Gotta keep that Yellow Piggy Bank safe. If investing in IVR, seems like the preferreds are the way do that.

stockfour/iStock via Getty Images

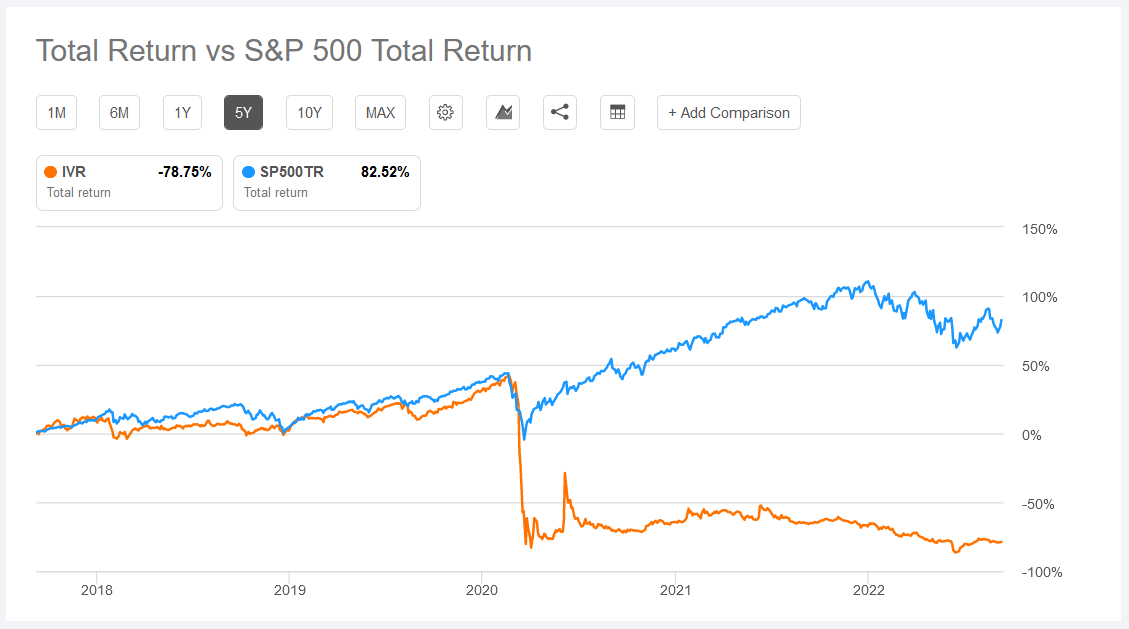

Invesco Mortgage Capital (NYSE:NYSE:IVR) is a mortgage based real estate investment trust (mREIT) which has been hammered in the last few years. The stock price has fallen from a high of $157 in February 2020 to $15.63 today which is a 90% decline. Historically the company has paid out a large number of dividends so total returns are more instructive. According to data from Seeking Alpha, the total returns for IVR haven’t been great either with five-year total returns at -78.75%.

Seeking Alpha

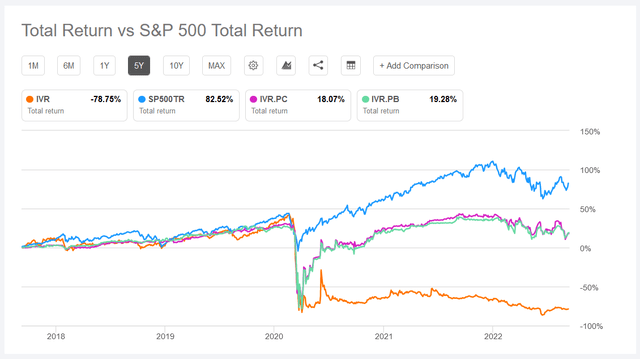

Fortunately there’s a better way for dividend seekers to protect their capital and invest in IVR if they are interested: their preferred shares. The company has two fixed-to-floating preferred shares outstanding, the Series B (IVR.PB) and the Series C (NYSE:NYSE:IVR.PC). Over the same period the preferred shares at least generated a positive total return though notably trailed the S&P 500.

Seeking Alpha

The short version of this article is that investing in IVR preferred seems safer than investing in IVR directly. Let’s turn to the company and history to understand a bit of why that is.

Invesco Mortgage Capital Overview and Capital Stack

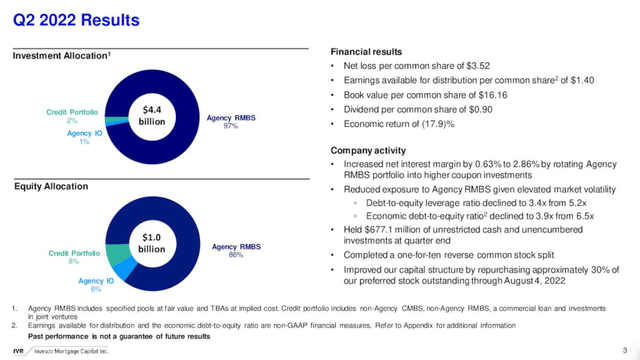

As an mREIT IVR seeks to generate profits through net interest margin on their investment portfolio primarily focused on agency residential mortgage backed securities (RMBS). We can see from the latest quarter that the company’s investment allocation is 97% focused in these agency RMBS.

IVR Q2’22 Earnings Presentation

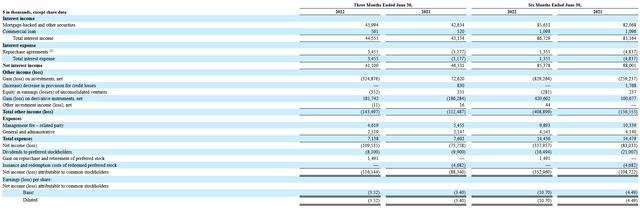

These types of companies typically have high leverage as a means to generate greater interest income between the spread of debt rates and investable securities’ rates. We can see that IVR is no different with a debt-to-equity ratio of 3.4x. Net interest margin of 2.86% gives one data point into profitability though if we take a look at the income statement from the last quarter we can learn a bit more detail.

IVR Q2’22 10-Q

From this we can observe that for each period referenced the company actually generated positive net interest income and yet negative net income due to losses in other income. We can also observe that the preferred dividends are covered by interest income. It seems the company’s hedging strategies generate significant losses for them.

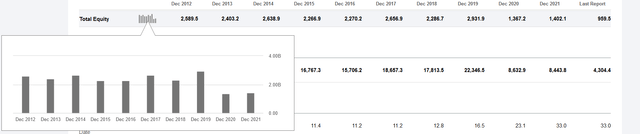

The result of consistent negative net income: equity value destruction. If we look at total equity value over time we can see it has declined significantly from 2019 when it was at $2,931m to the latest quarterly value of $959.5m. That’s a 67% decline in total equity value.

Seeking Alpha

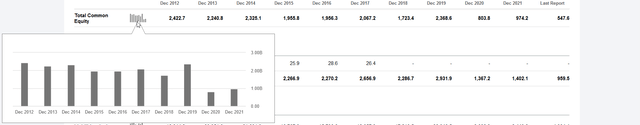

But it’s even worse if we consider the common share equity value over that time period.

Seeking Alpha

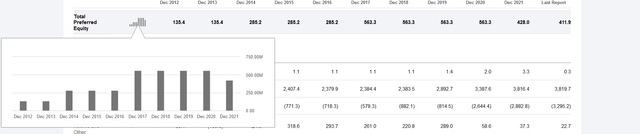

Here we can see that from 2019 common share equity value has declined 76.8%. We can see that the preferred equity value has been constant for that last couple of years at $563.3m.

Seeking Alpha

The recent decline in preferred equity value is because the company has been repurchasing preferred shares on the market with a program initiated in May 2022. As of their most recent quarterly earnings press release they have repurchased 30% of preferred shares at this point. With $677.1m in cash and liquid investments the company could choose to repurchase all of their preferred shares tomorrow if they so choose which would eliminate their dividend expense which was $37.795m in 2021.

What this would enable for management is more flexibility in dividend distribution for the common shares as well as eliminate the interest rate risk built into their fixed-to-floating preferred shares. It seems to me that the company’s strategy is to buy as much of their preferreds below par on the market as they can which is immediately earnings-accretive for the company.

Let’s turn to the preferred shares directly and a comparison between the two and the common shares.

IVR Preferred Shares and Dividend Yields

Many investors in IVR may be attracted to historical high dividend yield, which currently sits at 22.53%. Management actually raised the dividend by 2.8% in the last quarter which seems rather bold to me on the back of consistent net losses. With $677.1m in liquidity at the moment and a sizable loan book, the company is not going bankrupt immediately without some shock to the RMBS market.

We could have a debate about whether or not that dividend is sustainable. Given what I’ve shared above regarding yearly net losses and declining common equity value over time, I think it’s unlikely that this dividend is sustainable. In a capital crunch situation the first dividend to be cut would be the commons. As a REIT they can manage their dividend requirements by paying out through their preferreds first and then offering whatever payout target they must hit through the commons.

Regardless, if you are interested in chasing 22.53% yield, be aware that this comes with likely capital losses built in with the common position. Total return may be lower.

Rather than chase yield with the common shares I think dividend investors get a much safer return with the preferred shares. Let’s look at a comparison table of the three securities.

|

Price |

Dividend Yield |

Shares Outstanding (m) |

Average Volume |

Call Date |

|

|

IVR |

$15.45 |

22.53% |

33.024 |

597,500 |

N/A |

|

IVR.PB |

$20.80 |

9.21% |

4.537 |

28,600 |

12/27/2024 |

|

IVR.PC |

$19.98 |

9.27% |

7.817 |

82,200 |

9/27/2027 |

With IVR you get a high dividend yield and a high risk of capital loss. Both of the preferreds have healthy dividends and offer possible capital gains if they revert to par. Management accelerated repurchases after the quarterly date and disclosed in the 10-Q “Between July 1, 2022 and August 4, 2022, we repurchased 1,618,546 shares of our Series B Preferred Stock for $35.0 million and 3,063,389 shares of our Series C Preferred Stock for $65.6 million.” The shares outstanding number in the table is adjusted for these repurchases already.

The repurchase program is authorized for an additional 1,337,634 shares of IVR.PB and 1,316,470 shares of IVR.PC. If one believes that IVR a couple years down the line will still be around generating interest income then these preferred shares are likely worth par value. And as repurchases are done the value of these preferred shares are actually more secure in the capital stack. Both preferreds have taken a nosedive since August, so I suspect it’s likely the company has or will be executing the rest of their repurchase program.

So if one is invested in IVR common stock I think it’s perhaps a no brainer here to reallocate that position to either of the preferreds over the next year or so. As the repurchase is executed the dividend expenses will roll off the income statement which should help profitability. If the preferred shares continue to trade at a meaningful discount to par it’s possible that management could institute another repurchase program.

So the mechanics seem there for the preferreds to at least hold their value if not appreciate while receiving the dividend. The common stock may decline along with a continuing trend of book value destruction. I think a good strategy would be to switch from IVR to either of the preferreds until the repurchases are complete and start to show in their income statement. Then perhaps is a moment to revisit whether an allocation to their preferreds or the common is a better risk-reward setup.

A final note with regard to the preferreds is that both are fixed-to-floating rates, meaning when their call date comes along these shares are impacted by interest rates. If interest rates remain high into 2024, for instance, it’s possible that the yield on IVR.PB would jump meaningfully. After call, the yield is determined by 3-month LIBOR plus 5.18%. Current 3-month LIBOR is 3.17% which would total a 8.35% on par value which translates to $2.09 annually. That would imply a 10% yield on IVR.PB at current prices.

Final Thoughts

For full disclosure, I do not have a position here in the common or the preferreds. Nor am I particularly interested in establishing a position either. The reason being is what I highlighted above: a history of equity destruction.

Despite that I thought it was worth writing up this reflection given there are those who are invested in IVR and from my analysis it seems like a tactical reallocation to the preferred is warranted for those invested.

The company has a history of declining stock equity value which has caused IVR stock price to decline and I suspect this will continue. Despite this the company has enough liquidity on hand to repurchase all of the preferreds which gives some support.

Be the first to comment