CoffeeAndMilk/E+ via Getty Images

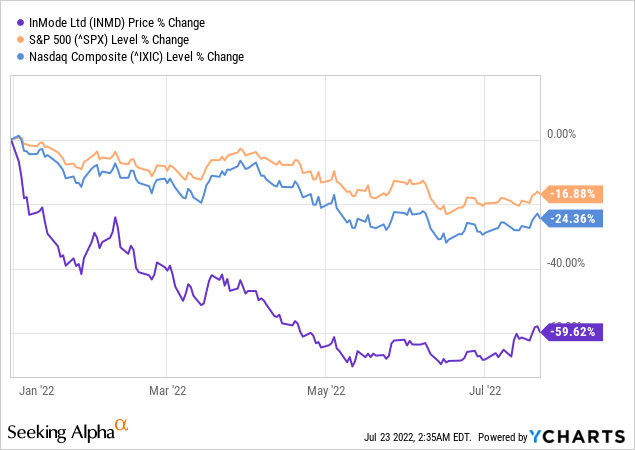

2022 has been a tough year on the stock market so far. This is true for every investor, but especially for shareholders of InMode (NASDAQ:INMD). After losing about 60% since the beginning of the year with significant negative alpha compared to indices and trading about 70% below its ATH from November 2021, InMode has recently shown signs of life.

ytd price performance (normalized), (ycharts)

On July 12, 2022, the company released preliminary financials for the second quarter of the current year; final numbers are scheduled for release on July 28, 2022. Management raised expectations for the full year. With this, InMode apparently caught market participants off guard, as the stock shot up in intraday trading action. The key points are as follows:

- Second quarter 2022 (preliminary): Revenue in the range of $113.0m to $113.3m, representing a year-over-year increase of 29% to 30%. This is a considerable beat against consensus of $103.0m.

- Adjusted guidance for the full year 2022: Increase of sales guidance to the range of $425m to $435m (previously: $415m to $425m). Consensus stood at $416.8m.

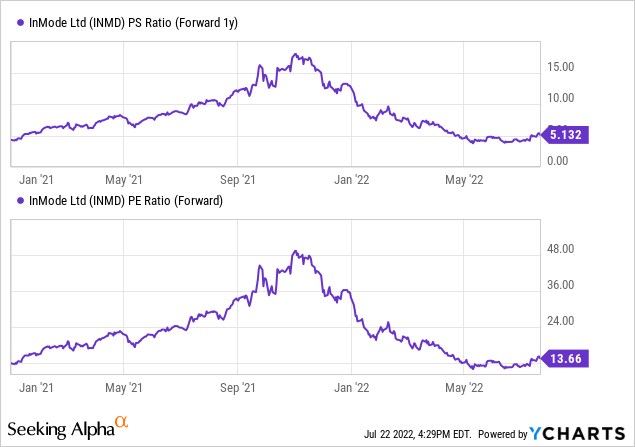

Although InMode stock does not yet have an extensive track record (the company went public in August 2019 only), current valuation levels in terms of PSR and PER suggest an attractive entry opportunity.

current valuation of INMD stock (PSR & PER fwd 1yr), (ycharts)

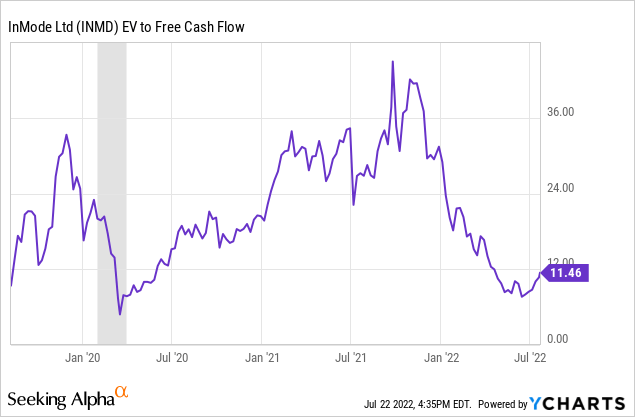

This assessment is supported by the EV-to-free cash flow ratio. Almost at the level of the pandemic-induced low back in the first quarter of 2020 (shaded in gray in the chart below), this valuation metric reversed in June 2022.

current valuation of INMD stock (EV to Free Cash Flow), (ycharts)

Internationlization

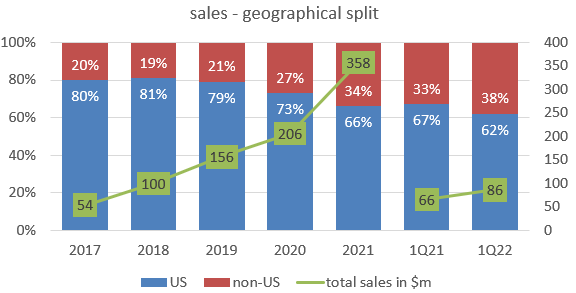

Internationalization is a central pillar in InMode’s equity story. The number of markets in which the company sells its products recently rose to 77 (earnings call 1Q22).

In the first quarter, we opened subsidiary in Italy and we are very happy with the level of demand in this territory. We see most of the growth coming from region where we have already established our presence yet, there remain opportunity in new territories and we will expect to keep expanding our presence outside the U.S. in the coming quarters.

189 direct sales representatives and a distribution network are responsible to develop these opportunities (source: investor presentation). Most recently, InMode announced that it received Health Canada certification for one of its devices for women wellness. Having completed the certification process successfully allows InMode to launch its EmpowerRF product in Canada (more details on the product can be found here).

We chart below illustrates the success of InMode’s revenue diversification efforts. Note that non-U.S. sales are driven by Canada, Europe and Latin America (earnings call 1Q22).

Asia in general and China in particular play a minor role. This is mainly due to Asian governments’ strict (lockdown) policies to combat the Covid pandemic which complicates any sales efforts considerably. For instance, let’s look at the Chinese market: InMode made $1.1m of revenues in 1Q22, while the full-year budget for 2022 is at $12m to $13m. Thus, InMode is clearly behind the run rate required to meet its budget.

Additionally, InMode has applied for approval for three of its product platforms with China Food and Drug Administration. However, Chinese regulators are apparently fully engaged in fighting the pandemic. Therefore, there is no clear timeline for when the Chinese market can be penetrated further.

INMD sales split by geography (author based on company data)

Recurring revenues

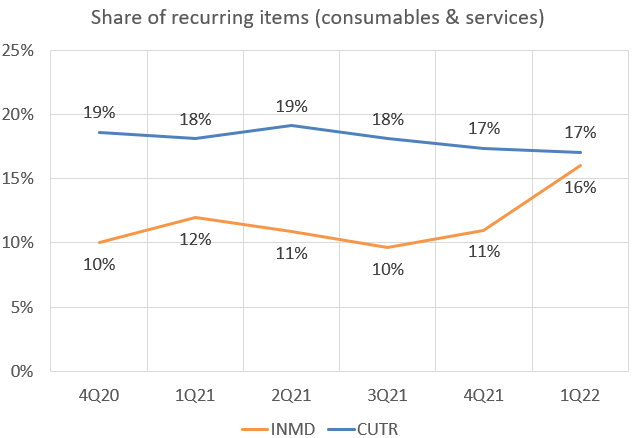

In our initiation research, we mentioned our concerns about the low share of recurring revenues driven by the sale of consumables and services within InMode’s revenue pile.

[Arenberg Capital] would like to see a (significantly) higher level of recurring revenues to increase the business’s visibility. Recall that in FY20 roughly 90% of revenues derived from the sale of medical aesthetic products. Thus, 10% stem from purely recurring items such as consumables (need to be replaced after each treatment) and warranty extensions (beyond twelve months).

The first good news: InMode management recognized the need to move towards more consumables as almost every system that they are now developing will require one or more disposables (earnings call 3Q21).

The second good news: In 1Q22, InMode posted a record revenue with consumables. This is indeed noteworthy as the share of recurring revenues within overall revenues jumped to 16%. In 1Q21, it stood at 12%. In the coming quarters, investors should keep an eye on whether the increase in 1Q22 is of a sustainable nature.

Referring to the chart below, please note that we use InMode’s peer company Cutera (CUTR) to give us a taste of the minimum potential of recurring items within InMode’s revenue mix.

INMD share of recurring revenues in total sales (author based on company data)

Supply chain issues and inflationary pressure

Regarding supply chains, InMode aims to deliver each platform within ten days to underline InMode’s strong commitment to physicians and clinics. Management has established a resilient supply chain. Among other things, there are at least three suppliers for each component.

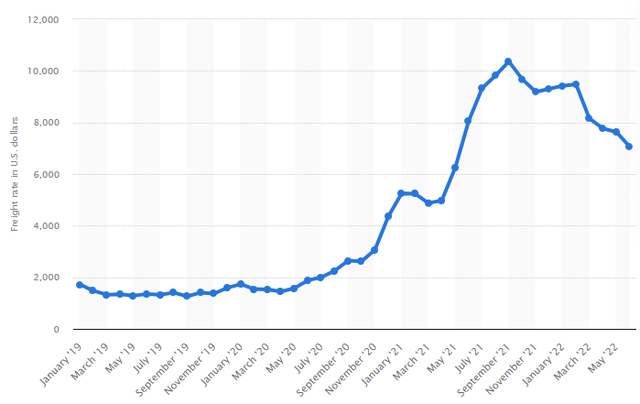

Regarding inflation, InMode is hit by both the price increase for electronic components and increase in shipping costs. While the latter continues to decline, it is still way above its pre-pandemic levels.

Global container freight rate index (in USD) from January 2019 to June 2022 (Statista)

Although management stated in the 1Q22 call that it would not pass on price increases to customers for the time being, we are curious to see whether this approach can be maintained.

I don’t think it’s necessarily to raise prices of the platforms and the disposable just because we are having some, I will call it temporarily, may be it will take longer than that, challenges with the supply chain. We all believe that it will come back to normal. […] And therefore, we have decided that we do not raise prices of the platforms. We will reexamine our decisions sometime at the end of the year.

We expect a change in strategy here, as inflation has picked up significantly since then (1Q22 call took place on May 02, 2022) and, in addition, price sensitivity on the customer side (physicians, clinics) has likely waned due to the overall inflationary environment, i.e., it is widely accepted/ expected to see price increases. So we expect InMode to pass on prices to its customers, and to do so already this year (not just at the turn of the year). We would even argue that the increase in full-year guidance is partly due to the effect of price adjustments. That’s one of the aspects we are eager to learn about in the company’s next earnings call scheduled for July 28, 2022.

InMode stock – DCF with revised assumptions

We have updated our DCF model, which we first presented in February 2022. The key assumptions and any changes are set out below:

| Assumption | Update | Previous |

| Projection period | Unchanged | 2022 through 2031 |

| Revenue growth |

We continue to believe that InMode can outperform the market. This has been shown by the preliminary figures for 2Q22. We are convinced that InMode is all set to continue to benefit from its internationalization and increasing market penetration of its products. We have only adjusted growth rates of the different product groups in our updated DCF model. The now more accentuated tilt towards the top-selling minimally-invasive product group leads to an increased revenue expectation for InMode in 2032 of just under $2.0bn. |

The global market for RF-based aesthetic devices is expected to expand from $1.1bn in 2020 to $3.2bn by 2030 Research&Markets). This implies a CAGR of +11.8%. Given InMode’s outperformance over the last years (= growing faster than the market) on the back of its ongoing international expansion and the continuous penetration of new application areas (including approval by authorities), we expect continuous above-market but fading annual growth rates over the projection period from initially +22% (FY22) down to +10% (FY31). This implies one (slight) upward revision of management’s topline guidance for FY22 (currently in the range $415m to $425m). By 2032, InMode would make revenues in the amount of $1.5bn. |

| SG&A expenses and R&D expenses | Unchanged | Both items combine for 45% of sales. This is in line with management’s target (3Q19 earnings call). |

| Corporate tax rate | According to the currently available investor presentation, the tax rate is expected to be in the range of 7.5% to 10.0%. Thus, we take 8.75% which is 50 bps above our previous assumption. | 8.25% – starting in FY22, InMode tax rate is expected to be between 7.5% and 9.0% as it operates facilities in a special tax area in Israel; this tax advantage is granted for ten years (according to investor presentation). |

| WACC | Increase to 14.23% due to increase in both risk-free rate and beta of InMode stock | 11.33% |

| Terminal growth rate | Decrease to 2% due to increased uncertainties and distortions around global economy and geopolitics | 4% |

| Net debt | -$396m (as of March 31, 2022) | -$384m (as of September 30, 2021) |

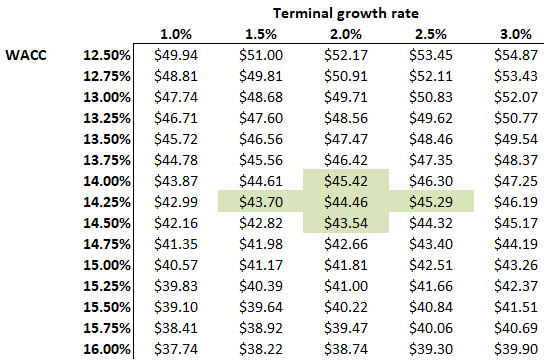

With these assumptions, the DCF results in a fair valuation of $44.50 per share. The sensitivity table below shows the fair share price based on the dimensions (1) terminal growth rate and (2) WACC.

DCF sensitivity contingent to WACC and terminal growth rate (author)

In our view, the current price level ($28.50 as per July 23, 2022) offers an attractive entry opportunity even when factoring in a substantial safety margin. Our upside potential could be up to 56% if the stock price reverts to its fair value. Hence, we conclude that InMode stock is a buy.

Conclusion

InMode stock price was beaten down significantly since its all-time high in late 2021. However, the company managed to record a strong second quarter in 2022 and raised its full-year guidance.

Our assessment is that there are multiple unknowns left such as an inflationary forces, the threat of a recession, the ongoing war in Ukraine and, probably further down the road, a further increase in geopolitical tensions. Yet, due to the systematic nature of these issues, we believe that InMode is set to outperform going forward on the back of a superior product technology, solid financials and a strong management team with a clear strategic vision.

We see strong operational developments in terms of internationalization and recurring revenues. We believe that these two levers are gate keepers for a successful monetization of InMode’s superior technology offering.

Finally, given the DCF-backed fair value per share of $44.50, we believe the current price level offers an attractive entry opportunity for long-term investors. Nevertheless, be aware that the share price will continue to be characterized by high volatility. We also believe that a soft landing recession will not have such a large impact on InMode’s performance, while a hard landing recession will likely be a postponing element. But we are of the opinion that this is not (yet) the scenario Mr. Market expects.

Be the first to comment