primeimages

Some key drivers of the present energy challenge concern resources, energy market dynamics, and sustainability. One, the earth’s physical resources are finite, a closed system generally, save for regenerative resources. Two, we need to supply greater amounts of energy in the future, approximately 50% more to 2050. Three, roughly 82% of primary energy demand is sourced from fossil fuels. And finally, a decarbonization drive is colliding with the physical energy world in the present. (I’ll save geopolitics for another day.) This breaks down as such:

Supply tightness

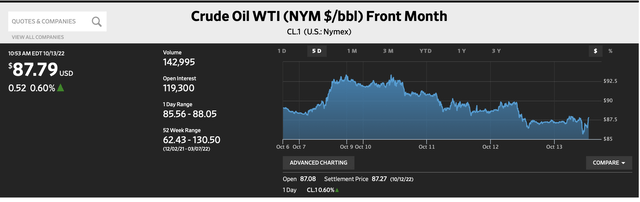

The tightness story of oil supply is of predominant concern to me, as is the arbitraged oil barrels owing to sanctions on Russia, and Iran factors in as well. OPEC (and the producing world) lacks spare capacity; an underinvestment hangover of the last number of years weighs into the equation. The newly announced 2 million b/d cut, levied until December 2023, supposedly really translates into a 800,000 b/d real effect, largely from Saudi Arabia and the UAE’s supply. Two things are happening. One, the increased price effect, evident in two trading days that followed the announcement, offers OPEC+ a more stable increased revenue stream in the short term, in advance of any recessionary effects. It’s an anti-volatility measure in a very volatile world. It protects spare capacity by throttling back supply.

Russia gets a bonus price hike. According to an oil trader, there are many millions of barrels of oil per day discounted, arbitraged, in the global market, seeing their way through the front and backdoors of Europe, the Middle East and/or Asian ports. That was artificially keeping prices below $90, to the true “market’s” disadvantage. The details of supply tightness are predominant in the market-not to be betted against.

This is not entirely a demand-driven cut, as suggested, owing to recessionary concerns. Savvy investors suggest to me that oil demand is sticky; there’s a ‘secular’ floor of demand. As a learned, practiced oilman said to me recently, “You shouldn’t bet against the market.”

While familiar with the run-up story in oil prices and related stocks such as Matador (MTDR), Devon (DVN), Occidental Petroleum (OXY), and Pioneer Natural Resources (PXD), the tightness overlay exists. Oxy received some positive price effects from Berkshire Hathaway’s share purchases (BRK.A) (BRK.B). Based on fundamentals not changing, I see no other reason than the Buffett effect that benefited Oxy’s stock price. If you can’t bet against the market, Buffett is a part of that fundamental, at times.

Matador Resources Company (MTDR) Charting

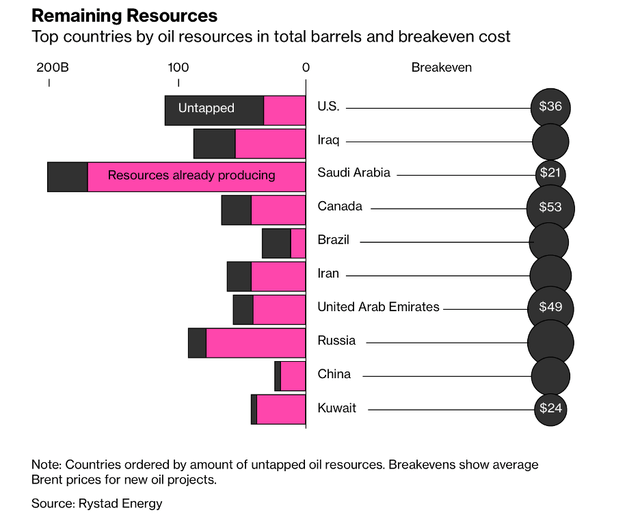

Whether one believes it or not, oil market factors below suggest nuance. I’m not focused on breakevens. They only matter as to who profits more right now.

Countries and their oil supply (Rystad)

The OPEC Secretary General said, of their announcement: “…energy security has a price.” The OPEC+ regime has shared interests. Additionally, this upcoming winter in Europe may reveal more challenges, affecting energy and food security.

A bigger picture

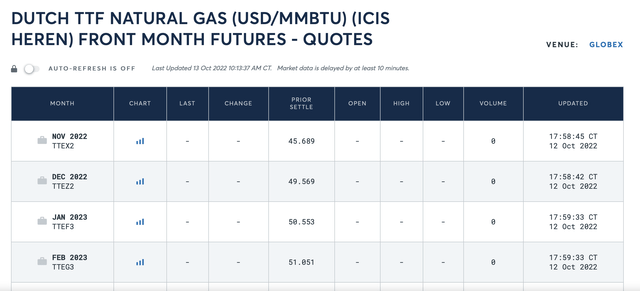

In the winter of 2021, prior to the invasion of Ukraine by Russia, fissures were being exposed in Europe, as it transitioned away from natural gas plus other energy sources without having adequate, secure back-up sources for renewables. One tragedy for Europe stems from its over-reliance on Russian gas which is now in shortfall and causing serious hardship to people and companies. The German economy, an engine of Europe, is expected to contract 3.5% next year according to a Deutsche Bank forecast. More coal is now being mined, shipped, and burned to redress the energy shortfalls, with more pollution wafting through locales and across the globe. Dutch futures, reflecting Europe’s gas pricing, were at $64 for year-end delivery in late September. They have declined to the $50 range, but winter and other factors are yet to be determined. Weather forecasts can affect pricing outlooks and other factors.

Ironically, the U.S. has one of the most, if not the most, market-based energy systems across the globe. Our energy mix moves accordingly. U.S. government R&D, tax policy and incentives helped moved the shale development forward, alongside the private sector. This took decades to develop.

Supply chains surrounding energy and food security and resources are shifting. (And supply chain investment theses are being explored ad infinitum.) After profiling some research about mutual fund underperformance, I started to think about the capital efficiency required of this energy transition.

Capital market challenges in the energy transition

I fear that the more recent rush toward ESG-related, sustainability-themed and like-minded funds and instruments are distorting the allocation of capital. We saw the markets tilt toward green-type funds during the pandemic (and at other times) and now swing back toward value and incumbent-economy investments. This value destruction doesn’t solve anything.

According to a recent interview, since publicly-traded, global nationals, and other oil and gas companies were burned in the last five years, they will produce resources more conservatively, return cash to shareholders, and run the business according to shareholder mandates. In this scenario, a status quo is expected for oil and gas for up to a decade. That’s a very long window right now.

(See YouTube video of CEO, CIO Jay Hatfield and Jennifer)

Jennifer Warren interviews Jay Hatfield, AMZA (J Warren, Concept Elemental)

Bets in energy and sustainability efforts

First, I invest in firms with my time or money that are of net benefit to society, the problem solvers. I invest in oil and gas companies that have strong leadership and sound license-to-operate approaches, with the scale, scope or mandate to advance society. Sustainable infrastructure firms and funds are part of my resources-oriented portfolio too. I would not underestimate innovative firms’ influences, the FAANGs-plus of all sizes, in nudging the energy mix as well. Increasingly, traditional economy and new economy organizations’ lines are blurring and how they operate.

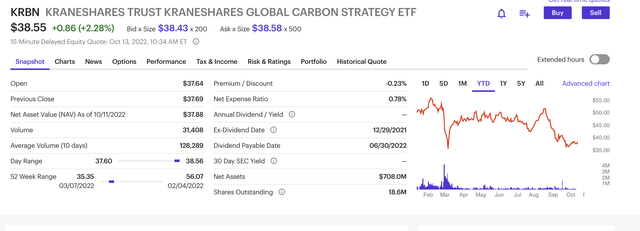

Relative to decarbonization efforts, better efforts to transparently reflect carbon market instruments- such as carbon investment vehicles, voluntary and involuntary markets, and trading regimes-are needed to sort out where value is highest. It feels like the frontiers of the Wild West, which is exhilarating but fraught with peril. [With a small-batch of shares, I’m watching KraneShares Global Carbon ETF: (KRBN).]

KraneShares Global Carbon ETF (E-Trade)

In conclusion, this market walkabout just describes a world of energy possibilities. The market is noisy but there are notable patterns. It’s really a stock-picking world in my mind.

Be the first to comment