MoMo Productions

Co-produced with “Hidden Opportunities”

Living off dividends means your portfolio generates a passive income stream that can cover your expenses “indefinitely.” When I say passive, I mean requiring no effort on your part. Dividend-paying securities make recurring payments into your account like clockwork. That means no more working towards earning a paycheck or worrying about your portfolio’s fluctuating value. The key is to keep those dividends rolling in sustainably.

Let me demonstrate the power of compounding with an example.

Suppose you invest $10,000 in your 10-year-old’s account and choose a basket of securities yielding 7%. And you make a $10 monthly addition to this portfolio and set the dividends to reinvest. By the time your child is 60, this portfolio will be producing over $25,000 annually. I am sure you have serious questions about the effects of inflation and the actual value of that future income – but remember that this simulation is only with a $10 monthly addition. It is fair to assume that a working adult can invest more to grow this portfolio and achieve inflation-beating returns.

The power of dividends through the effects of compounding is often misunderstood or ignored by the average investor. A diversified portfolio of dividend payers will keep you cash-flow rich through thick and thin economic conditions and lets you ignore everyday market sentiment and avoid emotional mistakes. After all, why sell something that pays you handsomely every month just because the broader market is bleeding?

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t… pays it. – Albert Einstein

I am living the retirement dream with big dividends from my carefully crafted portfolio. You can do the same; we have two picks with up to 11% yields to get you started.

Pick #1: SLRC – Yield 11.3%

Business Development Companies (‘BDC’) are critical pieces of the U.S. economy as they provide debt and equity financing to middle-market companies. The middle market loan market consists of over 200,000 private businesses in the U.S. that make up roughly one-third of the GDP. Today, we will discuss SLR Investment Corp. (SLRC), an investment-grade rated BDC with unique lending strategies that provide operational robustness during market volatility and economic contraction.

SLRC maintains a carefully crafted and highly diversified portfolio of 135 companies across 44 industries. The BDC maintains a strong funding profile to weather a rising rate environment, with a largely fixed-rate debt profile and a significant floating-rate investment portfolio:

$566 million of our $1.2 billion of funded debt comprised of senior unsecured fixed rate notes at a weighted average annual interest rate of 3.9%. 97.6% of our comprehensive investment portfolio was comprised of first lien senior secured floating rate loans, which provide greater downturn protection during a recession. – Q3 Conference Call Transcript

Let’s examine SLRC’s lending divisions which outline the unique characteristics of this BDC.

-

Sponsor Financing (30% of the investment portfolio) – This unit makes cash-flow loans to upper mid-market companies in non-cyclical industries. The most significant industry exposures are healthcare and diversified financials.

-

Asset-based loans (32% of the investment portfolio) – This division provides collateral-backed loans to asset-rich companies. Historically, this business has outperformed during volatile markets and recessions. Rising rates are pressuring asset-rich borrowers with strong cash flows but slowing demand. They are raising capital backed using their liquid assets, and SLRC plays a vital role in helping these companies navigate challenging economic conditions.

-

Life science loans (16% of the investment portfolio) involve loans made to borrowers with significant equity cushions with solid venture capital equity backing. SLRC makes these loans to venture capital-backed late-stage drug and medical device development companies. The healthcare sector is largely uncorrelated with economic cycles since the demand for lifesaving treatments and drugs doesn’t decline during recessions.

-

Equipment finance (22% of the investment portfolio) – This division makes senior secured financing arrangements collateralized by mission control equipment for investment-grade customers across industry types.

SLR Equipment Financing

At the end of Q3, 99.8% of SLRC’s portfolio consisted of senior secured loans- 97.6% in first-lien loans, 0.2% in second-lien cash flow loans, and 2% in second-lien asset-based loans. This means the BDC has access to mission-critical assets that will compel the underlying companies to make good on their debt obligations to stay in business.

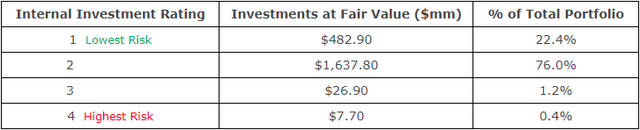

SLRC is executing well in this rising rate environment. Its weighted average asset level yield was 11.3% (up from 9.6% at the end of Q2), and the firm’s internal investment rating reveals that 98.4% of the loans carry a lower risk profile. (Source: Q3 Financial Results)

SLRC Earnings Report

SLRC merged with SUNS earlier this year, and management reports that a quicker realization of synergies, portfolio growth, rising interest rates, and stable portfolio quality are leading them to achieve annual distribution coverage from NII faster than expected. With leverage of 1.14x net debt-to-equity (well within SLRC’s target leverage range of 0.9x to 1.25x), the firm maintains adequate liquidity to fund new opportunities to boost investment income.

If interest rates were to move another 100 basis points higher, we would expect the portfolio on September 30, 2022, to generate incremental net investment income of $0.12 per share on an annualized basis – Q3 Conference Call Transcript

SLRC pays monthly distributions calculating an 11.3% annualized yield. The BDC trades at a massive 25% discount to NAV, and management announced a $50 million share repurchase program to take advantage of the market mispricing. Notably, the SLR team owns approximately 8% of the company’s stock and has a significant percentage of its annual incentives invested in SLRC. Contrary to main street’s opinion, SLRC’s portfolio companies are better-positioned to weather recessions and stay current on their debt obligations.

BDCs are regulated entities that sprung up from regulations originating back to the great depression. While the laws have evolved, the core intent remains to help the economy recover from recessions and related economic pressures. With high exposure to floating-rate investments and fixed-rate debt, SLRC is well-positioned to excel in this rising rate environment. An 11.3% yield is up for grabs from this strongly executing, deeply discounted, and highly misunderstood BDC.

Pick #2: EVA – Yield 6%

Enviva Inc. (EVA) is the world’s largest producer of industrial wood pellets. Money actually grows on trees for EVA as these wood pellets are a renewable and sustainable energy source produced by aggregating wood fiber and processing it into a transportable form.

The diagram below shows the lifecycle of EVA’s operations from sourcing to shipping. (Source: EVA August 2022 Investor Presentation)

Enviva August 2022 Investor Presentation

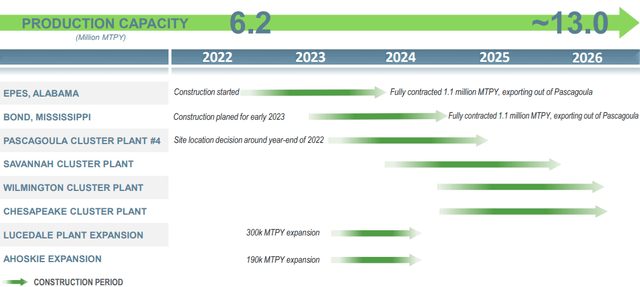

EVA owns and operates ten plants with a combined production capacity of ~6.2 million metric tons per year. These plants are located strategically in Virginia, North Carolina, South Carolina, Georgia, Florida, and Mississippi, and EVA is constructing its eleventh plant in Epes, Alabama. It doesn’t stop there – the company has plans to build five more plants and undertake expansion efforts in two existing plants in the next four years. With this expansion pipeline, EVA’s production capacity is set to double by 2026.

Enviva August 2022 Investor Presentation

EVA runs a fully contracted business governed by long-term take-or-pay contracts with an impressive contracted revenue backlog of over $21 billion and a contract-weighted average remaining term of 14 years. Due to its market leadership in a high-demand industry, EVA maintains high-profit margins, notably 75.4% Adj. Gross Margin for Q3 2022. At the midpoint, EVA projects a 10% YoY EBITDA increase for 2022.

EVA is a strong dividend grower, with continuous annual raises since its 2015 IPO. The company’s $3.62 dividend for 2022 is an 11% YoY increase and calculates to a healthy 6% yield. The company’s guidance for the fiscal year indicates 1.1x coverage for this dividend. EVA is still in its growth stages and continues to build its additional facilities to ramp up production and cater to the growing demand. The company is targeting a long-term dividend coverage ratio of 1.5x, which they expect to achieve by 2025.

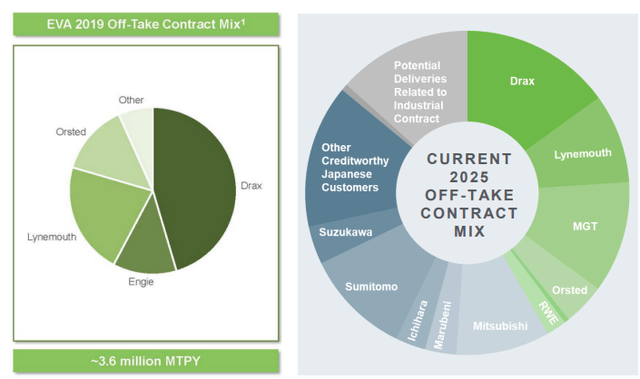

Over the years, there has been a substantial improvement in the diversification of EVA’s customer base. In 2019, a few major customers purchased a significant percentage of EVA’s total delivery volumes. The company continues to diversify by customer and geography, and projects no single customer to constitute more than 15% of the total delivery volume by 2025.

Enviva Investor Presentations

EVA is no longer a K-1 issuing partnership. Investors must note that the company completed its restructuring to a C-Corp last year and is a 1099 issuer as of January 1, 2022.

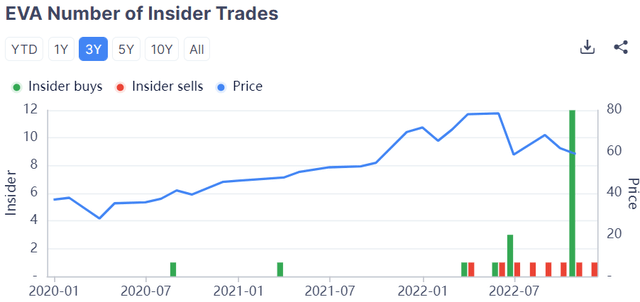

Blue Orca published a short thesis on EVA in October, resulting in Mr. Market’s knee-jerk reaction. In addition to providing a formal response refuting the allegations, EVA insiders are taking advantage of the drop by loading up on the shares of this wide-moat business. (Source: gurufocus)

Gurufocus

Decarbonization continues to be a priority for developed nations, and the demand for wood pellets for heat and power generation is projected to increase by ~90% in the next ten years. EVA is the world’s largest producer of wood pellets and maintains long-term contracts with credit-worthy customers. We like EVA for its competitive advantage, dividend friendliness, growth prospects, and highly profitable business model. Make your income grow on trees with the 6% yielding EVA in your portfolio.

Conclusion

Time is more valuable than money. Even the wealthiest person on earth cannot buy half a second more. This is why we insist that investors of all ages prioritize passive income building. You spend most of your adult life working hard to earn a living. But there is a point in your life when you want to take a small step back from work and spend more of your time in more fulfilling ways. This is why making your portfolio work harder than you do is critical.

Don’t let these paychecks from work hold you back from your dreams. Passive income has proven to supplement your income and eventually get you ready to retire on your terms. At HDO, we maintain a comprehensive portfolio of equities, preferred stocks, and baby bonds with a +9% average yield. Here we offered two picks with up to 11% yields to enable your dream retirement from your hard-working portfolio.

Be the first to comment