Brandon Bell

Petroleum prices are surging, and this time investors in Exxon Mobil (NYSE:XOM) and other energy producers can thank the Organization of Petroleum Exporting Countries for it. OPEC+, which includes Russia, just announced that it would reduce production by 2 million barrels per day starting in November. Expectations of such a decision have already been reflected in petroleum prices, which have seen some renewed upwards momentum in the last couple of days. I believe OPEC+’s decision to curtail output is a gift for Exxon Mobil as the company is set to benefit from higher realized market prices for its petroleum products and earnings estimates are set for an upwards revision as well!

OPEC+ decision to cut output is a gift for Exxon Mobil

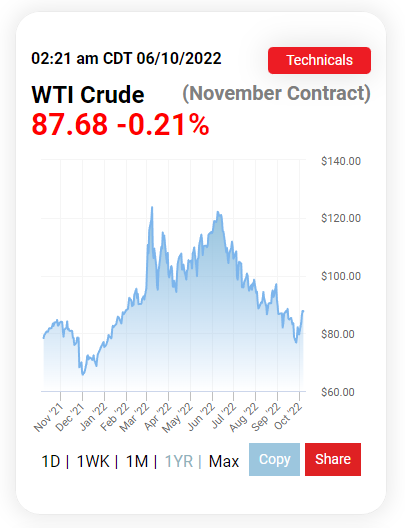

Petroleum prices have dropped to $80 a barrel in September, but have seen new momentum lately because OPEC+ decided to cut its output by 2 million barrels in a bid to reverse the recent slide in prices. Although OPEC+’s output cuts are going into effect only next month, the price cartel has sent an important signal to the market that it will do whatever it can to prop up faltering petroleum prices. OPEC+ also rebuffed US demands for more aggressive production, indicating that the market has to be prepared for higher prices for a longer period of time. Because of pricing pressure at the pump, the US did not only try to pressure OPEC to not curtail production, but also announced that it would release another 10M barrels from the Strategic Petroleum Reserve to help consumers. For Exxon Mobil, OPEC+’s decision to cut production is obviously a gift, since there is no other factor in the company’s business that is driving profit growth as much as higher petroleum prices.

Due to OPEC+ intervening in the market through output cuts, the petroleum price has started to move from about $80 a barrel to $88 a barrel, showing a 10% price reversal.

Oilprice.com

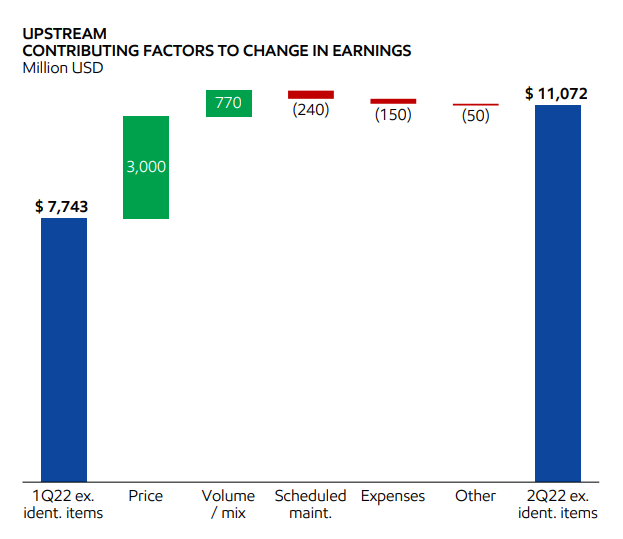

Shares of Exxon Mobil also responded positively to the OPEC+ announcement and surged 4.4% yesterday to $99. Exxon Mobil’s shares are understandably surging considering that the firm’s profit picture just greatly improved. In Q2’22, Exxon Mobil’s production profits soared $3.3B quarter over quarter, with $3.0B coming solely from higher petroleum prices.

Exxon Mobil: Q2’22 Earnings Bridge

Because of the uptick in petroleum pricing, I estimate that Exxon Mobil could generate $45-47B in free cash flow in FY 2022. In the first six months of FY 2022 the company already generated $27.7B in free cash flow: $16.9B in Q2’22 and $10.8B in Q1’22. Assuming that Exxon Mobil could generate between $45B and 47B in free cash flow this fiscal year, Exxon Mobil is currently trading at a P-FCF ratio of 9.0 X.

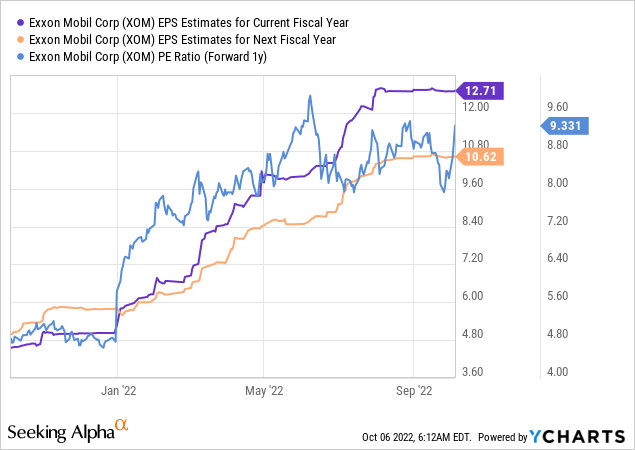

Exxon Mobil’s earnings estimates are set for an upwards revision

Because of the change in the supply situation, I expect Exxon Mobil’s earnings estimates for Q4’22 and for FY 2022 to increase by a decent margin. So far, expectations call for Exxon Mobil to generate EPS of $12.74 in FY 2022, but I see 5-10% upside to the consensus estimate due to the recent OPEC+ announcement and the impact it already had on petroleum pricing. Based off of next year’s earnings ($10.62), shares of Exxon Mobil are trading at a P-E ratio of 9.3 X and can still be considered reasonably cheap.

Risks with Exxon Mobil

The biggest commercial risk for Exxon Mobil is the unpredictability of petroleum prices, which are dependent on a variety of factors. Prices can fluctuate wildly based on supply and demand factors, political risks, the strength of economic growth etc. which makes it all but impossible to predict with accuracy how much money Exxon Mobil is going to get for its final products. However, the recent uptick in petroleum pricing is clearly a positive development for Exxon Mobil and the company is set to profit from higher realized market prices instantaneously. A fundamental down-turn in petroleum markets, driven by the expectation of a developing global recession, would likely negatively affect the market’s earnings and cash flow expectations for Exxon Mobil.

Final thoughts

OPEC+’s decision to limit its petroleum output by a relatively large amount of 2 million barrels is a gift for large producers like Exxon Mobil which stand to profit from reduced market supply and higher prices. Since the market immediately reflects changes in the supply situation through its price mechanism, Exxon Mobil is set to see higher profits and free cash flow in the fourth-quarter as well as for the full fiscal year. Shares of Exxon Mobil are still cheap based off of earnings and free cash flow, and I believe Exxon Mobil remains a long term buy here!

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger×

Be the first to comment