peepo

Overview

Joby Aviation (NYSE:JOBY) is an eVTOL (electric vertical takeoff and landing) company similar to Archer Aviation (ACHR). Also like Archer, it is a very early-stage company that is still developing its aircraft and seeking certification from the Federal Aviation Administration.

Founded in Q4 2009, Joby went through several rounds of raising capital and entered the public markets via SPAC merger with Reinvent Technology Partners in Q2 2021. Notably, the company that it merged with was operated by billionaire Reid Hoffman of LinkedIn. This progression in its capital structure mirrors that of Archer, which also went public via SPAC at around the same time.

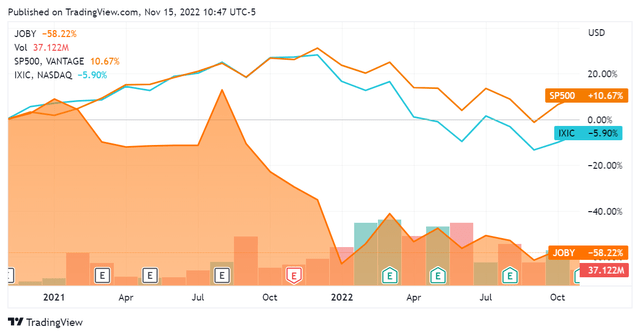

Joby has depreciated significantly since its listing, now trading at a 58% discount. Being a very early-stage growth company, it has displayed downward volatility far beyond that of the SP500 & NASDAQ composite.

SeekingAlpha.com JOBY 11.15.22

Since I recently posted an article about Archer Aviation, this article will follow a similar path in terms of reviewing the company’s progress towards getting to market as well as its financial situation at present. Notable points of comparison between the two companies will be highlighted.

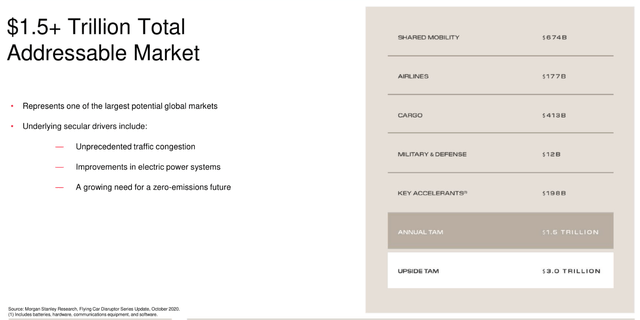

The business models between the two companies are functionally identical: creating a flying rideshare service while also operating as a vertically integrated eVTOL aircraft manufacturer. As such, the Strategic Review outlined in my article about Archer is directly applicable to Joby, notably including the $1.5 – $3T eVTOL aircraft market size estimation created by Morgan Stanley.

SEC ACHR Investor Presentation Q1 2021

Financials

Since this company is a long way out from revenue, it makes sense to look at it through the perspective of a ‘start up’ and assess its current cash position, operating expenditures, and financing position.

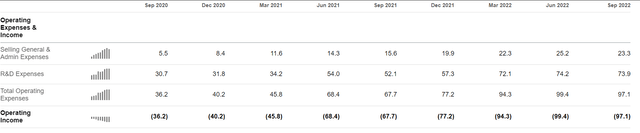

Joby is currently losing between $90 – $100M per quarter in terms of operating loss, again mirroring Archer Aviation. While Archer has had a different progression as to operating loss, one with somewhat more variance, they appear to both have arrived at the same present ‘steady state’ as to capital expenditures.

Joby

SeekingAlpha.com JOBY 11.15.22

Archer Aviation

SeekingAlpha.com ACHR 11.15.22

Adjusted EBITDA was also quite similar between the two companies, with Joby’s latest quarter coming in at -$77.7M and Archer’s at -$60.1M. Since these companies are both exceptionally early stage, we can’t learn much from this metric at present.

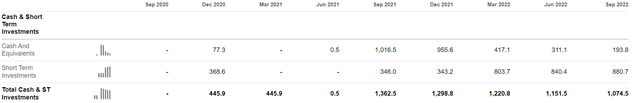

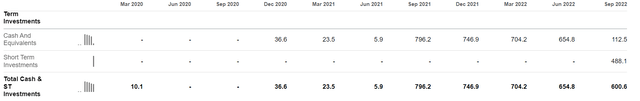

Both companies have a relatively healthy cash position that presents a runway for their entry into market. Since short term investments are considered readily convertible into cash, we can compare the two companies on the basis of the total cash & short-term investments metric highlighted below. Joby at present has 178.9% of Archer’s overall cash & short-term investments.

Joby

SeekingAlpha.com JOBY 11.15.22

Archer Aviation

SeekingAlpha.com ACHR 11.15.22

This is a good sign for Joby. Notably, both companies have become subject to stricter certification requirements by the FAA and have pushed their expectations as to market entry to 2025. Both companies are currently at Stage 2 of FAA compliance certification, although Joby achieved this milestone a full 5 months before Archer did. It is fair to assume that they have carried this momentum forward and continue to be ahead in terms of certification, but the process is complex enough to be difficult to predict.

Joby has the upper hand by on cash by roughly $400M. Aside from this, the financial picture of these two companies is more or less the same.

Progress

Joby and Archer have both established contracts with airlines. The difference here is the nature of the contracts. Joby established an investor relationship with Delta Airlines to the tune of $200M, with $60M already invested and $140M contingent on milestones. Archer, on the other hand, has established an early customer relationship with United Airlines for 200 of its aircraft and an option for 100 more; this is a contingent $1B purchase order with a $500M option in statements released by Archer’s management team.

Since both companies are well-capitalized and have the involvement of billionaires (Reid Hoffman for Joby and Tom Moelis for Archer), I consider Archer’s purchase contract to be much more significant than the investment contract that Joby has with Delta. This is true on both a qualitative and quantitative basis: Archer’s contract is more than 5x the size of the one signed by Joby.

The addendum here is that Joby has also been able to sign a contingent customer contract with the United States Department of Defense, namely the Air Force. Notably this contract was also increased by $45M in Q2 2022, bringing it to $75M and to 250% of its original size. This is difficult to compare numerically with the order agreement signed by Archer, but the DoD is a deep pocketed customer that has identified a significant interest in eVTOL aircraft. I take this as a very good sign for Joby.

Conclusion

Upon review, Joby is quite similar to Archer yet also has several achievements that may put it ahead of its direct competitor. It has a more robust cash position as well as a contract with the DoD as compared to Archer’s contingent purchase contract with United Airlines. Additionally, it is ahead on aircraft certification and could get to market faster as a result.

Both companies in question are charting completely novel territory and the path ahead has many uncertainties. This makes it difficult to predict exactly how things will play out, and it is realistic to believe that they both get to market at the same time.

Nonetheless, Joby appears to be marginally superior to Archer as to its overall picture. Given the vast market size that the companies are targeting, as well as the clear differentiation from competitors that both have displayed, I am bullish on both of them for the long term. This implicates an investment horizon of 3 full years for market entry and then a decade for profitability/cash flow generation; an investment in either will require patience on the part of the investor.

Be the first to comment