Just_Super

Then And Now

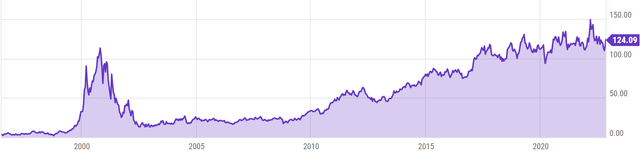

When an investor looks at a price chart for Check Point (NASDAQ:CHKP) it’s hard to dismiss the fact that anyone who bought into this stock at the peak of the Dot-com bubble would not only have underperformed the S&P by a wide margin but also have negative real returns. Currently its trading at roughly the same level as October of 2000. In many ways its hard not to ask the question – If I invest now would it repeat the performance of last twenty years? The share price peaked around March of 2022 and the parallels between what we saw in the last two years and the dotcom bubble is hard not to notice. So what is different in investing in this stock now versus investing back in 2000?

The Dot-Com Era

The year is 2000. Height of the Dot-com mania (Although its easy to call it as a mania in hindsight, living the last two years would give us an idea on how you could be sucked into buying an over valued stock. During manias, narratives and momentum are king). Personal computers had taken off and internet was a new fad. Early generations of Cyber security was mainly about protecting individual PCs and businesses that had adopted the internet. Although virus attacks were well known and could get devastating, the addressable market was still quite small. At its peak the combined market cap of technology companies was almost at $2.9T. Against this backdrop Check Point had a market cap that exceeded $70B dollars, trading at 1000 times earnings and 300 times sales! Anyway you look at it, it would be hard to justify being an investor at these levels! In fact, digging through the language from the company reports around that time there is mention of the slowdown for technology products that would affect their revenues. The subsequent years were catastrophic for the stock price. The stock fell about 90% and this was tightly correlated with the crash in the Nasdaq index. A falling tide sinks all ships.

Present Era

Combined market cap of top technology companies exceeds $15T and Check Point takes an extremely small slice of the pie at $16B dollars. Even though we are currently undergoing an economic downturn, language from the latest reports filed by the company shows a strong business and a business that is going to continue growing into the future as well. The latest earnings from Q3 were a further proof of that. Revenues and EPS came in at $578M and $1.77 ($8M and 5 cents above the mid-point of the projections respectively). Comparable quarter growth accelerated to 8% (from 5% of last year) and every segment of the business showed double digit growth while improving profitability. Management has also revised its forward guidance for full year 2022 revenues to $2.3B – $2.35B and non-GAAP EPS to $7.2 – $7.4. This resilience in business combined with a bright outlook for the industry has led to the stock price uncoupling itself from the broad market movements.

Year to Date, both SP500 and Nasdaq have fallen 21% and 34% but CHKP has not only outperformed the market but is actually up 7% for the year! Sporting a beta value of 0.6, it is rare for a technology stock to behave so much differently than the underlying index.

A Bright Industry Outlook

Cybersecurity industry as a whole has evolved quite a bit from its humble beginnings in the late 1980’s. Its evolution is tightly tied to the evolution in computing devices. Cybersecurity evolution has been divided into 5 generations. While the first two generations were about protecting standalone PCs and attacks affecting businesses in the early internet era (which drove the creation of firewall), the later generations became more advanced as the threats advanced to exploiting vulnerabilities in the applications and large-scale fast moving mega attacks that expanded to mobile and cloud. Large scale attacks have become a regular phenomenon and most of the time small businesses go completely under with little hope of recovery. Large scale businesses see significant loss of reputation and a complete halting of their business operations. Economic distress or not, cyber security is the last place you would expect a company to cut back on.

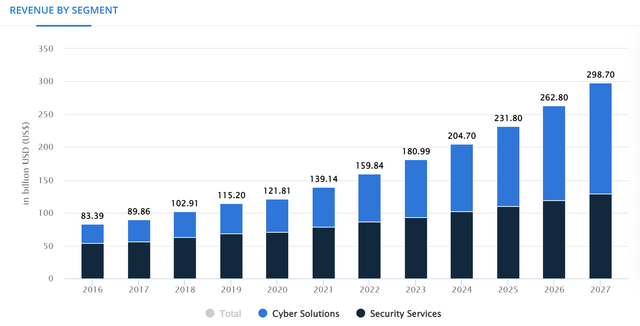

- Revenue in the cyber security market is projected to reach $160B in 2022 and expected to grow to $300B by 2027. Some estimates have it much higher. Largest segment is Security Services with a projected market volume of $86B in 2022

- Security Services is actually one of Check Point’s three strategic pillars. With over 60 security services designed to prevent 5th generation attacks (large-scale fast moving mega attacks), the company is well positioned to cash in on the growth in this segment. In its latest quarter, they posted double digit growth this segment.

- A study conducted on share price performance revealed that on average share price fell by 8.6% in one year after a cyber attack was made public. This could be just the reflection of how much top and bottom line of the business may get affected due to a cyber attack

- The average cost of a data breach was $4.35 million in 2021 global and $9.5M in the United States (Cost of a data breach 2022)

- In 2021, there were on average of 270 attacks per company over the year, a 31% increase over 2020.

- More than 80% of a survey respondents say their budgets have increased in 2021. IT security budgets are now up to 15% of all IT spending, 5 percentage points higher than reported in 2020 (State of Cybersecurity Report 2021)

Utilizing The Strength Of Its Balance Sheet

Check Point has a healthy balance sheet and has maintained good liquidity ratios for the past several years.

- Quick Ratio – 1.2

- Current Ratio – 1.2

- Debt to Equity – 0

- Cash Position – $3.6B

This allows the company a lot of flexibility in terms of strategic decisions. Should the company choose to pursue an accretive acquisition it has plenty of cash on hand and also easily be able to tap into debt markets. This is important going into an economic downturn as there could be plenty of companies within the target range, with a lot of valuable IP in the cyber security space but need to be “rescued”. I specially like acquisitions which are small and can be integrated well into the existing fabric of the company as opposed to big acquisitions which dents the balance sheet and becomes quite evident when it does not go well.

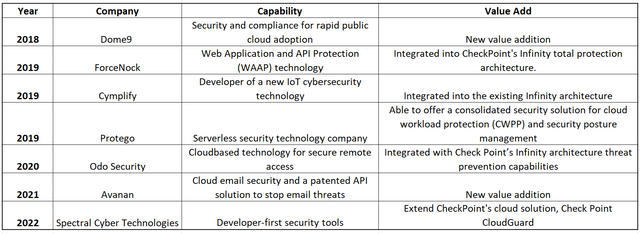

I have collected acquisition data of the company going back five years and there is no information on how much money was spent on each acquisition. But from what is available it looks like the company’s judgment on going for privately held small size companies has neither significantly inflated goodwill nor any impairment losses were identified for the past several years.

Acquisitions by CheckPoint (Author Collected)

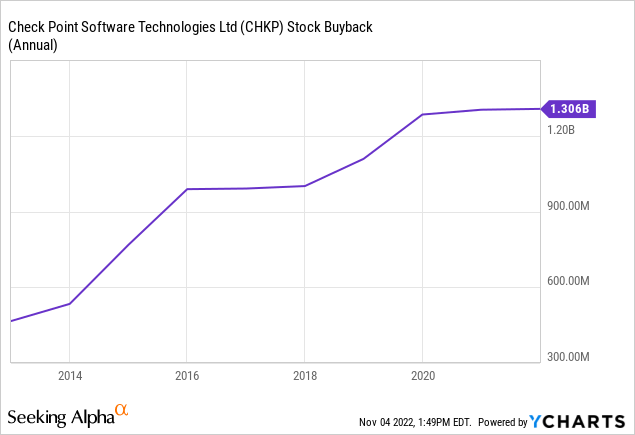

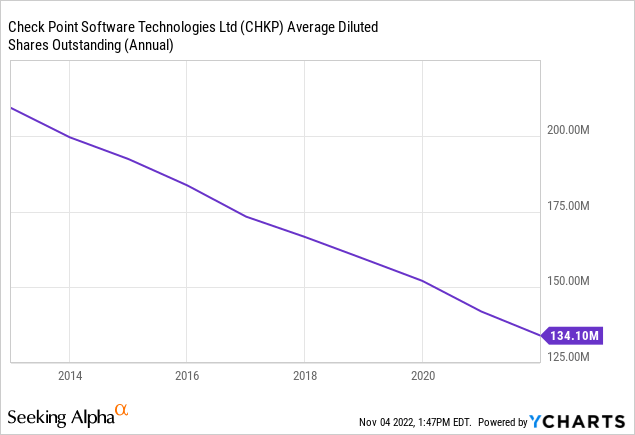

Company is also making good use of its cash through consistent stock buybacks. Over the last 5 years alone management has spent more than $5B in stock buybacks effectively reducing the share count by more than 20%

Risks

Cyber Security industry can be a cut throat industry and the industry is quite fragmented. Cisco Systems (CSCO), Fortinet (FTNT), Palo Alto Networks (PANW), Zscaler (ZS), CrowdStrike Holdings (CRWD), SentinelOne (S), Proofpoint, Mandiant (recently got acquired by Google) are some of its main competitors that operate at a similar or bigger scale than Check point. Check point’s main risks come from its competitors and although it is a market leader in some of the segments, rapid evolving threats and breakthrough in competitors offerings can quickly change that. So far Check point has been able to out innovate and pursue an acquisition strategy to mitigate the risks but the future could change in several ways.

- New products from competitors with better technologies and the emergence of new industry standards may render the existing products from Check Point obsolete

- To cut costs during an economic downturn, although highly unadvisable, low switching costs could make businesses choose an inferior but cheaper product offerings from a competitor and, competing in terms of price may affect Check Point’s margins

- A highly sophisticated next-gen attack that bypasses Check Point’s defenses could significantly harm its reputation and affect its future business

Valuation

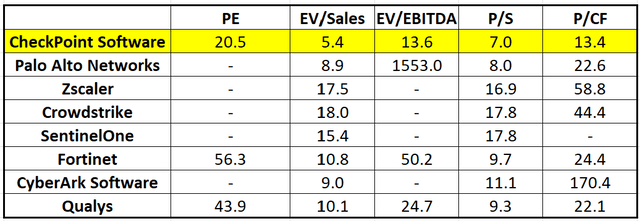

Let us see how well the company fares in terms of valuation against its peers.

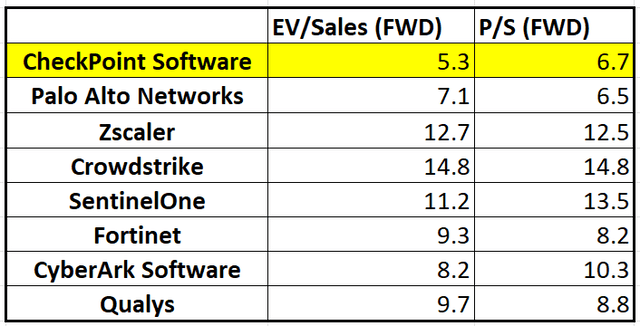

Valuation Vs comps (Seeking Alpha Webpages)

Irrespective of the metric used, Check Point’s valuation comes in much lower than all of its peers. As a matter of fact, a lot of companies are running at a net loss so some metrics cannot even be computed. In such instances even when we use EV/Sales or Price/Sales multiples, Check Point still ranks the lowest in terms of valuation.

The company also projected revenue growth for 2022 (mid-point at 7%). For a uniform comparison when including unprofitable companies, I have collected forward Price to Sales and EV to Sales multiples from Seeking Alpha’s webpages for the same peers. Out of all the companies, only Palo Alto networks came close to Check Point in terms of forward valuation.

Forward Sales multiples Vs Peers (Author Collected – Seeking Alpha Webpages)

Action

Investor can either buy shares of this company or buy the ETF BUG which has most of the publicly listed cyber security firms (CHKP is the largest holding in this ETF) Although the primary focus of this article is Check Point, the outlook of this entire industry is highly positive and if an investor wants to distribute their risk within the industry BUG is the best way to go about it. I myself have initiated positions in both BUG and CHKP; BUG because of my overall bullishness on this industry and CHKP because in addition to the industry outlook, to summarize I personally like it for its –

- Low correlated returns (returns have uncoupled from major indices)

- Strength of its balance sheet

- Growth playbook through small acquisitions and long term return of shareholder value through stock buybacks

- Strength of its business and it’s leg up on the industry

- Low and great positioning in terms of Valuation when compared to its peers

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment