David Ramos

For many investors, the Nokia Corporation (in Finnish, Nokia Oyj) (NYSE:NOK) is associated with mobile phones and a past era of glory. Since the collapse of the company’s mobile phone business and its eventual sale to Microsoft in 2014, Nokia has transformed itself into the world’s third-largest network equipment manufacturer. The company’s financial performance has not been spectacular in recent years, and Nokia has duly underperformed the market. While the company’s profitability has improved, revenues have largely declined in the last five years. The company is trading at an attractive level and should be seen as a short-term investment rather than a long-term bet.

A History Of Stock Market Underperformance

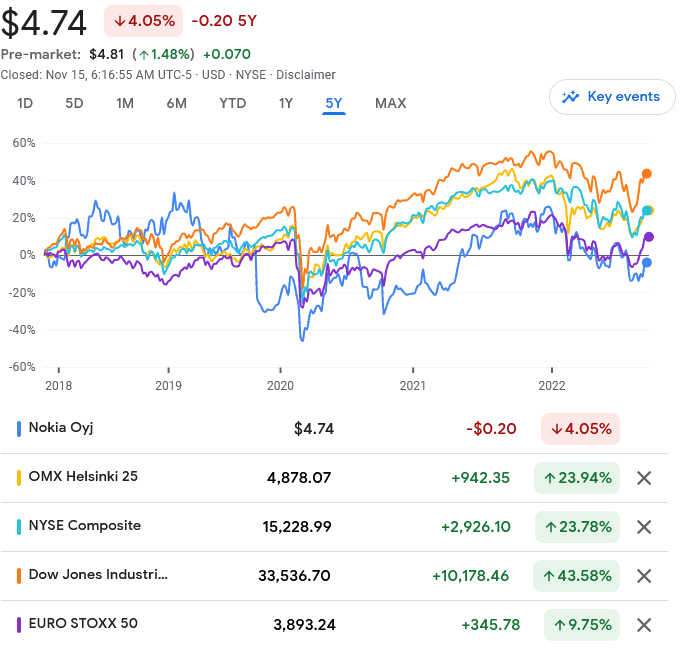

In the last five years, Nokia’s share price has declined just over 4%. In that time, the OMX Helsinki 25 has appreciated nearly 24%, while the NYSE Composite has also grown by nearly 24%, the Dow Jones Industrial Average (DJIA) grew nearly 44% and the Euro Stoxx 50 rose by some 9.75%. In the year-to-date, Nokia’s underperformance is even steeper. The share price is down 24.64%, while the OMX Helsinki 25 is down 12.91%, the NYSE Composite is down11.59%, the Dow Jones Industrial Average is down 8.33% and the Euro Stoxx 50 is down 10.08%.

Source: Google Finance

The company’s poor stock market performance reflects its declining revenues throughout that period. Nevertheless, that declining revenue occurred as the company improved its profitability.

Rising Profitability Amidst Declining Revenues

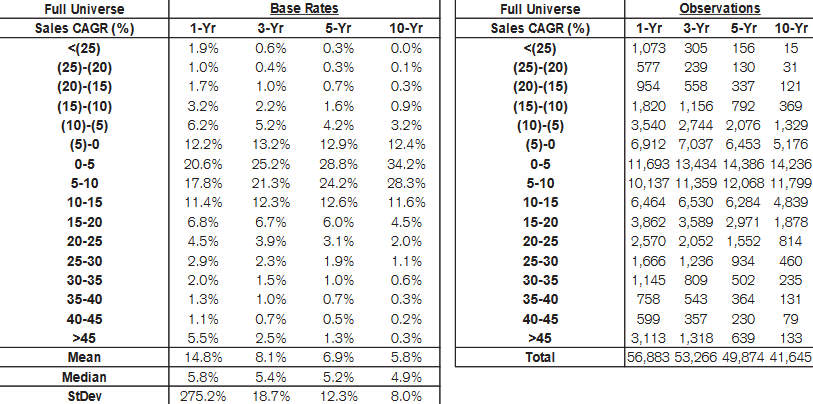

Revenue has declined from €23.147 billion in 2017, to €22.202 billion in 2021, declining at a compound annual growth rate (CAGR) of -0.83%. According to Credit Suisse’s (CS) The Base Rate Book, 12.9% of firms suffered a similar rate of decline between 1950 and 2015.

Source: Credit Suisse

Nokia’s Interim Report for Q3 2022 shows that in the first three quarters of the year, revenue was €17.462 billion, compared to €15.788 billion for the same period last year.

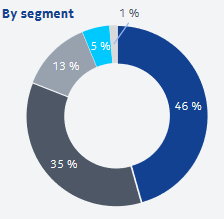

Revenue emanates from the company’s four business groups: Mobile Networks, Network Infrastructure, Cloud and Network Services, and Nokia Technologies. Each business group aims to be a leader in its respective sector.

Source: Nokia Factsheet

Mobile Networks develops products and services for radio access networks for technologies along the 2G to 5G spectrum, and microwave radio links used in transport networks. It has an estimated addressable market of €52 billion. Network Infrastructure develops fiber, copper, fixed wireless access technologies, IP routing, data center, subsea and terrestrial optical networks and related services to a range of clients, such as communications service providers (CSPS), webscales (including hyperscalers), digital industries and governments. It has an estimated addressable market of €48 billion. Cloud and Network Services empowers CSPs and enterprises to deploy and monetize 5G, cloud-native software and as-a-Service (SAAS) delivery models. It has an estimated addressable market of €28 billion. Nokia Technologies manages the company’s patent portfolio and monetizes its intellectual property, including patents; technologies and the brand itself.

In the third quarter, net sales grew 6% on a constant currency basis, (over 16% reported). By business group, that translates to a 12% increase for Mobile Networks; and 5% for Network infrastructure, and a decline of 3% for Cloud and Network Services and 19% for Nokia Technologies -due to expired licenses being in litigation or spending renewal. Network infrastructure has been a reliable engine of growth for the company, growing 14% year-over-year last year.

Gross profitability has remained largely flat at around 0.22 between 2017 and 2021. This is below the 0.33 threshold that Robert Novy-Marx’s work found as being attractive. The flatness has been achieved despite gross profits declining from €9.139 billion in 2017 to €8.834 billion in 2021. This is because the company has shed a lot of its assets in that time, with total assets declining from €41.024 billion in 2017, to €40.049 billion in 2021. While this may seem to be a negative in an epoch of growth, the asset growth effect tells us that there is an inverse relationship between asset growth and future returns. While returns throughout may have been poor, the company has, at a minimum, not been overly optimistic and misallocated capital in pursuit of returns. This will become clearer later. Nevertheless, gross profitability declined to 0.16 in the three quarters of the year.

Operating profit has shot up from €16 million in 2017 to €2.158 billion, at a 5-year operating profit CAGR of 166.68%. In the first nine months of the year, operating profit was €1.436 billion. Operating margin has also risen sharply, from 0.1% in 2017, to 9.7% in 2021. In the first nine months of the year, operating margin declined to 8.2%. According to The Base Rate Book, the median operating margin for the telecommunications industry was 9% between 1950 and 2015, and the mean was 11%.

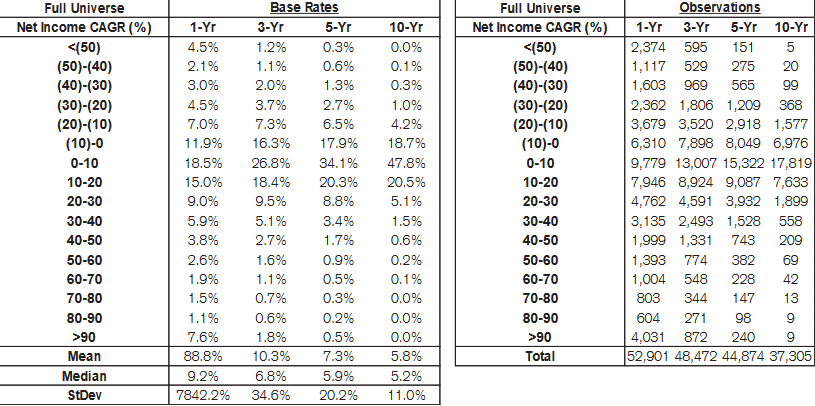

In 2017, the company made a loss of €1.473 billion, but by 2021, the company had turned things around and earned a profit of €1.654 billion. Given the negative values, we can’t calculate a 5-year earnings CAGR, but we can assume a base rate of over 0.5%.

Source: Credit Suisse

Free cash flow (FCF) has risen from €1.380 million in 2017, to €2.368 billion in 2021, for a 5-year FCF CAGR of 11.4%. In the first nine months of the year, FCF was €476 million, compared to €1.983 billion for the same period last year.

Return on capital employed (ROCE) has risen from what the company reported as “neg.” or a negative value in 2017 to 10.13% in 2021. This shows improving capital efficiency.

Opportunities Remain

Covid-19 accelerated a secular shift to digital. Industries with an underlying digital infrastructure, such as online retail; media and banking, have already reaped the dividends of this shift. However, physical industries, such as manufacturing, utilities and healthcare, have not undergone a similar history of sustained investment in ICT. Consequently, their supply infrastructure is not resilient, or flexible. The need to build more flexible and resilient supply chains has increased in the wake of the Russo-Ukrainian War.

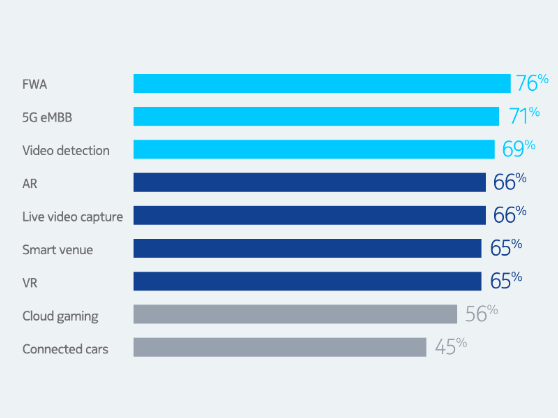

Nokia’s research shows that 80% of managers who understand 5G want it, and are willing to pay more for it. In fact, half of engaged users would switch providers to gain access to 5G. Furthermore, whereas 5G is often thought of as being largely about connectivity, the use cases go well beyond that.

Source: Nokia 5G Report

In the next decade, investment and adoption of end-to-end 5G technologies is expected to increase, with some reports estimating a 10-year CAGR of between 55% and nearly 69%. Nokia is well placed to capture a lot of value from that transition. The safety, productivity, efficiency and resiliency gains that will come as a result of 5G+ enabled digitization are expected to add $8 trillion to global GDP by 2030.

Valuation

With €861 million in FCF in the trailing twelve months (TTM), and an enterprise value of €21.74 billion, Nokia has an FCF yield of 39.6%. This is in comparison to an average FCF yield of 1.5% for the 1000 largest businesses in the United States, as calculated by New Constructs.

Nokia’s relative valuation is appealing, with a price-earnings ratio of 15.29, compared to 20.58 for the S&P 500.

Conclusion

While Nokia enjoys a higher FCF yield than the market, and its relative valuation is attractive, its sluggish performance over the last years suggests that the stock should be seen as an opportunity to capitalize on mean reversion, with the share price likely to improve. However, as Hendrik Bessembinder’s research shows, 96% of stocks do not outperform Treasury bills if held across their life. Nokia should be held, if an investor already has a position, and any investor who buys the stocks should only do so until the FCF yield begins to align with the market. This is not a long-term buy.

Be the first to comment