David Arment/iStock via Getty Images

Co-Diagnostics (NASDAQ:CODX) initially drew my attention because of its stellar A+ quant ratings. I wrote a pair of articles to check out the fundamental story backing up its fine financial metrics. The first was 03/2021’s “Co-Diagnostics: A+ Student Faces New Tests” (“A+ Student”); I followed it with 01/2022’s “Co-Diagnostics: Swinging For The Fences” (“Fences”).

I have been optimistic on the company’s prospects. I am less so after reviewing its recently released Q4 2021 earnings call (the “Call”) as I will explain.

Co-Diagnostics developed Eikon testing platform as a bridge to endemic COVID

Co-Diagnostics was an effective COVID-19 testing pioneer. As discussed in A+ Student it was at the forefront in terms of approval for its COVID-19 testing technology. This early success catapulted it to its A+ quant ratings.

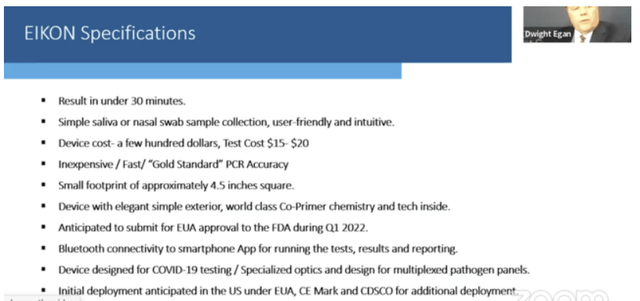

The challenge for Co-Diagnostics was to maintain its mojo if and when the pandemic wound down, as indeed it currently seems to be doing. This was the issue I addressed in Fences, where I enthused about Co-Diagnostics’ newest product, its Eikon testing platform. It included the following Eikon specifications slide:

Eikon specification slide from 1/10/2022 H. C. Wainwright presentation (codiagnostics.com)

Eikon would provide an excellent encore for Co-Diagnostics to succeed as COVID-19 moved from its pandemic to an endemic phase. Here was a versatile testing solution that fit into a broad array of testing scenarios.

Eikon had featured prominently (23 hits for the word “Eikon”) in Co-Diagnostics’ Q3 earnings call. The Eikon platform goal was to provide fast, cheap and accurate results, initially for Covid-19 with multiplexing potential to extend its coverage.

Co-Diagnostics anticipated Eikon having a role in:

…normaliz…[ing] and creat…[ing] safe schools, safe workplaces, restaurants, hotels, ships, entertainment venues…

The Call dropped all mention of Eikon, raising questions

My appetite having been thoroughly whetted by previous discussions, an Eikon update was the first thing I looked for in the Call when it was released on 03/24/2022. Alas, it made no mention of Eikon.

What became of Eikon? I googled “Co-Diagnostics Eikon” on 03/31/2022 as I write. The following entry encouraged me that Eikon had not just been abandoned:

Co-Diagnostics CEO Dwight Egan and Dr. Kirk Ririe, President of the Company’s subsidiary, will be presenting in the conference’s At-Home & Point-of-Care Diagnostics track on Monday, February 21 from 12:20 pm to 12:50 pm. The presentation, titled “Co-Diagnostics’ New Eikon PCR Platform,” will be demonstrating how the Company’s new platform technology is designed to provide inexpensive, fast, and accurate PCR results for at-home and point-of-care testing. Products built on the Eikon PCR platform are subject to FDA review and are not currently for sale.

The latest entry, dated 03/02/2022 took me to an enthusiastic write-up on Co-Diagnostic’s web site, headlined, “Co-Diagnostics New Rapid PCR Point-of-Care and at Home Testing Platform to Detect Covid-19 and Other Diseases Using CoPrimer™ Technology”. It prominently featured the following picture of its device:

Co-Diagnostics’ Eikon testing device (codiagnostics.com)

So apparently Eikon is still a “thing”. Why it was not mentioned, even in passing during the Call, was a mystery.

Upon reading the Call it seems that Co-Diagnostics has settled on a new name for its Eikon test without bothering to communicate a name change. Eikon has morphed into the “Co-Dx YourTest”. While the Call says nary a peep about Eikon, it has plenty to say about Co-Dx YourTest, including that:

- “… it is designed to accommodate multiplex assays as the Company expands its future suite of products to include additional respiratory, STI and other infectious diseases…”,

- “…it is the exact prescription for addressing a whole new field of at-home and point-of-care testing for a range of pathogens…”,

- “…results are PCR gold standard results compared to less accurate antigen test results…”, and

- “…[will provide] testing of several infections with one patient sample with a single test such as flu A, flu B, RSV and COVID … more robust testing with multi-target differentiation … tha[n] is possible in non-PCR-based testing protocols from our competitors.”

Co-Diagnostics has apparently settled on a stealth renaming of “Eikon” to “Co-Dx YourTest”. I would have preferred it if there had been an announcement or press releases on this change. There was none, but the Eikon specifications set out in the graphic above seem to hold for Co-Dx YourTest, with one key exception.

The Q1 2022 EUA timeline is gone. According to the Call:

The time required to prepare the …[the Co-Dx YourTest PCR platform] for clinical trials has unfortunately been extended. This extension is due to a number of factors, including a major user factor study that was conducted in order to meet regulatory requirements for a device with an even broader market potential. This study is required in order to simultaneously submit for clearance for both, direct saliva and swab samples. Receiving this clearance is critical because the use of swabs will be necessary to collect samples from the throat, such as for strep A, or from other sample sources associated with STIs.

This extension hurts, but it is hardly unexpected that time targets for such a critical project fall by the wayside. Strategy-wise prepping its new platform to extend beyond COVID-19 makes good sense. Time-wise there is some solace in CEO Egan’s response to an analysts’ question that the delay will be measured in months rather than years.

Co-Diagnostics’ buyback announcement was ill-advised

On 03/15/2022 Co-Diagnostics announced a $30 million buyback program. During the Call CFO Brown discussed it as follows:

We believe this element of our capital allocation strategy [$30 million share buyback authorization] is aligned with our commitment to return value to our shareholders, and also reflects confidence in our balance sheet and strong cash flow generation. Additionally, we believe that this authorization provides us with an opportunity to strategically allocate capital in a way that demonstrates our positive outlook for the future of Co-Diagnostics.

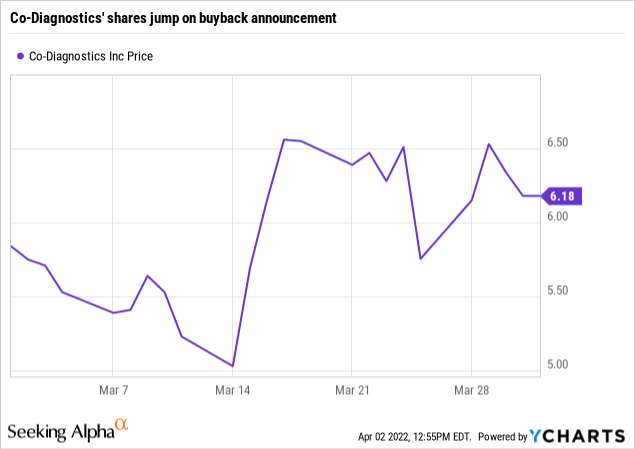

Judging by its share reaction the market liked the idea as shown by the chart below:

For sure, Co-Diagnostics has had a crazy good pandemic. Check out the revenue and expense excerpt from its pre-pandemic (2018-2019) table of operations below:

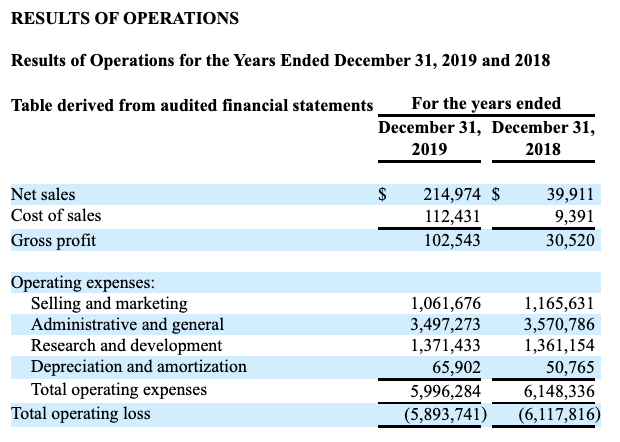

Co-Diagnostic’s 2020 10-K (seekingalpha.com)

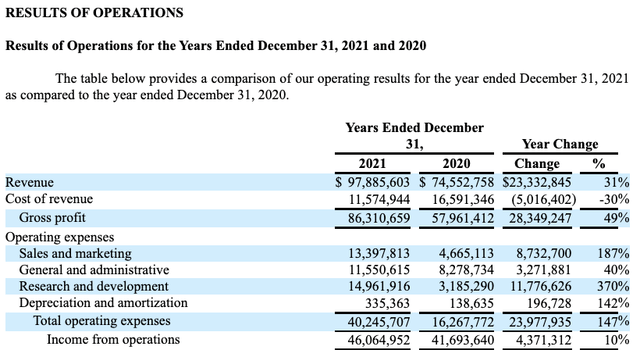

Before the pandemic, Co-Diagnostics was operating at a significant annual loss. At that time it was in no position to allocate capital beyond expenses. Its real capital issues had to do with raising capital, not allocating it. Co-Diagnostics’ increase in pandemic era revenues shown below compared its pre-pandemic revenues is astronomic.

Co-Diagnostic’s 202210-K (seekingalpha.com)

As described in its 10-K (p. 20), substantially all of the pandemic era revenue derives from COVID-19 tests. In other words, Co-Diagnostics has shown great skill in adapting to the pandemic. It has yet to show how it will fare without COVID-19 testing revenues.

By my reckoning it should be using its pandemic testing booty to vigorously expand its revenue base beyond COVID-19 not to buy back its stock. That was where I had imagined Eikon, now Co-Dx YourTest, could play a starring role. Assume Co-Dx YourTest can get an EUA while the pandemic is still supporting the importance of home testing. In such a scenario it’s not a stretch that it would be also able to get approval for a flu panel.

With its Co-Dx YourTest timeline uncertain, Co-Diagnostics earnings beyond COVID testing are speculative. Accordingly its future earnings could quickly drop back to negative. Judging by CFO Brown’s answer to a specific buyback question during the Call, this is an issue the company is fully considering:

…we’re looking at both, the need to commercialize the Co-Dx YourTest PCR device in addition to share buybacks. So, we’re managing both of those needs simultaneously. And so, we’ve done our analysis on our end and know what makes the most sense for us, both — on both things. We know that it’s going to require cash to be able to commercialize the product. So, we’re making sure we have that still with us so we can make that happen because that’s our number one goal.

Encouragingly, Co-Diagnostics is acting with its eyes open and setting its priorities correctly.

Co-Diagnostics’ Q1 2022 guidance gives it a nice start for its post-pandemic era but no more

During the Call CFO Brown guided for Q1, revenues ranging from $21 to $22 million, a 7.5% increase at the midpoint over Q1, 2021. He expects EBITDA ranging from $9-$10 million. As a point of comparison, EBITDA for 2021 was $52.1 million. He provided no EBITDA figure for Q1 2021.

This guidance, given on 03/24/2022 towards the very end of Q1 2022, is of limited use in terms of forward earnings. An 03/2022 McKinsey report titled “When will the COVID-19 pandemic end?” points to the various uncertainties in projecting the future course of the pandemic. It is heavily dependent on what variant takes hold over time and on differing policies around the world.

Co-Diagnostics has offered no forward guidance beyond its Q1 2022. It will likely be reporting its Q1 2022 results in mid-May 2022. At that time we will likely get some color on what revenues it expects in Q2 2022 and an updated timeline for Co-Dx YourTest. The waiting game is on.

Conclusion

Co-Diagnostics has a $209 million market cap and a pristine balance sheet. Its forward revenue trajectory is highly uncertain. It has definite speculative appeal but I rate it as hold.

Be the first to comment