JillianCain/iStock Editorial via Getty Images

We wrote an article on Kohl’s after it emerged that an activist wanted to separate the e-commerce division. We argued that shares were cheap regardless of the separation, and that a separation would not significantly alter our view of the company.

We rated shares a buy, and since then they have significantly outperformed the S&P 500. Part of the reason is that the company is back in the news with many potential suitors that are interested in buying the whole company. However the offers received so far have been disappointing, in our opinion, and we think shareholders should wait for at least $75 per share. In our case we plan to vote the few shares we have against any takeover below $75 per share, and do not mind if there is no acquisition and the company continues being public.

Seeking Alpha

Financials

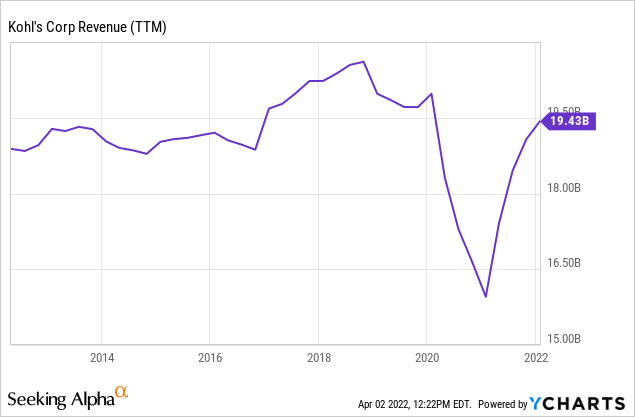

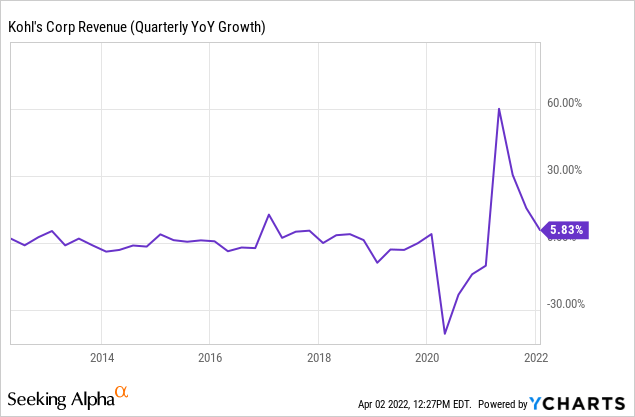

Kohl’s has not managed to increase revenue much in the last ten years, with peak revenues actually around 2018. During the worst of the Covid crisis revenue crashed to almost $15 billion, but has since recovered to ~$19 billion, which is a run-rate a little bit higher than it was ten years ago, but not by much.

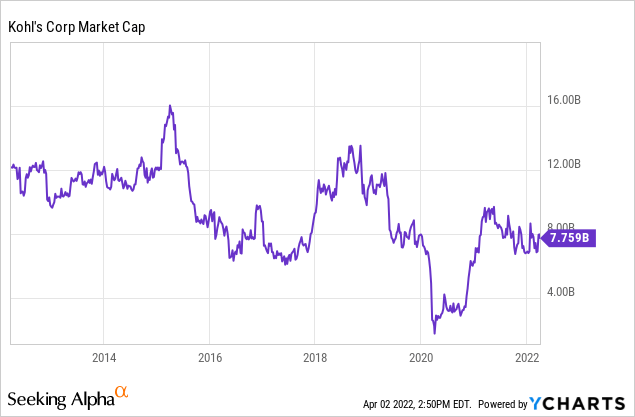

However, thanks to aggressive share buy-backs the market cap is much lower. Ten years ago Kohl’s used to have around 240 million shares outstanding, and today that number has been reduced to about 128 million. That means that you get a lot more revenue per share than you did ten years ago, almost twice in fact.

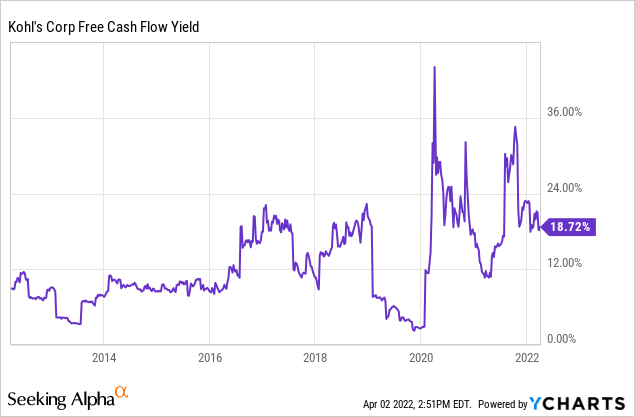

Shares outstanding should continue decreasing, since the board authorized a $3B share repurchase program. That is ~40% of the current market cap! We think that at the current low valuation it is certainly one of the best uses management can make of this capital. Shares are so cheap that the current free cash flow yield is ~18%.

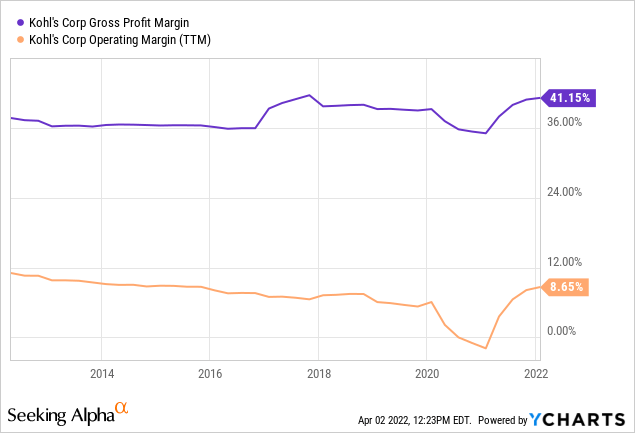

One bright spot for the company is margins, which have recently rebounded and appear to have changed direction after many years of constantly decreasing. The 2021 operating margin of 8.6% is the highest since 2014, and gross profit margins have been improving recently as well.

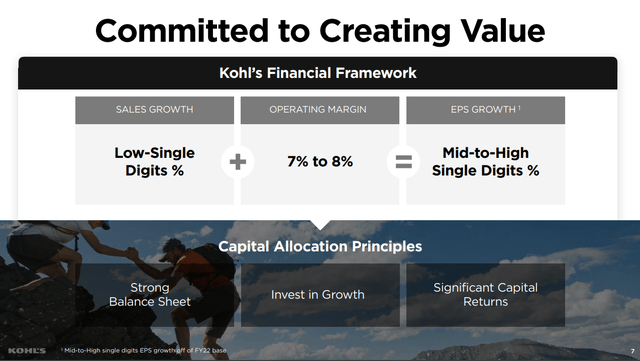

As part of its financial framework, Kohl’s is committing to maintaining an operating margin of at least 7% to 8%, and it believes that it can manage this performance while achieving low-single digit sales growth.

Kohl’s Analyst Day Presentation

As we previously mentioned, one of the weak points for Kohl’s has been revenue growth. But that seems to have also improved, with the company quickly recovering from the Covid downturn, and most recently posting ~5.8% growth.

Valuation

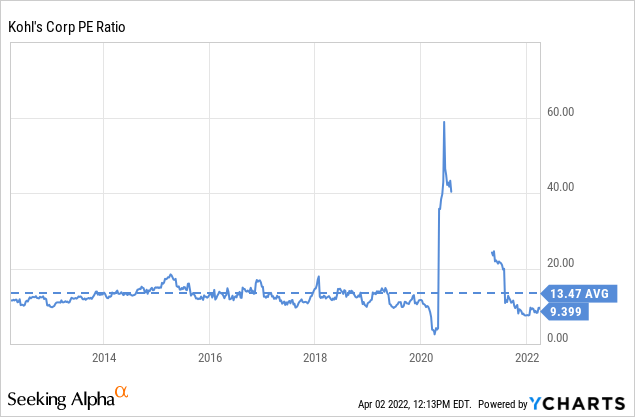

Below we show how, despite the share price being affected by takeover speculation, shares are trading close to their historical valuation averages. We don’t think the numbers that are being talked about, in the high sixties, represent a fair price for Kohl’s shareholders.

For example, in the last ten years the average trailing twelve months price/earnings ratio was 13.4x, and shares currently trade below that with a P/E of ~9.3x.

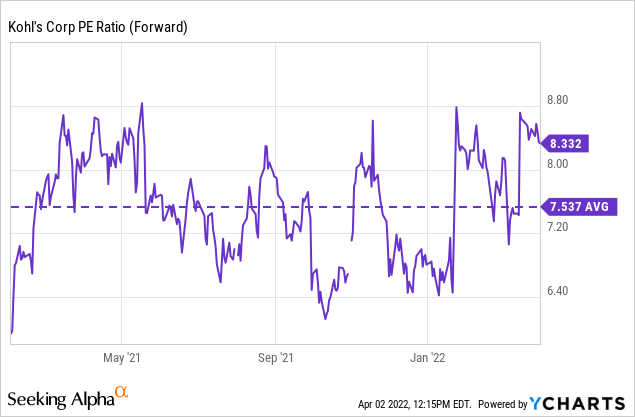

The forward P/E ratio is even cheaper, at ~8.3x, and it is barely above what it has averaged during the last year.

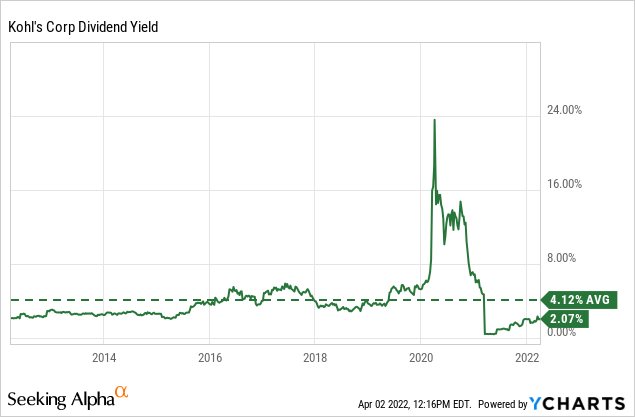

Similarly the average dividend yield for the last ten years was 4.12%, and with the recent doubling of the dividend that places it at 4.14%, so it is basically trading at its average dividend yield.

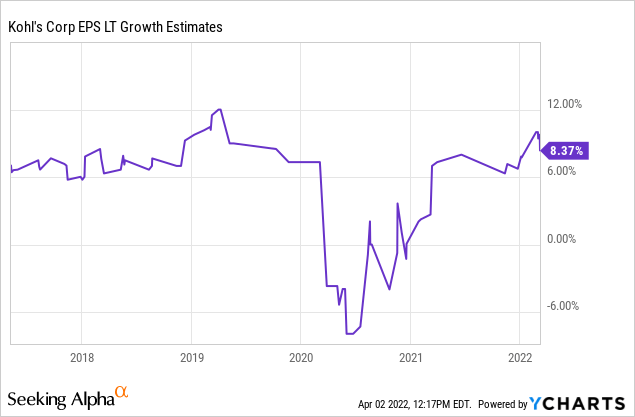

That is despite analysts becoming more optimistic about the company, as can be seen the average long-term EPS growth estimates have been trending higher coming out of the Covid downturn, and right now are at a very respectable 8.3%.

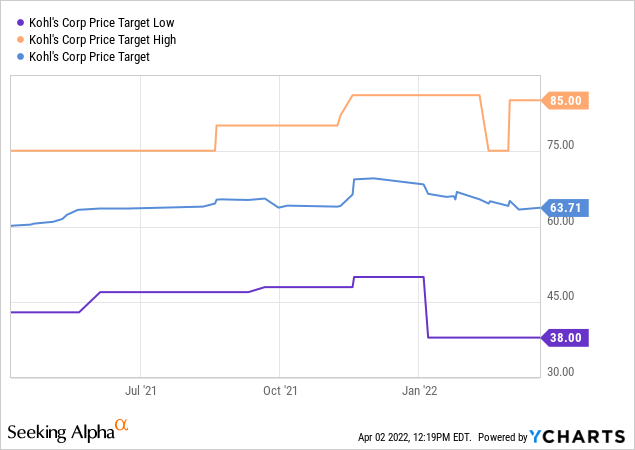

In fact the current share price is very close to the average analyst price target of $63. We think a takeover premium of at least 20% is to be expected to the average analyst price estimate, therefore our takeover price target is above $75 per share. And this is not even above the highest analyst price target estimate.

Optionality

Now, if the takeover does not take place that is fine with us. We believe the company can continue rewarding shareholders with an attractive dividend, share repurchases, and that there is some optionality embedded in some of the initiatives they are doing. In particular the rolling out of Sephora to 850 stores by 2023, which they expect to grow to a $2 billion business.

We also think there is an opportunity to use the digital properties as platforms, similar to what Macy’s is doing with Macys.com and bloomingdales.com, letting selected third party resellers into the platform.

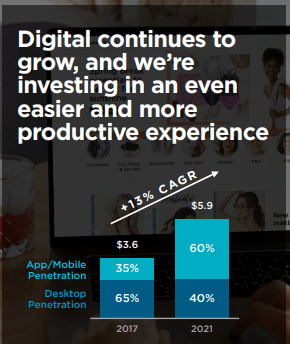

Kohl’s has an attractive digital business, as well as a good omnichannel strategy. An omnichannel customer is 6x more valuable than a digital-only one. In any case, Kohl’s has a very attractive and growing digital business, with 1.7 billion website visits per year, and 18M active app users.

Kohl’s Analyst Day Presentation

Finally there is also some optionality as to the owned real estate Kohl’s has. It owns ~35% of its stores, and if it needed that capital it could do a sale-leaseback transaction.

Conclusion

All of this to say that we think the takeover offers that are being discussed in the media in the high sixties significantly undervalue the business. We have a few shares and we plan to vote against any offer below $75 per share, and hope the rest of the shareholders feel the same. We would hate for this company to be taken away from public shareholders at a ridiculously low price.

Be the first to comment