We Are

Owl Rock Capital Corporation (NYSE:ORCC) offers a new buying opportunity to income investors.

After the lender reported second-quarter results, the share price fell, and I believe the drop represents an excellent opportunity to purchase one of the safest business development companies at an even greater discount to the BDC’s net asset value.

Owl Rock is a good investment because of its strong portfolio health, good coverage, and a discount to net asset value.

Safety-Oriented Investment Portfolio

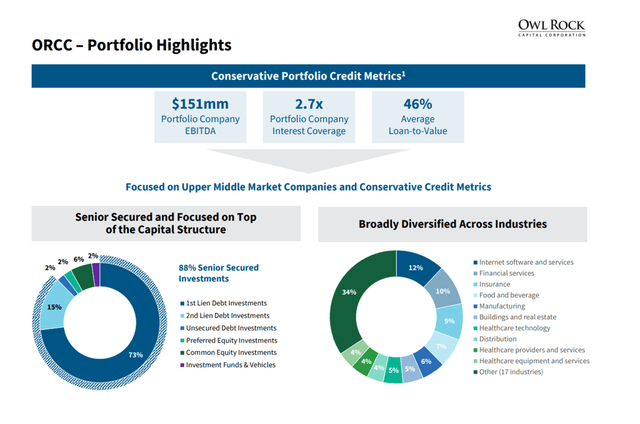

Owl Rock is a business development firm that has carefully cultivated a risk-averse investment strategy. The BDC primarily invests in upper middle-market companies with predictable cash flows and businesses that are recession-resistant. Internet software, financial services, and insurance companies are among the most heavily represented industries in Owl Rock’s investment portfolio, as they have very predictable businesses.

The top ten investments of the BDC currently account for 23% of Owl Rock’s total portfolio (based on fair value), indicating that Owl Rock is well-diversified. As of June 30, 2022, the fair value of Owl Rock’s investment portfolio was $12.6 billion, with 168 portfolio companies.

Owl Rock has a very conservatively constructed portfolio that consists of 88% Senior Secured investments, which I believe have great value for investors concerned about the potential impact of a recession.

The portfolio is heavily weighted toward first liens, which account for 73% of the BDC’s investments as of June 30, 2022. Second Liens, the second most secure debt instrument after First Liens, accounted for 15% of all investments.

The remaining 12% of Owl Rock’s investment portfolio is made up of unsecured debt, investment funds, and common/preferred equity.

The portfolio is performing well because only one portfolio company was non-accrual at the end of 2Q-22, accounting for 0.1% of the debt investment cost at fair value. Non-accruals remained unchanged from the previous quarter.

Portfolio Highlights (Owl Rock Capital)

Dividend Coverage And Possible Improvement In Payout Ratio

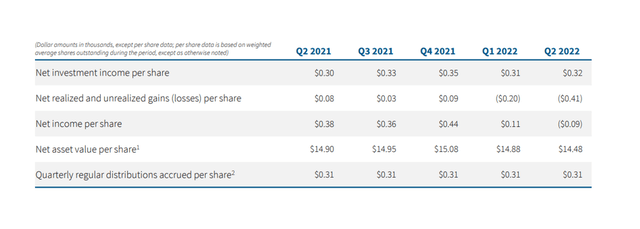

Owl Rock covered its dividend with net investment income in the second quarter and has done so consistently over the last year. In the previous twelve months, Owl Rock’s payout ratio was 95% based on net investment income. The payout ratio was 97% in 2Q-22.

Unless Owl Rock’s non-accrual situation worsens significantly, I don’t see why the BDC can’t continue to pay its $0.31 per share distribution.

Net Investment Income (Owl Rock Capital)

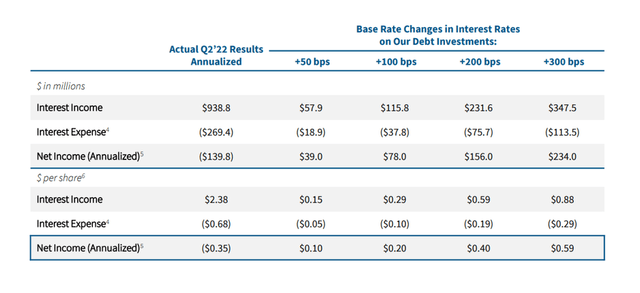

Higher interest rates may result in a better payout ratio for Owl Rock. Interest rate changes are expected to benefit ORCC’s debt investments, with net income increasing $0.20 per share annually if interest rates rise 100 basis points.

The chart below only shows changes in net income, and actual results may differ depending on the size and rate of interest rate increases.

Changes In Net Income (Owl Rock Capital)

Trading At A 12% Discount To Net Asset Value

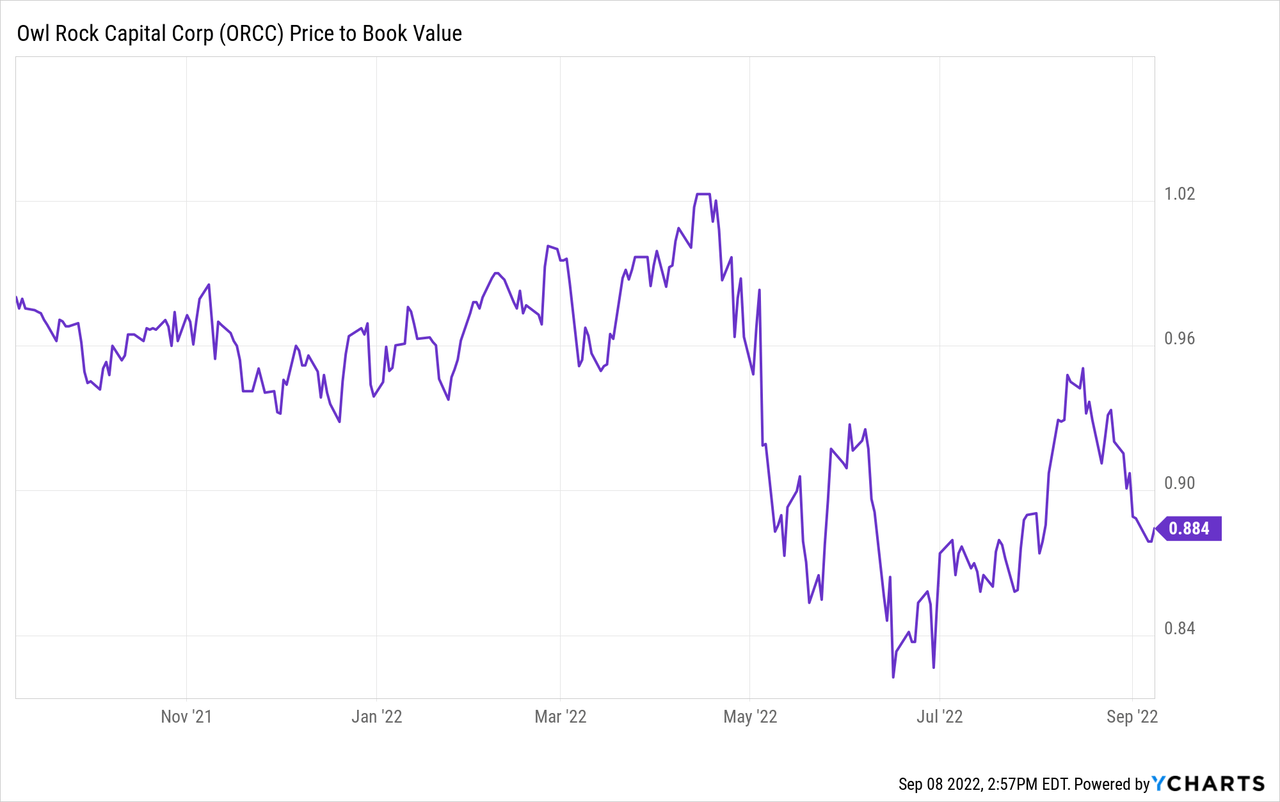

Although I believe the quality of the BDC’s investment portfolio does not justify this, Owl Rock’s stock can be purchased at a discount to net asset value.

Owl Rock’s net asset value as of June 30, 2022 was $14.48, and the stock is currently trading at $12.73, representing a 12% discount to its net asset value. Owl Rock’s stock has traded, for a short period of time, at a higher net asset value discount in June/July, but also at a lower NAV discount in the first four months of the year.

Given how safe Owl Rock’s portfolio is structured and how low the non-accruals are, I believe the 12% discount is appealing.

Why Owl Rock Capital Could See A Lower Valuation

Owl Rock continues to have only one company in non-accrual status, indicating excellent portfolio health. However, non-accruals may increase if Owl Rock’s portfolio companies face financial difficulties as a result of a recession. In the event of higher non-accruals, Owl Rock’s net asset value would most likely be impacted by increased loan losses, causing the stock to trade at an even greater discount to net asset value.

My Conclusion

This is another opportunity to purchase Owl Rock’s 88% senior-secured investment portfolio at a discount to book value and with a 9.7% yield.

I believe there are three reasons why income investors should consider purchasing Owl Rock.

First and foremost, the portfolio is geared toward safe First Liens, and the portfolio quality is strong, with only one non-accrual. Second, the business development company’s dividend is covered by net investment income. Third, given its safety-first portfolio structure, Owl Rock is trading at an unjustified 12% discount to net asset value.

Owl Rock is a no-brainer.

Be the first to comment