G0d4ather

As my followers know, Broadcom (NASDAQ:AVGO) is – and has been – my favorite semiconductor company based on its competitive advantage in high-speed networking, its long-term track record of generating strong free cash flow and dividend growth, and CEO Hock Tan’s ability to organically grow the company while making relatively large strategic acquisitions to grow the company via M&A as well. All of those characteristics continue to be on display this year. Today, I will take a look at the upcoming Q4 report due out Thursday and explain why Broadcom – which is currently trading at only 13x forward earnings while yielding 3% on its $16.40/share annual dividend – represents tremendous value. Broadcom is a buy.

Investment Thesis

Apple (AAPL) still accounts for a large percentage of Broadcom sales. According to the 2021 10-K Filing, Broadcom reported that aggregate sales to Apple, through all channels, were estimated to account for ~20% of net revenue in FY2021. But that’s not a reason to worry. In fact, just the opposite. I say that because – for those of you who remember – some years back Apple was being so tough in negotiations with Broadcom that CEO Hock Tan threatened to completely exit the business. That appears to have really gotten Apple CEO Tim Cook’s attention, and the next thing you know contracts were quietly signed and Hock Tan brushed off his earlier comments about exiting the business. Point being: Tan likely achieved the contract margin he desired out of that business.

However, that is not the primary investment thesis in Broadcom. In my opinion, the backbone of Broadcom is its high-speed networking development platform (both hardware & software). This is the key component of Broadcom’s success in its semiconductor solutions segment.

For instance, listen to Hock Tan talk about Broadcom’s leading-edge high-speed networking switch on the company’s Q3 conference call in September:

In mid-August, Broadcom announced the Tomahawk 5 switch series, providing 51.2 terabit per second of Ethernet switching capacity in a single monolithic device, double the bandwidth of any other switch silicon available in the market today. We also announced the industry’s first silicon photonics co-packaged with the Tomahawk, which will enable a new benchmark for low power, and extend our leadership and innovation in hyperscale data centers.

Later on the conference call, Tan said he expects the Networking Segment will be up 30% year-over-year in Q4.

But this is not a short-term trend. As Tan pointed out, Broadcom is still selling previous generation Tomahawk 1, 2, 3, products. The Tomahawk 4 was estimated to be less than 30% of sales in Q3. The point is that these products coexist while customers migrate over time to the latest technology. So, by the time Broadcom announces Tomahawk 6 availability (an estimated two years from now), the company will likely only just be getting to the point where Tomahawk 1 will be phased out.

It’s this very strong pipeline of high-speed networking products that always keeps Broadcom a step-ahead of the competition (or perhaps even two steps…). And, of course, in the technology sector – and especially in an area as critical as high-speed networking – it is the leading-edge highest-performance products that achieve the highest margin.

For Q3, networking revenue was a record $2.3 billion – up 30% yoy and 35% of Broadcom’s total Semiconductor Segment revenue – which was $6.6 billion, +32% yoy. Overall, gross margin was 76% of revenue – up 80 basis points year-on-year. This, when much of the semiconductor industry is suffering lower revenue and lower margin. Clearly, Broadcom is a leader in the sector.

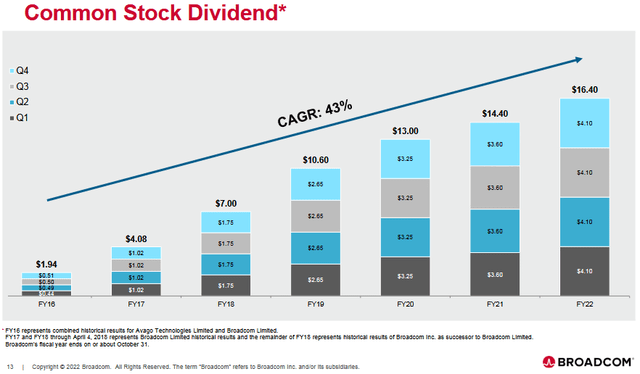

Free-cash-flow in Q3 was $4.3 billion – a whopping 51% of total revenue of $8.46 billion (+25% yoy). This is the primary investment thesis for Broadcom: Strong product innovation and pipelines, high margin products, and outstanding free cash flow generation. The result is excellent shareholder returns. The slide below was taken from Broadcom’s most recent September Presentation, and displays how Broadcom has been one of the best dividend growth stocks in the entire S&P 500 since 2016: growing the annual dividend from $1.94 to $16.40/share, for a 43% CAGR:

Broadcom

Share Buybacks

In Q3, Broadcom continued to use its excellent FCF to also buy back shares under a $10 billion share buyback program that was initiated in December of last year. In Q3, 3.2 million shares were repurchased for $1.5 billion. That averages out to an estimated $468/share. At pixel time, the current share price is $528 – indicating the share buybacks were an excellent use of shareholder capital during the quarter.

The Q3 buybacks followed buybacks of $2.7 billion in Q1 and $2.8 billion in Q2. In aggregate, over the first three quarters of FY22, Broadcom has spent $7 billion on buybacks meaning there is likely ~$3 billion left on the share repurchase program. However, note that Broadcom has not repurchased any shares since the company announced the pending acquisition of VMware (VMW) because repurchases are subject to regulatory rules. However, Hock Tan assured shareholders that AVGO will continue buybacks “as soon as we can under SEC rules.” Regardless, the stoppage of share buyback due to the VMWare acquisition was one reason Broadcom had almost $10 billion in cash at the end of Q3, up ~$1 billion from the end of the prior quarter.

Q4 Expectations

On the Q3 conference call referenced earlier, Hock Tan gave revenue guidance for Q4, including:

- Networking Segment revenue is expected to be up 30% yoy in Q4 (35% of total semiconductor solutions revenue in Q3).

- Wireless revenue (25% of semiconductor revenue in Q3) is expected to be seasonally up 20% sequentially and grow 10% year-on-year in Q4.

- Broadband revenue (17% of semiconductor revenue in Q3 and +20% yoy) is expected to grow above 20% yoy.

- Industrial resales are expected to rebound to high single-digit growth yoy (sales in Q3 were $244 million, -4% yoy, reflecting weakness in China but partially offset by continued strength in the U.S. and Europe).

- Infrastructure software (in Q3, revenue was $1.8 billion, +5% yoy, and 22% of total revenue) is expected to have “mid-single-digit percentage growth year-over-year.”

Note that Broadcom’s largest semiconductor solutions segments – Networking, Wireless, and Broadband, which in aggregate accounted for 77% of Q3 semiconductor segment revenue – are expected to grow 35%, 10%, and 20%+ on a year-over-year basis, respectively. But rather than go through all that analysis, note that Broadcom’s Q4 consolidated revenue guidance is $8.9 billion (with adjusted EBITDA of ~63% of projected revenue, and non-GAAP diluted share count to be 435 million).

And note that while infrastructure growth is not that impressive, ~90% of it is recurring revenue with average contract lengths of around three years. That gives Broadcom a very nice and stable high-margin enterprise software revenue base. Going forward, if the pending VMWare acquisition is completed, that will move AVGO’s software segment to ~45% of total revenue, while – in my opinion – significantly increasing the growth potential of the software segment.

Note that if the Q4 revenue guidance of $8.9 billion is actually achieved, that would be up ~20% as compared to the $7.41 billion in Q4 revenue last year.

Now, some investors might be overly concerned that Apple’s issues with Foxconn shutdowns in China will lead to revenue shortfalls for Broadcom given that Apple – as pointed out earlier – is a very large and important customer for Broadcom’s semiconductor sales. However, this points out another big advantage of investing in Broadcom: The company does not allow customers to cancel orders. Note Hock Tan’s comments on the Q3 conference call referenced earlier:

Well, as to clarify the first couple of points, our backlog and our terms are very clear. We do not allow cancellation on our backlog. We have not seen that …

Also, note that Broadcom’s revenue continues to grow each quarter sequentially as its backlog continues to build up: at the end of Q3 the backlog increased to $31 billion (an estimated 3.7x Q3 revenue). The point here is that Broadcom is still shipping below its booking rate, which is fantastic given the narrative that most other semiconductor companies are painting these days.

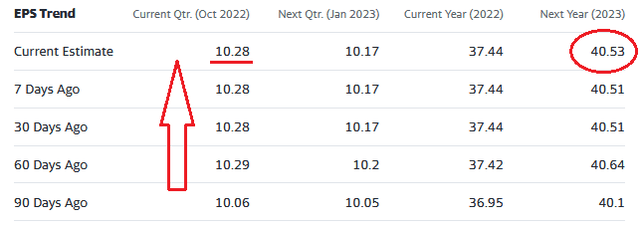

All that being the case, it’s probably not that surprising that AVGO’s Q4 EPS estimates have – according to Yahoo Finance – actually been rising over the past 90 days despite the negative news about Foxconn’s challenges in China:

Yahoo Finance

Note that the $10.28/share estimated, if achieved, would equate to ~33% yoy growth as compared to the $7.81/share of non-GAAP EPS in Q4 of last year.

Summary and Conclusion

Bottom line: Investors have been given guidance for Q4 that indicates an estimated ~20% yoy increase in revenue and a ~33% increase in EPS. And, given Broadcom’s no-cancellation policy, investors have a pretty clear line-of-sight that those numbers (and the free-cash-flow that goes with them…) will be achieved. Meantime, and unlike many semiconductor companies, Broadcom’s margin is actually creeping up.

Lastly, note that the full-year FY23 EPS estimate (see top-rich corner of the chart above) is $40.53. At pixel time the price of AVGO is $528.58, which implies a forward P/E of only 13.0x. And that is the opportunity for long-term investors: In Broadcom stock, you get a forward P/E of only 13x for a company that is growing both revenue (20% yoy) and earnings (33% yoy) at double digit rates. And, remember, a stock that grows at 15% yoy should – all things being equal – double about every five years. And Broadcom is obviously growing faster than that.

Meantime, investors can likely expect an announcement this month for another 10%-15% increase in the dividend. Putting it all together, I reiterate my BUY rating on Broadcom.

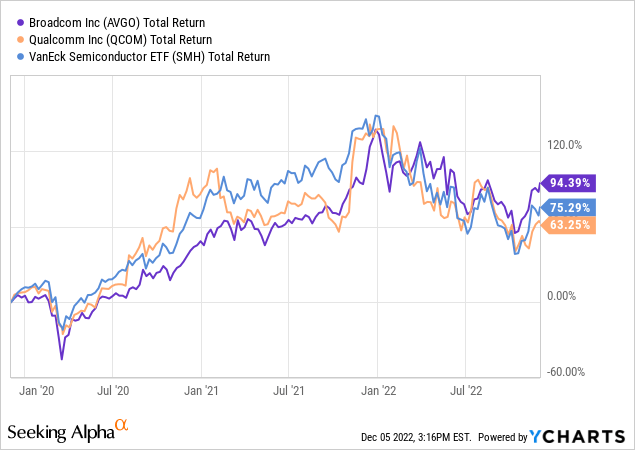

I’ll end with a three-year total returns chart of Broadcom compared to the broad semiconductor sector as represented by the VanEck Semiconductor ETF (SMH) and Qualcomm (QCOM), and note that Qualcomm is trading with a forward P/E of 12.3x while QCOM’s Q4 EBIT margin was only 34%, while Broadcom’s free-cash-flow margin in Q3 was 51%:

Be the first to comment