vlbentley

Leading South African petrochemical producer Sasol’s (NYSE:SSL) latest trading statement highlighted more operational challenges. This time it wasn’t just coal quality but also production issues due to unplanned outages from load-shedding, as well as adverse weather conditions at its main plant Secunda. As a result, guidance numbers were revised downward in line with assumptions for mining productivity, Synfuels production, liquid fuel sales volumes, and chemical Africa sales volumes. Only the guidance for gas volumes was raised. Compounding investor concerns was the $750m convertible issuance in November, which will likely prove dilutive relative to the projected ~$30m of pre-tax interest savings.

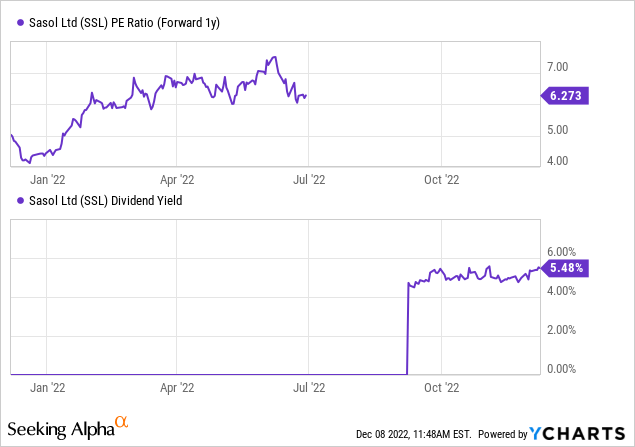

That said, the valuation case is stronger than ever – the stock offers investors exposure to a stronger oil price environment at an fwd P/E of ~6x while also paying out a well-covered mid-single-digit % dividend yield. There aren’t any catalysts to lift the ESG overhang anytime soon, but Sasol’s positive progress toward its 30% emission reduction target, as well as its leadership in Fischer-Tropsch (FT) technology, present valuable optionality.

Ongoing Production Challenges Weigh on the Guidance

On a headline basis, Sasol’s double-digit earnings per share growth for H1 2023 remains intact at over +20% YoY. One bright spot was gas production of 111-114bn standard cubic feet, which was well above the prior 109-112bn standard cubic feet guidance range on supportive Brent oil prices and refining margins, as well as favorable FX. That’s where the good news ends, though. The company is seeing a bigger impact from lower chemical sales prices and higher feedstock costs, driving a downward revision in chemicals Africa sales volumes (now at 0-4% above the prior year vs. the previous guidance of 6-12% above the prior year). Liquid fuels sales volumes were also down to 52-55m barrels (lower than the previous guidance range of 53-56m barrels).

The key negative from the Sasol update was perhaps the operational challenges in October and November at its Secunda operations in South Africa, which weighed on production and sales volumes (down to 6.6-6.9m tons vs. previous guidance of 7.0-7.2m tons). These challenges were down to lower productivity amid safety and operational stoppages, as well as flooding, which led to additional outages during the period. In turn, this drove a downward revision to the guidance for mining productivity at 950-1,050 t/cm/s (down from the previous guidance range of 1,000-1,100 t/cm/s) and sales volumes across business units. Given Sasol’s current coal stockpile at ~2.2m tons (as of November 29th), though, there is at least some operational buffer here.

Addressing ESG Concerns Remains the Key Hurdle

In the meantime, Sasol’s carbon footprint remains a major problem in an increasingly ESG-driven investment world. For context, the company has a Scope 1/2 carbon footprint in line with the likes of Saudi Aramco (ARMCO) despite having a significantly smaller production scale. Given the ESG constraints on major fund managers with regard to the greenhouse emissions of the overall portfolio, including Sasol in a portfolio would require a lot of tradeoffs (and justifications). So it comes as no surprise to me that Sasol stock has been weighed down by an ESG overhang in recent years.

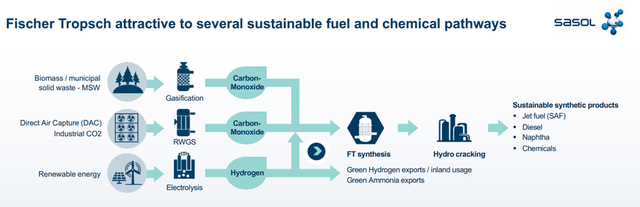

That said, Sasol’s global leadership in Fischer-Tropsch technology bodes well for its ability to address ESG concerns over the long run. FT facilitates the conversion of carbon to fuels and chemicals in a carbon-agnostic manner – for instance, Sasol captures carbon dioxide from industrial waste and then uses it to produce fuels and chemicals in a process known as ‘power to chemical/fuels’ (or ‘Power-to-X’).

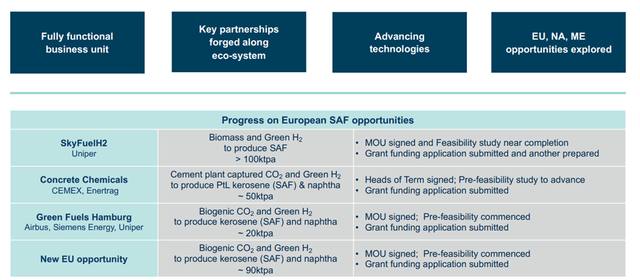

Over the mid to long term, this opens up significant new addressable market opportunities – Sasol has guided to share gains in sustainable aviation fuels, for instance, which is set to grow significantly in a net-zero world. It’s hard to gauge the size of other addressable markets or the impact of transition plans at Secunda beyond 2030, though, with more ‘green’ growth opportunities available to Sasol, I think the market might be underestimating Sasol’s ability to make the ESG leap. From here, progress in key growth markets like sustainable aviation fuels and a further decarbonizing of the operation over and above current targets could reverse some of the ESG overhang placed on the stock in recent years.

More Operational Challenges but Valuation Case Remains Compelling

Sasol’s latest operating update offered little cheer for investors as more operational challenges are set to weigh on the upcoming fiscal half-year results. Supply-side issues were the key culprit, driving a downward revision to the current guidance across key operating metrics such as mining productivity, Synfuels production, liquid fuel sales volumes, and chemical Africa sales volumes. The recent convertible issuance won’t help sentiment either, though the balance sheet is now robust enough to ride out the worst of any downcycles ahead without sacrificing the capital return.

Perhaps most importantly for investors, the valuation case is still compelling. Relative to a market where most other O&G names are richly priced, Sasol offers investors exposure to oil/refined product spreads at a very attractive valuation of ~6x fwd P/E. Even with re-rating catalysts still some way off, the 5-6% dividend yield certainly helps in the meantime.

Be the first to comment