Thomas Barwick

Investment thesis

A few months ago, I outlined in an article (This Is What Costco and Target Told Us About Booking and Airbnb) how investors were receiving many signs that people would travel a lot and it was an easy call to bet on a strong travel rebound this year as things have almost gotten back to normal after the pandemic. Among the industry, I own Airbnb (NASDAQ:ABNB). The company just reported earnings and I am very pleased by it, making my bull case stronger. In fact, the company has completed its turnaround and is now fully profitable, giving me strong reasons to believe it will be free cash flow positive in every quarter from now on.

In this article, I would like to give my view of the report and the earnings call, focusing more and some key points: Airbnb has now become profitable and free cash flow positive, key metrics such as nights and experiences booked and gross booking value are growing and, as a consequence, cash held on behalf of customers is growing, too.

Q2 and 1H 2022 Results

Let’s recap the main results Airbnb posted, starting from the key metrics that are a measure of its business’ health.

- Nights and experiences booked in Q2 reached 103.7 million, up 25% YoY and 24% compared to 2019. The same metric for 1H is 205.8 million compared to 147.5 in 2021, a 39.5% increase YoY and a 24% compared to 2019.

- Gross booking value (GBV) was driven by higher average daily rates (ADR) and reached $17 billion, up 27% YoY (34% excluding FX) and 73% compared to 2019. Over the first six months of the year, GBV reached $34.15 billion, +44% compared to $23.71 billion in 2021, and +72% compared to 2019.

- Revenue for the quarter reached $2.1 billion, up 58% YoY (64% ex FX) and 73% compared to 2019. In the first half, the company revenue hit $3.6 billion, a 75% increase compared to 2019.

- Net income was positive, making this the most profitable Q2 ever for the company with $379 million, up $447 million from last year’s ($68) and up almost $700 million from Q2 2019.

- EBITDA came in strong at $711 million, an increase of 227% compared to the $217 million in Q2 2021 and a $754 million improvement compared to the ($43) of Q2 2019. The EBITDA margin is now at 34%, a very juicy number for shareholders.

- Free cash flow, a king metric in today’s markets, was just shy of $800 million. In the first six months the company’s FCF reached $1.99 billion, up 44% from $1.3 billion in 2021. Compared to 2019, FCF is up 4x as in the first six months of that year it was only $400 million.

To me these results clarify once and for all that Airbnb has become profitable, leaving behind many other hot IPO stocks whose valuations soared without being profitable at all.

Where does Airbnb profitability find its support? There are two main drivers: the company’s organic growth is still very fast and it is outperforming the industry that, as I explained in my previous article, it is expected to grow at a CAGR of 5% from 2022 to 2027. Secondly, Airbnb has learned in the early stages of the pandemic that keeping costs under control is key to reach high performance. Airbnb laid off 25% of its workforce, taking care of the fired employees, and has since become strongly committed to keeping costs low.

Let’s take a look at the cost structure.

| in $ million | Q2 2021 | Q2 2022 | YoY change | 1H 2021 | 1H 2022 | YoY change |

| cost of revenue | 294.4 | 390.1 | 32% | 548.9 | 752.7 | 37% |

| operations and support | 208.1 | 258.3 | 24% | 393.6 | 491.3 | 25% |

| product development | 349.7 | 375.1 | 7% | 712.8 | 734.1 | 2% |

| sales and marketing | 315.3 | 379.9 | 20% | 544.4 | 724.5 | 33% |

| G&A | 218.3 | 243.3 | 11% | 408.1 | 453.8 | 11% |

As we can see, the company is increasing its costs and this is comprehensible as it is still investing heavily to grow. However, the percentage change in costs are lower than the increase we have seen both regarding total revenues and net income. Furthermore, the fact that product development’s expenses are not growing as fast tells us that Airbnb is confident it has built a platform that works and that can be improved constantly without having to start from scratch.

Travel Trends

Airbnb reported that while domestic and short-distance travel continued to be more popular than in 2019, it is seeing improvement in both longer-distance and cross-border travel. Cross-border travel is recovering and there are strong signs of travelers returning to cities (historically one of the strongest areas of our business). Gross nights booked to high-density urban areas represented 47% of gross nights booked in Q2 2022, even exceeding pre-pandemic (Q2 2019) levels.

Trip length is also increasing. Airbnb has been focusing and long-term stays and it reported once again that stays of 28 days or more remained the fastest-growing category by trip length compared to 2019. Long-term stays accounted for 19% of gross nights booked in Q2 2022, up from 13% in Q2 2019. Overall, 45% of gross nights booked were from stays of at least seven nights in Q2 2022.

Average daily rates increased by 40% compared to 2019 and averaged $164.

Supply, which is key for Airbnb’s business model, grew both in non-urban and urban areas. With the decision to take down mainland Chinese listings, the company still has over 6 million active listings and 4 million hosts. Airbnb is also aware that one of the biggest sources of new hosts are prior guests, and it reported that 36% of new hosts in Q2 were prior guests.

Cash Flows and Unearned Fees

Now, historically Airbnb achieves its highest GBV in the first two quarters, as people book their vacations. The revenue then peaks in the third quarter, where most check-ins take place as in the norther hemisphere summer vacations take place. This means that from the time a guest books and the time of the check-in, that is, between the time a guest pays and a host receives its money, Airbnb holds this cash on behalf of the two parties. Now, as the company reported:

we saw strong demand early in Q2 that exceeded our expectations as guests in Europe and North America booked earlier than they have historically. Lead times lengthened by 7% during the quarter compared to Q2 2019. Guests also booked earlier in Q2 2022 as compared to Q2 2021 when guest demand ramped during the quarter.

This means that Airbnb kept the unearned fees benefit Q2 cash flows, but are not yet recognized as revenue. During Q2, unearned fees totaled $2 billion, the highest amount Airbnb ever achieved in Q2. During the earnings call, it was reported that for Q4 Airbnb is already seeing the same trend of early bookings. Now, while unearned fees are at $2 billion, the total amount of cash held on behalf of customers totaled $7.47 billion in Q2.

Airbnb isn’t idle with this money, but it invests it. In its annual report, the company states what it does with these funds:

we hold on behalf of our hosts and guests a substantial amount of funds, which are generally held in bank deposit accounts and in U.S. treasury bills and recorded on our consolidated balance sheets as funds receivable and amounts held on behalf of customers.

I think this is particularly important as it allows Airbnb earn interests with other people’s money. This is an extra profit that goes directly to the bottom line and affects both net income and cash flow. If the timeframe during which Airbnb holds this money widens, the company benefits from this as it has more time to earn interests. Now, currently the 3 month U.S. treasury bill yields around 2.5%. In the past three months we have seen this yield rise up from 0.5% back in April. Now, let’s imagine that Airbnb invested its $7.5 billion held on behalf of customers in these treasury bills at an average rate somewhat around 1.5%. This would give the company $112.5 million in interests which would go feed both its net income and its free cash flow. This is equal to almost a third of the quarterly net income and 14% of the FCF for Q2. Thus, we have to consider this part of Airbnb’s business model because it has an impact on the full results. In its consolidated statements of cash flow, the company reported for the first half a net cash provided by investing activities of $171 million, 47.5% of the net income and 8.5% of FCF. As the 3 month U.S. treasury yield moves up, we should expect Airbnb to benefit.

Furthermore, Airbnb has a very conservative balance sheet, with almost $10 billion in cash and marketable securities and a long term debt just shy of $2 billion, which should be almost totally covered by this year expected EBITDA. With interest rates rising, Airbnb, unlike many other tech stocks, will benefit by collecting more interests while being able to pay down its debt without having to trouble at all about refinancing it at higher rates.

Airbnb plans for the future

Strategy

In order to grow, Airbnb needs to unlock more hosting. In order to have enough selection for guests booking on our platform, it needs to invest in growing the size and quality of the host community. It has to attract new guests to Airbnb and convert more of them into brand advocates. The company is actually good at doing this as it has really become known thanks to word of mouth. Hosts have chosen to become such often after having used Airbnb as guests. The company still has ample room to go to penetrate Asian markets outside of China. In addition, the company thinks it has just begun to unlock the potential of booking not only a house but also experiences.

Growth and profitability

As we have seen, Airbnb is delivering good results both in terms of growth and profitability. Regarding how the company views these two, David Stephenson, Airbnb’s CFO said that:

while we’re thrilled with this margin expansion, we’re heavily in growth mode. We are not in profit maximization mode. We really want to balance profitability with growth. Our priority is investing in growth. And $10 billion cash is more than we need, $8 billion is more than sufficient to aggressively invest in growth in the business. And that is our #1 priority. At the same time, we’re able to both invest and grow just given the profitability profile of our business overall. So I’m proud that we can do both, but the priority for us is investment growth.

As an investor, given the stage of its development Airbnb is in, I like that the first priority is growth. However, I like it even more once I see the company become profitable. While we may expect margins not to go always up in a straightforward way as we would expect from a mature company, it is an extremely good signs to see them and to see that they are high. The profitability led Airbnb to have $10 billion in cash and since the company believes this is more than needed, it announced a $2 billion buyback program that will offset share dilution used in the company’s stock-compensation programs. The end of dilution is another factor I like as an investor.

Valuation

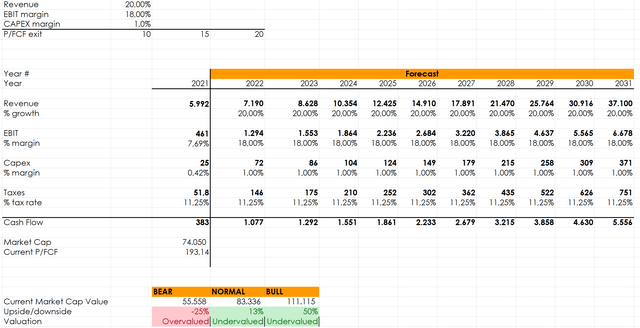

When we are before companies that are in growth mode, it is difficult to forecast exactly how this trend will be over the next decade. I made the assumption that overall, the company will grow at a CAGR of 20% which I think is achievable giving the fast pace the company grew its revenue at over the past 3 years. One of the things I like most about the company is that it is asset-light, thus it spends very little on capex. Compared to its EBIT margin in 2021, I do expect the company to keep at least a 17-18% EBIT margin, which may actually grow in the next ten years as the company matures.

Finally, I chose three possible P/FCF exits to get a grasp of the company’s valuation.

If we choose a 10 price/fcf multiple as our exit after ten years, the company is at the moment overvalued by 25%. However, this is a very low multiple. If we choose a multiple of 15 we are already in undervaluation territory, with a potential 13% upside. In a more bullish scenario, a 20 p/fcf multiple gives us a 50% upside. Given the fact that the company currently trades at 31 p/fcf as shown from Seeking Alpha’s valuation page, I do think this bull scenario has some margin of safety while having quite a chance of success. I personally have chosen this multiple as my exit and I do think the company can execute well its strategy to become in a decade a $30-40 billion company in revenue. This is why I rate it a buy once again, as done in my previous coverage.

Be the first to comment