SDI Productions

Investment thesis

My recommendation to investors is to take no position in Sharecare, Inc. (NASDAQ:SHCR) due to valuation. However, SHCR is benefiting from a long-term, upward trend in its business. I think the company is well-positioned to take market share because of its diversified product range and integrated platform, which addresses various pain points in the healthcare industry. The company is well-positioned for growth because of its solid leadership and expanding customer base.

Business overview

Sharecare, Inc. is a digital healthcare platform that allows its subscribers to monitor all of their health data in one place. The SHCR platform acts as a central hub where people, patients, and caregivers can find high-quality, clinically-tested content, make digital connections with other people, communities, and healthcare professionals, and put health-related plans into action.

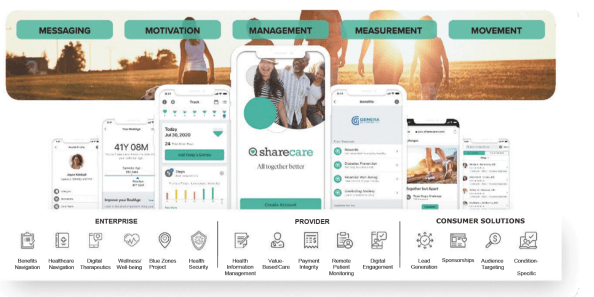

S-1

Sharecare, Inc. has a good chance of increasing its market share

I believe it is common knowledge that the healthcare system is causing increasing difficulty for individuals and entities due to its increasing complexity, skewed incentives, and escalating costs. The primary cause, in my opinion, is the complexity and annoyance that consumers face throughout their healthcare journey—from health plan enrollment to provider selection to post-care follow-up to continuing care management. Customers are also impacted by a lack of coordinated services, which makes it more difficult to meet an individual’s complete care and wellness needs. As a result, despite the growing popularity of value-based care models, I believe there is a growing awareness of the need for continuous patient engagement to drive improved outcomes.

To make matters worse, becoming involved with the healthcare system comes with its own set of challenges, such as navigating the maze of providers and facilities. Despite their best efforts, many people struggle to find suitable primary care physicians and specialists due to a lack of user-friendly provider directories and reliable cost and quality data. A lack of technology compatibility across providers, a lack of mechanisms to monitor patients, and, most importantly, a lack of incentives for any one provider to ensure the consumer does not get lost in the system are all barriers to successful care coordination in the aftermath of a healthcare event.

As a result, as healthcare costs rise, health plans and employers are focusing more on cost containment, often by raising premiums for members and employees. Another important factor, in my opinion, is that incentives are not always aligned across the care continuum, which can lead to bad experiences for patients.

Sharecare, Inc., in my opinion, has a good chance of increasing its market share due to the breadth of its product offering and the fact that it targets a diverse range of customers via its business, provider, and consumer solutions channels. I anticipate a sizable total addressable market (“TAM”) with such a diverse range of services and clientele.

There is a great opening for a disruptive platform like Sharecare

I think there is a great opening for a disruptive platform like SHCR because of the prevalence of technological solutions and the drive to make healthcare more widely available while maintaining its quality and lowering costs. SHCR’s integrated platform offers health plans and employers a more affordable option for their users, while also presenting a huge potential to address concerns of access, affordability, and service quality.

SHCR’s ability to combine a wide range of digital healthcare services into a single platform makes it possible for members to be more involved and offers an attractive alternative to a market that has to deal with a lot of healthcare vendors but has little contact with patients.

The interoperability of the SHCR platform is one of its main benefits because it was developed with human-centered design principles in mind to aid in the maximization of stakeholders’ well-being. The platform unifies disjointed solutions and stakeholders to give members a centralized hub from which to access all SHCR and partner-provided services and content. A positive user experience is crucial to keeping existing customers happy, which is why I think it should be a top priority.

SHCR’s platform has a scalable and adjustable infrastructure, which enables the company to fulfill the varying needs of its customers and to seize new opportunities, such as the creation of its facility and employee readiness and digital vaccine helper tools in the wake of the COVID-19 pandemic. It is my opinion that SHCR is able to interact with and incorporate third-party solutions into its ecosystem thanks to the versatility and scalability of its platform infrastructure, which in turn helps to increase visibility, participation, and positive outcomes through the coordinated exchange of data.

When compared to other digital health platforms, which simply transfer customers to a third-party solution, resulting in a disjointed user experience, SHCR stands out due to its integration with third-party solutions, including single sign-on. What sets SHCR apart from the competition is this, in my opinion.

Sharecare’s platform makes use of a novel architecture and data aggregation capabilities

To give users a hyper-personalized experience, SHCR’s own technology platform makes use of a novel architecture and data aggregation capabilities, both of which, in my opinion, significantly improve the service they deliver. To facilitate customization of its digital assets and boost member value, SHCR’s platform offers a suite of privacy-first technologies and AI software applications. Using the latest design patterns for scalability and adaptability, SHCR’s unified, robust platform is built on a technological stack that is both highly secure and capable of supporting multiple tenants. In addition, SCHR can quickly absorb massive amounts of multivariate data from numerous sources thanks to its data architecture. SHCR is in a particularly advantageous position to expand and actively involve members due to the high value they place on the quality and quantity of this data.

In my opinion, SHCR is in a particularly advantageous position to innovate new product offerings in response to market factors that directly and indirectly speed time-to-market for new inventions (refer to the example mentioned above). Their credibility as a health information resource has been built over the course of nearly a decade, allowing them to lay the groundwork for supporting dramatic improvements in population health and community wellbeing.

Sharecare has a wide range of product offerings

SHCR offers a wide range of products and services, which it promotes to a wide variety of customers through its business, provider, and consumer solutions channels. In my opinion, SGHC has an advantage over competing digital health platforms and point solutions because it is able to merge all of these individual products into a single, cohesive whole. SHCR’s product line stands out from competitors that don’t offer access to care or a provider component by giving members clinical connectivity to healthcare systems and/or providers through a variety of integrated touchpoints.

In addition, all of the content published by SHCR is subject to careful medical assessment and fact-checking before it is made available to the public. There are approximately 40,000 videos, along with over 200,000 articles, slideshows, and questions and answers written by experts, according to the SHCR S-1 filing. Through collaboration, SHCR and other organizations have developed, reviewed, and enhanced the platform’s content. The scale and quality of our content library allow SHCR to provide highly tailored content to members, which I feel boosts engagement and trust.

Share has a huge base of well-known clients

According to SHCR’s S-1, the company serves a large and varied group of customers, including seven Blue Cross Blue Shield health plans, many Fortune 100 companies like Walmart and Delta Air Lines, and several large public sector clients like the State Health Benefit Plan of Georgia. This suggests that SHCR has a significant opportunity to earn revenue from existing contracts. I believe they have a captive market in their large client base, which will allow them to more effectively promote their offerings to potential customers and maximize the number of people who sign up as members.

Valuation

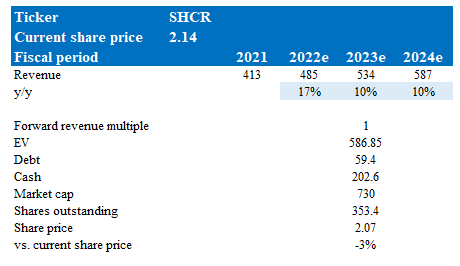

My model suggests that SHCR is fairly valued today. My model values SHCR on a forward revenue basis, as the business is not generating meaningful profits today. The model follows management’s FY22 guidance, which I believe is achievable given SHCR’s year-to-date performance so far.

SHCR is trading at 1x forward revenue today, and I assumed it would trade at a similar range 1 year from now as I do not expect any major events that would change this. That said, SHCR used to trade at a much higher multiple, so that leaves room for a potential valuation re-rating upwards.

Based on these assumptions, I believe SHCR’s stock is worth $2.07 in FY23.

Own estimates

Risks

Fast-innovating and competitive industry

The market for SHCR solutions is cutthroat, fluid, and splintered. They go up against other digital health technology companies that cater to members’ demands in a variety of health-related areas, generally through wellness-, benefits-, and health-oriented platforms. They also face competition from a plethora of other providers in the digital healthcare market who offer point solutions that concentrate on only one facet of a patient’s health.

High concentration of customer revenue

To a significant extent, SHCR has based its revenue on the patronage of just a few large clients. The loss of even a single significant client, or the need to renegotiate even a single contract, might have a significant negative impact on SHCR’s financial results.

Conclusion

In conclusion, I think the current price of SHCR is fairly valued. Members of SHCR can monitor their health from one convenient online platform thanks to SHCR’s digital healthcare platform. In a sector plagued by issues like increasing prices, skewed incentives, and a lack of coordinated services, I do think Sharecare, Inc. has a good chance of gaining market share.

Be the first to comment