SimonSkafar

Dear readers/followers,

In this article, we’re going to be taking a look at the PPL Corporation (NYSE:PPL), a utility that is found in Pennsylvania, Kentucky, and Rhode Island, servicing millions of customers in a large area. The company is active in the distribution and transmission of electricity and gas, and is a modern, potentially future-proof utility.

I invest over 10% of my portfolio in utility companies, and I’m adding PPL to my list of companies to watch here.

Let’s see what the company does.

PPL Corporation – a solid utility

This company is a fairly solid overall business to own. It doesn’t have the highest yield in its sector, but nor is a 3% yield “bad”, per se. As highlighted in its 2022 EEI Financial Conference, PPL operates in attractive areas, namely the following.

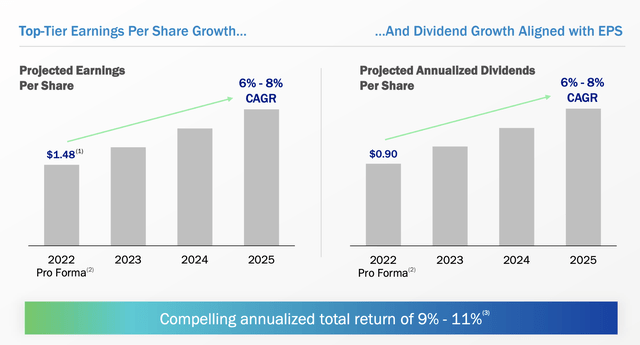

The company has one of the most solid balance sheets in the entire US utility sector, because it has no equity issuances. The company targets $27B of infrastructure and system investments through 2030, and argues that it offers an attractive 6-8%, visible annual dividend and EPS growth. The company’s operations are proven, in that the company has executed investment plans in the past, while maintaining affordable rates for its customers but also offer appealing returns for shareholders. The best of the best in a capitalist context, where “everyone is happy”, essentially.

In its 3Q22 earnings release, the company mentioned the projected EPS and dividend until 2025E.

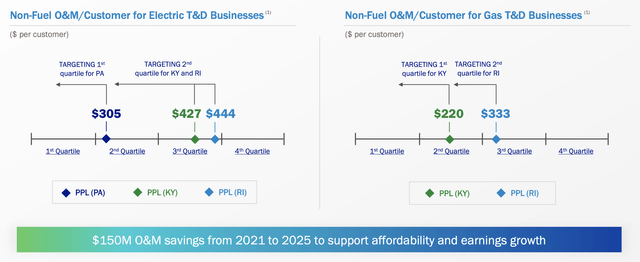

The company is aiming to provide substantial savings through the centralization of services, lowering licensing and related costs, and enabling economies of scale from centralization. Operating margin has improved in a 2011-2021 CAGR of 0.5%, better reliability, and increased customer satisfaction – and the target is that the company will deliver the same positive trends in the areas of Kentucky and Rhode Island as well.

The current aim is improving its overall business mix with increases in sustainable infrastructure and generation, and lowering the coal exposure of the company by $1B in 2026, resulting in a mix that’s only 14% coal-fired, and 86% sustainable – out of a $27.2B rate base.

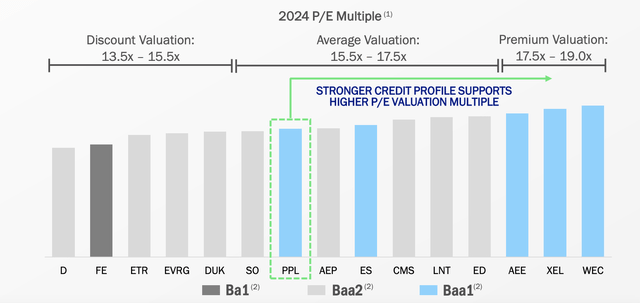

The end target is to have a 0% coal-fired generation capacity by 2050 at the latest, with 2040 being less than a billion. The goal for the company is that its improved balance sheet, financial flexibility and generation, provides PPL for a justification for an average valuation that’s in the 15.5x to 17.5x in its peer group – the premium companies here being the following.

I very much like seeing numbers and considerations like this, because this is more or less how I invest in utilities as well. I pick the best-rated, most well-financed with the best operational circumstances, and I try to buy them at relatively cheap prices when possible.

The company is skillfully managed by a board that has an average tenure of nearly 8 years or above. The company’s appeal as an investment is very much confirmed by the latest operational results for 3Q22.

PPL reported continued solid execution of its plan, generation GAAP of a nearly quarter-dollar per share, and increasing its 2022E EPS guidance by 3 cents. It also confirmed the aforementioned target of a 6-8% annual growth in EPS as well as dividends – again, a solid overall trend.

Also, the company’s business transformation is on track to deliver at least $150M in savings by 2025, with potential well beyond 2025 as well.

The company filed for generation replacement, with a DSM expected from Kentucky in the next quarter, and is slated to submit several plans in Rhode Island before the ear is over, including an efficiency plan, advanced meter plan, and a grid modernization plan.

The company remains heavily exposed to PA and KY, with RI being a small geography with less than 5 cents in ongoing earnings on a quarterly basis. Electricity sales volumes remain solid and stable, and close to flat on a weather-normalized basis for the quarter.

The company does have maturing debt – but less than $360M for the next year, and most of its $13B in maturities well beyond 2027. PPL is A-rated, which as far as utilities go is superbly solid.

The fact is that PPL has been underperforming the sector for some time – and over the last year, the pricing/valuation for the company has been very volatile. It’s legacy coal assets which were viewed as a major risk previously, are now being viewed more positively due to the increased pricing of electricity – and there’s some uncertainty with regards to RI asset integration, as it’s being considered for the next few years.

There’s also the elephant-sized consideration in the room – PPL cut its storied dividend by no less than 51.8% back in February, which is one of the major influences of how volatile the share price has been during this year. This company was one to avoid exactly because of the expectation for a dividend cut, which is also why I haven’t bought the company until now. If you had bought PPL back in 2016-2017, your returns could have been some negative 6% in 5 years, which is abysmally bad.

However, every company has a time to shine and a time to grow. And it’s possible that PPL is coming. Because the company is fundamentally sound, it’s A-rated, and it had a very appealing rate base. The new dividend is covered extensively by earnings – which wouldn’t have been the case with the old one, and I view it as very safe.

The problem with PPL lies not in the current dividend level, management or company quality. Instead, the reason for my “HOLD” rating is to be found in the valuation portion of the company’s overall thesis.

PPL’s Valuation

So, PPL is a quality utility. The fact that it cut the dividend is bad, and some investors might give the company an “F” for that reason for the next few years. Me, I take a more open approach to this and look at what we need to pay to get the company today, not in the future.

The problem is, that picture is looking rather grim.

The company itself expects that it should trade between 15-17.5x P/E. I actually agree with this.

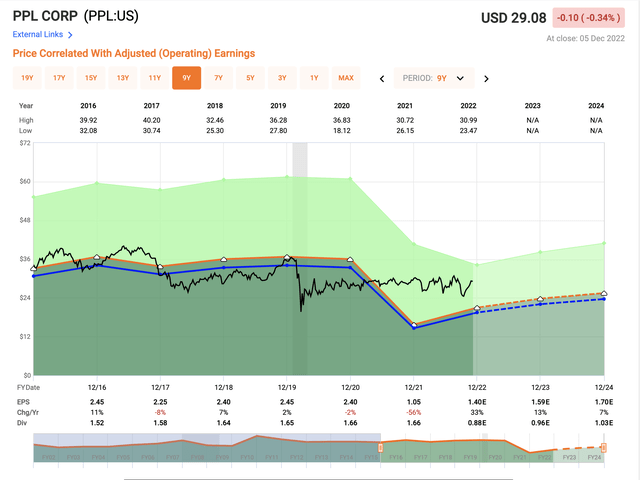

The major problem is that it currently trades at 21.15x, which is well above where any utility with its sort of history and issues should be trading. The reason for this somewhat skewed valuation is clear, of course. EPS is nearly half of what it was in 2018-2019, and it’s not going back quickly. The 2024E EPS is no more than $1.7/share.

PPL Valuation (F.A.S.T graphs)

Even if we consider a 15-17x trading range based on this estimate until 2024, the highest possible upside we can expect from this investment is in the lower single digits, no higher than that.

That is unacceptable, even for a utility. PPL needs to be lower. About 2 months back, the company briefly touched below $24.5, which implied a double-digit upside accompanied by a yield that was above 3.4% – at least for a time. That was an “okay” time to “BUY” PPL, as I see it. But since then, the company has sort of normalized to a premium that I don’t view as justified for the business – even with A-.

Because there are better alternatives with better upsides, better yields, and better theses. Take Enel (OTCPK:ENLAY). Take Fortum (OTCPK:FOJCF), and take E.ON (OTCPK:EONGY). All of them with equal or better overall rate bases, solid credit ratings, and absolutely stellar dividends (with the exception of Fortum, we’ll see what happens there).

So in context, and viewing the story on an international playing field – which I do, because I’m an international investor, the current thesis for PPL is not a positive one.

I don’t see an acceptable upside I would be willing to invest in.

PPL is considered a “BUY” by analysts nonetheless – even a low one. Current analyst PTs from 14 analysts following the company have PPL at a $29.5/shar, and 10 out of 14 analysts consider this company a “BUY” or a similar rating, despite an official upside of less than 2%.

I call these estimates, and these analysts wrong.

I want a better return for my money – you’re worth more than that. Your money is worth more than a measly single-digit (low) return on an annual basis.

My own PT for PPL, and when I would start considering the company as a “BUY”, is once it hits its 2022-2025E 15x midpoint. In this case, this comes to a $24.7/share PT, where the upside would be good enough for me to consider it a solid “BUY”.

Anything else, as I see it, is paying far too much. I’d rather buy other utilities.

Thesis

My current thesis for PPL is as follows:

- This is a solid, class-leading utility with good fundamentals, a well-covered yield following a dividend cut, and excellent operating environment with great investment plans. On every level, this ticks the boxes of what a utility “should” be and how it should operate.

- However, the company’s premiumization is completely unwarranted here – and the returns on a conservative basis if investing here are abysmal.

- It’s a “HOLD” – and my PT is $24.7 before I’ll invest a cent in the company.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic, good enough upside based on earnings growth or multiple expansion/reversion.

The company does not fulfill my valuation criteria, which makes it a “HOLD”.

Be the first to comment