JuSun

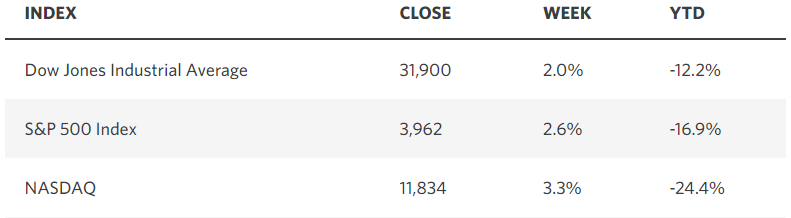

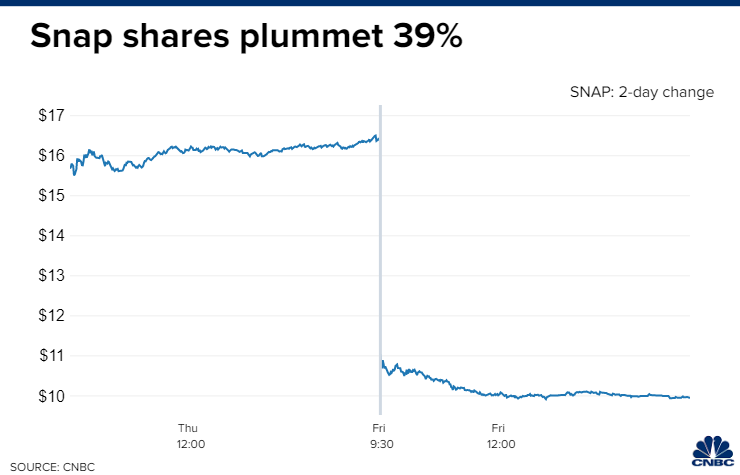

Last week the S&P 500 rose four days in a row before another dismal earnings report from Snap sent social media stocks reeling on Friday, taking the rest of the market with them. There was also a worse-than-expected PMI report from S&P Global, which revealed the service sector weakened significantly in July. Still, stocks had their best week in a month. While the bears see Snap’s shortfall as an indication of a broader softening of enterprise advertising, the company is hardly a bellwether with just $4 billion in sales. Its struggles could be as much a function of competition from TikTok and privacy changes at Apple as they are macroeconomic headwinds. We will find out if Snap is a canary or a carcass when the social media behemoths report this week.

Edward Jones

If the start of second-quarter earnings season was supposed to be the catalyst for a retest of the June lows, the bears were left empty handed. So far, 68% of the companies reporting beat estimates and the expected overall growth rate increased from 4% at the end of the quarter to 4.8% on Friday That was largely due to the energy and healthcare sectors. This week will be the true test with 175 constituents of the index reporting, including Microsoft, Google, Facebook, Apple, and Amazon.

CNBC

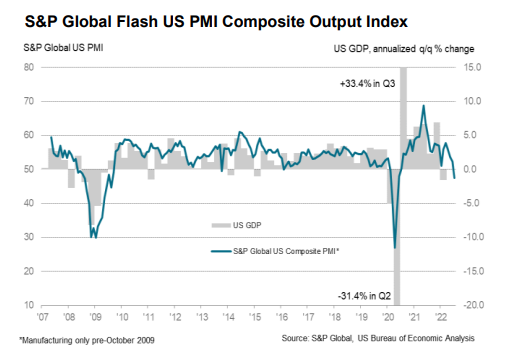

I have to admit that S&P Global’s mid-month survey of purchasing managers in the service sector is a red flag that concerns me. It shows a contraction in business activity during July for the first time in two years, which should not be ignored. Companies indicated that demand weakened, due to inflationary pressures and higher interest rates. On positive notes, new orders returned to expansion territory, and the increase in input costs was the softest in six months. The manufacturing sector is still in expansion mode. Chris Williamson, who is S&P Global’s Chief Economist, said that survey results are consistent with annual GDP contracting at a rate of 1%. That was not the case during the second quarter.

S&P Global

This does not mean we will have a contraction in the third quarter, as this is just one month of activity, and we saw similar short-lived dips below the 50.0 level that marks the pivot between expansion and contraction during the prior expansion. Still, the index needs to rise back above 50.0 for confirmation. Investors expected a sharp deceleration in the rate of economic growth after an incredibly rapid tightening of financial conditions since the beginning of this year. That is necessary to bring down the rate of inflation, which is clearly happening based on these survey results. Williamson noted that “the weakening demand environment has helped to alleviate inflationary pressures.” He also said that “average prices charged for goods and services consequently rose at a much reduced rate in July, the rate of inflation still running high by historical standards but now down to a 16-month low…”

While there are legitimate concerns about a recession ahead, the consensus on Wall Street believes we are already in one, even though one has never occurred coincident with such a strong labor market. If we do see a negative GDP print on Thursday for the second quarter, it may be received positively by investors who understand that bear markets have historically bottomed four months before a recession ends. Additionally, any contraction is likely to be mild and short considering how strong the consumer is today.

An unappreciated and underreported aspect of the current expansion is that the lowest paid workers have been the greatest beneficiaries of wage increases. According to the Atlanta Fed Wage Tracker, the lowest paid quartile of workers is realizing wage growth of 7% over the past year. This is the group most assume to be hardest hit by inflation, but real wages from this quartile have only recently turned negative and may soon be positive again if the headline inflation number falls below 7% this fall, as I expect.

Bloomberg

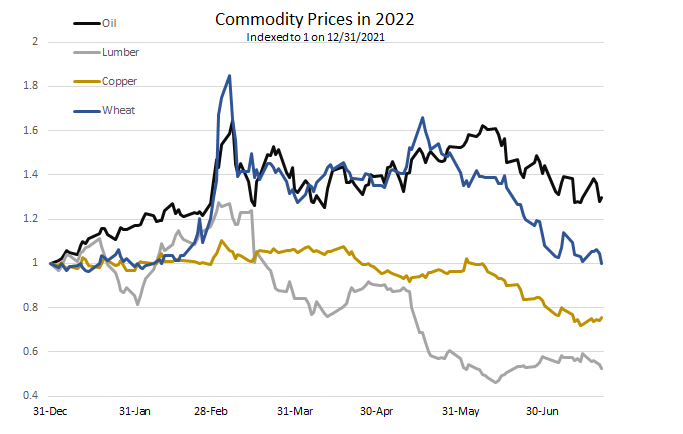

Food and energy consumes a larger percentage of the bottom quartile’s budget than any other, and those two categories have seen rapid price drops from oil to wheat, corn, and soybeans. The drop in input prices should result in lower consumer prices this fall and alleviate the strain on lower-income consumers.

Edward Jones

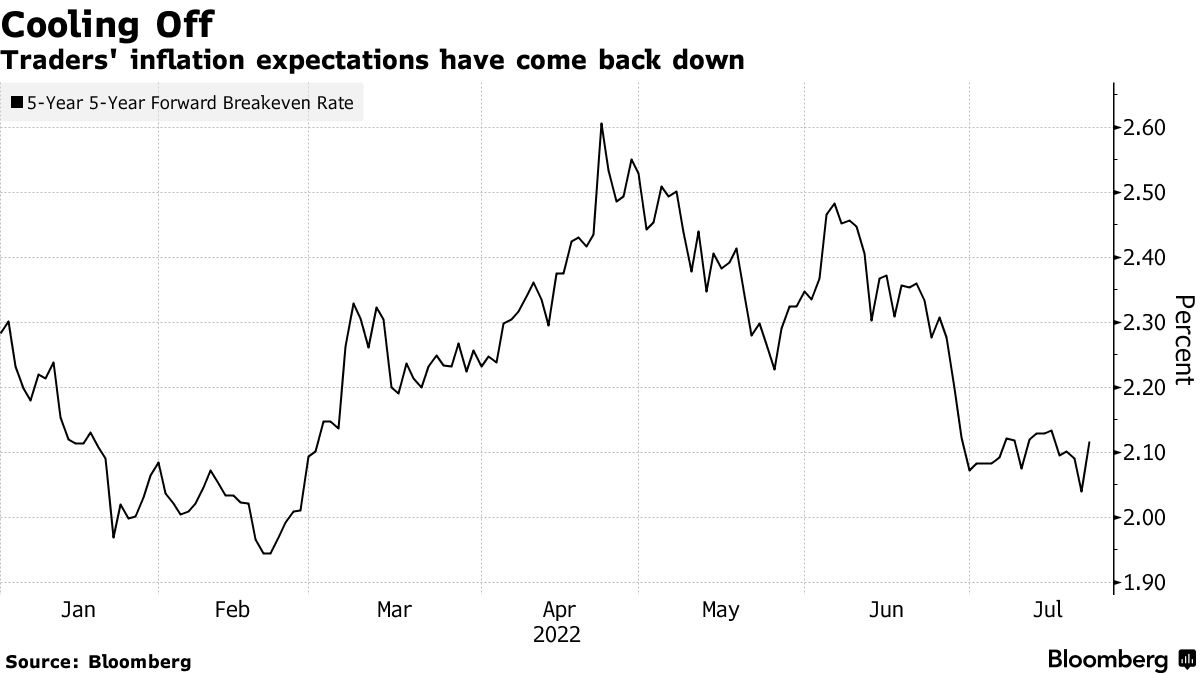

The chart below underlies my bullish tilt. I estimate that half the surge in inflation this year has been the result of the increase in food and energy prices that followed the Russian invasion of Ukraine in February, which also compounded global supply-chain issues. That drove long-term inflation expectations up from approximately 2% to 2.6%. Expectations for rate hikes by the Fed followed with the consensus seeing the benchmark rate peaking at 4% at some point in 2023.

Bloomberg

In recent weeks long-term inflation expectations have fallen back to levels where they were before the Russian invasion and alongside the decline in commodity prices. Rate hike expectations have also fallen, and the consensus now sees a peak at 3.3% closer to the end of this year. It is not just long-term expectations that are easing, as the two-year breakeven on Treasury Inflation Protected Securities has fallen from more than 4.9% in March to just 3.1% today.

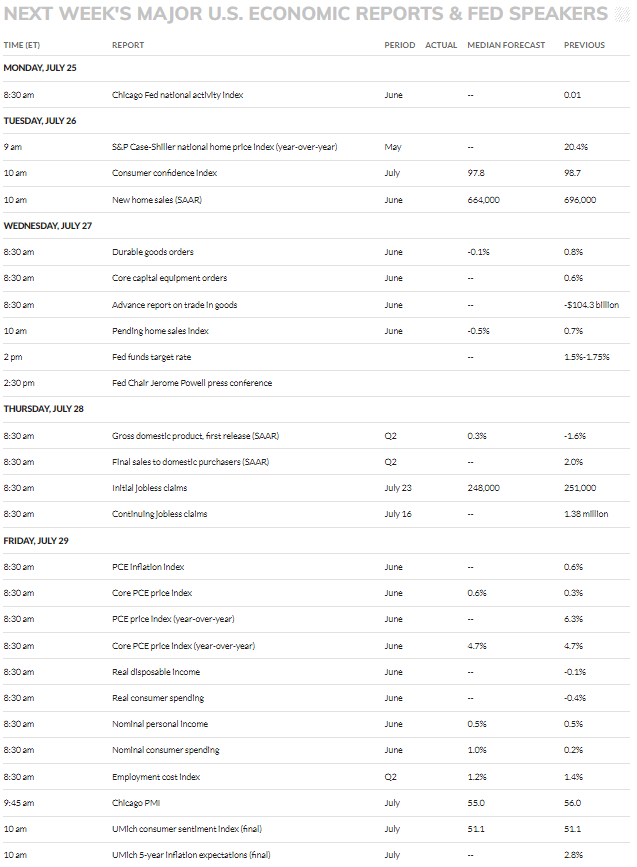

This week could be the most pivotal one of the year, as we will learn whether the economy avoided a recession during the first half of the year, digest earnings reports from one third of the S&P 500, see if the rate of inflation fell during the month of July, and receive and update from Chairman Powell on monetary policy. I anticipate no recession, better-than-feared earnings reports, a decline in the rate of inflation, and a 75-basis-point rate hike from the Fed. Powell is likely to remain guarded, so as not to ignite animal spirits of speculation again, but also express confidence that the Fed is on track to produce a soft landing.

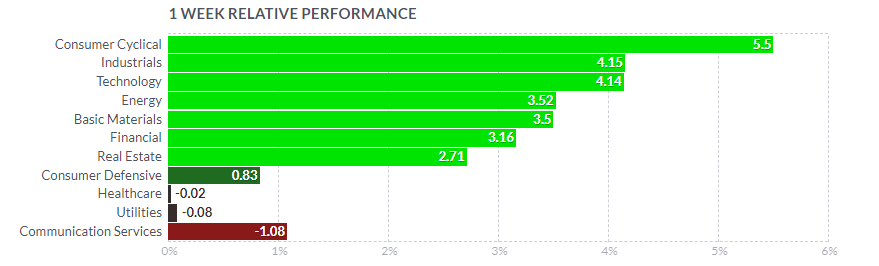

Last week’s sector performance clearly had a pro-growth tilt to it with defensive sectors bringing up the rear. Cyclical sectors typically start to outperform defensive ones at the end of bear markets. That tells me that investors are looking past the inflation- and Fed-induced economic slowdown this summer towards a reacceleration in growth as we end 2022 and start 2023, which is my playbook for a soft landing, but we need to see a lot more weeks like the last to cement that outlook.

Finviz

Economic Data

This week is packed with economic data on top of 175 earnings reports. The most high-impact reports will be the Fed’s rate decision on Wednesday, the initial estimate of second-quarter GDP on Thursday, and the Fed’s preferred inflation report (PCE) on Friday.

MarketWatch

Technical Picture

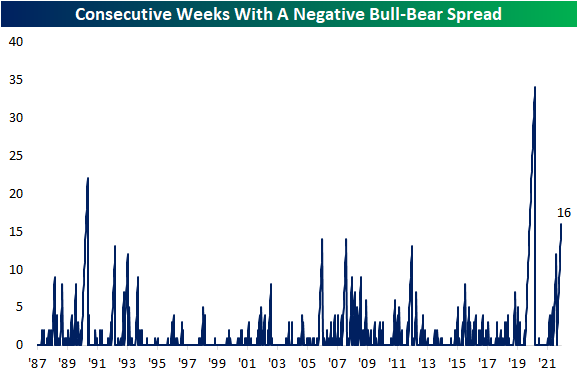

I would have thought the strong rally off the June low would improve sentiment, but that is not the case at all. According to the American Association of Individual Investors, there have been more bears than bulls in their survey for 16 consecutive weeks, which is the third longest streak in 35 years. From a contrarian standpoint, this is bullish.

Bespoke

Be the first to comment