alvarez

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 13, 2022. Please check latest data before investing.

HYT rights offering

BlackRock Corporate High Yield Fund (NYSE:HYT) has announced a rights offering! From the press release:

September 8, 2022 | BlackRock Corporate High Yield Fund, Inc. Announces Terms of Rights Offering. BlackRock Corporate High Yield Fund, Inc. (NYSE: HYT) (the “Fund”) today announced that its Board of Directors (the “Board”) has approved the terms of the issuance of transferable rights (“Rights”) to the holders of shares of the Fund’s common stock (par value $0.10 per share) (“Shares”) as of September 20, 2022 (the “Record Date”). All expenses of the Offer will be borne by the Adviser, and not by the Fund or any of the Fund’s shareholders.

- Holders of Shares on the Record Date (“Record Date Shareholders”) will receive one Right for each outstanding Share owned on the Record Date. The Rights entitle the holders to purchase one new Share for every 5 Rights held (1-for-5).

- The subscription price per Share (the “Subscription Price”) will be determined on the expiration date of the Offer, which is currently expected to be October 13, 2022, unless extended by the Fund (the “Expiration Date”), and will be equal to 95% of the average of the last reported sales price per Share on the New York Stock Exchange (the “NYSE”) on the Expiration Date and each of the four (4) immediately preceding trading days, provided that, if such price is equal to or above net asset value (“NAV”) per Common Share at the close of trading on the NYSE on the Expiration Date, the Subscription Price shall be reduced to $0.01 below NAV per Common Share at the close of trading on the NYSE on the Expiration Date (the “Formula Price”). If, however, the Formula Price is less than 90% of the Fund’s NAV per Share at the close of trading on the NYSE on the Expiration Date, the Subscription Price will be 90% of the Fund’s NAV per Share at the close of trading on the NYSE on the Expiration Date.

- Record Date Shareholders who fully exercise all Rights issued to them can subscribe, subject to certain limitations and allotment, for any additional Shares which were not subscribed for by other holders of Rights at the Subscription Price, subject to the right of the Board to eliminate this over-subscription privilege. Investors who are not Record Date Shareholders but who otherwise acquire Rights in the secondary market are not entitled to participate in the over-subscription privilege. If sufficient Shares are available, all Record Date Shareholders’ over-subscription requests will be honored in full. If these requests exceed available Shares, they will be allocated pro rata among those fully exercising Record Date Shareholders who over-subscribe based on the number of Rights originally issued to them by the Fund.

- Rights are transferable and are expected to be admitted for trading on the NYSE under the symbol “HYT RT” during the course of the Offer and will cease trading one day before the Offer’s Expiration Date (September 20, 2022 through October 12, 2022). During this time, Record Date Shareholders may also choose to sell their Rights.

This is a fairly unusual event for BlackRock funds, who tend not to conduct many rights offerings at all. This is probably because due to their size and reputation, they don’t have much trouble raising capital to launch completely new funds (see: BSTZ, BMEZ, BIGZ, ECAT, BCAT, just off the top of my head from recent memory).

HYT is a fairly large high-yield bond fund at $1.22 billion in net assets. With the announced 1-for-5 offering, the fund can increase its AUM by up to 20% assuming maximum subscription. The ex-rights date for the offering was September 19, 2022 while the expiry date is October 13, 2022. It is noteworthy that the fund sponsor, and not the fund shareholders, will bear all of the costs of the offering. This is a positive sign and shows alignment between the fund sponsor and shareholders.

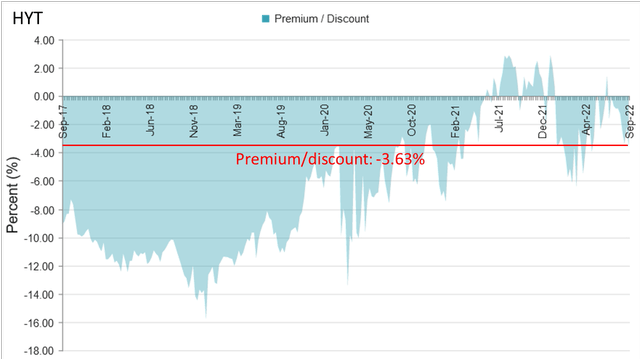

Why did HYT call a rights offering now? I’m not entirely sure, but it could be due to the fact that HYT is trading at a relatively narrow discount vs. its recent averages. A higher starting valuation makes announcing a rights offering more palatable, as these usually lead to a drop in the premium/discount valuation (and share price).

The subscription formula will be the higher of 90% of NAV or 95% of the market price of the fund, as defined by the average closing price in the final five days of the offering. This is a transferable offering, so the rights will be tradable on the secondary market under the symbol “HYT RT”. However, only primary rightsholders (those who held the fund through the ex-rights date) have the ability to take part in the over-subscription privilege, which is where they can subscribe for excess shares that weren’t allocated to other rightsholders.

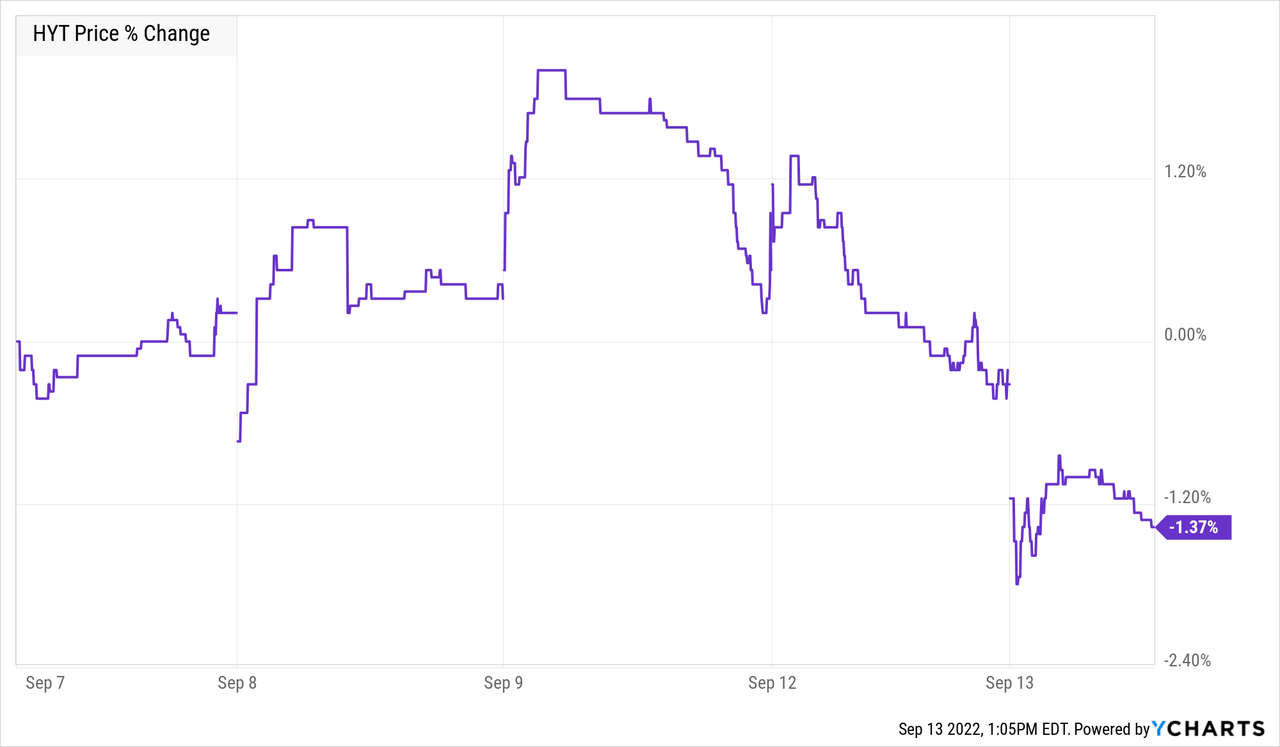

For some unknown reason, HYT actually spiked higher on the day after the rights offering was announced (September 9). It has since given back those gains and then a bit more, however it is likely that today’s drop is simply due to a large downward move in the market causing widespread losses to risky assets.

Income Lab

The subscription formula has a “floor” of 90% of NAV, i.e. a -10% discount, which limits the maximum dilution that the fund can suffer. Together with the modest 1-for-5 offering condition (most other rights offerings are 1-for-3), as well as the fact that there is no sales load or other expenses borne by the fund, the maximum NAV/share dilution assuming full subscription will be –1.7%.

Subscription strategy

What’s the plan for the offering? Generally, we’d recommend sidestepping the offering by selling the fund and replacing it with a similar fund in the meantime. I don’t think that HYT is an exception in this case. While the offering isn’t going to be extremely dilutive, we’d still previously observed the floor of the offering acting as a magnet drawing the premium/discount of the fund towards it until expiry. Hence, I wouldn’t be surprised to see HYT head towards a -10% discount over the next month.

We recommended to our members last week that if one wanted to sell HYT, they should do so before the ex-rights date. For those who have held HYT through the ex-rights date but are not interested in subscribing for new shares, I’d recommend selling the rights as soon as you receive them, as our experience has been that the rights gradually decrease in value as the expiry date nears.

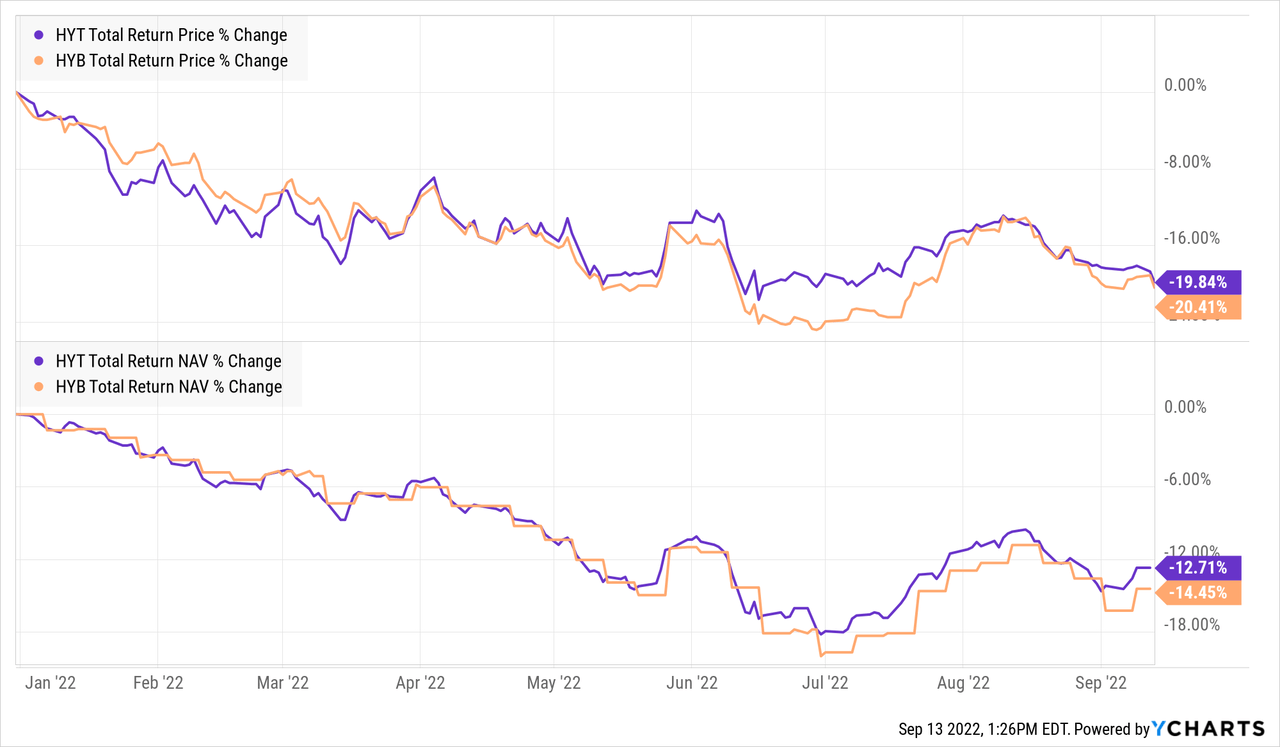

One candidate for replacing HYT with could be HYB (HYB), a holding of our Tactical Income-100 portfolio. HYB trades at a discount of around -10%, making it more discounted than HYT currently. Both funds have had similar NAV profiles over the last year.

Income Lab

Strategy Statement

Our goal at the CEF/ETF Income Laboratory is to provide consistent income with enhanced total returns. We achieve this by:

- (1) Identifying the most profitable CEF and ETF opportunities.

- (2) Avoiding mismanaged or overpriced funds that can sink your portfolio.

- (3) Employing our unique CEF rotation strategy to “double compound“ your income.

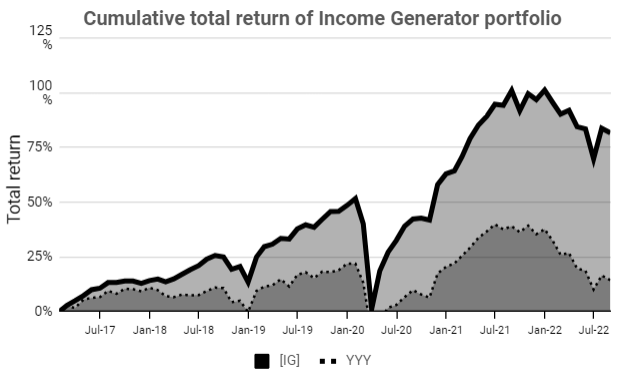

It’s the combination of these factors that has allowed our Income Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) whilst providing growing income, too (approx. 10% CAGR).

Income Lab

Remember, it’s really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter!

Be the first to comment