Bet_Noire

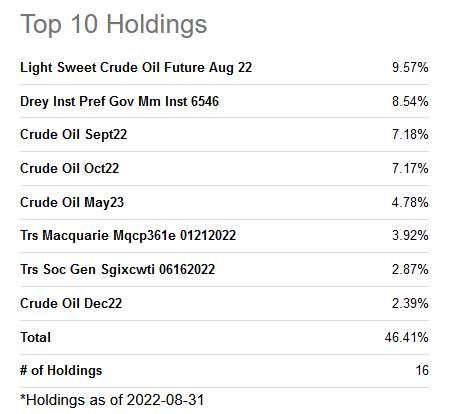

The soul-crushing drop in spot crude oil prices during the early days of the 2020 pandemic almost convinced The United States Oil ETF, LP (NYSEARCA:USO) to shut down. It suffered for years from contango issues, owning only nearest futures contracts. Basically, every month the trust was losing value/money, forced to buy higher priced contracts on regular rollovers. That all changed in late April 2020, when the fund changed its design from front-month-only exposure to swaps and contracts much further out in time, diversified for exposure, if you will. Below is graph of the Top 10 positions a week ago, spread out over time into the middle of 2023.

USO, Top 10 Holdings – August 31st, 2022

There are other considerations if you want to own this exchange-traded fund (“ETF”). The fund charges 0.79% annually for management fees. USO is structured as a commodities pool, meaning a K-1 form is sent at tax time. And remember, long-term holders will be taxed on any gains, even if they didn’t sell shares during the year.

Track Record

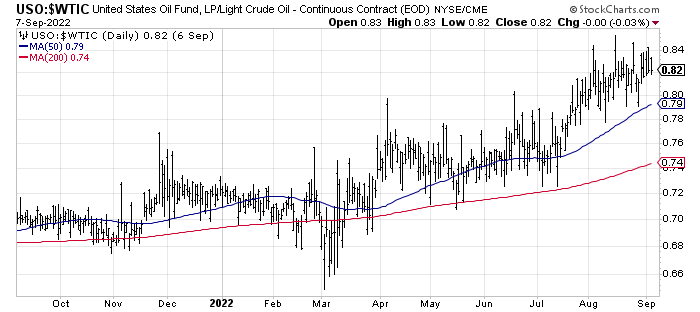

Overall tracking of spot crude oil prices has been statistically easier to do with the new design. Below is a 2-year graph (into early August) showing the advantageous value push of rollovers from higher priced to lower priced product with the backwardation of futures in 2022’s oil market.

YCharts, Price Performance Comparison – USO vs. Light Crude, 2 Years

Again, if you call sell exposure to a commodity at a higher price today than purchased contracts months down the road for theoretical delivery, fund owners are getting a small profit on the exchange. Conversely, when contango is present, where market expectations are calling for rising prices, rollovers will still hurt USO, but nowhere to the degree as existed before April 2020. Today’s pricing schedule (early morning – September 7th, 2022) for light sweet crude oil futures is drawn below. Notice forward prices are lower than the front-month October contract.

Crude Oil Futures Quotes – CME Group Website – September 7th, 2022

With the spike in quotes on the Russian invasion of Ukraine in March-April, forward contracts have traded at a sizable discount, under the assumption supply/demand balance would eventually play out. This is exactly what has occurred over the last six months. But for USO investors, a backwardation in pricing has actually helped the ETF to “outperform” spot prices on the downturn by a good +15% in relative terms. I have drawn a ratio comparison between the two below.

StockCharts.com, Ratio of USO vs. Spot Light Crude – 12 Months of Daily Changes

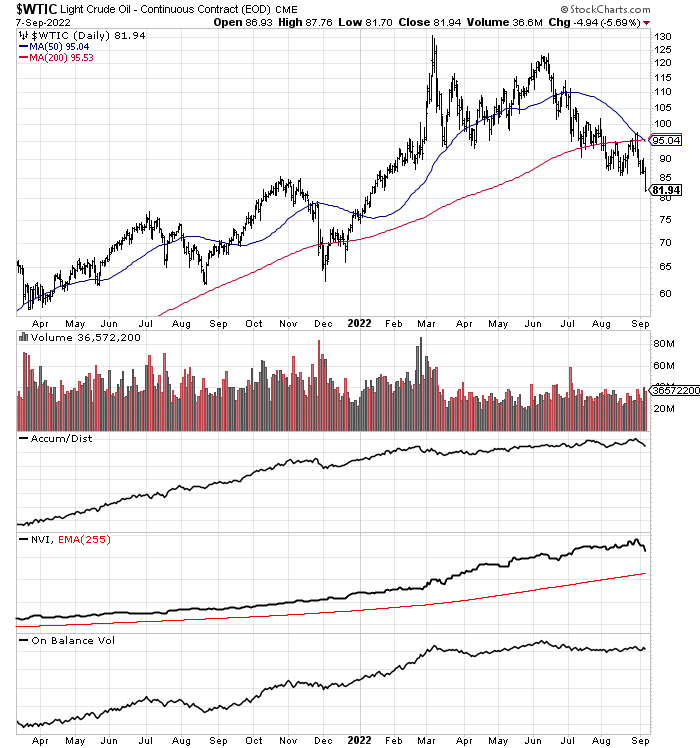

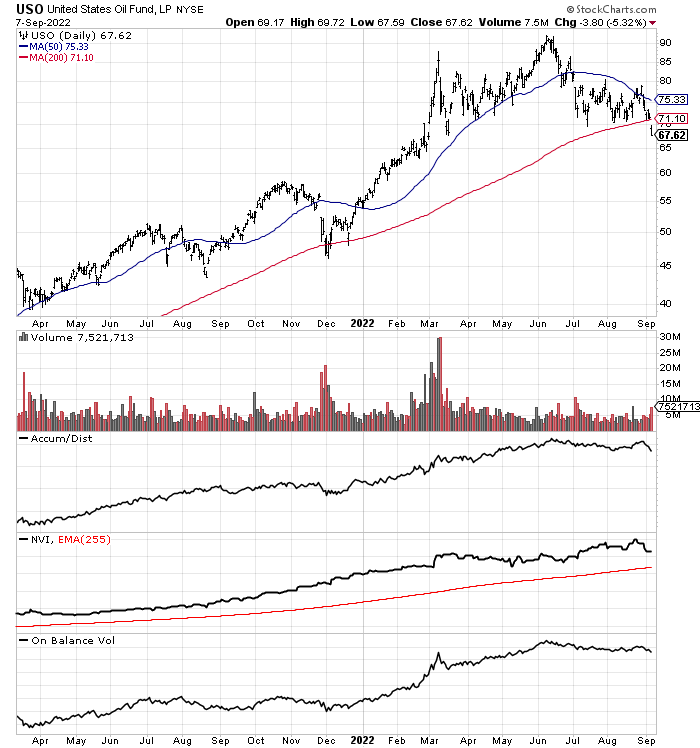

Below are 18-month charts of daily changes in price/volume, alongside several momentum indicators I like to watch. You can see the difference in performance two ways, created by the backwardation of contracts. First, spot crude oil peaked in March around US$130 a barrel, but USO kept climbing into June. Second, crude oil quotes have been trading under the 200-day moving average for over a month, while USO just dropped under this technical bellwether today.

StockCharts.com, Spot Light Crude – 18 Months of Daily Changes StockCharts.com, USO – 18 Months of Daily Changes

The good news for investors purchasing USO or crude oil futures is momentum indicators remain quite strong. The Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume readings are in very positive uptrends.

Forecasting Ideas

In a variety of articles since the spring, I have talked about my forecast of prices falling the rest of the year, perhaps all the way back to US$70 a barrel in a deep recession scenario. While extra downside below $80 is a distinct possibility, I can envision scenarios involving another spike in prices. In the low $80s for price right now, I am more neutral/unsure in predicting the next major crude oil price move.

I am coming up with an equilibrium price currently of $70-80 per barrel, if supply/demand forces were relatively balanced. The global cost of production is roughly in this range currently, especially if underinvestment in new supply for years requires some premium to encourage exploration and capital spending. If the world wants to keep production levels constant, quickly depleting wells require new projects to pull oil/gas out of the ground into the future. Of course, we can debate the long-term demand outlook for crude oil with electric vehicles stealing a bigger auto share yearly. However, if crude oil demand worldwide grows even a little over the next 5-10 years, a near-shortage condition could exist well beyond 2022. The long-term underinvestment theme by Big Oil may be the main reason Warren Buffett is happy paying top dollar for growing stakes in Occidental Petroleum (OXY) and Chevron (CVX).

The first worthwhile reason to change my bearish stance is OPEC+ would prefer high crude oil prices, and last weekend announced a production cut of 100,000 barrels per day. They are putting the market on notice future cuts are possible if the global economy dips into recession.

All told, the oil marketplace appears to be very susceptible to supply shocks during 2023, just like the early 2022 Russian invasion of Ukraine created serious headaches for importing European nations. U.S. supply shocks for oil could occur soon, possibly from a major hurricane in the Gulf of Mexico hitting between now and October that slashes oil/gas production and refining for weeks or months. Another issue may arise when/if the U.S. government is forced to cut back on emergency Strategic Petroleum Reserve sales at the end of October, to keep inventory in place for future black swan events.

Other risks from the Middle East could trip up supply. I was thinking a nuclear-monitoring deal with Iran would be finished by late summer to open new supplies to Europe, reducing the potential for serious shortages this winter. Yet, a deal has been elusive and Iran’s supply to the world remains lower than it could be. If a deal is not reached soon, Israel has been making clear and loud gestures, it is ready to bomb Iran’s nuclear facilities, which could immediately lead to an Iranian effort to shut Persian Gulf trade in crude oil. If you thought locating new supply to make up for Russia’s war decision was difficult for the market to absorb, closing the Persian Gulf would be far more problematic for the world.

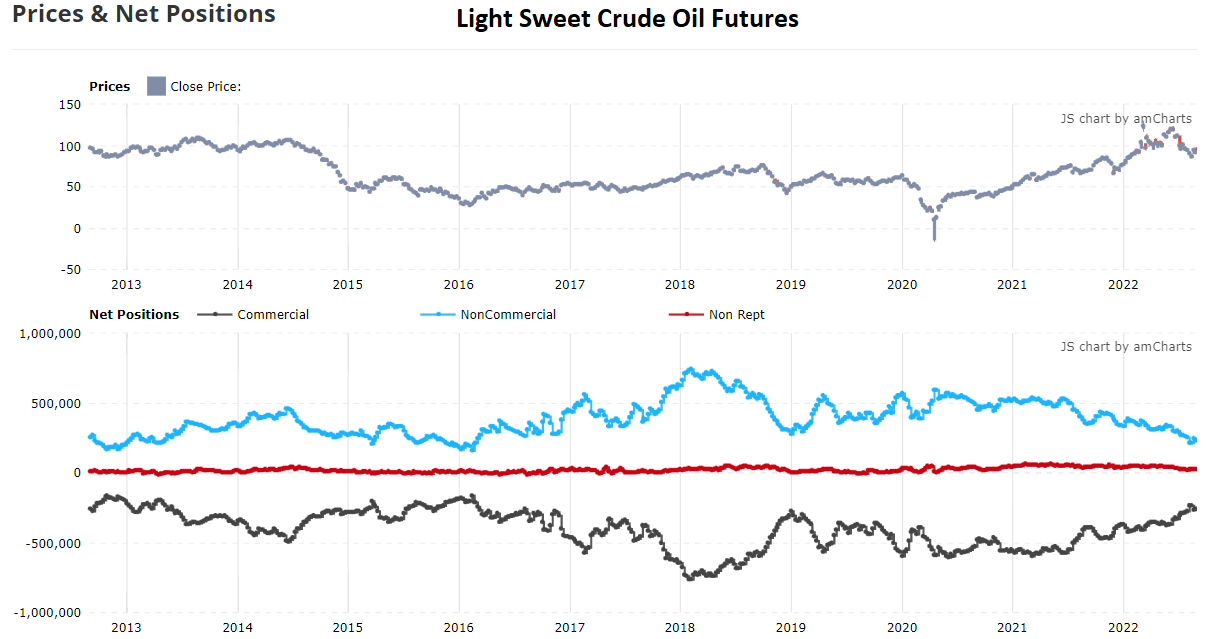

Then we can look at current positioning by market participants. Futures trading does not show an oversized speculative bubble today, as one would expect following the rapid climb from $20 to $130 per barrel over 24 months into April. Small traders and investors are now the least net long in six years, according to the Commitments of Trader report, while commercial hedgers (like oil companies and refiners) are actually covering net short crude oil futures positioning. I rate this sentiment setup as the most bullish since early 2016. At that point, crude oil bottomed under $30 and rose to $85 a few years later. Without doubt, the COT numbers argue for higher quotes for crude oil, not lower, in the months ahead.

Tradingster Website, COT Report – Light Sweet Crude Oil, August 30th, 2022

Final Thoughts

The backwardation setup in crude oil futures still favors the United States Oil ETF design. If you are searching for direct commodity exposure in your portfolio (bypassing oil/gas production company risks) and desire upside to crude oil, now could be a good time to consider purchasing a stake.

Am I 100% convinced prices above $100 a barrel are coming soon? No, but the odds are improving for bulls, absent a massive economic downturn torpedoes demand. You can use the latest price weakness in crude oil and drop below the important 200-day moving average as an accumulation zone, while many technicians and frustrated short-term bulls exit. To me, USO is something of a hedge investment, both to protect against a new round of money printing (hoping to reverse an economic slowdown) and/or another black swan event shocking supply.

A final investment angle is call option premiums on USO are quite high from all the volatility in 2022. You can sell covered calls and create extra yield of 5% or 10% annually without giving away too much upside.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment