Kevin Dietsch/Getty Images News

On the 16th of November, NASA launched the Space Launch System – SLS – during the Artemis I mission. Artemis I is the first mission out of a series of multiple complex missions that should eventually put humans back on the Moon’s surface, little over 50 years after Neil Armstrong set foot on the Moon. In this report, I will look at which stocks are involved in turning these missions into reality and why comparison with the Apollo missions might be skewed.

Artemis Missions

The Artemis Program was established in 2017 during the presidency of Donald Trump, but its origin dates back to a time when George W. Bush was still president of the United States. At the time, it was known that the Space Shuttle program would shut down in 2010 and a plan was needed for continued crewed space exploration and the completion of the International Space Station. In that framework, the Constellation Program with crewed orbital flight, crewed lunar exploration and crewed Mars exploration as objectives was formed in 2004 with a budget of $230 billion in 2004-dollars.

When President Obama took office, he retired funding for the Constellation Program in 2011 as the program was over budget and keeping the schedule would require an additional $150 billion. An investigation concluded that NASA simply did not have the means to realize its aspirations of crewed missions to the Moon and Mars.

Some elements of the Constellation Programs were preserved. For instance, the Orion spacecraft which can transport crews was repurposed for deep space travel and transports to the International Space Station were transferred to the Commercial Crew Program while lessons learned from the Ares rocket family to be used for the Constellation Program were transferred to the Space Launch System which would become the new super heavy-lift expandable launch vehicle. So, while funding for the Constellation Program was halted, key elements of the program remained in development.

Artemis Phase I (NASA)

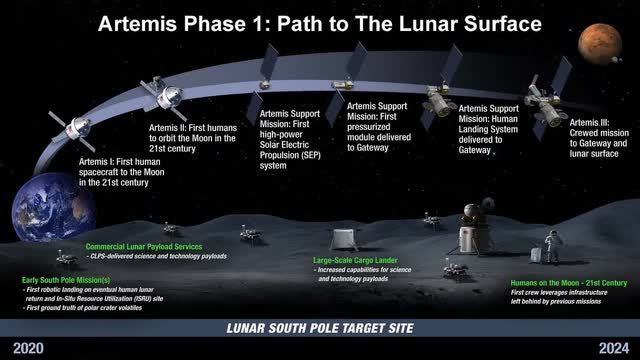

In 2017, the Artemis Program was established with $35 billion in costs from 2020 through 2024. The figure above depicts various stages within the first phase of the Artemis program. Currently five launches have been scheduled, Artemis I through Artemis V, each with different objectives.

On the 16th of November, the first launch took place marking the maiden flight for the SLS and the Orion capsule with a Trans-Lunar Injection orbit. Along the way 10 small satellites, called CubeSats, will be deployed.

Planned for May 2024, Artemis II will be the first crewed mission performing a lunar fly-by with CubeSats as secondary payloads. Artemis III, planned for 2025, will be the first lunar landing mission followed by the Artemis IV mission in 2027 which aims to provide a second lunar landing for the Artemis program and also includes delivery and integration of a module to a lunar space station (Lunar Gateway). The fifth mission is tentatively scheduled for 2028 and will launch astronauts to the Lunar Gateway, deliver a refueling and communication module, a robotic arm and a Lunar Terrain Vehicle.

Important to note is that the lunar missions are not to put mankind on the lunar surface once again and then use it as a prestige element, but the goal seems to be to have some kind of semi-permanent presence in lunar orbit as well as major expansion of lunar exploration on the surface and create a permanent base somewhere in the future.

The Stocks Going To The Moon

With some sort of longer-term value chain and generation, it’s also interesting to see which companies and stocks are involved in the Artemis program. While this is already being presented as an achievement in US space exploration, the reality is different.

Block Variants SLS (NASA)

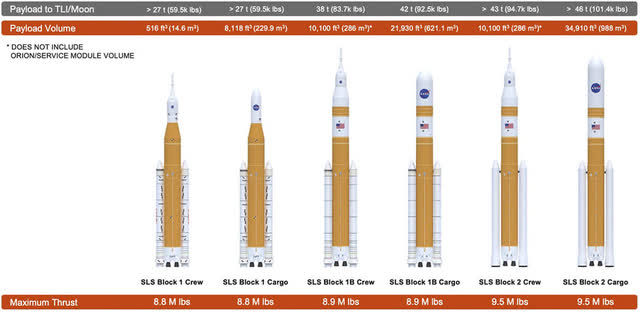

There currently are three Blocks of the SLS planned. Block 1 will be used for the first three Artemis missions, while Block 1B will feature an expandable upper stage or EUS as a replacement for the Interim Cryogenic Propulsion Stage which was derived from the Delta Cryogenic Second stage used on the Delta III and Delta IV rockets. The EUS will be used on Block 1B and Block 2 of the SLS and put into service with the Artemis IV mission. Block 2 also will feature upgraded boosters increasing the payload-to-moon capability by roughly 70% compared to the initial SLS configuration.

Boeing (BA) is the prime contractor for the Space Launch System core stage which is used on the Block 1, Block 1B and Block 2 variants. Furthermore, it will also provide the EUS for the Block 1B and Block 2 variants. So, as the contractor for the core stage Boeing’s role is big.

AeroJet Rocketdyne (AJRD) also has a sizable role in the SLS as it adapts the Space Shuttle’s RS-25 engines for use on the SLS. In the future from Block 2 and onward, the RS-25D variant will be upgraded to RS-25E variant increasing the payload capability and decreasing the unit costs of the engines. The preserved RS-25 engines allow for four Artemis mission flights, while AeroJet Rocketdyne has been awarded contracts to support up to another six missions with 24 engines under contract.

AeroJet Rocketdyne also provides the RL10B-2 propulsion systems for the Intermediate Cryogenic Propulsion Stage, which will be upgraded to the RL10C-2 on the second and third Artemis mission. The EUS will make use of RL10C-3 engines, which are also developed by AeroJet Rocketdyne.

On the first eight missions the solid rocket boosters from the Space Shuttle program can be used, but after that new solid rocket boosters are required for Block 2 capability. This will be provided by Northrop Grumman (NOC). Furthermore, in the future launches will be transferred to a joint venture between Boeing and Northrop Grumman.

Lockheed Martin (LMT) also has involvement in the SLS and Artemis Program. Through its joint venture with Boeing on the United Launch Alliance, it has been contracted to provide the three Intermediate Cryogenic Propulsion Stage for the first three missions and more importantly the Orion crew module is developed by Lockheed Martin.

SpaceX also has a vital role in the program as it provides the Human Landing System or HLS that will be used to put crews on the lunar surface.

So, we do see major US defense contractors provide a significant input in the Artemis Program. However, the involvement also is more global with private companies occupying key roles. Several other companies also are eligible to delivering payloads to the lunar surface via supporting programs. These companies amongst others include Blue Origin, SpaceX (SPACE) and Lockheed Martin. SpaceX also plays an important role in setting up the Lunar Gateway, as well as transporting the Northrop Grumman developed Habitation and Logistics Outpost.

There also are significant contributions from international partners, which at this moment are barely recognized. For instance, Airbus (OTCPK:EADSF) and its ArianeGroup provide the service module and propulsion components of the Orion spacecraft while German Schaeffler (OTC:SFFLY) provides roller bearings for the rocket engines, American-Swedish ESAB (ESAB) provides fuel tank structures, Toyota (TM) is contracted for the development of a crewed lunar vehicle. Canadian participation is also present in the form of pressurization lines for the core stage from Magna International (MGA) and a robotic arm for the Lunar Gateway from MDA (MDA:CA). So, earmarking this as a pure US play is not in the slightest reflective of reality.

Lunar Mission Plagued By Delays

One thing that I have been hearing about the Artemis Program is that Boeing is once again a major contractor on a program that’s facing delays and how could it be that 50 years ago we were able to put men on the Moon and with technological advancement in the past five decades, we have not been able to achieve an undelayed return to the Moon.

I think that’s a bit of a simplistic way to look at it. When President Obama cut funding for the Constellation Program, much of the framework for the lunar missions was removed. Changes to the funding did allow development of key components to continue but the general framework to which a timeline could be tied was effectively removed. The initial plan was to have a launch in 2016, but that was with the Constellation Program still in force. President Obama did remove the broader framework. Whether President Obama was right with his course of action on space exploration is likely subject to debate. From the predecessor of the SLS, it was expected that it would not enter service until mid-2020s and the overall program would be over-budget. So, in that light one could conclude that President Obama made the right decision. However, absent of a broader framework the SLS launch date target was just a random milestone not tied to any framework or realistic timeline. Measured from the objective to have the SLS launched before the end of 2016, one can conclude that there have almost been six years of delays.

However, I do think it’s more appropriate to consider the estimated launch dates from the point in 2017. While often documented as estimated launch dates they were actually NETs or “no earlier than” dates and were set at mid-2020. So, in some way you could speak of 2.5 years of delays instead of six years and one should keep in mind that the pandemic also had an impact on the rocket readiness. From August 2022, the launch has been delayed several times. The 29th of August launch was scrubbed due to erroneous temperature sensor readings followed by the 3 September launch being scrubbed due to a hydrogen leak. Subsequently NASA opted to skip a 27th of September and 14th of November launch opportunity due to adverse weather.

So, we did see delays but more recently those were driven by adverse weather and usual reasons to call off launches. Back in the days of the Space Shuttles, hydrogen leaks were a common cause for delays. Still, the launch was delayed by years, and while we cannot conclude which elements caused delays and how many days, weeks or months in delays each element caused. However, there are several complicating factors to the Artemis mission. One thing to keep in mind is that a lot of parts and technology are adopted from the Space Shuttle era meaning that existing technology had to integrated into a new product, work in harmony with new technology to execute a more advanced mission, and that creates challenges by itself. In some way it’s a risk mitigation, but it also provides integration challenges. Next to that, for those looking at the moon missions that put humans on the lunar surface it is quite important to keep one thing in mind. Compared to 1969, there are two main differences. The first one is funding. The Saturn V used to put man on the Moon had cost $51.8 billion compared to $23 billion for the SLS. Money does not solve everything, but in some way when projects are running behind on schedule applying extra money translating into additional resources can keep programs on schedule and that kind of money was simply not available for the Artemis program, meaning that if the program ran into problems, it inevitably would lead to slips in the timeline. When the Saturn V was built, the budget was virtually limitless as the US was engaged in a space race with the Soviet Union. No matter what, the US would put the first person on the Moon and the US was willing to pay the price for that.

Next to funding leading to inflation or deflation of schedule risk, another big element is that over time and based on previous experiences we have grown less risk tolerant. NASA has learned from the fatal missions with the Space Shuttle and crew safety is considered much more important than years ago and that leads to the smallest deviations in manufacturing and testing leading to delays. Sensor packages have grown more advanced, meaning that we can also observe the smallest of deviations. Decades ago, aerospace was relatively unexplored so it required a moonshot to make things happen and the risk that came with the unexplored areas was just accepted as is. These days, the industry has more experience and as a result safety standards are much higher. So, while we are literally aiming for a moonshot we do not want the same risk profile as experienced decades ago and that also infuses the schedule with delays.

Conclusion: Writing History With Your Portfolio

There are high chances that as an investor in the aerospace and defense industry, you are indirectly part of a historical attempt to put humans on the Moon once again with the ultimate goal to put a permanent base on the lunar surface. I do not believe that it’s going to result in stock prices of names that are involved in the Artemis program skyrocketing, but it’s important to note that if the Artemis Program is expanded beyond the current five planned missions and lunar travel becomes more common there are bigger opportunities in space to generate value. This is related to of course the higher frequency of the scientific missions, but also prospects of commercial lunar travel and more appetite for crewed Mars missions.

For now, I believe it’s important to recognize that while the Artemis program has suffered delays it is not quite comparable to the Apollo missions, because at the time of the Apollo missions the funds were limitless and the risk profile was accepted as is and the days of the Artemis program are operated on a lower budget, complex use of old technology integrated with new technologies and less appetite for risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment