RafaPress/iStock via Getty Images

On Sunday, October 30, former Brazilian President Lula narrowly defeated sitting President Jair Bolsonaro to become the nation’s leader. Brazil is South America’s most populous country with its leading economy. Brazil’s climate, geography, and geology make it a global leader in raw material production. Multinational giants like Vale (VALE), the global mining behemoth, and Petrobras (PBR), Brazil’s energy company, dominate the local commodity market. Meanwhile, many small businesses depend on raw material production, and other business avenues in the world’s seventh most populous country can be sensitive to political change.

Elections have consequences. VALE and PBR will likely thrive as worldwide inflation supports higher commodity prices. However, the jury is still out for the future of Brazil’s small-cap companies as the politically divided country shifts from a business-friendly right-wing leader to President Lula da Silva, a left-wing liberal-socialist.

The iShares MSCI Brazil Small-Cap ETF (NASDAQ:EWZS) holds a portfolio of Brazil’s leading small-cap companies. Companies with smaller market caps now face a significant shift in Brazilian politics.

An ideological shift

Jair Bolsonaro was elected President in 2018. He ran on a business-friendly, anti-corruption platform following years of scandal-ridden Brazilian politicians.

The October 30 Brazilian runoff election offered a choice of the current right-wing business-friendly incumbent President versus the former President, a left-wing, socialist candidate. The gulf between the candidate’s platforms and pledged direction for Brazil could not be wider, and the contest was close. Former President Lula da Silva won the election with 50.9%, with President Bolsonaro receiving 49.1% of the vote. While President Lula won, he did not receive a mandate.

Political ideologies divide Brazil, much like the US, which goes to the polls in the mid-term elections that will determine legislative majorities this week.

Incoming President Luiz Inacio Lula da Silva is a Brazilian politician, trade unionist, and former metalworker who was a former President before he was convicted and imprisoned on corruption charges. President Lula led the country from 2003 through 2010 and spent 580 days in prison. On January 1, 2023, he will return as the leader of South America’s leading economy.

In many ways, the October 30 election was a choice between capitalism and socialism. While the more socialist candidate eked out a victory, outgoing President Bolsonaro will remain a high-profile opponent of the coming administration. Brazil is essentially a capitalist country with a “mixed economy,” blending a free market economy with state intervention, regulation, and elements of a planned economy. The Lula victory will push Brazil towards a liberal-socialist orientation, given his social platform, past leadership, and support for environmental causes. President Bolsonaro likely suffered defeat because of his administration’s response to the pandemic, which caused Brazil to suffer the second-leading number of fatalities and third most infections.

Brazilian markets have been stable following Lula’s victory over the current far right-wing, business-friendly, and capitalist President Bolsonaro.

Brazil is a raw material supermarket

Brazil’s political and economic direction is a critical concern for the world, as the country is the leading producer and exporter of soybeans, free market sugarcane, Arabica coffee beans, and oranges. Brazil also supplies the world with iron ore, crude oil, animal proteins, and a host of other raw materials.

The Brazilian currency and stock market have been steady in the wake of the election.

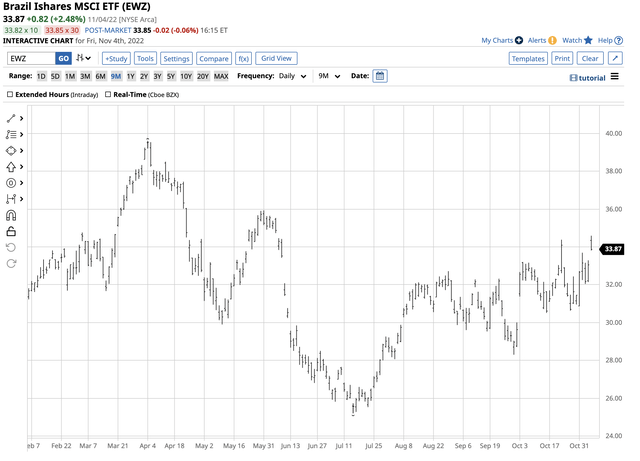

Chart of the EWZ Large-Cap Brazilian Stock ETF Product (Barchart)

The iShares MSCI Brazil ETF (EWZ) closed at $31.45 per share on Friday, October 28, before the runoff election, and was at the $33.87 level on November 4, after incoming President Lula’s victory, a 7.7% increase.

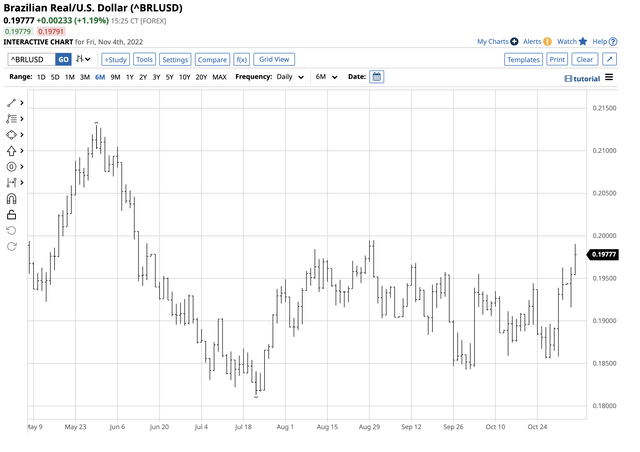

Chart of the Exchange Rate Between the Brazilian Real and the US Dollar (Barchart)

Meanwhile, the Brazilian real rallied from $0.1891 against the US dollar on October 28 to the $0.19777 level on November 4, a 4.6% rise. Large-cap Brazilian stocks and the real appear to be giving a thumbs up to the election results.

Pushing the socialist envelope

Socialism is a political and economic theory of social organization that advocates that the means of production, distribution, and exchange should be owned or regulated by the community. Liberal socialism incorporates liberal principles in socialism, taking the inner freedom of the human spirit as a given and adopting liberty as the goal, means, and rule of shared human life. The socialist aspect recognizes liberty through political and economic autonomy and emancipation from the grip of material necessity.

President Lula da Silva is a liberal socialist, meaning his administration will embrace environmental initiatives and support workers’ rights. With the demand for commodities rising and Brazil’s position as a leading world raw material producer and exporter, unions will likely benefit from rising wages and benefits, weighing on many companies’ earnings.

The pros and cons of a “mixed economy” for small-cap stocks

Large-cap companies like VALE, PBR, and other leading Brazilian firms will likely see more government regulation and pressure to increase employee wages. A “mixed economy” could weigh on earnings over the coming months and years. In Q3 2022, PBR earned $1.33 per share. On November 3, PBR’s board approved a massive $8.5 billion dividend. The annual forward dividend payout stands at $4.50 per share, translating to a 35.6% yield with the shares at the $12.65 level on November 4.

In Q3, mining giant VALE earned $1.05 per share, beating consensus forecasts. VALE’s annual dividend is at the $1.37 per share level, yielding 9.52% at the $14.39 level on November 4. PBR, VALE, and the other leading commodity-related Brazilian companies have earnings that can absorb the shift to a liberal socialist administration. Meanwhile, the recent election results highlight a divided nation, limiting the incoming President’s ability to push the economy too far from capitalism to liberal socialism. Winning by a nose is not a mandate, but President Lula will work to fulfill campaign pledges over the coming months and years. Those chances could impact small-cap companies as expenses are likely to rise.

One positive factor for small-cap companies is the bullish trend in commodity prices, which supports earnings for Brazilian companies supporting the raw materials sector. While the large-cap EWZ ETF rose 7.7% after the election, the small-cap EWZS did even better.

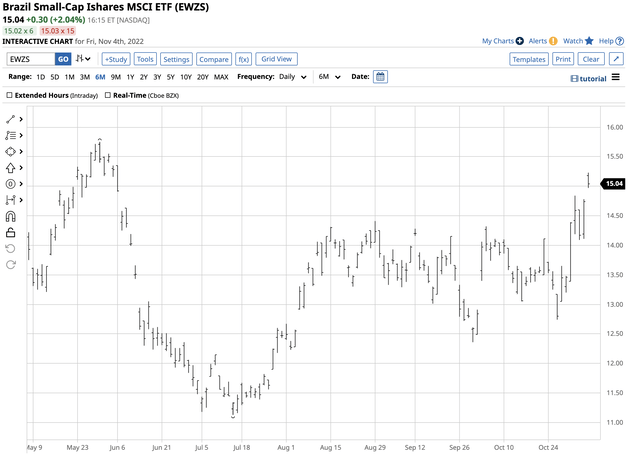

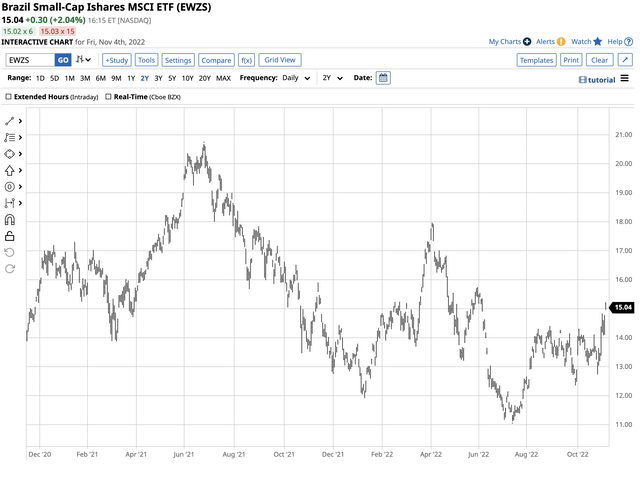

Chart of the EWZS Brazilian Small-Cap ETF Product (Barchart)

The chart illustrates the move from $13.46 on October 28 to $15.04 on November 4, an 11.7% rise in the small-cap ETF. However, increasing wages, higher corporate taxes, and more regulation under the Lula administration could pose risks for small-cap Brazilian shares over the coming months and years.

EWZS is the Brazilian small-cap ETF

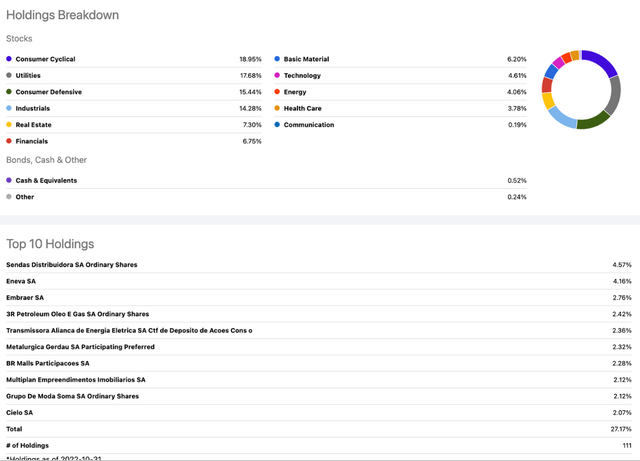

The top holdings of EWZS include:

Holdings of the EWZS Brazilian Small-Cap ETF Product (Seeking Alpha)

At $15.04 per share on November 4, EWZS had $95.073 million in assets under management. EWZS trades an average of 51,365 shares daily and charges a 0.57% management fee. Meanwhile, the $0.59 per share annual dividend translates to a 3.92% yield. The dividend currently pays for the management fee when holding EWZS for under one quarter.

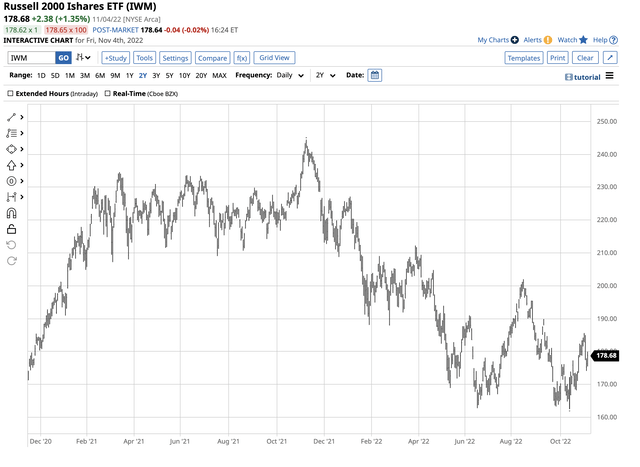

The leading US small-cap stock ETF, the iShares Russell 2000 ETF (IWM), has underperformed EWZS in 2022.

Chart of the IWM- Small-Cap US Stock ETF Product (Barchart)

The chart shows the decline from $222.45 to $178.68 per share or 19.7% in the IWM from December 31, 2021, through November 4, 2022.

Chart of the EWZS ETF Product (Barchart)

Over the same period, EWZS rose from $13.73 to $15.04 per share or a 9.5% rise.

While the incoming liberal socialist administration poses political risks for Brazilian small-cap stocks, the trend remains bullish. Worldwide inflation supports the earnings of many Brazilian companies, and the close election will likely curb President Lula’s enthusiasm for pushing South America’s leading economy towards a socialist path. Brazilian small-caps have outperformed US small-caps in 2022, and the trend looks likely to continue.

The next Brazilian President is a seasoned politician who will likely be sensitive to divisions in his country and will take a cautious route when moving the country slightly to the left. I favor Brazilian large and small-cap stocks as they have provided a safe oasis compared to US equities. Worldwide inflation and Brazil’s position as a leading commodity producer and exporter will only enhance earnings over the coming months.

The price action over the first week since the election validates the strength of Brazilian shares.

Be the first to comment