wsmahar

How we got to here – Our calls

Back in June, we called a peak for the US 10yr yield when it hit 3.5%. We premised this on quite a rapid change in the structure of the curve, where the 5yr moved from a state of trading quite cheap to the curve to one where it traded outright rich. That switch is a classic turning point signal. And it worked. The 10yr shot back down towards 2.5%.

As it approached 2.5%, we argued that it should not break any lower, and in fact called for it to turn higher, and for it to re-target 3%. The rationale was that the 10yr yield should not trade too far through the funds rate, at least until the funds rate had actually peaked.

Along that journey back towards 3%, we also noted that the prior fall in market rates (and tighter credit spreads) had loosened financial conditions far too much, which laid the groundwork for a subsequent break back above 3%.

And since then, we consolidated this view against a backdrop where evidence began to grow that the US economy was refusing to lie down (re-firming of many macro data through July and August) and called for a re-hit of 3.5%. This has been topped off by an August CPI reading that shows US inflation still running with a solid 8% handle, down but not by enough.

Where now? We’re suggesting 3.75% (highest since 2011).

If the funds rate gets to 4.25%, the 10yr is heading to 3.75%

The combination of financial conditions not being tight enough and the resoluteness of stubbornly robust US macro conditions (excluding the housing market) places pressure on the Federal Reserve to continue to tighten rates. The market discount now has the funds rate hitting 4.25%. That same discount was 3.5% about a month ago. And even though we’ve had a notable elevation in the market discount, the risk remains that the market continues to edge the likely terminal rate higher still.

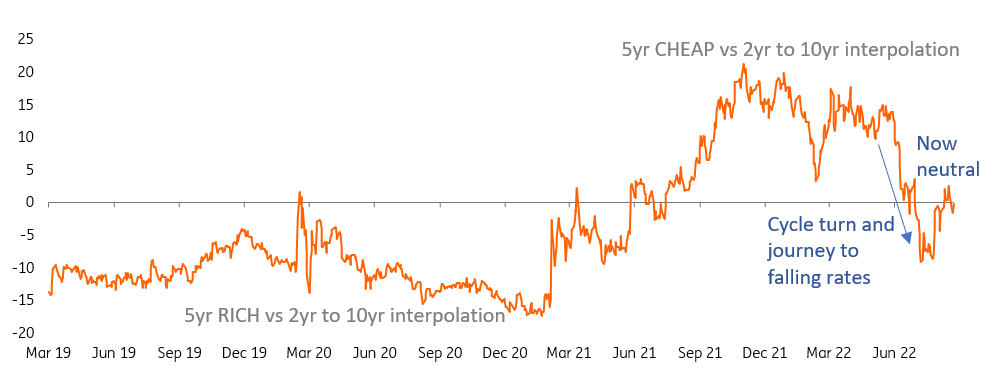

The 5yr Is Now Neutral To The Curve (bp) – No Particular Signal Here (Macrobond, ING estimates)

For bonds, this is crucial. The messaging from the curve structure, which sees the 5yr currently trading neutral to the curve, is not pointing in any particular direction (chart above).

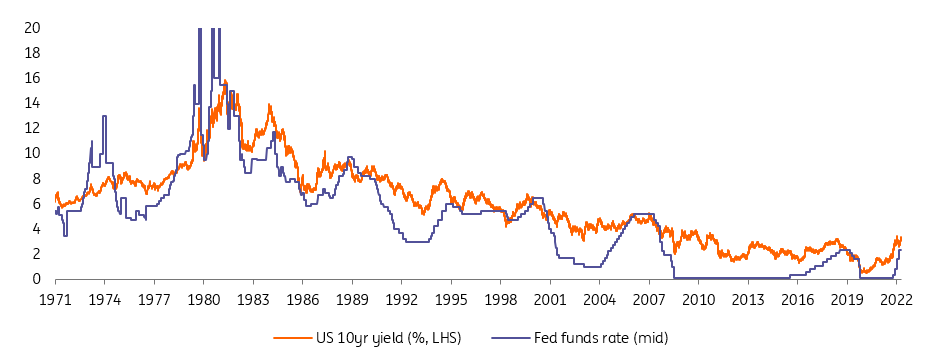

So, we look at the funds rate for key guidance. If the funds rate gets to 4.25%, in all probability the 10yr Treasury yield heads for 3.75%. At 50bp through the funds rate, there is room for it to get higher. It just depends on the conviction the market attaches to the funds rate getting to above 4%. The 10yr Treasury yield can trade through the funds rate at this phase of the cycle, but not by more than 50bp (chart below).

Direction Comes From Terminal Funds Rate Discount – And That’s Still Up (Macrobond, ING estimates)

And in fact, anything more than 25bp through for the 10yr Treasury yield versus the funds rate has been unusual historically. Once the peak for the funds rate is in, then the 10yr yield can sail up to 150bp through the funds rate. But we need to see the peak first, and the market can’t say with certainty that the 4% area will be the peak.

So we need the actual peak to be delivered before we can say for sure that the peak is in. That’s what keeps the pressure up.

What about 4%? We need more to call for that

That would suggest that a funds rate peaking at 4% or higher can easily drag the 10yr yield up to 3.75% (a level last seen in 2011).

And what about the possibility of a 4% handle for the 10yr Treasury yield? It’s possible, but not probable based on what we know. We look to the virtual collapse in the 2yr breakeven inflation rate in recent months (albeit up post CPI) as evidence that the inflation battle can be won, as the market thinks it will be. That’s in the 2.5% area, which can help at the very least tame any potential route towards 4%.

Hence, 3.5-3.75% is our target range for the 10yr Treasury yield.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment