imaginima

In Shakespeare’s Richard III, the iconic playwright wrote, “Now is the winter of our discontent made into a glorious happy summer by the accession to the throne of Edward of the House of York.” On May 6, 2023, King Charles of the House of Windsor will ascend to the throne at his official coronation. Meanwhile, the coming months could mark a winter of discontent throughout Europe as scarce energy supplies cause high prices and some frigid days and nights. Rising energy prices in Europe will impact US energy prices and bolster profits for US multinational oil and gas companies.

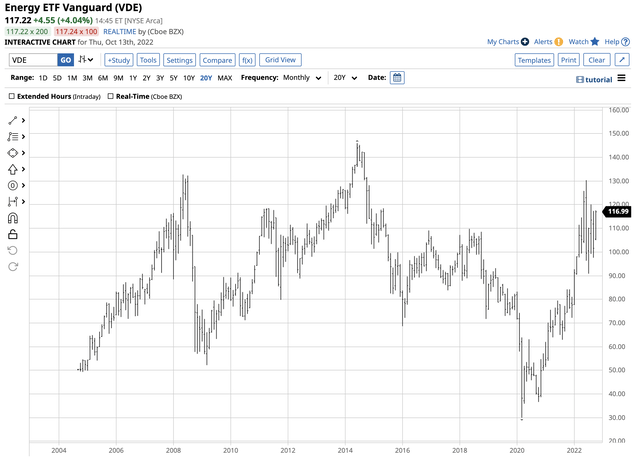

The stock market has been ugly in 2022, with the S&P 500 falling 24.77% over the first three quarters of this year. Meanwhile, traditional energy companies have bucked the bearish trend in equities, posting gains over the first nine months of 2022 and moving higher than the Q3 closing level as of Oct. 13. The Vanguard Energy ETF product (NYSEARCA:VDE) holds shares in the leading US traditional energy companies.

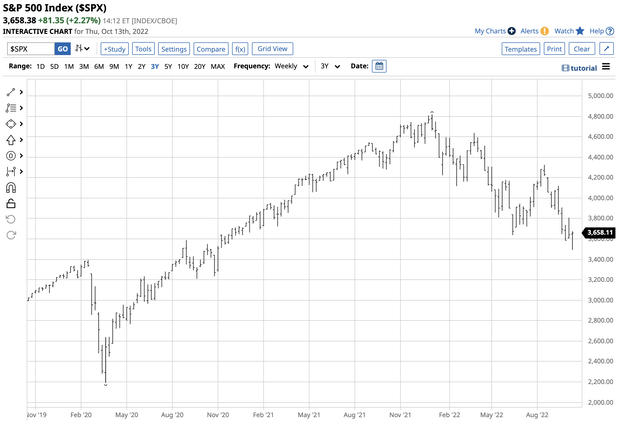

Bearish action in the stock market in 2022

The S&P 500 is the stock market’s most diversified index. In 2022, the barometer for the overall stock market has made lower highs and lower lows.

Chart of the S&P 500 Index (Barchart)

After closing at 4,766.18 on Dec. 31, 2021, the index was at the 3,658.38 level on Oct. 13, over 23% below the level at the end of 2021. Rising interest rates and the strongest US dollar in two decades have weighed on equities.

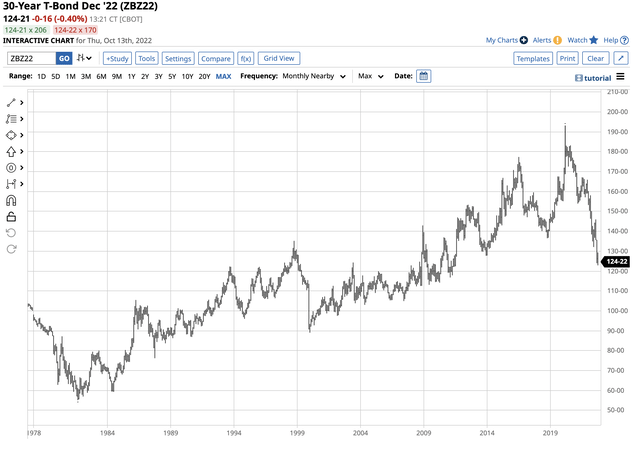

Chart of the US 30-Year Treasury Bond Futures (Barchart)

The chart of the nearby US 30-Year Treasury bond futures shows the decline to a low of 122-28, the lowest level since July 2011. Meanwhile, after sitting at zero percent until March 2022, the short-term Fed Funds Rate stands at 3.00% to 3.25%. The Oct. 13 September CPI data was higher than expected at 0.4%, reflecting an 8.2% increase in consumer prices over the past year. Core inflation accelerated by 0.6%, a 6.6% increase since the same time in 2021, and was at the highest level since August 1982. The CPI data could set the stage for the fourth consecutive 75 basis point rate hike when the FOMC meets on Nov. 1-2. After initial selling in the stock market, it experienced a rip-your-face-off rally that created a bullish key reversal in the S&P 500 on Oct. 13. However, the central bank has the ammunition to drive the Fed Funds Rate to the 4% level or higher by the end of 2022. Rising interest rates attract capital to fixed-income instruments and away from the stock market. Moreover, it supports a rising US dollar.

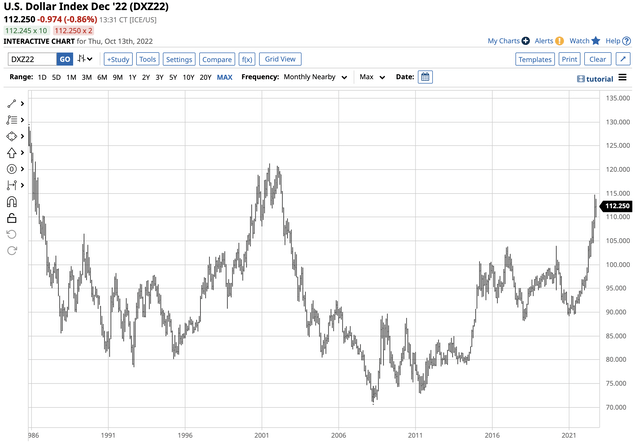

Chart of the US Dollar Index (Barchart)

The dollar index futures contract chart shows a rise to 114.475 in September 2022. At over the 112 level on Oct. 13, the dollar remains at a two-decade high. A strong dollar weighs on the profits of US multinational companies as it makes them less competitive against other worldwide firms. A rising dollar and interest rates, geopolitical tensions at the highest level since the 1962 Cuban Missile Crisis, and overwhelmingly bearish sentiment have weighed on the stock market in 2022.

The VDE bucks the bearish trend

The war in Ukraine and US energy policy have caused traditional energy commodities to rally in 2022. Crude oil and natural gas rose to the highest prices since 2008 and remained above the 2021 closing levels on Oct. 13, 2022. Rising fossil fuel prices have turbocharged earnings for US companies producing and refining hydrocarbons. While the overall stock market declined since the end of last year, the Vanguard Energy ETF product (VDE) has posted impressive gains.

Chart of the VDE ETF Product (Barchart)

The chart illustrates the VDE ETF at $117.22 was 51% above the 2021 closing level of $77.61 per share. VDE traded to a high of $130.35 in June before correcting, but the ETF remains a bright spot in an overall bearish equity market.

VDE holds a portfolio of winners this year

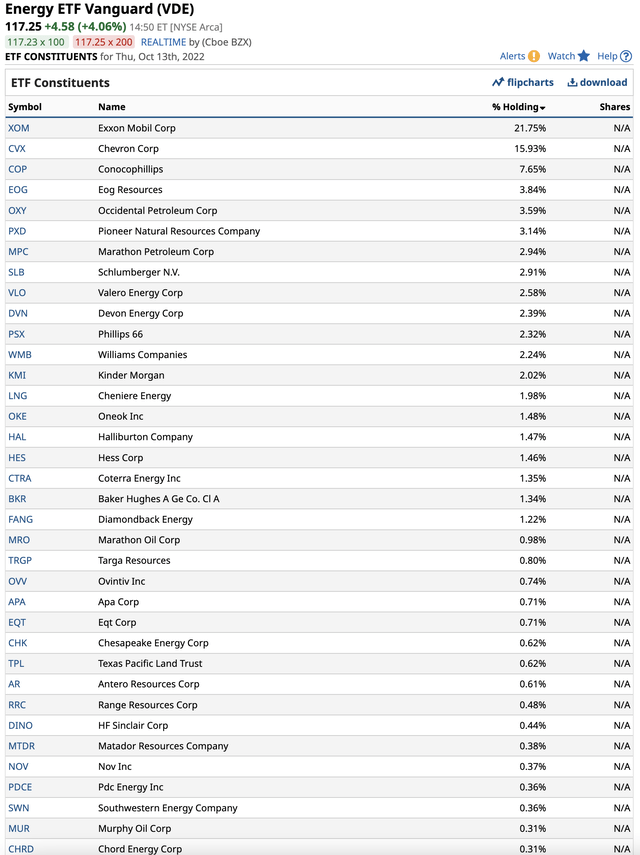

The top holdings of the VDE ETF include:

Top Holdings of the VDE ETF Product (Barchart)

VDE has a 37.68% exposure to the top two US oil companies, Exxon Mobil (XOM) and Chevron Corporation (CVX). The ETF also holds a diversified portfolio of refining, oil services, and natural gas companies. Energy has been the place to be in the stock market, and that trend is likely to continue as crude oil, natural gas, and coal prices remain at multi-year highs despite the recent price corrections. Energy prices in 2022 have turbocharged the traditional energy company’s earnings.

An attractive dividend and liquidity

At the $117.22 per share level, VDE had over $7.87 billion in assets under management. The highly liquid ETF trades over 1.057 million shares daily and charges a 0.10% management fee. Meanwhile, the blended dividend yield of VDE’s holding yields $4 per share or around a 3.4% above-market dividend, more than compensating for the management fee and paying shareholders an attractive yield while they wait for additional capital appreciation.

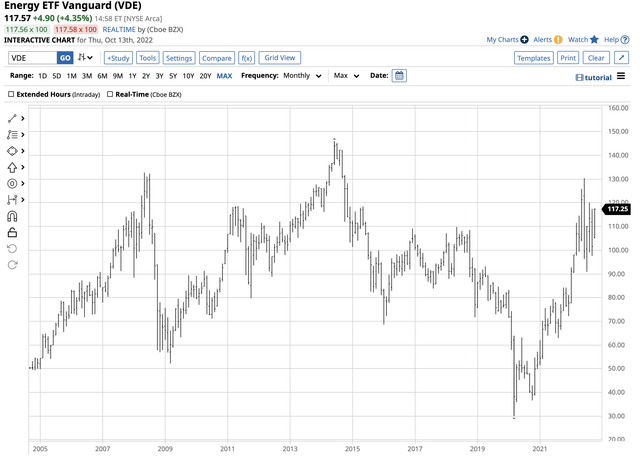

Long-Term Chart of the VDE ETF Product (Barchart)

The chart shows that VDE rose to a record high of $145.97 in June 2014. The first technical resistance level is at the June 2022, $130.35, but I believe VDE is heading for a challenge of the 2014 peak and a new record high over the coming weeks and months.

Three reasons for higher energy prices and a continuation of the bullish VDE trend

Three factors support gains in crude oil, natural gas, coal, and the companies that produce, refine, and service traditional energy commodities.

- US energy policy has passed the crude oil market’s pricing power back to the international cartel OPEC. As the US follows a greener path for energy production and consumption, oil and gas output has declined because of governmental roadblocks and an unfavorable environment for producers and refiners. Lower US output makes the world’s wealthiest economy dependent on foreign energy sources. After years of suffering from increasing shale production, the cartel is extracting a pound of flesh from US consumers with prices at the highest level in years.

- The US administration has responded to higher oil prices by releasing an unprecedented amount of crude oil from the US Strategic Petroleum Reserve. The SPR stood at 594.7 million barrels at the end of 2021. At 408.8 million barrels on Oct. 7, the SPY has declined 31.3% and stands at the lowest level since the mid-1980s. US releases will continue through November and the mid-term elections, but the one million barrel per day sales will end, likely supporting oil prices. Moreover, the US administration has said it plans to replace the SPR at prices below the $80 per barrel level, putting a floor under oil prices. Nearby NYMEX futures settled at $89.11 per barrel on Oct. 13, above the price where any purchases will occur.

- OPEC has a warm and fuzzy relationship with Russia. Since 2016, Russia has been a highly influential cartel non-member, with production policy decisions a function of negotiations between Riyadh, Saudi Arabia, and Moscow. The Russian oil minister was present at the recent OPEC meeting in Vienna, where the cartel cut production by two million barrels per day. Russia is using its oil and natural gas market position as an economic weapon against “unfriendly” countries supporting Ukraine. Russia, Saudi Arabia, and OPEC members should continue to push oil and gas prices higher and fill their coffers with the spoils.

An additional factor facing the crude oil market is China. As the world’s most populous country and second-leading economy emerge from COVID-19 lockdowns, oil, gas, and coal demand will likely explode, putting additional upward pressure on prices.

Meanwhile, US multinational oil and gas companies will go along for the bullish ride with Russia, Saudi Arabia, and other oil-producing countries as prices remain elevated. Traditional energy and the VDE ETF offer an oasis and substantial returns in an environment where the stock market is downright ugly. I’m a buyer of VDE on any pullbacks and expect the ETF to move to a new record high. Green energy may be the future, but in 2022, fossil fuels will continue to power the world.

Be the first to comment