Sundry Photography

Thesis

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) stock has recovered markedly from its May lows. We also updated investors in our previous update that its valuation was attractive. Accordingly, CRWD held its May lows resiliently as it significantly outperformed (20% Vs. 0.68%) the SPDR S&P 500 ETF (SPY) since our May update.

Given the sharp recovery from its May lows, we believe investors who missed May’s bottom are tempted to join the rally. However, we urge investors to be patient.

While CRWD is a high-conviction pick, we must also be cautious about overpaying too much for growth. Given the current macro headwinds, investors need to recalibrate the growth premium they intend to pay for high-growth stocks like CRWD.

Our valuation analysis suggests that CRWD is slightly overvalued now, but less so than in April, when we cautioned investors about the lack of margin of safety at those levels.

We have aggressively added its recent May/June lows but have held back from adding more. While we are not in a hurry to sell, we are also not keen to add at the current levels. Our price action analysis also suggests that CRWD is near- and medium-term overbought, and a potential retracement could follow.

Therefore, we revise our rating from Buy to Hold and urge investors to be patient.

CrowdStrike Offers High-Quality Cybersecurity Exposure

CrowdStrike has won several plaudits for the capability of its endpoint detection and response (EDR) architecture, which has expanded into extended detection and response (XDR).

The company has also moved into zero trust cloud security to expand its TAM. Furthermore, the company’s operating model is also free cash flow (FCF) profitable, offering tremendous visibility to underpin its valuation. Coupled with its high revenue growth cadence, it’s a high-quality pure-play cybersecurity stock. Therefore, it has held its recovery from its COVID bottom resolutely, unlike the low-quality stocks that suffered steep sell downs, reaching their March 2020 lows.

Morgan Stanley (MS) also highlighted the quality of its business model in June. It added (edited):

Security remains a top priority due to rising cyber threats and is by far the most defensive area of spend within IT budgets. CrowdStrike’s strong FCF generation and scale should also prove advantageous in a less certain macro environment as funding for rising private competitors begin to wane and others likely face disruption due to changes in ownership. – Barron’s

Management is also confident in the resilience of the cybersecurity market. As a result, we believe the macro headwinds and potential earnings compression may not impact CrowdStrike as significantly as its non-cybersecurity SaaS peers. CFO Burt Podbere accentuated (edited):

We feel that we’re in the most favorable competitive environment we’ve ever been in, right? Obviously, the latest competitor in Carbon Black, VMware (VMW), got acquired. So that’s another one gone by the wayside. Why are these things happening because we’re winning. All these things are just saying one thing, that cyber is here to stay. It’s going to grow, and the security backdrop is just getting worse, whether it’s from a regulatory environment, whether it’s just the bad actors coming out more in droves, whatever it is, I think we would all agree that cyber is here to stay for quite some time. (Stifel 2022 Cross Sector Insight Conference)

But, The De-rating Is Justified

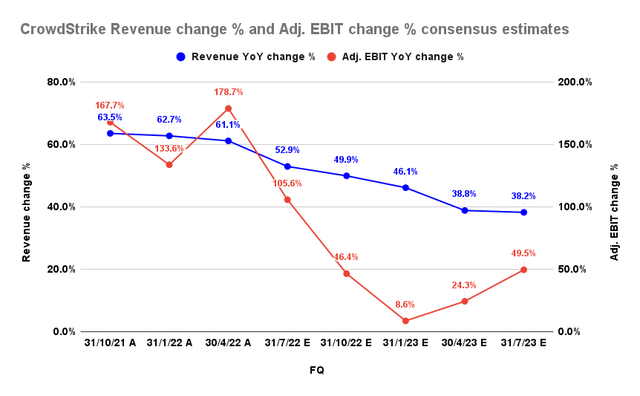

CrowdStrike revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Notwithstanding, we believe the battering seen in CRWD from its November 2021 highs is justified. Despite the remarkable recovery from its May lows, CRWD remains nearly 40% below its November highs.

So, we believe investors would be keen to know when CRWD can retake its all-time highs moving forward?

However, there’s no straightforward answer to that question. But, we will present our valuation model in the subsequent section to help investors make sense of its valuation.

Given CrowdStrike’s massive growth cadence over the past few years, the going will get much more challenging moving ahead. As a result, the consensus estimates suggest that CrowdStrike is still projected to digest its highly challenging comps from 2021 through CQ1’23 before bottoming. Coupled with its aggressive OpEx investments, it could also affect its adjusted EBIT growth cadence, thus impacting its valuation.

CRWD Stock – Don’t Overpay For Growth To Improve Outperformance Potential

| Stock | CRWD |

| Current market cap | $42.59B |

| Hurdle rate [CAGR] | 20% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed TTM FCF margin in CQ4’26 | 30% |

| Implied TTM revenue by CQ4’26 | $7.98B |

CRWD reverse cash flow valuation model. Data source: S&P Cap IQ, author

We believe growth investors have learned a great deal about valuation over the past year as gains dissipated rapidly for long-term buy-and-hold investors.

No matter what they tell you, valuations matter. And using the right fundamental metrics to model their valuations matters even more. We have also stopped using revenue-based valuation metrics, as we think they don’t proffer meaningful insights to our valuation models and distort our analytical framework.

Therefore, we urge investors to use cash flow valuation for high-growth plays.

We applied a market-outperform hurdle rate of 20% for CRWD (the minimum that we require for high-growth stocks). Consequently, we selected an FCF yield of 2.5% in our model, which we believe is appropriate in a “healthy-growth” environment.

The current environment is not ideal for growth stocks. Why? Consider that the market rejected further buying upside in April at an FY25 FCF yield of 2.16%, which the market considered too low.

However, the market formed its bottom in May at an FY25 FCF yield of 4% (too high). Therefore, we think the market has adjusted its valuation accordingly to compensate for the risks of holding high-growth.

Consequently, our valuation model suggests that CrowdStrike needs to deliver a TTM revenue of $7.98B by CQ4’26, which is unlikely. Hence, investors should be wary of adding CRWD at the current levels if they are looking for market outperformance.

Is CRWD Stock A Buy, Sell, Or Hold?

We revise our rating on CRWD from Buy to Hold.

CrowdStrike is a high-quality cybersecurity company led by an excellent management team. It has also executed very well, which has justified its growth premium. However, it’s still important for investors not to overpay to improve their chances of market outperformance.

Therefore, we urge investors to be patient with CRWD. Wait for a deeper retracement before adding exposure.

Be the first to comment