Laser1987

Introduction

It’s time to dive into CSX Corporation’s (NASDAQ:CSX) third-quarter earnings. While railroad earnings are interesting and important to follow, in general, we’re now dealing with one of the most challenging and fascinating macro environments in a long time. Railroads are dealing with efficiency and labor issues, slowing economic growth, an aggressive Federal Reserve, and high inflation. In a just-released article, I discussed Union Pacific’s (UNP) earnings, which showed that the railroad was struggling with all of these things. CSX is also dealing with these issues, yet this railroad is doing much better. While the operating performance was disappointing, the company beat estimates and stuck to its full-year outlook, which came as a surprise.

In this article, we’re going to discuss all of these things and assess whether CSX is a suitable investment at these prices.

So, let’s get to it!

The Bigger Picture

As (almost) always, I’m starting this article by diving into the bigger picture. Without it, it’s pointless to look at the earnings results from America’s second-largest public railroad.

With a market cap of $58.0 billion, CSX is the largest railroad in America’s East, where it services major economic hubs together with its main competitor Norfolk Southern (NSC) – which is a holding in my portfolio. Headquartered in Jacksonville, Florida, CSX services everything from New England (NOT included in the map below) thanks to its Pan Am acquisition to the very south of Florida.

CSX Corp.

The beauty of railroads is that they are cash machines. While it does require a lot of money to run an equipment-intensive business, it’s highly profitable to connect the supply and demand of goods via rail.

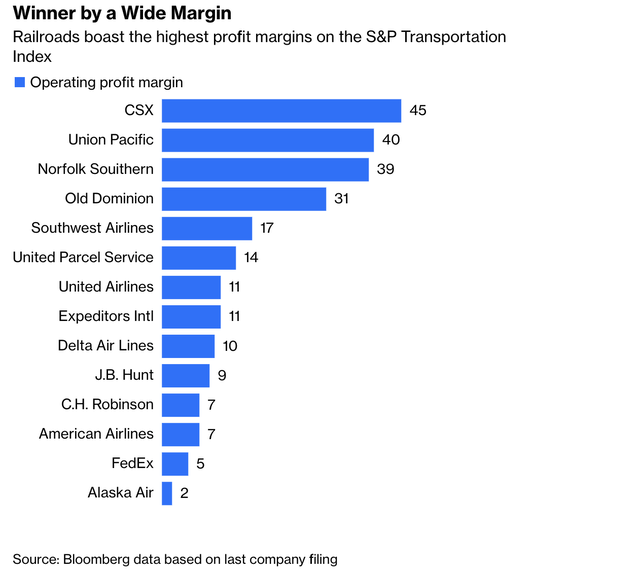

Hence, when looking at the bigger picture, America’s railroads are the most profitable transportation companies in the S&P Transportation Index.

Unfortunately, this efficiency has come under fire.

Essentially, railroads have become extremely profitable thanks to Precision Railroading (“PSR”):

Under PSR, freight trains operate on fixed schedules, much like passenger trains, instead of being dispatched whenever a sufficient number of loaded cars are available. In the past, container trains and general merchandise trains operated separately; under PSR they are combined as needed. Inventories of freight cars and locomotives are reduced and fewer workers are employed for a given level of traffic.

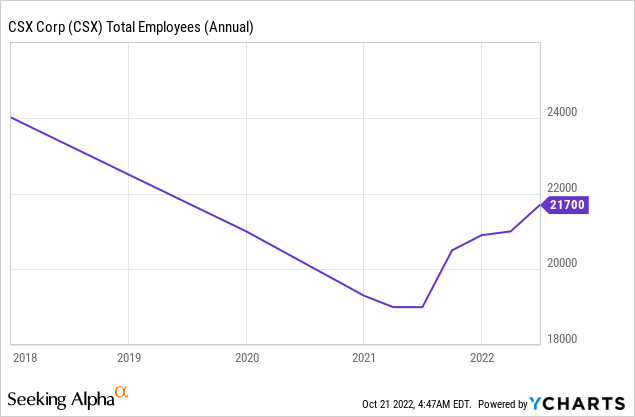

Thanks to changes like longer trains, railroads have consistently decreased the number of employees, which helped to increase margins. During the pandemic, these layoffs accelerated. After all, volumes took a big hit due to global lockdowns.

Once “post-pandemic” demand came back, railroads ran into trouble. On the one hand, we can only partially blame them as every single company struggled with the massive decline in demand due to lockdowns and the surge in demand that followed. It’s impossible to deal with that without running into problems. After all, railroads are just one part of a very long and complex transportation supply chain.

On the other hand, PSR was an issue, and it caused the government to take a closer look at railroads. It also doesn’t help that competition is low, which is the cause for even more scrutiny. According to Bloomberg (using Union Pacific as an example):

Railroads, though, usually have only one main competitor and count on many captive customers. It’s expensive to move chemicals, metal, coal, grain, and other goods by truck. Often, rail is the only sustainable option. And if Union Pacific is the only railroad that has tracks near a factory, that plant owner has little to no leverage to push back on price and poor service. That allows railroads, not just Union Pacific, to focus more on profit than service. This means that even though Union Pacific can’t get a railcar on time to a customer’s freight yard about half the time, the railroad will continue to raise prices. Union Pacific has been clear that it will keep its prices above its own inflation rate, which is expected to run about 5% this year.

In other words, railroads are now accelerating investments in equipment and labor (to move more equipment) in order to satisfy customers.

To make things worse, railroads not only need to deal with rising volumes compared to the pandemic lows, but they also need to start to incorporate falling (future) volumes in their models as economic growth is slowing.

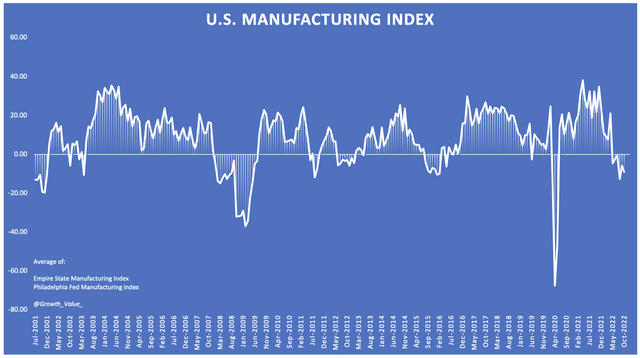

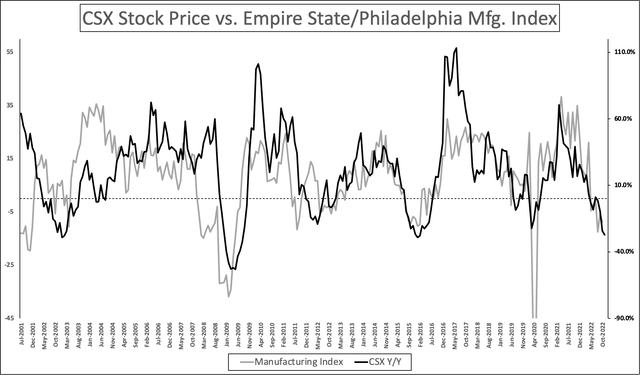

For example, manufacturing sentiment is back in contraction territory, using my chart displaying an average of the Empire State and Philadelphia Fed manufacturing surveys. What this means is that economic growth will come down in the months/quarters ahead.

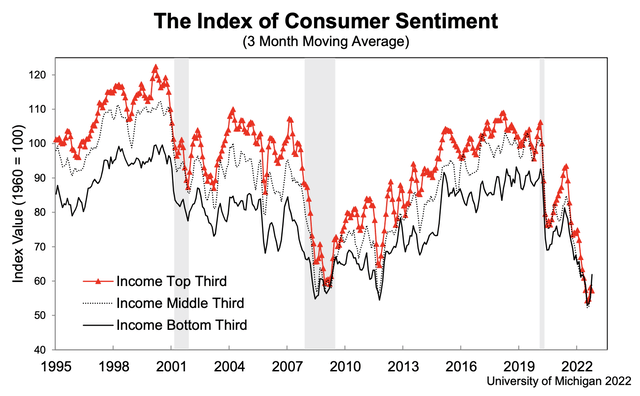

It also doesn’t help that this time, it isn’t just manufacturing. Weakness is everywhere. This time, it also hits consumers. During the 2015/2016 manufacturing recession that was not the case as consumers enjoyed the benefits of imploding commodity prices.

Now, they are suffering from rising rates, high inflation, and related issues.

This is hurting railroads in multiple ways. First of all, when the economy suffers, railroads suffer. They are so large that it’s impossible to escape economic weakness. America’s Class I railroads connect every single supply chain: energy, industrials, intermodal, commodities, you name it.

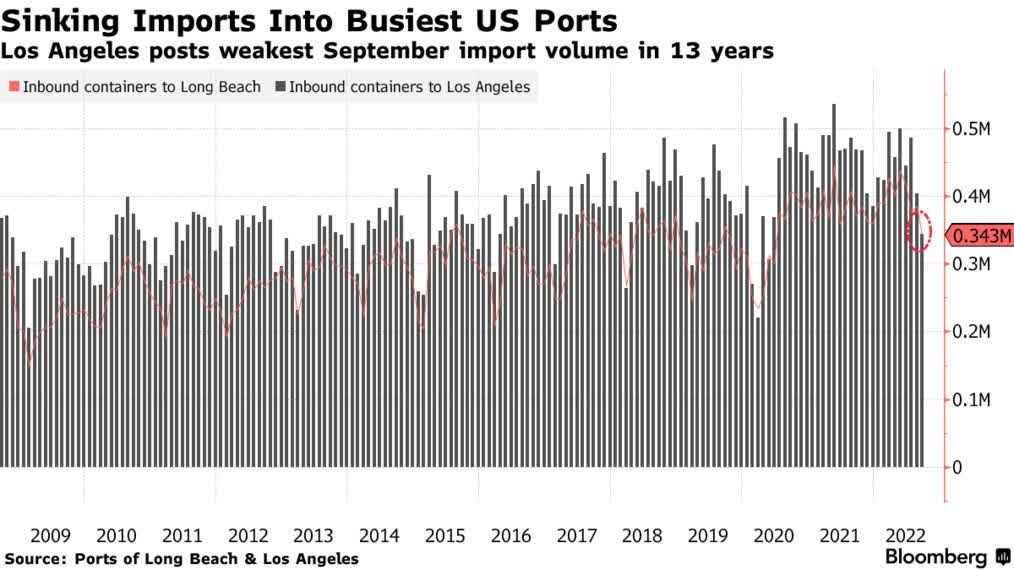

One way railroads are hurt is by lower imports. As a lot of (cheap) consumer goods are imported, we now see that the busiest US ports are witnessing a steep decline in container imports:

Bloomberg

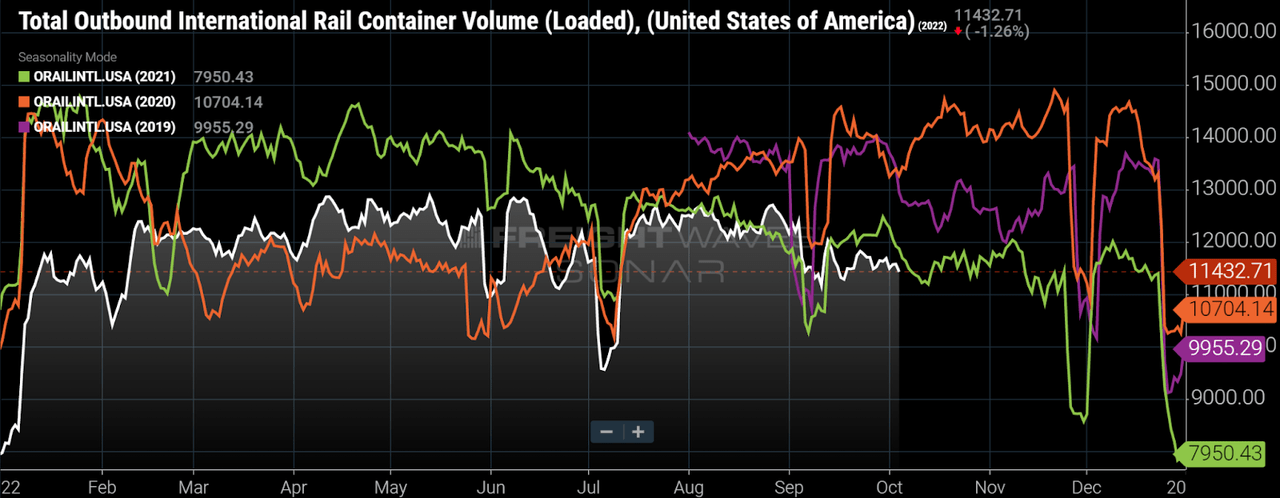

Unfortunately, outbound volumes aren’t much better as outbound rail container volumes are now below anything we’ve seen in the prior three years.

FreightWaves

Now, based on this context, let’s dive into CSX’s numbers.

What Happened In 3Q22?

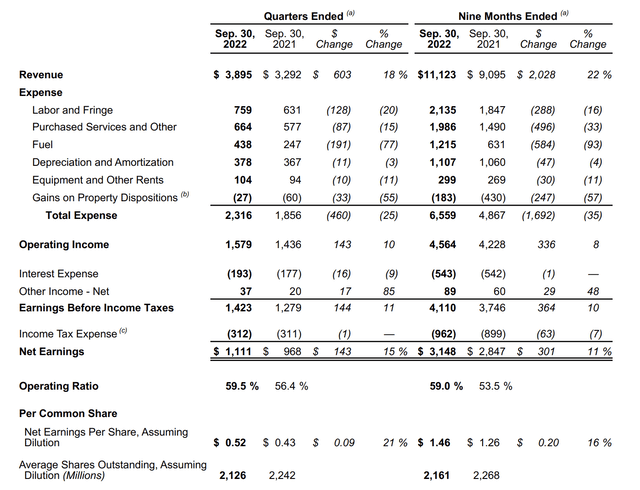

Let’s start with the headline numbers that hit the wires first. In 3Q22, CSX generated $0.52 in GAAP EPS. That’s $0.03 higher than expected and 21% higher compared to the prior-year quarter.

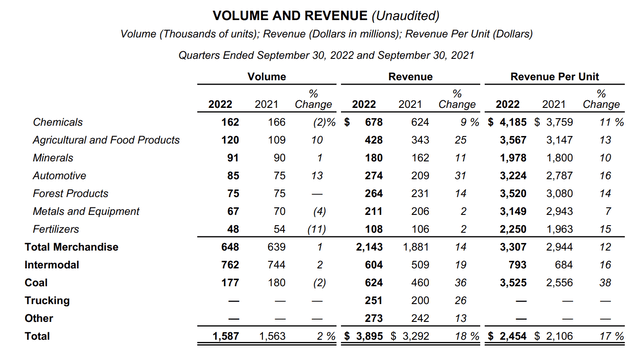

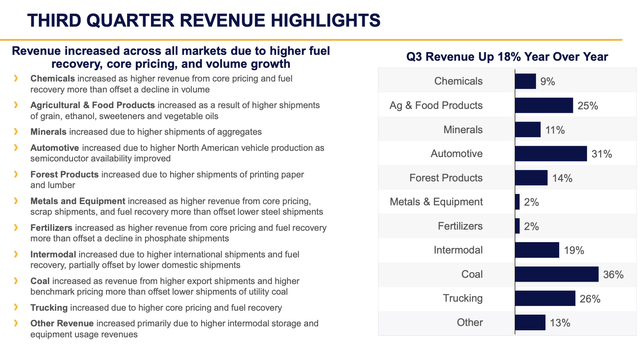

Growth in EPS was provided by strong top-line growth. The company shipped roughly 1.6 million carloads in the third quarter, which is 2% more compared to 3Q21. Intermodal was up, the merchandise was up led by agriculture, miners, and automotive, while fertilizers, chemicals, and coal shipments were down.

Automotive shipments are strong thanks to easing supply chain issues, which allow producers to turn backlog into finished vehicles. Agriculture benefits from high export demand. The same goes for coal and fertilizers, however, due to timing issues, these shipments were somewhat weak in 3Q22. Yet, I’m not too worried about that as the war in Ukraine and changing global trade flows (and macro circumstances) have paved the way for long-term tailwinds for energy and agricultural exports. This includes coal, petroleum products, and everything related to agriculture.

On top of that, I am a firm believer in America’s future as the world’s manufacturing hub as European companies are now shifting production due to unsustainably high energy prices – and related regulations. That will more than likely provide US railroads with decades of secular demand growth.

When adding pricing, we end up with the company’s aforementioned 18% revenue growth rate. Please note that pricing includes fuel surcharges. Between 3Q21 and 3Q22, fuel surcharges rose from $184 million to $474 million, which explains a big part of the roughly $600 million increase in revenues.

Moreover, the lag between charging more for fuel and actual fuel prices was $40 million (in CSX’s favor). The lag happens as railroads cannot use real-time fuel surcharges due to the structure of contracts and deals. Sometimes this lag is favorable (like in 3Q22), and sometimes it’s a headwind.

The overview below shows the same revenue growth rates we saw in the table above. However, this time, we also get some company comments, which adds some more color to it.

With that said, the company struggled with higher expenses. In the third quarter, total expenses rose by 25% to $2.3 billion, which caused the operating ratio to increase to 59.5%, up from 56.4%.

If you’re new to railroads, the operating ratio measures how much it costs as a percentage of total revenues to operate the railroad. The lower the better.

Expenses rose across the board. Fuel costs were up 77%. Labor expenses were up 20%. Purchased services were 15% more expensive. These expenses also include $42 million of out-of-period expenses related to adjusting union labor accruals for the tentative agreements. The acquisitions of Pan Am and Quality Carriers added $46 million worth of expenses.

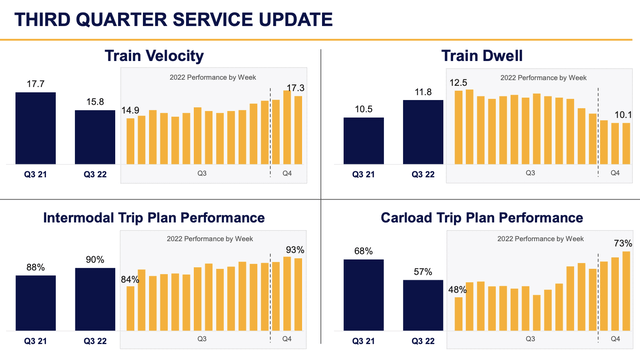

With that said, how did operations do? We know that operations were less efficient from a financial point of view. However, what matters is the company’s hiring process and system fluidity.

The answer is: improvements are clearly visible.

While train velocity, dwell, and carload trip plan performance all showed a deterioration versus the prior year, intermodal trip plan compliance continues to improve. The company is also seeing strong improvements going into the fourth quarter.

The company promoted 254 conductors in 3Q22, and ended the quarter with 6,759 train and engine employees, the highest number since March 2020. The company has more than 700 employees in training and expectations are that this number will rise in 4Q22.

According to the company:

We are confident that these metrics show that our efforts to hire, train and retain new employees are starting to take hold and make a difference for our customers. Though we are encouraged by the operational momentum, we will not let up.

We will continue to push forward and take actions necessary until service is fully restored to a level that our customers expect. We are promoting new conductors, allocating the appropriate number of assets and improving the overall reliability and operational resilience of our network.

That said, year-to-date, the company has generated $2.8 billion in free cash flow – excluding the proceeds from property dispositions. This is up from $2.6 billion in the first three quarters of 2021. The company used this cash to buy back shares worth $3.7 billion and distribute dividends valued at $645 million. This shows that CSX prioritizes buybacks over dividends.

I discussed this in a dividend-focused CSX article earlier this year.

What’s Next?

So far, I have to say that I liked the results. Revenue growth was strong. Expenses rose faster, but that was expected. The same goes for the surge in the company’s operating ratio.

What I like is that hiring is going smoothly. Operating metrics are showing very promising improvements, and it looks like the company will be able to quickly move to the next level when it comes to customer satisfaction – especially if slower economic growth (or a full-blown recession) allows the company to reduce its backlog.

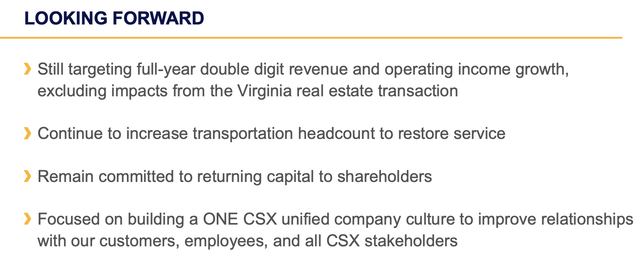

Speaking of slower economic growth, one major takeaway is that CSX did NOT adjust its outlook. Unlike Union Pacific, CSX does not see lower full-year revenues.

The company did not adjust its revenue nor its operating income outlook as it continues to see double-digit revenue growth.

According to CEO Joe Hinrichs, who is taking over from Jim Foote:

While there is uncertainty in the global economy, we feel confident in our ability to deliver on this guidance as we look over the remainder of this year. As we mentioned in our earlier remarks, we are pleased with the positive momentum in our service metrics. And we continue our hiring and training efforts to ensure that we have the resources needed to build on these trends and drive improved network fluidity.

In other words, it seems that moderating economic demand will be offset by the company’s ability to work on backlog by improving its operating business. If this turns out to be correct at the end of this year, I have to say that I’m truly impressed.

With that said, the market knows that the pressure on shipments is rising. Even if the company is able to maintain its revenue outlook, 2023 is set up to be a rather tough year.

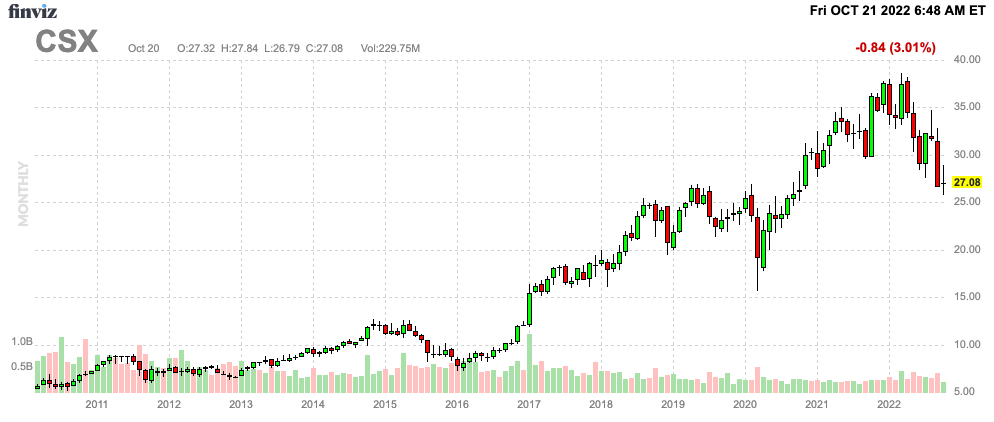

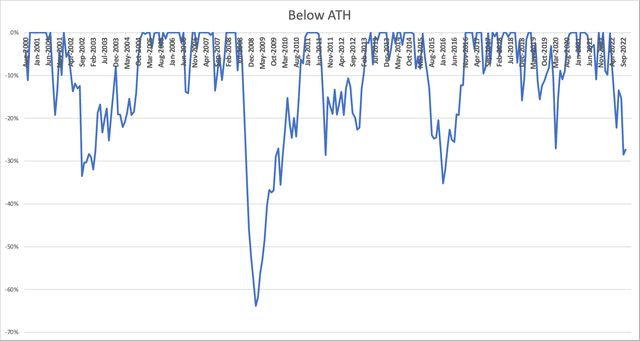

Hence, the stock is trading 30% below its all-time high. That’s prior to the post-earnings reaction, which is looking to be quite positive thanks to management sticking to its outlook (and the reasons behind it).

FINVIZ

The good news is that a lot of weakness has been priced in. CSX losing 30% is something that almost exclusively happens during recessions.

Using monthly closing prices, we’re dealing with a drawdown similar to the one in 2020 (again, based on monthly closing prices). The 2016 sell-off was roughly 10 points worse.

When combining the CSX stock price with the manufacturing sentiment indicator I used at the start of this article, we see that investors have priced in a lot of economic weakness.

This obviously does not mean that there isn’t more downside. The economy remains in a very tough place as the Federal Reserve will likely hike until something “breaks”. I discussed this in greater detail on a podcast with Seeking Alpha’s Leslie Osborn, which you can access here.

Nonetheless, when it comes to long-term investing, I like buying stocks whenever I like the risk/reward. And that’s currently the case.

CSX is trading at an enterprise value of $71.3 billion, consisting of its $58.0 billion market cap and $13.3 billion in 2023E net debt.

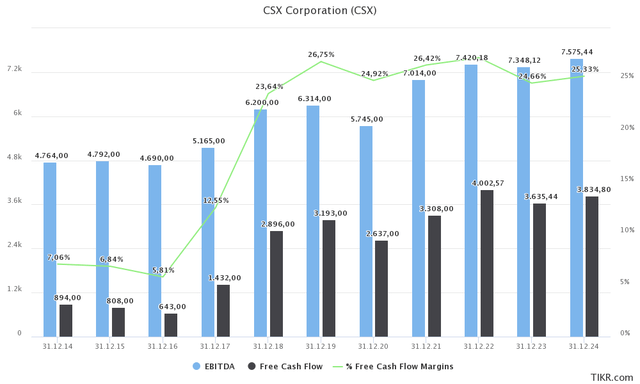

That’s 9.7x 2023E EBITDA of $7.4 billion. Note that EBITDA growth is expected to remain flattish. CSX witnessed the same during the challenging 2014-2016 years. It helps that free cash flow is expected to remain high. At these levels, CSX could maintain a free cash flow yield of more than 6%, which does provide the company with opportunities to maintain high buyback levels, on top of sustaining its 1.4% dividend yield.

That said, a 9.7x EV/EBITDA valuation is the cheapest valuation since early 2017. When combining this with the aforementioned free cash flow yield, I think the risk/reward is great. Hence, I’m bullish despite ongoing economic challenges.

With that in mind, here’s my takeaway.

Takeaway

Times are challenging. Economic growth is under tremendous pressure, making a recession a done deal, at this point. Meanwhile, inflation is high, preventing the Fed from taking its foot off the brake anytime soon.

Moreover, railroads need to deal with operating inefficiencies, labor issues, and the above-mentioned economic challenges.

The good news is that CSX did a tremendous job. While expenses outperformed revenues, causing the operating ratio to almost hit 60%, the company remains in a good spot to improve its business in the quarters ahead.

For now, CSX can mitigate slower economic growth risks by increasing network fluidity. It has accelerated hiring and operating metrics are rapidly improving.

With regard to the upcoming recession, a lot has been priced in. While I do not believe that CSX shares will use these earnings to start a longer-term uptrend, I do like the risk/reward.

The company is trading at an attractive price. Yes, this price could get even more attractive, but as a long-term investor, I believe that gradually buying on weakness is the way to go.

The only reason why I do not own CSX is that I have significant positions in Union Pacific, Norfolk Southern, and Canadian Pacific (CP). I do not believe that CSX is worse than any of them. If anything, I think CSX is in a good spot to outperform some of them.

(Dis)agree? Let me know in the comments!

Be the first to comment