Joaquin Corbalan/iStock via Getty Images

Investment Thesis

The Trade Desk (NASDAQ:TTD) is leading the charge in a world of advertising that’s increasingly looking for transparency. The company has grown into a true ad tech leader, and as digital advertising (and in particular connected TV) continues to take up a greater share of global advertising dollars, I think The Trade Desk is positioned to benefit immensely.

Connected TV has been an area in which The Trade Desk has excelled over the past few years, with CEO Jeff Green singing its praises in the Q2’22 earnings call:

I don’t know that we’ve ever experienced a secular tailwind like this before. CTV is evolving faster than anyone predicted. And if we continue to execute, I believe we will benefit as much as any company in the world from this tailwind, just like we did in Q2 and through most of the pandemic.

The opportunity within connected TV is becoming more and more obvious for digital advertising players, with the likes of Disney+ and Netflix announcing plans to operate ad-supported streaming services that should further fuel demand for programmatic advertising.

But it’s not just the streaming services themselves that are opening up to this switch. Advertisers that have previously relied heavily on traditional, linear TV are preparing for the huge shift to CTV – and this could become very apparent in the second half of 2022, as political ads start making their way onto a connected TV near you.

Political Ad Spending Ramps Up

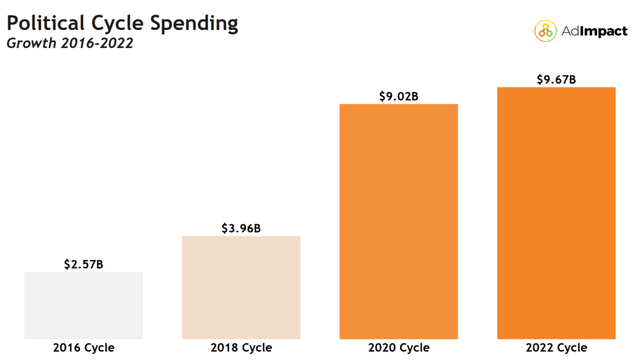

While the notion of in-your-face political advertising seems unusual to me (as someone who has lived in the U.K. for their entire life), election season is underway in the U.S and so too are the political ads. These midterm elections already are shaping up to be record breaking, with political ad spending expected to amount to more than $9.6 billion in 2022, according to AdImpact.

It’s already been a fairly bumper 2022 so far, even before the classic election season begins. According to Digiday:

This year’s midterm elections spending is on track to beat 2020, with the industry investing in streaming services and emerging platforms like TikTok.

As of July, the 2022 election cycle is already outpacing 2020 by around $700 million, according to AdImpact. In August alone, AdImpact reported a whopping increase of 203% in political spending as the raft of November elections draws closer. With research firm WARC this week warning of an economic slowdown that will remove some $90 billion of growth in the ad industry this year and next, there is a lot riding on this last quarter.

While local broadcast television still accounts for the majority of political advertising, digital ads on platforms like Facebook, Google and connected TV services are catching up. And with access to more services and fundraising tools, campaigns are now spending earlier than in past elections and contributing to a bigger total spend.

This could be the boost that advertisers need in a year where ad budgets have been hit due to the tough economic climate, but in 2022 there’s going to be a particular focus on political advertising via connected TVs – which just so happens to be The Trade Desk’s fastest-growing segment.

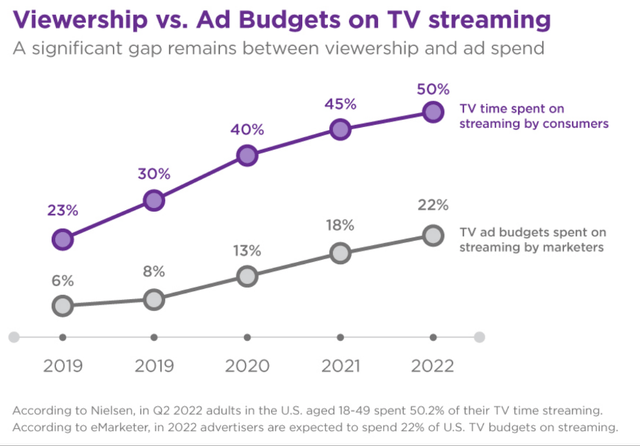

The Rise Of Streaming

I think it’s fair to say that streaming is not necessarily an “up and coming” technology anymore. It still has plenty of room to grow, but in Q2 of 2022 U.S. consumers aged 18-49 spent more than half of their TV time streaming. The most exciting part of this for investors in The Trade Desk is the fact that only 22% of TV advertising budgets were spent on streaming in H1’22, leaving plenty of room for growth in the future as the gap between ad spend and viewership closes up.

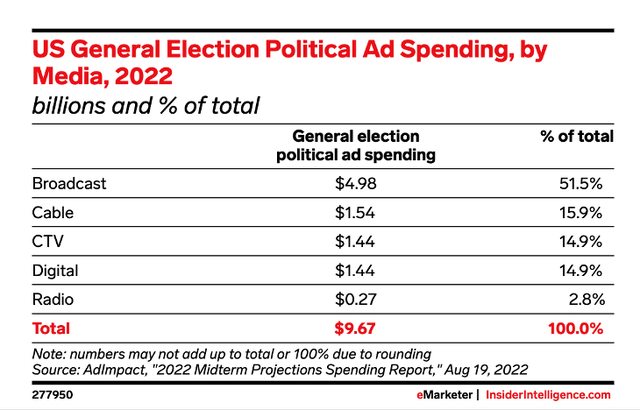

While streaming itself may not seem overly “growthy” at the minute (just ask Netflix (NFLX) shareholders), the advertising shift from linear to connected TV remains a secular trend that still has a long way to go – and I expect that we will see this shift continue when it comes to political advertising. In fact, eMarketer expects CTV to make up 14.9% of all political ad spending in the 2022 election, totaling $1.44 billion.

eMarketer / Insider Intelligence

Yet these numbers only tell half the story, as Insider Intelligence highlights just how much growth in CTV this would represent:

Political advertisers increased their spending on CTV devices by 1500% in the first half of 2022 compared with the same period in 2020, according to Basis Technologies, which handles programmatic ads for political campaigns. Our own CTV advertising forecast expects overall 2022 growth over 2020 to “only” be 109%, meaning that political advertising is heavily over-indexing on CTV.

The percentage of spending flowing to CTV this fall is expected to increase even further as target audiences broaden as the general election approaches and budgets grow.

It seems clear that CTV is going to be a new part of the political advertising landscape for years to come, but there’s some even better news for The Trade Desk. I have long believed that this company’s commitment to an open internet vs the “walled gardens” of Google (GOOG) (GOOGL) and Facebook (META) would be a long-term benefit, and this thesis appears to be playing out. Insider Intelligence highlights further that programmatic advertising leaders such as The Trade Desk and Microsoft’s Xandr (MSFT) are seeing “an influx in political advertisements” as a result of the crackdown on Big Tech platforms following the 2020 election.

But just how good could this election cycle be for The Trade Desk? Let’s take a look at the figures from previous cycles to try and get an idea.

A Boost For The Trade Desk

2022 is shaping up to be a pretty horrible year for advertisers, with the likes of Roku (ROKU), Snap (SNAP), and Meta faltering in their Q2 results. Yet there was one company, once again, that continued to defy the odds – of course, I’m talking about The Trade Desk. It produced stellar results in Q2, but with a macroeconomic environment that doesn’t appear to be getting much better, how does the rest of the year look?

Well, as you’ve probably guessed by now, I think The Trade Desk should see a substantial boost from political advertising in the US midterms – the big question now is – exactly how much of a boost? Let’s take a look at how it has performed in recent election years.

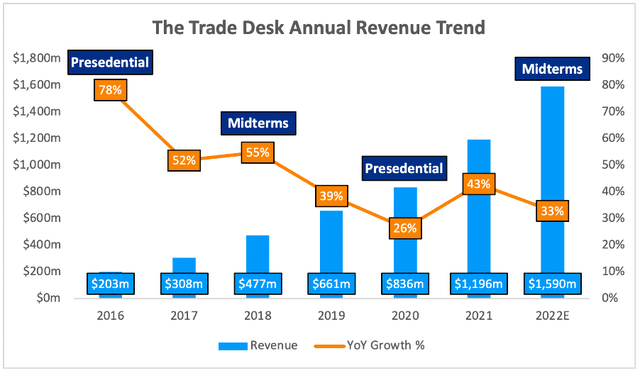

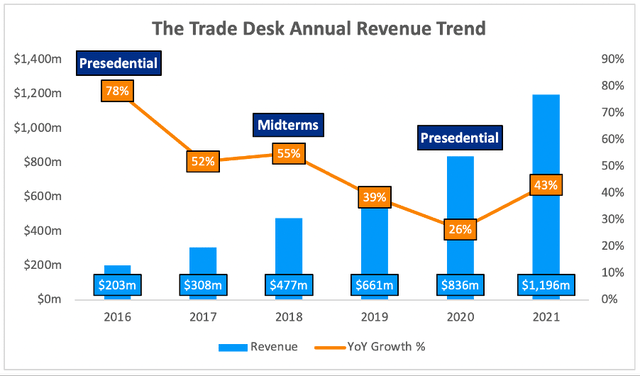

The 78% YoY growth in 2016 was phenomenal, and we also can see in 2018 that YoY growth accelerated from 52% to 55% during a midterm election year. These years both imply that The Trade Desk has historically got a nice boost courtesy of political ad spend, but 2020 showed a real slowdown in YoY growth despite is being the biggest year on record for political advertising – so what happened? COVID happened.

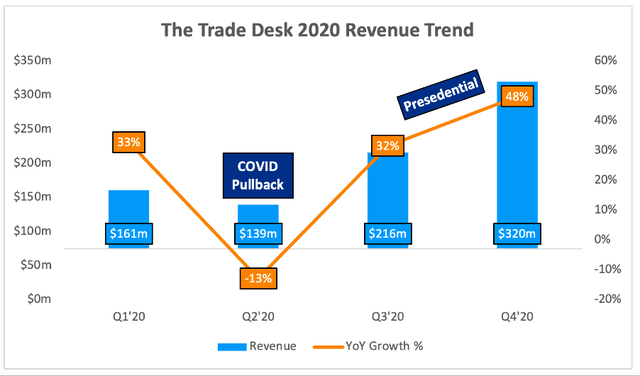

Diving further into these 2020 revenue growth rates, we can see that there was a huge fall in revenue in Q2’20 – which should come as a surprise to nobody. Q2’20 was the peak of the first lockdowns, where businesses, governments, and, hey, pretty much everyone had no idea exactly how the world was going to cope with a pandemic.

Yet as we became more accustomed to Zoom calls and “the new normal,” industries started to open back up and advertising started to return. Looking under the hood, we can see that The Trade Desk experienced 48% YoY growth in Q4’20, the peak quarter for spending in the presidential election. CFO Blake Grayson kindly spelled out the impact of this political ad spend on the Q4 2020 earnings call.

And finally, as you can imagine, we had strong US political spend during the quarter. In Q4, political spend represented a high single digit percent share of our spend. For the full year 2020, political spend represented a mid-single digit percent share of our spend.

We can see how political advertising spend has always been a positive for The Trade Desk, but combined with the expected tailwinds in CTV, could the 2022 elections provide an even more substantial boost?

A Positive Surprise On The Horizon?

I’m now wondering whether or not analysts and Mr. Market are giving The Trade Desk enough credit for the potential tailwinds of political advertisers fully embracing CTV. To try and get an idea, I’ve added in an additional column to the previous graph, which includes analysts’ estimates for The Trade Desk’s FY22 revenues according to Seeking Alpha.

The Trade Desk / Seeking Alpha / Excel

It looks like analysts are expecting 2022 to deliver 33% YoY growth vs. the 43% YoY growth achieved in 2021. The albeit brief history of The Trade Desk shows that these election years tend to outperform the years either side of it, and so it’s surprising to see such a slowdown from 2021 to 2022. Yet 2022 is a very different year, with the economy reversing course and entering a recession, which in turn has led to a difficult environment for advertisers.

With so much macroeconomic negativity, I can understand why the expectations are for “only” 33% YoY growth – there have been several companies who benefited from a digital boom in 2021 that are now seeing negative growth rates in 2022. Drilling down even further, this 33% growth figure implies that The Trade Desk will see YoY growth of 29% in H2’22 – despite it being an election year full of tailwinds that should help The Trade Desk.

Part of the reason for these conservative expectations could be CFO Blake Grayson’s comments on the Q2 earnings call, particularly his note that political ad spend will only make up a low single-digit percentage of total Q3 spend:

And then with regards to your question on political, in the midterms, the spend will occur much closer to Election Day than we might find in a presidential year, like we expect to see that start ramping here over the late summer. I would say through November, there’s so many races out there that are going to be competitive, and we’ll just have to see how competitive, whether it’s the House the Senate, governor campaigns or whatnot. I think that our overall expectation, and is that the in Q3, we expected to be a low single-digit percentage spend in Q3.

The Trade Desk is known for continually beating its own guidance, so I for one would not be surprised if Grayson is somewhat understating the potential impact of political ad spending in Q3 – and regardless, Q4 is likely to be the peak for political advertisers.

Another reason to believe that political ad spend could provide a greater-than-expected boost is a classic supply and demand issue: Advertisers want to reach this huge and growing audience of streamers, but there is a limited amount of ad inventory. According to Protocol:

Limited inventory is likely to drive up prices for streaming ads, which could have ripple effects on non-political advertisers. “I expect that we are going to see some surges in really competitive bidding in connected TV, particularly in states with competitive, high-profile races,” Briscoe said.

Given that one of the ways The Trade Desk generates revenue is by charging clients a platform fee based on a percentage of a client’s total spend on advertising, higher ad prices = higher spend = higher fees = more revenue for The Trade Desk = happy investor.

Bottom Line

I always have believed The Trade Desk to be a high-quality business, and nothing demonstrated this more clearly than its ability to produce stellar Q2’22 results in a challenging macroeconomic environment. The company has always been able to take headwinds in its stride, while successfully capitalizing on all the tailwinds blowing it forward.

I believe that the shift toward connected TV for political advertisements will pave the way for a strong end to 2022 for The Trade Desk, and I think this is currently being (at least partially) overlooked by the market.

Unfortunately, I don’t possess a crystal ball, and cannot predict the future – but there are so many signs implying that these secular tailwinds will drive The Trade Desk onto further success during this election period. Some may be worried about these upcoming results due to the impact of a recession on advertisers, but I for one am excited to see just how much benefit The Trade Desk will see from a political advertising landscape that is undergoing a huge shift to connected TV.

Be the first to comment