martin-dm

It has been written many times that one of the riskiest areas of commercial real estate is the retail sector, due to its direct relation to households’ disposable income and elasticity of demand. However, as I’ve also written many times, there are important differences between retail sub – segments, which can finally make a difference in the returns of a company. The market often doesn’t recognize these differences and, as a result, mispricings occur. One such discrepancy is found in Whitestone REIT (NYSE:WSR), a company that acquires, owns, manages, develops and redevelops open – air neighborhood centers in several areas in the Sunbelt. Let’s see why.

Company snapshot: Operations and portfolio fundamentals

Whitestone REIT currently owns and manages 60 properties, with a total footprint of 5.2 million square feet. The company’s geographical focus is in the Sunbelt, with the majority of the NOI coming from the Phoenix area (39%), while the rest is generated from Houston, Dallas / Fort Worth and Austin / San Antonio. These markets are characterized by favorable demographics and increased job creation, as compared to the all – metro average. Today, the Sunbelt hosts 50% of the U.S. population, and it is set to grow to 55% by 2030. In addition, the Dallas metro area reached the first place in terms of new job creation in 2019. These two factors are fueled by low to no personal and corporate income tax rates, with the exception of California and a nicer climate, but that’s by far the second reason for productive individuals. This trend is expected to continue, with Sunbelt metropolitan areas growing at a much faster rate than their nationwide counterparts, benefiting local real estate.

The company focuses primarily in four sub sectors of retail real estate, namely food (grocery and restaurant), education and entertainment, financial and logistics services and self care. From the whole retail real estate universe, grocery properties are considered as the ones with the lowest risk, as they are characterized with low elasticity of demand. That is, one will continue to visit the grocery store to buy their groceries, even if they had a wage cut, directly or indirectly (inflation). From the other sub sectors, self care and services could be regarded as relatively safe. The company focuses in smaller retail units, typically 3000 to 4000 square foot each, which get leased for higher rates than larger units.

This is a triple – net REIT with some extras

In periods of high inflation, rising costs could affect a company’s profit margins. Whitestone REIT is almost exclusively a triple – net lease REIT, as 93% of their leases, in terms of square footage, are structured as such. That means that the company is almost completely shielded against property related costs, such as repairs and maintenance, insurance etc. In addition, current lease structure includes a 3% annual rent bump, which is brilliant, if you think that FED’s inflation target is 2%. What is really interesting, however, is that the company had the providence to include sales percentage clauses in their lease agreements, meaning that probably they agreed to a specific base rent, plus that percentage. However, this could be a double axe. In periods of rising consumer demand, such arrangements are good. In periods of monetary tightening, this puts an extra risk to the company’s revenues. In addition, the company boasts a lower – than – peer weighted average lease term, but in an (artificially) slowing economy this isn’t the best news. I would go with longer lease terms, together with those annual 3% bumps, more easily.

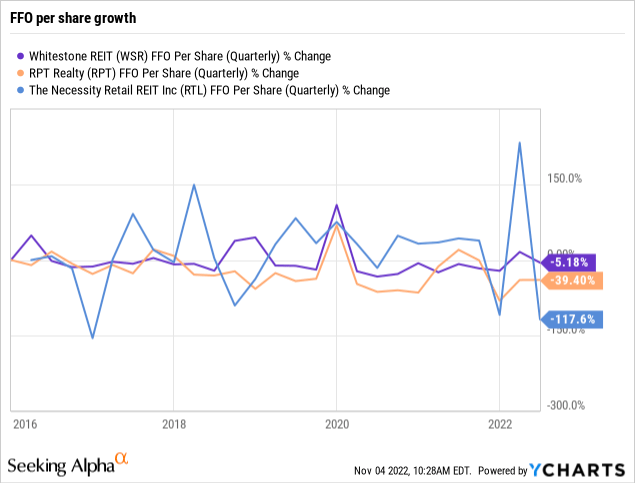

Growing FFO but also growing share count

A REIT’s holy grail is its ability to increase its funds from operations at a pace that is at least in – line with its peers. To see if that’s true for Whitestone, I will form a peer group comprised of RPT Realty (RPT) and Necessity Retail REIT (RTL). As we can see, on a quarterly basis, the company hasn’t done well in terms of FFO growth, during the last five years, although their peers did it substantially worse. Even if we take into account the COVID-19 pandemic, prior to 2019 there was no significant FFO growth per share. According to the company’s recent earnings call, however, they are on track for a YoY FFO per share increase of 16%.

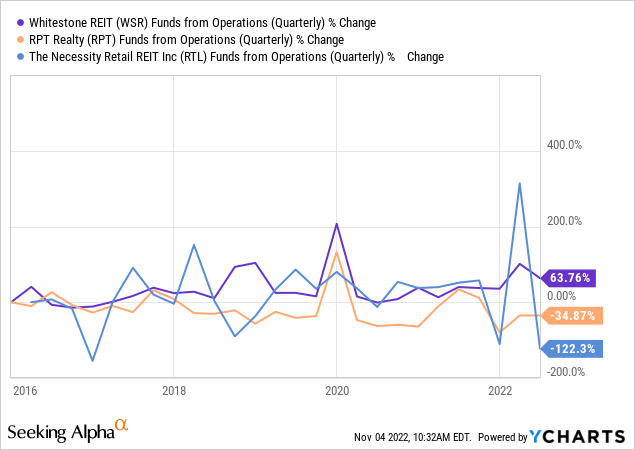

However, if we remove the “per share” denominator, we can see that the company increased their FFO figure by more than 60%, during the same period. This leads to the conclusion that Whitestone is a serial diluter. Indeed, since 2019, there’s an ongoing, $100 million common shares ATM program. Under this program, during the first six months of 2022, the company sold approximately 3 million shares, with net proceeds of just above $25 million. At the end of Q2 2022, the company had a weighted average of 50 million shares outstanding. This means that the company sold new shares at an amount equal to 6% of their total number of common shares outstanding, in half year’s time.

In addition, last May, the SEC approved the company’s shelf program, under which, Whitestone can sell, from time to time, up to $500 million of securities, including, common and preferred shares, debt, depositary shares and subscription rights.

Whitestone is currently trading at $9.16 per share, while the company’s FFO guidance for FY 2022 was $1 – $1.02 per share. These numbers imply a P/FFO multiple of 9x, while the company’s peers, RPT and RTL are trading at 9.5x and 8.1x respectively. So, there doesn’t seem to be any meaningful valuation discrepancy here, despite the FFO growth data presented above.

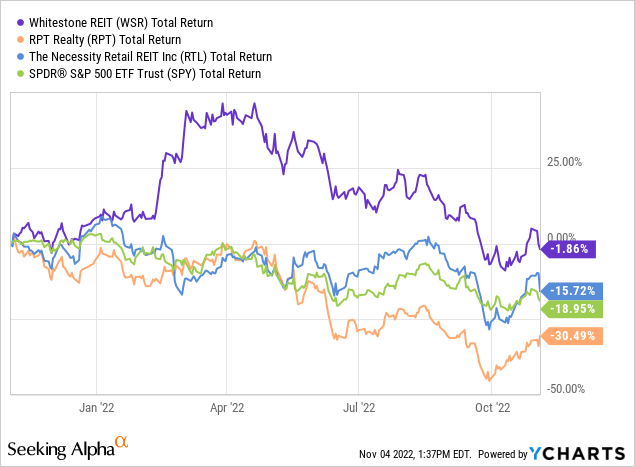

Still, an investment in Whitestone a year ago, would have yielded slightly negative returns by now, which is significantly better than its peers and the S&P 500. I selected this time frame to see how the company responded to the recent market downturn. In larger time frames, S&P 500 is clearly the winner, but still, Whitestone is outperforming its peers in every scenario.

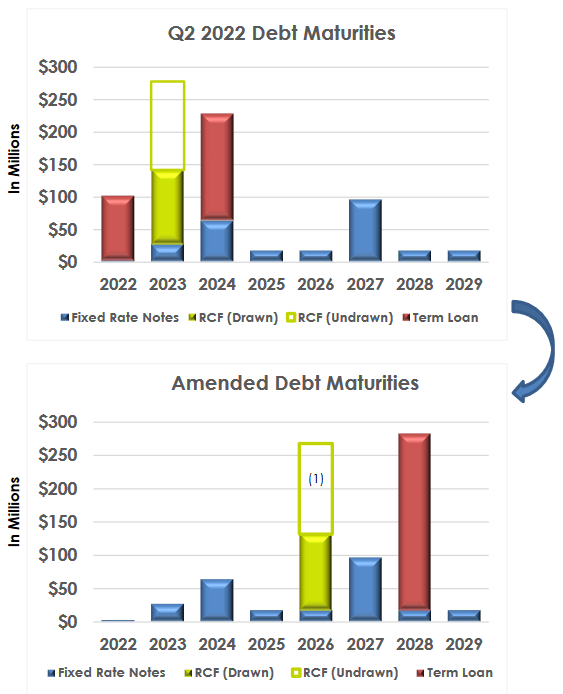

Mitigated financing risk

We already know that, by definition, REITs are leveraged companies, and Whitestone belonged heavily to this definition. As we can see in the graphs listed below, the company had $100 million of financial obligations due this year, but by amending and extending their credit facility managed to create a much more laddered situation. Right now, the company’s total debt reaches $637 million, which stands for a Debt – to – EBITDA of 8.2x. The company’s goal is to reduce this multiple to 7x in 2023.

Whitestone REIT debt maturities: Before and After (Whitestone REIT Q3 2022 Earnings Presentation)

According to the company’s management, the current weighted average cost of finance is 4.64%, while they anticipate $1.3 million more in interest expenses in Q4 2022, as 18% of their total debt is exposed to variable interest. However, in Whitestone’s recent earnings call, management said that the company is in a position to simultaneously pay down debt and increase its earnings. Two of the keys to achieve this goal is the lowering of the overall G&A, and the termination of the company’s shareholder rights plan. It remains to be seen if this will happen, in this environment.

Conclusions

Despite all the COVID-19 turmoil, Whitestone managed to provide better – than – peer returns, while it also outperformed S&P 500, in a one-year time frame. The company’s business model, which focuses in the growing areas of the Sunbelt and in smaller, neighborhood units, including grocery stores, is what differentiates it from the competition and reduces the overall risk. While occupancy rate is somewhat low, in the ballpark of 90%, it is expected to grow by year end. The company is very well shielded against inflation, by annual 3% rent bumps and by the majority of their triple – net leases. The company had some management problems and problematic agreements in the past, which undermined shareholders’ returns, but this is now history. By extending and amending their corporate credit facility, the company lowered their overall financing cost, while they substantially improved their debt maturity profile. They are committed in paying down more debt, while improving earnings, and that’s why investors should keep an eye in the dilutive action of the company. Apart from that, an investment at a reasonable P/FFO multiple of 9x makes sense here.

Be the first to comment