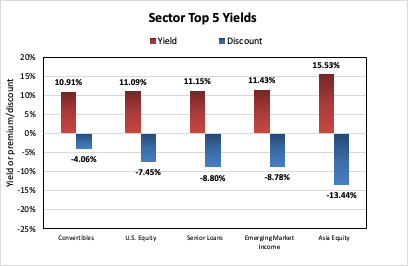

The sectors with the highest yields are Asia Equity (15.53%), Emerging Market Income (+11.43%), and Senior Loans (+11.15%). Discounts are included for comparison. The average sector yield is 8.72% (up from 8.44% last week).

Income Lab

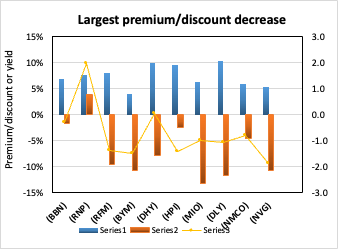

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| BlackRock Taxable Municipal Bond Trust | (BBN) | -6.26% | 6.88% | -1.59% | -0.3 | -3.96% | 1.79% |

| Cohen & Steers REIT and Preferred Inc Fd | (RNP) | -6.14% | 7.59% | 3.82% | 2.0 | -11.38% | -6.12% |

| RiverNorth Flexible Municipal Income | (RFM) | -5.35% | 7.96% | -9.65% | -1.4 | -5.82% | -0.23% |

| BlackRock Muni Inc Qty Trust | (BYM) | -5.29% | 4.01% | -10.69% | -1.5 | -3.07% | 0.87% |

| Credit Suisse High Yield Bond Fund | (DHY) | -4.90% | 10.05% | -7.84% | 0.1 | -6.57% | 0.00% |

| JHancock Preferred Income | (HPI) | -4.87% | 9.53% | -2.51% | -1.4 | -7.33% | -2.68% |

| Pioneer Municipal High Income Opp Fund | (MIO) | -4.87% | 6.24% | -13.32% | -1.0 | -3.83% | 1.59% |

| DoubleLine Yield Opportunities Fund | (DLY) | -4.86% | 10.40% | -11.74% | -1.1 | -5.48% | -0.26% |

| Nuveen Municipal Credit Opps Fund | (NMCO) | -4.72% | 5.90% | -4.57% | -0.8 | -4.18% | 0.57% |

| Nuveen AMT-Free Muni Credit Inc | (NVG) | -4.58% | 5.38% | -10.65% | -1.9 | -4.33% | 0.59% |

Income Lab

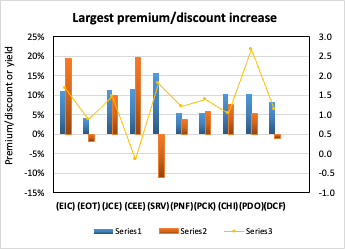

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| Eagle Point Income Co Inc | (EIC) | 12.68% | 11.07% | 19.34% | 1.7 | 11.38% | 0.00% |

| Eaton Vance National Municipal Opprs Tr | (EOT) | 6.52% | 4.19% | -1.76% | 0.9 | 7.38% | 0.28% |

| Nuveen Core Equity Alpha | (JCE) | 6.12% | 11.34% | 10.02% | 1.5 | 2.80% | -2.91% |

| The Central and Eastern Europe Fund | (CEE) | 5.45% | 11.69% | 19.68% | -0.2 | 1.62% | -1.02% |

| Cushing® MLP & Infras Total Return | (SRV) | 5.08% | 15.63% | -10.99% | 1.8 | -2.94% | -8.44% |

| PIMCO NY Municipal Income | (PNF) | 4.94% | 5.44% | 3.81% | 1.2 | 3.69% | -0.22% |

| Pimco CA Municipal Income II | (PCK) | 3.73% | 5.41% | 5.81% | 1.4 | 2.90% | 0.00% |

| Calamos Convertible Opp Inc | (CHI) | 3.55% | 10.30% | 7.68% | 1.0 | -0.09% | -3.38% |

| PIMCO Dynamic Income Opportunities Fund | (PDO) | 3.43% | 10.25% | 5.20% | 2.7 | 0.47% | -0.14% |

| BNY Mellon Alcentra Gl Crd Inc 2024 Tgt | (DCF) | 3.37% | 8.33% | -1.18% | 1.1 | -2.17% | -1.17% |

Income Lab

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

December 8, 2022| First Trust/abrdn Emerging Opportunity Fund Announces Termination and Liquidation.

November 10, 2022| RiverNorth Opportunities Fund, Inc. Announces Final Results of Rights Offering.

November 9, 2022 | Macquarie Global Infrastructure Total Return Fund Inc. announces results of the special stockholder meeting relating to the proposed reorganization with abrdn Global Infrastructure Income Fund.

November 9, 2022 | Delaware Ivy High Income Opportunities Fund Announces Results of the Special Shareholder Meeting Relating to the Proposed Reorganization With abrdn Income Credit Strategies Fund.

November 9, 2022 | abrdn U.S. Closed-End Funds Announce Results of Special Shareholder Meetings Relating to Proposed Reorganizations with Delaware Management Company-Advised Closed-End Funds.

November 7, 2022 | Tortoise Announces Final Results of Tender Offers for its Closed-End Funds.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

December 12, 2022 | Delaware Enhanced Global Dividend and Income Fund Announces Results of the Special Shareholder Meeting Relating to the Proposed Reorganization With abrdn Global Dynamic Dividend Fund and Self-Tender Offer for up to 30% of Its Shares.

December 1, 2022 | Delaware Enhanced Global Dividend and Income Fund announces potential self-tender offer for up to 30% of its shares.

November 30, 2022 | Delaware Investments® Dividend and Income Fund, Inc. Announces Results of the Special Shareholder Meeting Relating to the Proposed Reorganization With abrdn Global Dynamic Dividend Fund. Today, Delaware Investments Dividend and Income Fund, Inc. (the “Acquired Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol (DDF), announced that it held its adjourned Special Meeting of Shareholders (the “Meeting”) on November 30, 2022. At the Meeting

November 9, 2022 | Eaton Vance Closed-End Funds Announce Proposed Merger.

October 28, 2022 | Delaware Investments National Municipal Income Fund Announces Additional Information Related to Its Self-Tender Offer for up to Fifty Percent of Its Common Shares.

September 20, 2022 | First Trust/abrdn Emerging Opportunity Fund Announces Approval of Liquidation.

August 11, 2022 | Abrdn’s U.S. Closed-End Funds Announce Special Shareholder Meetings Relating to Proposed Acquisition of Assets of Four Delaware Management Company-Advised Closed-End Funds.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

————————————

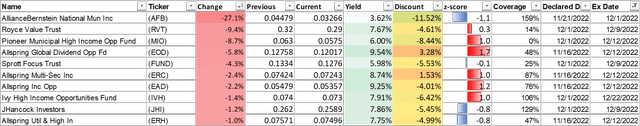

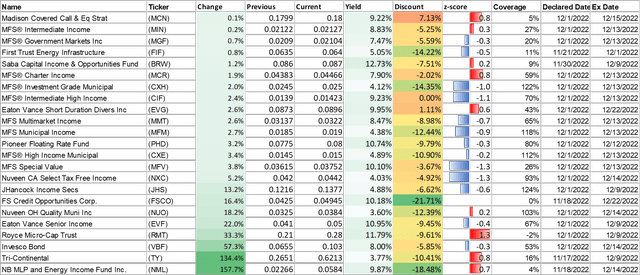

Distribution changes announced this month

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. =I’ve also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I’ve separated the funds into two sub-categories, cutters, and boosters.

Cutters

Boosters

Commentary

1. DEX to merge with AGD, self-tender will proceed

The special meeting of shareholders for Delaware Enhanced Global Dividend and Income Fund (DEX) to approve its merger into took place on December 12, 2022. There were just enough shareholders voting to constitute a quorum (51.97%), and the merger was approved. We discussed this event previously in a previous CEF Weekly Roundup.

As a result, the self-tender offer of 30% of DEX shares at 98% NAV will go ahead, with a starting date of January 12, 2023 and an expiry date of February 10, 2023. Currently, DEX’s discount is -6.62%, a 52-week high (i.e., narrow). As a result, the potential to gain alpha from the tender offer is diminished, particularly considering that the acquiring fund, AGD, is currently at a -12.33% discount. Thus, we’ll likely be sitting this one out unless the discount widens back out again.

2. FEO successfully liquidates

As discussed in previous CEF Weekly Roundups (here and here), First Trust/abrdn Emerging Opportunity Fund (FEO) has successfully liquidated, courtesy of pressure from the activists Saba.

The fund was liquidated on December 7, 2022, returning $9.635572 to shareholders as a final liquidating distribution. As a result, there was indeed the potential to gain ~1% in one week (around +1.2% in fact) by buying FEO at a -1% discount in its final week of trading.

Be the first to comment