Drew Angerer/Getty Images News

With today’s article, we are going to chat about the S&P 500 (NYSEARCA:SPY), picking up the style of my last article on it and with a focus on the latest Fed conference.

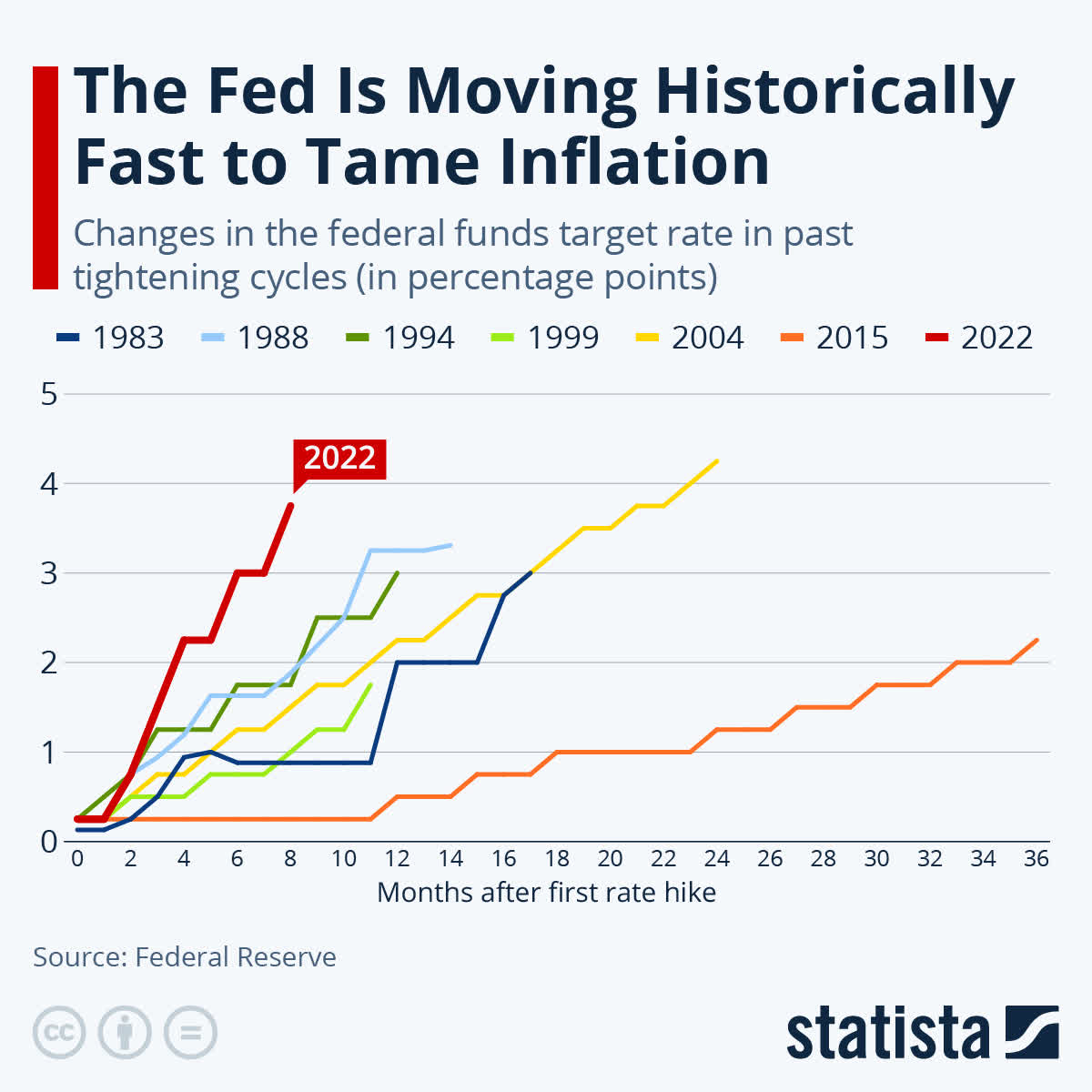

The significant volatility of the main U.S. index continues, and the inflation situation does not seem to be calming down. Last Wednesday, the Fed spoke after its classic meeting, which is increasingly watched by investors, to understand where markets may go. The U.S. market and the world’s major developed markets have been deeply affected by the unparalleled monetary tightening in history undertaken during 2022.

Statista.com

We will take a look at why the S&P 500 could fall further.

FOMC November Meeting

Last Wednesday, Fed president Jerome Powell spoke after the usual FOMC meeting, which is increasingly watched by investors, to understand where markets may go. The U.S. market and the world’s major developed markets have been deeply affected by the unparalleled monetary tightening in history undertaken during 2022.

As widely predicted in recent weeks and thus priced in by the markets, the rise in this meeting was 75 basis points. The choice is understandable. Although the odds of a 50 basis point hike had begun to grow in the past week, this would have led to a big rally in the bond and stock markets, something that, as we have said on other occasions, the Fed wants to avoid.

Now the Fed has been able to give another strong signal to the market and can begin to calmly let new rate hikes, which are in line with expectations, and thus lower rate hikes, begin to be metabolized at future meetings.

Powell did not want to hint that we are nearing the end of the hikes, although he did hint at the reality of the facts, namely base rates that are getting higher and higher and the need sooner or later to slow the pace of hikes. However, Powell made it clear that with the economic data in hand, the level of restrictive rates the Fed might want to go to is higher than expected in past meetings. A particularly hawkish tone.

The interesting talk was about the Fed’s three significant doubts:

- How quickly to raise interest rates;

- How far to go in rate levels;

- And lastly, how long to stay at restrictive policy rates.

So it was made clear that the most critical points are numbers 2 and 3. And the focus was precisely on the need to keep rates high, the distance from the Fed’s pivot, and especially the need for higher base rates than previously thought.

That is a move to avoid market euphoria, and as we might have expected, Powell tried very hard not to give positive news that could bring rallies in the bond and stock market, which would have an effect contrary to what the Fed wants right now. And this has been precisely the market reaction.

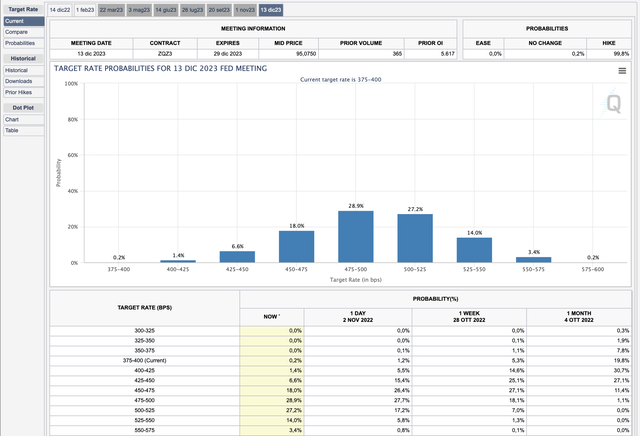

Futures yields on Fed Funds have indeed rallied, changing in meaningful ways. We see how the midpoint of the rate distribution at the end of next year went from 450 and 500 basis points to 475 to 525 basis points.

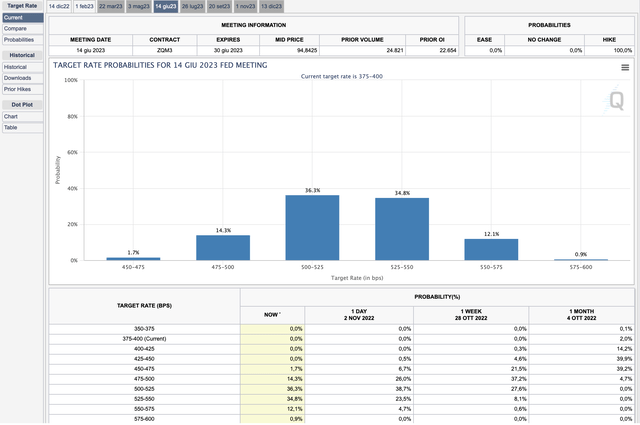

And the same thing has happened on closer maturities, such as June 2023.

What have been the critical economic data in recent weeks?

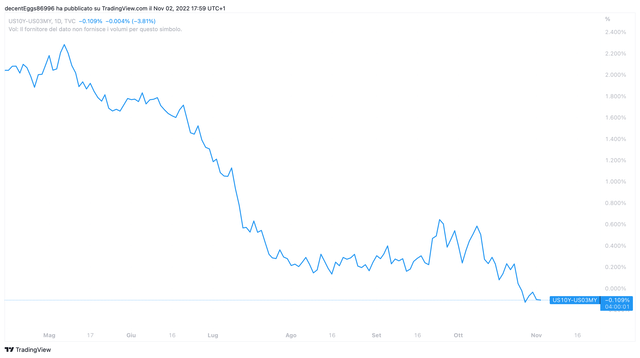

The first interesting fact is a technical signal that led to a recession in 100% of cases.

There has been much talk in the past months about the inversion of the yield curve between 10 and 2 years. This inversion had always anticipated every recession, but not every inversion in the spread between the 10-year and 2-year has led to a recession.

However, we have come to a different point, an inversion between the 3-month and 10-year spreads, albeit a recent and small one.

The curve is inverted by about ten basis points, and the inversion has been underway for over a week. The importance of inversions on the economy is also determined by their duration (the longer they are, the more damaging they can be) and their magnitude (an inversion of a few basis points can be considered insignificant).

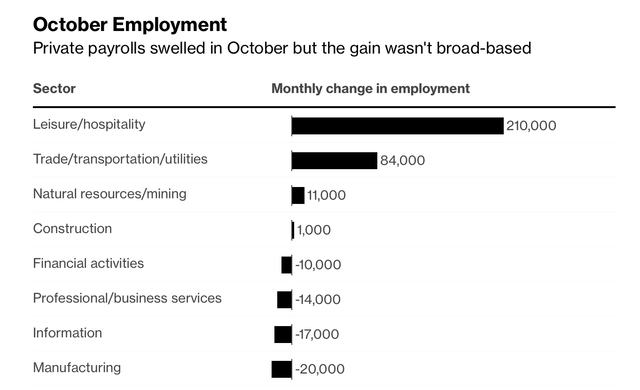

Friday, we also had the release of labour data. The data can be considered mixed. On the one hand, we saw an increase in jobs. 261K private jobs adds was not what the Fed and Powell wanted to see, but this comes just above the 210k new jobs forecast and in line with Wednesday’s ADP report of 239K new private sector jobs for October.

The expectation, however, is that over the next few months, the hiring freeze, or in some cases, the start of layoffs, in companies most affected by the macroeconomic cycle and negative sentiment will begin to affect labour data and may consequently ease an extremely hot market.

For example, in the ADP report, we have already seen a contraction in the manufacturing, financial and information sectors.

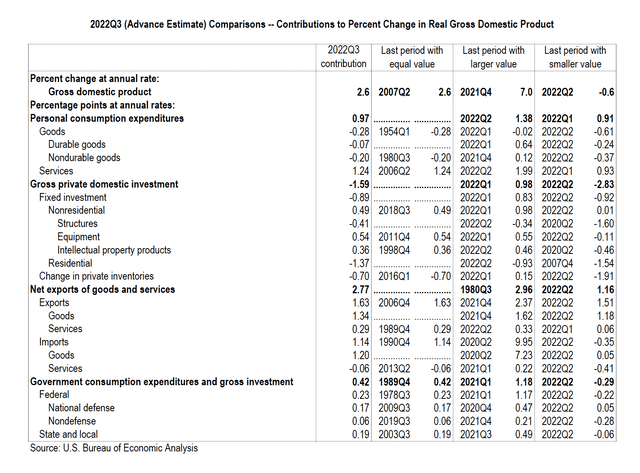

Another interesting point is related to U.S. GDP in Q3.

That is another data point that somewhat misleads a first superficial analysis. The GDP has grown in direct comparison, but the growth is conditioned by an important factor. In economic accounting, GDP is calculated by adding private investment I, consumption C, government spending G, and the difference between exports X and imports M.

Thus, the formula shows that a slight M decline leads to an increase in GDP. Moreover, the GDP figure is annualized QoQ. It means that by measuring the quarter-over-quarter number, a small anomaly such as this is magnified by the annualization of the measure.

So we see that in the table with the contributions on the percentage change in GDP, GDP growth is explained mainly by the decrease in imports.

Earnings Season

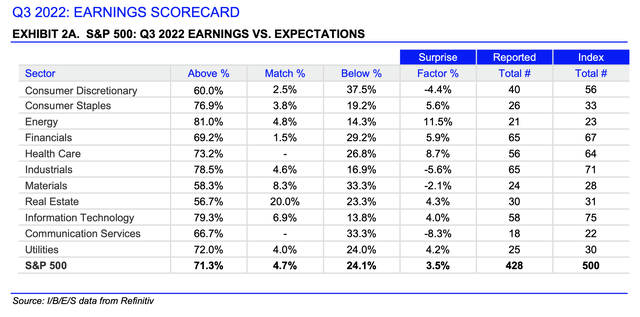

During this latest round of quarterly reports, there were some interesting data.

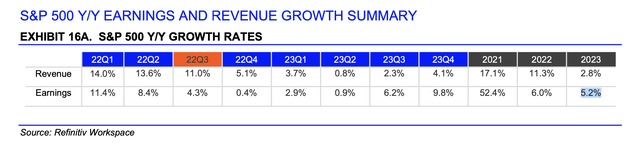

We see from the trend in total expected earnings that, for now, the downward revisions by analysts have not reversed as happened in past quarters.

However, 71.3% of companies in the S&P 500 reported higher than expected earnings, with 428 companies out of 500 already reported earnings while I write.

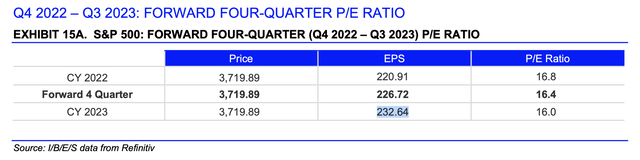

To make up some numbers with the S&P 500 EPS estimates for the next four quarters, we saw a slight decline from when I wrote last quarter. Specifically, about 2023, we see an expectation today of about $233 versus $244.

So the estimates are coming down, but perhaps not yet low enough. We have an expectation of a 5.2% growth in earnings in 2023 when Jerome Powell, himself at Wednesday’s conference, was saying how the likelihood of a soft landing is decreasing. The decrease is due to the worsening macro situation and rising rates.

At these levels (about 3750 points), the SP500 has a forward PE of about 16 for 2023.

Conclusions

As we see the rise in interest rates continue, there is motivation to see a multiple compression and the points in favour of pricing in line with the long-term average increase.

There is every reason to also see further compression in multiples, which could go below the historical average, should there be a deterioration in economic conditions.

For example, flat EPS in 2023, at a multiple of 14, would take the S&P 500 just above 3,000 points.

At present, it is difficult to have an extremely bullish or bearish view. However, the upcoming economic data and macroeconomic decisions will give a new direction to the market, which certainly still has room to go down.

Be the first to comment