TomasSereda/iStock via Getty Images

Investment Thesis

Imperial Metals (OTCPK:IPMLF) offers a high-risk/reward opportunity in the copper mining industry, manifested in a high-cost mine portfolio trading at a discount to book value. If copper prices remain stable, net cash flows could exceed $800 million in the next five years and triple this amount in the long term. On the other hand, if commodity prices return to historical averages, IPMLF will revert to value destruction, a theme that prevailed over the past decade when copper prices declined below production costs.

Revenue Trends

Copper price remains steady, holding its post-lockdown rally, supported by lower inventory levels worldwide following a solid economic rebound in recent quarters. Higher copper prices encouraged IPMLF to restart mining at the Mount Polley mine, which was put under care and maintenance since 2019 when copper prices declined, rendering production unprofitable, similar to the Huckleberry mine, which met a similar fate three years earlier. Since 2019, all revenue came from the company’s 30% interest in the Red Chris mine, operated by Newcrest (OTCPK:NCMGF).

The problem is that the proceeds from the Red Chris mine are insufficient to cover maintenance expenses of its idle portfolio, consisting of Mount Polley and Huckleberry mines. Management restarted mining in Mount Polley earlier this year, and if the project is on schedule, the mill should also be operating by now. Current copper prices stand at $4.29 per pound, exceeding total production costs, around $3.5 per pound of copper and $1400 per ounce of gold, based on reserve estimates discussed in the next section.

IPMLF lacks the competitiveness of its larger peers capable of maintaining production through commodity price cycles until lower prices remove high-cost producers such as IPMLF from the market, restoring supply/demand balance. The long-term bullish case for copper mirrors increased demand for renewables and electric vehicles, “EVs.” On the other hand, IPMLF’s decision to reopen its high-cost mines flags potential over-supply risk. Copper is not rare and is often found in large quantities in Gold ores.

Valuation and Reserves

Red Chris

The open-pit zone of Red Chris contains 75 million tonnes of ore mineral reserves, 694 million pounds of copper, and 952,397 ounces of gold. Historically, recoveries hovered around 79% for copper and 51% for gold. Using these estimates, the market value of copper and gold reserves is $2,353,581,256 and $901,014,310, respectively. To mine these metals, IPMLF and its partner NCMGF spend $13 per tonne, translating to $1,012,500,000 in total expenses. Based on current metal prices, the undiscounted net profit from the open pit is $2,242,095,566, and Imperial’s share of this profit is 30%, or $672,628,669.

The bulk of Red Chris’ value stems from its underground reserves, which require a Block Cave mine, a dangerous and expensive mine design. From my understanding, two people died working on the Block Cave in 2021, which still is incomplete. Imperial is issuing more shares to fund its share of the expenses. If the project succeeds, both companies will unlock 410 million tonnes of additional ore minerals containing 3,213,347,702 pounds of copper and 4,047,687 ounces of gold, net recovery rates. The market value of these are $13,785,261,641 and $7,508,459,385 respectively. Again these figures exclude production costs, expected to be $21 per tonne ($10,080,000,000 in operating expenses). Incorporating capital costs of 5,000,000,000 reduces cash flows to $6,213,721,026, 30% or $1,864,116,307 is attributed to IPMLF.

Red Chris mill and mining capacity are 13.6 million tonnes per annum, which means it would take the company 36 years to mine all the 480 million tonnes of mineralized ore reserves (open pit + Block Cave). Investors should take this into account when projecting the returns discussed above. Using a discount rate of 4.5%, the discounted cash flows of IPMLF’s 30% share in the mine is approximately $1,268,372,488, still almost three times its current market cap.

Mount Polley

The last time Mount Polley was operational, cash costs were between $2.8 and $3 per pound of copper. Cut-off analysis using Mill Heat Value incorporates the copper price of $3.5, covering milling, processing, and capital sustaining costs. At the time of this writing, copper price stands at $4.29 per pound, exceeding the cut-off price estimates.

Mount Polley mine reserves are much smaller than Red Chris, standing at approximately 52 million tonnes, containing 314,114,631 pounds of copper and 524,594 ounces of gold, with market value of $875,908,648 for copper and $681,185,309 for gold based on current metal prices ($4.29/pound copper and $1855/ounce gold), net of the recovery rate of 65% and 70% for copper and gold, respectively. Mining and milling capacity ranges between 17,800 to 22,000 tons per day, giving the mine an estimated life of 7-8 years.

Management estimates operating and capital costs around $1.2 billion, leaving $357,093,957 undiscounted net profit for the project. This assumes current copper and gold prices remain stable through the mine’s life.

Huckleberry

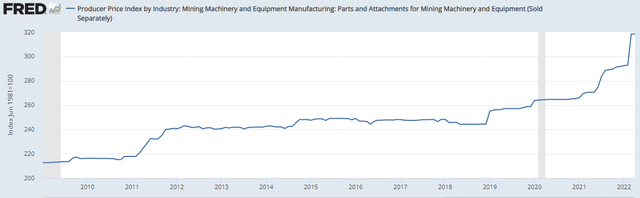

Huckleberry mine contains 35 million tonnes of mineral reserves. Copper grade hovers around 0.325%, translating to 250,775,823 pounds. Assuming a recovery rate of 90%, the market value of these reserves is $968,245,452. In 2011, management estimated operating costs of $8.5 per tonne. However, mining equipment and services prices have risen sharply, as indicated below.

Incorporating a 25% rise in management’s 2011 cost estimates, total operating costs for the Huckleberry mine stand at $371,875,000 when and if the company resumes operations. Excluding any capital expenses related to mining operations, the net profit stands at $596,370,452.

Financial Position

IPMLF made significant progress in cleaning its balance sheet over the past decade. Still, its precarious mine portfolio is translating to high borrowing costs. For example, last year, the company signed a C$10 million, 1-year promissory note bearing an 8% interest rate, and longer-term borrowing is likely to carry higher interest rates.

To solve this problem, IPMLF is resorting to the equity market, raising the capital needed for the Block Cave and Mount Polley operations through new equity. The company also received help from one of its major shareholders, who guaranteed C$75,000 of its C$125 million credit facility, reducing the interest rate to 2% + CDOR (currently standing at 3.7%). Investors should expect more dilutions as the company continues to work on its mining portfolio.

Summary

Imperial Metals offers a high-risk/reward copper play, manifested in high-cost mine portfolio trading at a discount to book value. If commodity prices maintain the post-lockdown rally, the company will generate lucrative cash flows in the coming five years, multiple times above its current market cap. However, as a high-cost producer, Imperial Metals is less competitive than its peers, amplifying the risk of commodity price fluctuations.

Be the first to comment