Steve Smith/OJO Images via Getty Images

Investment thesis

The recent years shaped by the pandemic and the economic downturn have changed the way many of us work, our habits, how we consume certain products, and how we spend our time and our money. The apparel, footwear, and accessories industries have been strongly impacted and despite some major headwinds have built up, also many chances are there in the coming years but the increasing competition suggests that there may be higher challenges to overcome and investors should pick their stocks in this industry not only by considering the greatest opportunities but consciously pondering the risks. Nike (NYSE:NKE) and Lululemon Athletica (NASDAQ:LULU) are two major competitors and both have their advantages and specific risk profiles. In this article, I will give an in-depth analysis of each of them, while comparing the most important metrics and aspects in a face-to-face comparison, and finally also assessing their stock’s valuation in different scenarios. My verdict on which stock is a better buy will be given by pondering all actual analyzed elements, but also by looking at possible future opportunities and risks in the coming few years.

A quick look at the industry

Companies in the consumer cyclical sector and especially apparel as well as footwear and accessories manufacturers are among the worst performers in the past year, as dropping consumer confidence, increasing inflationary price pressure, bottlenecks in the supply chain, as well as pandemic-related restrictions, and the ongoing war in Ukraine, have formed significant headwinds.

Despite that, the pandemic and subsequent change into more hybrid work have also changed clothing habits for many people as there has been increased demand for leisure and sportswear, as wearing athletic attire as casual clothing has become more fashionable. The global sportswear market is expected to grow at 6.1% CAGR, reaching a valuation of $249B by 2028. While there are many interesting companies in this industry, this analysis specifically compares the global market leader Nike to its smaller competitor Lululemon Athletica, which although smaller in size, is becoming very popular and could achieve impressive growth in the last few years.

An in-depth company comparison

Nike is the world’s largest sportswear brand, with footwear as its main product category with 66% of revenue in the fiscal year 2022, followed by apparel with 30% of sales and equipment with 4%. The company also owns very popular subsidiaries including Jordan Brand with $5,12B in wholesale revenue in the past fiscal year and Converse reporting sales of $2.34B, up 6% from 2021 and even 16% from 2020. Lululemon is by far a smaller competitor, the Canadian company was founded 34 years after Nike and while having a very limited offer in sport’s shoes, the brand could establish itself as the leading manufacturer of Yoga apparel. With the constantly increasing global popularity of Yoga, Lululemon could grow into a significant sportswear brand, with strong pricing power and increasing brand awareness. The company’s sales strategy is divided between operating its stores, generating 45.1% of sales in the fiscal year 2021, and direct sales to consumers representing 44.4% of the revenue. Nike is instead transitioning to more direct sales from its previously prevalent wholesale strategy, as in the fiscal year 2011 the latter revenue was still more than 5.2 times the size of its direct sales, while in 2022 this proportion dropped to less than 1.4. For both companies, the US and Canada are the most important market, with Lululemon totaling 85% of its revenue, and Nike generating 41% in North America, followed by the EMEA region with 28%, China with 17%, and Asia-Pacific and Latin America with 14% of sales in the last fiscal year.

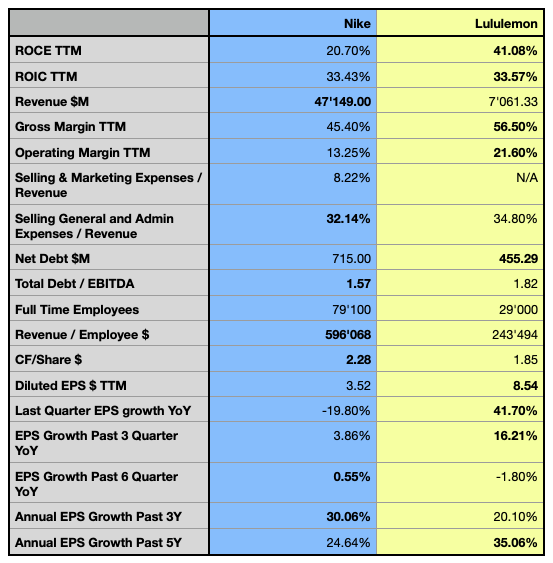

Author, using data from S&P Capital IQ

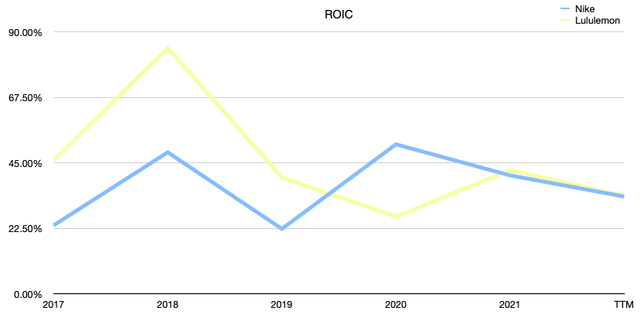

In this financial comparison, it’s interesting to note how both companies recently perform similarly in terms of their Return on Invested Capital (ROIC), a very important metric I consider when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment. While Nike’s ROIC is hovering around 36% on average in the past five years, Lululemon’s metric is falling from an average of 45%, as the company grew substantially in the past few years, reporting a higher Return on Capital Employed (ROCE) when compared to the market leader, as the latter could even increase its returns to investors by optimizing the significant idling cash position of about $13B at the end of May 2022.

Author, using data from S&P Capital IQ

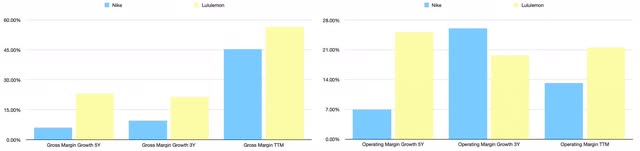

Although reporting a slight deceleration of this metric in the past 3 years compared to the past 5 years, from 23.2% CAGR to 21.5% CAGR, Lululemon stands out for its significantly higher gross margin, while Nike’s gross margin growth accelerated from 6% CAGR in the past 5 years to 9.6% CAGR in the past 3 years, as the company’s switch to more direct sales positively impacts its pricing power. On the operational side, LULU reported by far a higher efficiency, despite Nike substantially optimizing its profitability, accelerating from 7% CAGR over the past 5 years, to 26.1% CAGR in the past 3 years. Despite this, the recent drop in Nike’s EPS reported in its latest quarter results, is a warning sign that the strong dollar and the revenue decline in its business in China may further negatively affect its results in the short term.

Author, using data from S&P Capital IQ

Despite Nike seems to have a more cash-rich business, Lululemon could achieve impressive returns for its investors as its EPS is more than double compared to its competitors, despite also here the company’s profitability seeming to decelerate in the past 3 years when compared to its growth over the last 5 years, while Nike’s EPS growth is instead accelerating. In terms of debt, while both companies rely on capital from third parties for their growth, Nike has a lower exposure when considering the companies’ leverage ratio.

The stocks’ performance

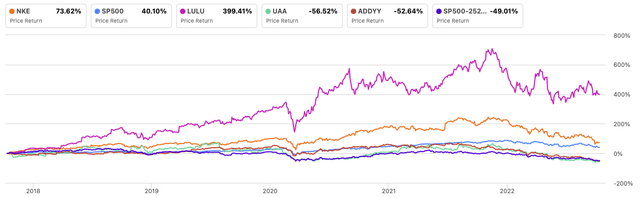

Considering both stocks’ performance over the past 5 years, LULU returned a massive 400% performance, while NKE reported close to 74%, still significantly outperforming the S&P 500 (SP500) and other major competitors such as Under Armour (NYSE:UAA) and adidas AG (OTCQX:ADDYY), as well as the industry reference S&P 500 Apparel Accessories & Luxury Goods Index (SP500-25203010). It’s important to note how LULU could achieve significant relative strength over almost the entire analyzed period, while since the pandemic, the stock has had an even more massive performance.

Author, using SeekingAlpha.com

While Nike has proven to be the industry leader for many years, Lululemon may have positioned itself in its market at the right moment and has since greatly achieved to capture its growth opportunity. In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer even better opportunities, while also evaluating the possible risks in different scenarios.

Valuation

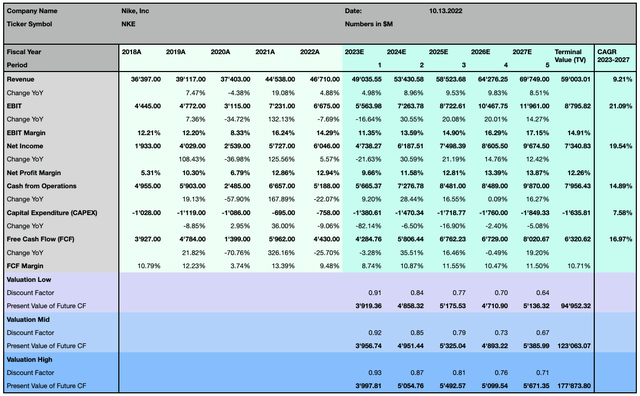

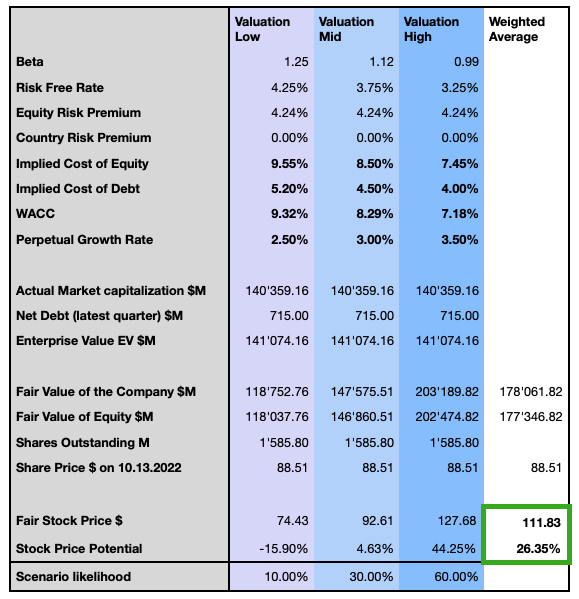

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. As forecasted by the street consensus, Nike is anticipated to generate a consistent, solid 16.97% Free Cash Flow (FCF) CAGR over the coming 5 years, with substantially increased net profitability at 19.54% CAGR, while its revenue is forecasted to grow slightly slower, at 9.21% CAGR, significantly over the expected market growth rate.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be considerably undervalued with a weighted average price target with a 26.35% upside potential at $111.83.

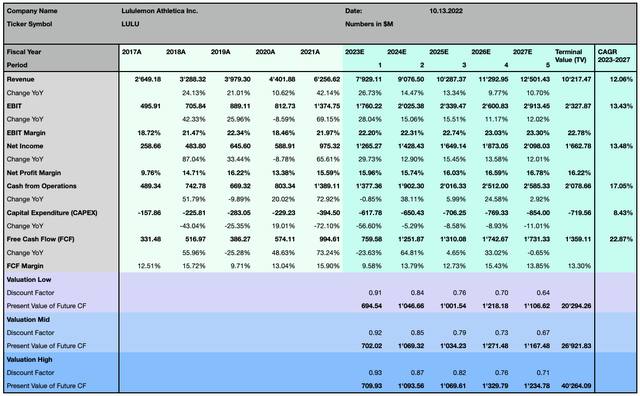

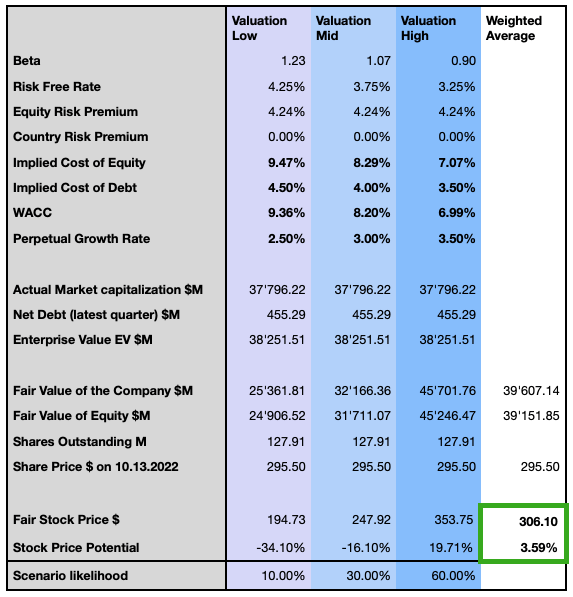

Lululemon is instead forecasted to generate substantially higher growth in terms of FCF, with an expected 22.87% CAGR over the coming 5 years, while its net profitability is projected to grow slower at 13.48% CAGR, and the company is forecasted to expand even faster than its competitor in terms of sales with 12.06% CAGR.

Author, using data from S&P Capital IQ

I then consider the same three scenarios affected by the company’s fundamentals and by the exogenous factors.

Author

This leads us to conclude that LULU may be priced quite well at the actual price, with a slight upside potential of 3.6% at $306.10, when considering the weighted average price target, and more significant potential in the most optimistic scenario.

Investors should consider that those forecasts are based on relatively higher discount rates and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and risk discussion

Both companies are impacted by the consumer’s discretionary spending, which could, in the event of a possible deep or extended recession, significantly deteriorate the projected outlook over the next few years. Despite Lululemon being less diversified in terms of product categories and brands, it offers more casual clothing that fits the most recent trend of hybrid working habits, while Nike’s apparel is more sporty. Nike can count on highly diversified demographics and a global customer base, while Lululemon’s customers tend to be western and with relatively higher incomes.

Lululemon’s innovation capacity could still bring many surprises in the foreseeable future as the company’s recent efforts with its Mirror product and Studio membership, as well as its step into the shoe business, are seemingly still not meaningful but could lead to better results in the long run. Nike’s strong brand awareness and brand value together with its side brands and millions of customers around the world can count on its position as a market leader, with strong marketing capabilities and important economies of scale in low-cost manufacturing locations mostly in Vietnam, China, and Indonesia.

For both companies, the high dependency on the North American market can represent a risk. While Nike may have significant potential in emerging markets such as India, China, Brazil, or gradually also Indonesia, where the middle class is flourishing, Lululemon could diversify into Europe and Asia Pacific within higher income countries such as Singapore, Australia, or Japan seen as a better target. In this sense, Lululemon as a Yoga-related brand has a more limited audience and as its products are relatively higher priced than e.g. Nike’s, Puma’s (OTCPK:PMMAF), or Under Armour’s products, more price-conscious consumers may look elsewhere for cheaper alternatives.

Nike has a much bigger financial capacity and could acquire smaller companies to innovate and integrate technology and digitalization into its more traditional business, as virtual reality, augmented reality and the metaverse could have a strong impact on people’s lives in many circumstances, fitness, and sports activities are seen as great application fields. Wearables could also bear a significant opportunity for the company as their applications are constantly increasing and the technologies are more democratized.

Nike’s ongoing transition to direct sales has the potential to further increase the company’s financial strength and increase its pricing power, as big retailers can have a strong negotiation power, while the brand also loses its direct impact on the customer’s experience.

Both companies are highly exposed to pressure on their marketing budget with increasing competition from established companies but also newcomers, as well as to fluctuations in the USD towards foreign currencies, where Nike bears the higher risk, as the company’s sales are more diversified in other currencies and the second biggest single market after the US is China, while the two countries are escalating the ongoing trade tensions.

The verdict: Which stock is the better buy?

Both companies are two very interesting players in the apparel or the footwear and accessories industry. While fundamentally they both have their advantages and weaknesses, they also offer different risk profiles to investors. Lululemon’s stock price has been driven by significant growth in its business and is projected to grow faster than Nike, while Nike is on a good way to improve its profitability as the company is transitioning to more direct sales and can count on massive brand awareness and brand value on a global scale. LULU is still mostly highly dependent on North America’s consumers and focuses on a more specific customer base. The three scenarios explained in my valuation model define NKE as being the most undervalued stock, with also the lowest risk when considering the worst-case scenario. Despite Lululemon being forecasted to grow significantly faster, the stock has not been sold off as much as NKE and is still quite fairly priced at the actual level. If in the next few years a major recession should affect the US and maybe as well other countries in the world, it is likely that LULU would face more challenges and its valuation would likely be more affected than Nike’s. Looking at all the elements considered in this analysis, I would consider Nike to be the better choice, while it would likely not grow as fast as Lululemon is forecasted to grow, the company offers a better valuation and higher financial strength as well as greater diversification and a massive brand value that could offer great opportunities for the company in the next few years.

Be the first to comment